-

×

XJO Quant - High Probability Trading Setups on ASX 200 Index

1 × $31.00

XJO Quant - High Probability Trading Setups on ASX 200 Index

1 × $31.00 -

×

Forex Trading using Intermarket Analysis with Louis Mendelsohn

1 × $6.00

Forex Trading using Intermarket Analysis with Louis Mendelsohn

1 × $6.00 -

×

Chart Your Way to Profits (2nd Ed.) with Tim Knight

1 × $6.00

Chart Your Way to Profits (2nd Ed.) with Tim Knight

1 × $6.00 -

×

Original Charting 1936 with W.D.Gann

1 × $6.00

Original Charting 1936 with W.D.Gann

1 × $6.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

ETFs for the Long Run: What They Are, How They Work, and Simple Strategies for Successful Long-Term Investing - Lawrence Carrel

1 × $6.00

ETFs for the Long Run: What They Are, How They Work, and Simple Strategies for Successful Long-Term Investing - Lawrence Carrel

1 × $6.00 -

×

Long-Term Memory in the Stock Market Prices (Article) with Andrew W.Lo

1 × $6.00

Long-Term Memory in the Stock Market Prices (Article) with Andrew W.Lo

1 × $6.00 -

×

Getting Started in Options (3rd Ed.) with Michael Thomsett

1 × $6.00

Getting Started in Options (3rd Ed.) with Michael Thomsett

1 × $6.00 -

×

Toolkit For Thinkorswim with Bigtrends

1 × $54.00

Toolkit For Thinkorswim with Bigtrends

1 × $54.00 -

×

Hamzei Analytics Indicators for eSignal (hamzeianalytics.com)

1 × $6.00

Hamzei Analytics Indicators for eSignal (hamzeianalytics.com)

1 × $6.00 -

×

Stock Patterns for DayTrading. Home Study Course

1 × $6.00

Stock Patterns for DayTrading. Home Study Course

1 × $6.00 -

×

Day Trading For A Living

1 × $31.00

Day Trading For A Living

1 × $31.00 -

×

The Four Biggest Mistakes in Futures Trading (1st Edition) with Jay Kaeppel

1 × $6.00

The Four Biggest Mistakes in Futures Trading (1st Edition) with Jay Kaeppel

1 × $6.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

Breakout Trading Systems with Chris Tate

1 × $6.00

Breakout Trading Systems with Chris Tate

1 × $6.00 -

×

Manage By The Greeks 2016 with Dan Sheridan

1 × $23.00

Manage By The Greeks 2016 with Dan Sheridan

1 × $23.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Lazy Gap Trader Course with David Frost

1 × $6.00

Lazy Gap Trader Course with David Frost

1 × $6.00 -

×

Forex Mentor - FX Winning Strategies

1 × $15.00

Forex Mentor - FX Winning Strategies

1 × $15.00 -

×

I3T3 Complete Course with All Modules

1 × $10.00

I3T3 Complete Course with All Modules

1 × $10.00 -

×

Astrology At Work & Others

1 × $6.00

Astrology At Work & Others

1 × $6.00 -

×

Management Consultancy & Banking in a Era of Globalization

1 × $6.00

Management Consultancy & Banking in a Era of Globalization

1 × $6.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Trading The Curran 3-Line Break Method A Professional Strategy For Daytrading The Eminis By Chris Curran

1 × $4.00

Trading The Curran 3-Line Break Method A Professional Strategy For Daytrading The Eminis By Chris Curran

