-

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

The Art and Application of Technical Analysis with Cynthia Kase

1 × $6.00

The Art and Application of Technical Analysis with Cynthia Kase

1 × $6.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

Freak Forex Technicals with Ken FX Freak

1 × $6.00

Freak Forex Technicals with Ken FX Freak

1 × $6.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

10 Pips System. The 3rd Candle with Abner Gelin

1 × $6.00

10 Pips System. The 3rd Candle with Abner Gelin

1 × $6.00 -

×

2010 The Market Mastery Protégé Program

1 × $31.00

2010 The Market Mastery Protégé Program

1 × $31.00 -

×

11 Elements of Prudent Investing with Andy Karabinos

1 × $6.00

11 Elements of Prudent Investing with Andy Karabinos

1 × $6.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

10 Pips Anytime you Want with Karl Dittmann

1 × $6.00

10 Pips Anytime you Want with Karl Dittmann

1 × $6.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

10 Best Swing Trading Patterns & Strategies with Dave Landry

1 × $4.00

10 Best Swing Trading Patterns & Strategies with Dave Landry

1 × $4.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

3 Day Bootcamp EXPERT LEVEL with FX Savages

1 × $6.00

3 Day Bootcamp EXPERT LEVEL with FX Savages

1 × $6.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

2 Trades A Day with Jason Hale

1 × $15.00

2 Trades A Day with Jason Hale

1 × $15.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

101 Option Trading Secrets with Kenneth Trester

1 × $6.00

101 Option Trading Secrets with Kenneth Trester

1 × $6.00 -

×

(SU281) Complex & Organic Modeling

1 × $85.00

(SU281) Complex & Organic Modeling

1 × $85.00 -

×

Investment Analysis and Portfolio Management with Frank Reilly

1 × $6.00

Investment Analysis and Portfolio Management with Frank Reilly

1 × $6.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

Volume Cycles in the stock Market

1 × $6.00

Volume Cycles in the stock Market

1 × $6.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

2 Day Personal Training Course (Seminar Package) with Martin Pring

1 × $6.00

2 Day Personal Training Course (Seminar Package) with Martin Pring

1 × $6.00 -

×

11 Paper with Charles Drummond

1 × $6.00

11 Paper with Charles Drummond

1 × $6.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Full-Day Premium Pitchfork Class with Forex Pitchfork Master Trader

1 × $15.00

Full-Day Premium Pitchfork Class with Forex Pitchfork Master Trader

1 × $15.00 -

×

The Handbook of Chaos Control with H.G.Schuster

1 × $6.00

The Handbook of Chaos Control with H.G.Schuster

1 × $6.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Practical Speculation with Victor Niederhoffer, Laurel Kenner

1 × $6.00

Practical Speculation with Victor Niederhoffer, Laurel Kenner

1 × $6.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

2017 Plan or Get Slaughtered Class with Doc Severson

1 × $6.00

2017 Plan or Get Slaughtered Class with Doc Severson

1 × $6.00 -

×

10-Week Stock Trading Program with Stock Market Lab

1 × $6.00

10-Week Stock Trading Program with Stock Market Lab

1 × $6.00 -

×

Formula to a Fortune with Steve Briese, Glen Ring

1 × $6.00

Formula to a Fortune with Steve Briese, Glen Ring

1 × $6.00 -

×

Learn how to trade Volatility 75 Index Technical Analysis with Patrick Muke

1 × $6.00

Learn how to trade Volatility 75 Index Technical Analysis with Patrick Muke

1 × $6.00 -

×

12 Strategies for Picking Tops & Bottoms

1 × $23.00

12 Strategies for Picking Tops & Bottoms

1 × $23.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Forex Trading Education Program (Apr-June 2010) with Jimmy Young

1 × $6.00

Forex Trading Education Program (Apr-June 2010) with Jimmy Young

1 × $6.00 -

×

Forex Trading with Ed Ponsi

1 × $6.00

Forex Trading with Ed Ponsi

1 × $6.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

2-Phase A.I. Trade Spy Total Immersion Experience with Jeff Bierman - The Quant Guy

1 × $209.00

2-Phase A.I. Trade Spy Total Immersion Experience with Jeff Bierman - The Quant Guy

1 × $209.00 -

×

How to Trade a Vertical Market

1 × $93.00

How to Trade a Vertical Market

1 × $93.00 -

×

15 Minutes to Financial Freedom with The Better Traders

1 × $20.00

15 Minutes to Financial Freedom with The Better Traders

1 × $20.00 -

×

Euro Trading Course with Bkforex

1 × $6.00

Euro Trading Course with Bkforex

1 × $6.00 -

×

Module 4 Elliot Wave and Identify Wave Count

1 × $31.00

Module 4 Elliot Wave and Identify Wave Count

1 × $31.00 -

×

Financial Freedom Mastery Course with Freedom Team Trading

1 × $31.00

Financial Freedom Mastery Course with Freedom Team Trading

1 × $31.00

Crash or Correction – Top 5 Patterns Every Trader Must Master with Todd Gordon

$97.00 Original price was: $97.00.$6.00Current price is: $6.00.

