-

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00

Crash or Correction – Top 5 Patterns Every Trader Must Master with Todd Gordon

$97.00 Original price was: $97.00.$6.00Current price is: $6.00.

File Size: 878 MB

Delivery Time: 1–12 hours

Media Type: Online Course

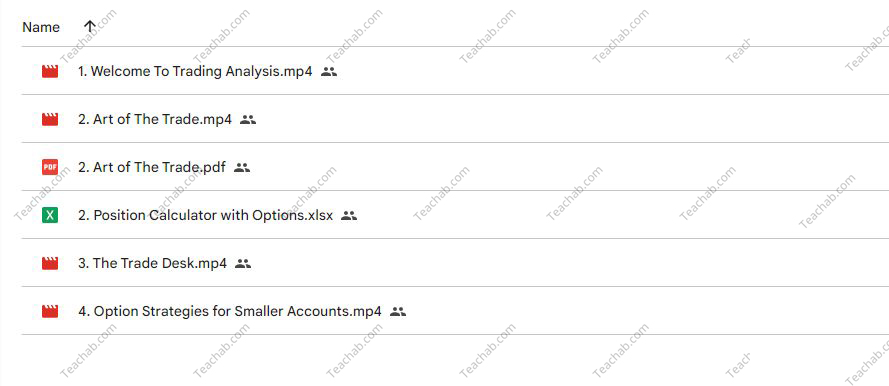

Content Proof: Watch Here!

You may check content proof of “Crash or Correction – Top 5 Patterns Every Trader Must Master with Todd Gordon” below:

Deciphering Market Movements: Mastering Top 5 Patterns Every Trader Must Know with Todd Gordon

Unraveling the Mystery: Crash or Correction?

In the unpredictable world of trading, distinguishing between a crash and a correction is crucial for making informed decisions. Join us as we explore the top 5 patterns every trader must master with Todd Gordon, shedding light on the nuances of market movements and equipping you with the knowledge to navigate volatility with confidence.

Understanding Market Dynamics: The Difference Between Crash and Correction

Before delving into specific patterns, it’s essential to understand the fundamental difference between a crash and a correction. A crash is characterized by a rapid and severe decline in asset prices, often accompanied by panic selling and widespread fear in the market. On the other hand, a correction is a temporary reversal in the prevailing trend, typically representing a healthy retracement before the resumption of the primary trend.

Pattern 1: Head and Shoulders – Spotting Trend Reversals

The head and shoulders pattern is a classic reversal pattern that signals a potential trend reversal from bullish to bearish or vice versa. This pattern consists of three peaks, with the middle peak (the head) being higher than the other two (the shoulders). Traders use this pattern to anticipate trend reversals and adjust their positions accordingly.

Pattern 2: Double Top and Double Bottom – Identifying Support and Resistance Levels

The double top and double bottom patterns are reversal patterns that occur after an extended uptrend or downtrend, respectively. A double top pattern forms when prices reach a peak twice before reversing lower, indicating resistance levels. Conversely, a double bottom pattern forms when prices reach a trough twice before reversing higher, indicating support levels.

Pattern 3: Triangle Patterns – Predicting Breakouts

Triangle patterns are continuation patterns that occur when prices consolidate within a converging range, forming higher lows and lower highs. These patterns represent a period of indecision in the market, with traders awaiting a breakout to determine the next direction of the trend. By identifying triangle patterns, traders can anticipate potential breakouts and position themselves for profitable trades.

Pattern 4: Candlestick Patterns – Reading Market Sentiment

Candlestick patterns are visual representations of price movements over a specific period, providing valuable insights into market sentiment and direction. From bullish engulfing patterns to bearish harami patterns, each candlestick formation conveys information about the balance of power between buyers and sellers, allowing traders to make informed decisions about their trades.

Pattern 5: Fibonacci Retracement – Riding the Waves of Retracement

Fibonacci retracement is a technical analysis tool used to identify potential support and resistance levels based on the Fibonacci sequence. By measuring the distance of a price move and applying Fibonacci ratios such as 38.2%, 50%, and 61.8%, traders can anticipate levels where price may potentially reverse or continue its trend, enabling them to enter trades with favorable risk-reward ratios.

Conclusion: Empowering Traders with Knowledge and Insight

In conclusion, mastering the top 5 patterns discussed with Todd Gordon empowers traders to navigate the complexities of market movements with confidence and precision. By understanding the nuances of these patterns and incorporating them into their trading strategies, traders can make informed decisions, mitigate risks, and seize opportunities in both bullish and bearish market conditions.

FAQs

- How can I differentiate between a crash and a correction?

- A crash is characterized by a rapid and severe decline in asset prices, often accompanied by panic selling and widespread fear in the market. In contrast, a correction is a temporary reversal in the prevailing trend, typically representing a healthy retracement before the resumption of the primary trend.

- What are some common reversal patterns traders should be familiar with?

- Some common reversal patterns include the head and shoulders pattern, double top and double bottom patterns, and candlestick reversal patterns such as bullish engulfing and bearish harami.

- How do traders use Fibonacci retracement in their analysis?

- Traders use Fibonacci retracement to identify potential support and resistance levels based on the Fibonacci sequence. By applying Fibonacci ratios to price charts, traders can anticipate levels where price may potentially reverse or continue its trend, enabling them to enter trades with favorable risk-reward ratios.

- What are the benefits of mastering these patterns as a trader?

- Mastering these patterns allows traders to make informed decisions, identify high-probability trading opportunities, and manage risk effectively. By understanding market dynamics and recognizing patterns, traders can navigate volatility with confidence and achieve consistent profitability in the markets.

- Where can I learn more about these patterns and how to apply them in my trading?

- Todd Gordon provides educational resources, webinars, and workshops to help traders master these patterns and enhance their trading skills. Additionally, there are numerous books, online courses, and trading platforms that offer in-depth guidance on pattern recognition and technical analysis.

Be the first to review “Crash or Correction – Top 5 Patterns Every Trader Must Master with Todd Gordon” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.