1 × $4.00 -

×

Japenese Candlesticks Charting, Analysis & Trading with Irwin Porter

1 × $6.00

Japenese Candlesticks Charting, Analysis & Trading with Irwin Porter

1 × $6.00 -

×

www Trading System Ezine with Alex Krzhechevsky

1 × $6.00

www Trading System Ezine with Alex Krzhechevsky

1 × $6.00 -

×

Intermediate Options Trading Course

1 × $39.00

Intermediate Options Trading Course

1 × $39.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

GMB Master Academy

1 × $31.00

GMB Master Academy

1 × $31.00 -

×

Boiler Room Trading

1 × $15.00

Boiler Room Trading

1 × $15.00 -

×

Trendfund.com - Scalping, Options, Advanced Options

1 × $4.00

Trendfund.com - Scalping, Options, Advanced Options

1 × $4.00 -

×

Scalping is Fun Course with Peter Devaere

1 × $109.00

Scalping is Fun Course with Peter Devaere

1 × $109.00 -

×

Forex Options Trading

1 × $6.00

Forex Options Trading

1 × $6.00 -

×

FX At One Glance - Ichimoku Advanced Japanese Techniques

1 × $15.00

FX At One Glance - Ichimoku Advanced Japanese Techniques

1 × $15.00 -

×

Forex Supreme Course with Ethan Wilson

1 × $6.00

Forex Supreme Course with Ethan Wilson

1 × $6.00 -

×

Trading System Development 101,102,103

1 × $6.00

Trading System Development 101,102,103

1 × $6.00 -

×

Market Makers Method Forex Trading with Nick Nechanicky

1 × $5.00

Market Makers Method Forex Trading with Nick Nechanicky

1 × $5.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00

CM Pivot Power Trade Method with Austin Passamonte

$6.00

File Size: Cooming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

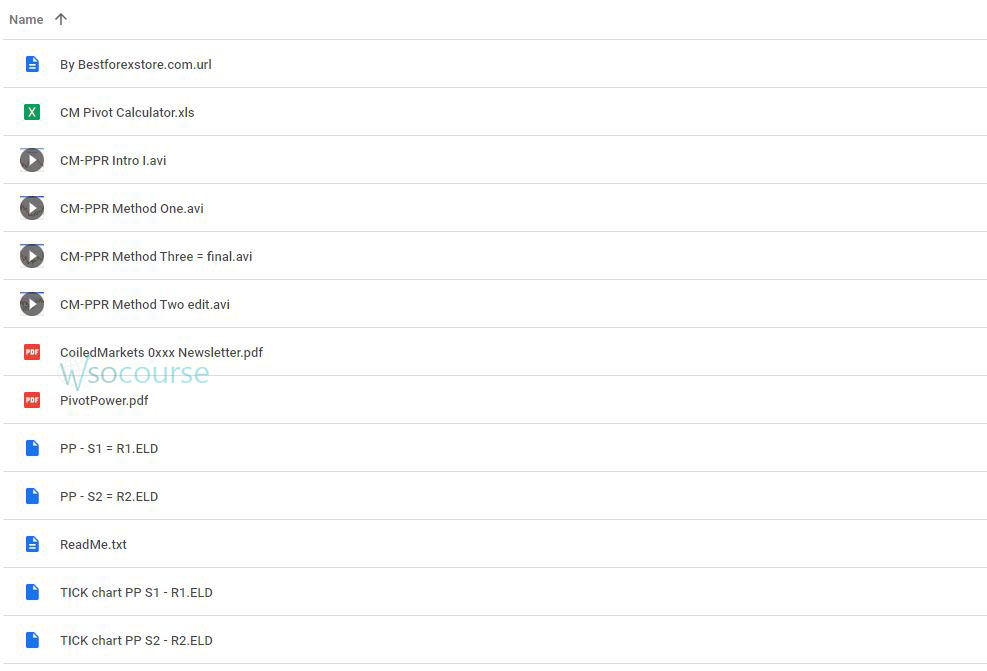

You may check content proof of “CM Pivot Power Trade Method with Austin Passamonte” below:

CM Pivot Power Trade Method with Austin Passamonte: Unleashing Profit Potential

Introduction

In the ever-evolving landscape of day trading, the CM Pivot Power Trade Method, pioneered by Austin Passamonte, stands out as a revolutionary approach. This method harnesses the power of pivot points to predict market movements more accurately, offering traders a robust strategy to maximize their returns. In this article, we will explore how this technique can transform your trading experience, ensuring you make the most out of every trade.

What is the CM Pivot Power Trade Method?

Understanding Pivot Points

Pivot points are technical indicators used by traders to determine potential support and resistance levels. They are calculated using the previous trading session’s high, low, and close prices.

The Core of CM Pivot Power Trade

Austin Passamonte’s CM Pivot Power Trade Method takes this concept further by incorporating unique calculations and market insights, enabling traders to pinpoint highly probable trade entries and exits.

Benefits of CM Pivot Power Trade Method

Increased Accuracy

By focusing on key pivot levels, traders can engage with the market at points where the price movements are more predictable, reducing the risk of loss.

Enhanced Decision Making

The clarity provided by this method empowers traders to make informed decisions quickly, an essential factor in the fast-paced trading environment.

Implementing the Strategy

Step-by-Step Guide

- Identify the Pivot Points: Calculate the pivot points based on the previous day’s market data.

- Monitor Market Behavior: Watch how the market responds to these pivot levels.

- Execute Trades: Place trades when the price action confirms the predicted movements at pivot points.

Tools and Resources

Utilizing charting software and pivot calculators can simplify the process, making it accessible even for novice traders.

Case Studies: Success Stories

We’ve seen numerous traders who’ve significantly boosted their portfolios using this method. Detailed case studies reveal consistent success rates and improved profit margins.

Challenges and How to Overcome Them

Common Pitfalls

- Overreliance on Pivot Points: Diversify strategies to avoid heavy losses in atypical market conditions.

- Timing Errors: Timing the trades around pivot points is crucial and often requires practice.

Solutions

- Continuous Learning: Stay updated with market trends and adjust your strategy accordingly.

- Simulation and Backtesting: Practice with historical data to refine your execution timing.

Future of Trading with Pivot Points

Innovations on the Horizon

The integration of AI and machine learning with pivot-based trading methods promises even greater precision and efficiency in the future.

Conclusion

The CM Pivot Power Trade Method offers a comprehensive and efficient strategy for day traders. By effectively utilizing pivot points, traders can enhance their trading accuracy and decision-making skills, leading to improved profitability. As markets evolve, so too will this method, incorporating more advanced technologies to aid in trading decisions.

Frequently Asked Questions:

- What are pivot points?

Pivot points are technical analysis indicators used to determine potential support and resistance levels in the trading world. - How does the CM Pivot Power Trade Method differ from standard pivot point strategies? Austin Passamonte’s method involves unique calculations that provide more precise entry and exit points.

- Is this method suitable for beginners?

Yes, with adequate study and practice, even beginners can effectively implement this strategy. - Can this method be applied to all markets?

While primarily used in forex and futures, it can be adapted to various markets with some modifications. - What is the key to success with the CM Pivot Power Trade Method?

Understanding market patterns and practicing timely execution are crucial.

Be the first to review “CM Pivot Power Trade Method with Austin Passamonte” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Reviews

There are no reviews yet.