File Size: 878 MB

Delivery Time: 1–12 hours

Media Type: Online Course

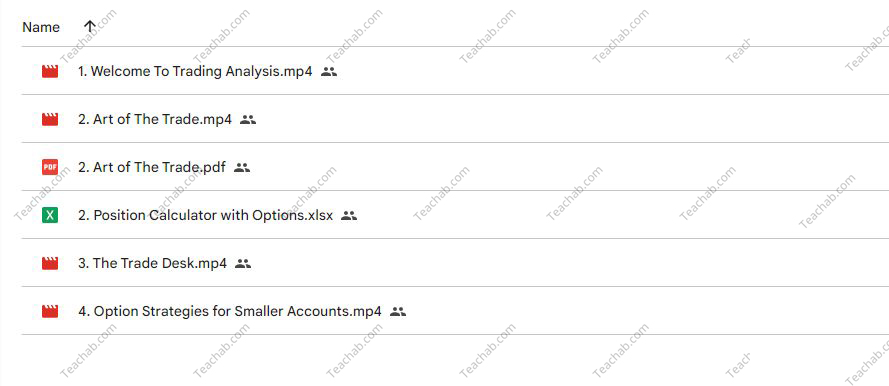

Content Proof: Watch Here!

You may check content proof of “Crash or Correction – Top 5 Patterns Every Trader Must Master with Todd Gordon” below:

Deciphering Market Movements: Mastering Top 5 Patterns Every Trader Must Know with Todd Gordon

Unraveling the Mystery: Crash or Correction?

In the unpredictable world of trading, distinguishing between a crash and a correction is crucial for making informed decisions. Join us as we explore the top 5 patterns every trader must master with Todd Gordon, shedding light on the nuances of market movements and equipping you with the knowledge to navigate volatility with confidence.

Understanding Market Dynamics: The Difference Between Crash and Correction

Before delving into specific patterns, it’s essential to understand the fundamental difference between a crash and a correction. A crash is characterized by a rapid and severe decline in asset prices, often accompanied by panic selling and widespread fear in the market. On the other hand, a correction is a temporary reversal in the prevailing trend, typically representing a healthy retracement before the resumption of the primary trend.

Pattern 1: Head and Shoulders – Spotting Trend Reversals

The head and shoulders pattern is a classic reversal pattern that signals a potential trend reversal from bullish to bearish or vice versa. This pattern consists of three peaks, with the middle peak (the head) being higher than the other two (the shoulders). Traders use this pattern to anticipate trend reversals and adjust their positions accordingly.

Pattern 2: Double Top and Double Bottom – Identifying Support and Resistance Levels

The double top and double bottom patterns are reversal patterns that occur after an extended uptrend or downtrend, respectively. A double top pattern forms when prices reach a peak twice before reversing lower, indicating resistance levels. Conversely, a double bottom pattern forms when prices reach a trough twice before reversing higher, indicating support levels.

Pattern 3: Triangle Patterns – Predicting Breakouts

Triangle patterns are continuation patterns that occur when prices consolidate within a converging range, forming higher lows and lower highs. These patterns represent a period of indecision in the market, with traders awaiting a breakout to determine the next direction of the trend. By identifying triangle patterns, traders can anticipate potential breakouts and position themselves for profitable trades.

Pattern 4: Candlestick Patterns – Reading Market Sentiment

Candlestick patterns are visual representations of price movements over a specific period, providing valuable insights into market sentiment and direction. From bullish engulfing patterns to bearish harami patterns, each candlestick formation conveys information about the balance of power between buyers and sellers, allowing traders to make informed decisions about their trades.

Pattern 5: Fibonacci Retracement – Riding the Waves of Retracement

Fibonacci retracement is a technical analysis tool used to identify potential support and resistance levels based on the Fibonacci sequence. By measuring the distance of a price move and applying Fibonacci ratios such as 38.2%, 50%, and 61.8%, traders can anticipate levels where price may potentially reverse or continue its trend, enabling them to enter trades with favorable risk-reward ratios.

Conclusion: Empowering Traders with Knowledge and Insight

In conclusion, mastering the top 5 patterns discussed with Todd Gordon empowers traders to navigate the complexities of market movements with confidence and precision. By understanding the nuances of these patterns and incorporating them into their trading strategies, traders can make informed decisions, mitigate risks, and seize opportunities in both bullish and bearish market conditions.

FAQs

- How can I differentiate between a crash and a correction?

- A crash is characterized by a rapid and severe decline in asset prices, often accompanied by panic selling and widespread fear in the market. In contrast, a correction is a temporary reversal in the prevailing trend, typically representing a healthy retracement before the resumption of the primary trend.

- What are some common reversal patterns traders should be familiar with?

- Some common reversal patterns include the head and shoulders pattern, double top and double bottom patterns, and candlestick reversal patterns such as bullish engulfing and bearish harami.

- How do traders use Fibonacci retracement in their analysis?

- Traders use Fibonacci retracement to identify potential support and resistance levels based on the Fibonacci sequence. By applying Fibonacci ratios to price charts, traders can anticipate levels where price may potentially reverse or continue its trend, enabling them to enter trades with favorable risk-reward ratios.

- What are the benefits of mastering these patterns as a trader?

- Mastering these patterns allows traders to make informed decisions, identify high-probability trading opportunities, and manage risk effectively. By understanding market dynamics and recognizing patterns, traders can navigate volatility with confidence and achieve consistent profitability in the markets.

- Where can I learn more about these patterns and how to apply them in my trading?

- Todd Gordon provides educational resources, webinars, and workshops to help traders master these patterns and enhance their trading skills. Additionally, there are numerous books, online courses, and trading platforms that offer in-depth guidance on pattern recognition and technical analysis.

Be the first to review “Crash or Correction – Top 5 Patterns Every Trader Must Master with Todd Gordon” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.