-

×

Quick Scalp Trader (Unlocked)

1 × $31.00

Quick Scalp Trader (Unlocked)

1 × $31.00 -

×

Complete Trading Bundle with AAA Quants

1 × $27.00

Complete Trading Bundle with AAA Quants

1 × $27.00 -

×

FX GOAT CURRENCIES COURSE 2.0

1 × $13.00

FX GOAT CURRENCIES COURSE 2.0

1 × $13.00 -

×

The Online Investing Book with Harry Domash

1 × $6.00

The Online Investing Book with Harry Domash

1 × $6.00 -

×

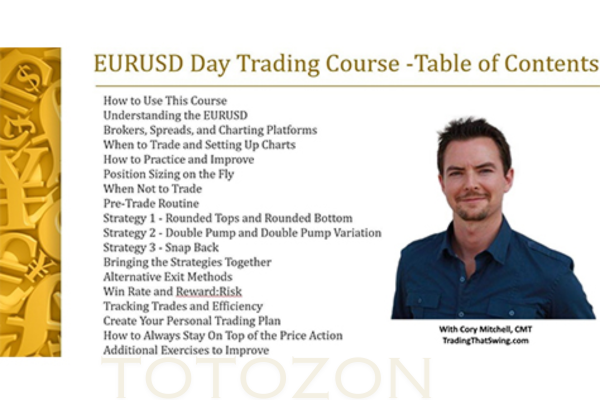

The EURUSD Day Trading Course with Cory Mitchell - Trade That Swing

1 × $15.00

The EURUSD Day Trading Course with Cory Mitchell - Trade That Swing

1 × $15.00 -

×

TRADER SMILE MANAGEMENT TRAINING COURSE

1 × $31.00

TRADER SMILE MANAGEMENT TRAINING COURSE

1 × $31.00 -

×

Momentum Explained. Vol.1

1 × $6.00

Momentum Explained. Vol.1

1 × $6.00 -

×

The Finessee_fx Enigma Course + PD Array Matrix with Pipsey Hussle

1 × $13.00

The Finessee_fx Enigma Course + PD Array Matrix with Pipsey Hussle

1 × $13.00 -

×

Cloud9Nine Trading Course

1 × $5.00

Cloud9Nine Trading Course

1 × $5.00 -

×

Street Smarts & TS Code with Larry Connors & Linda Bradford Rashcke

1 × $6.00

Street Smarts & TS Code with Larry Connors & Linda Bradford Rashcke

1 × $6.00 -

×

Toast FX Course

1 × $5.00

Toast FX Course

1 × $5.00 -

×

Investments (6th Ed.)

1 × $6.00

Investments (6th Ed.)

1 × $6.00 -

×

Tradeciety Online Forex Trading MasterClass

1 × $5.00

Tradeciety Online Forex Trading MasterClass

1 × $5.00 -

×

Hot Trading Investing Strategy: ETF and Futures with QSB Funds

1 × $6.00

Hot Trading Investing Strategy: ETF and Futures with QSB Funds

1 × $6.00 -

×

The Order Flow Edge Trading Course with Michael Valtos

1 × $20.00

The Order Flow Edge Trading Course with Michael Valtos

1 × $20.00 -

×

Trading Indicators for the 21th Century

1 × $15.00

Trading Indicators for the 21th Century

1 × $15.00 -

×

The Ultimate Supply and Demand Course - Anonymous

1 × $31.00

The Ultimate Supply and Demand Course - Anonymous

1 × $31.00 -

×

Dynamic Swing Trader-NETPICKS (Unlocked)

1 × $54.00

Dynamic Swing Trader-NETPICKS (Unlocked)

1 × $54.00 -

×

Trading Psychology - How to Think Like a Professional Trader - 4 DVD

1 × $6.00

Trading Psychology - How to Think Like a Professional Trader - 4 DVD

1 × $6.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

The Smart Income Strategy with Anthony Verner

1 × $171.00

The Smart Income Strategy with Anthony Verner

1 × $171.00 -

×

Maximizing Profits with Weekly Options with Optionpit

1 × $15.00

Maximizing Profits with Weekly Options with Optionpit

1 × $15.00 -

×

The Investor Accelerator Premium Membership

1 × $34.00

The Investor Accelerator Premium Membership

1 × $34.00 -

×

Mindset Trader Day Trading Course with Mafia Trading

1 × $6.00

Mindset Trader Day Trading Course with Mafia Trading

1 × $6.00 -

×

MOJO TOOLBOX with ProTrader Mike

1 × $23.00

MOJO TOOLBOX with ProTrader Mike

1 × $23.00 -

×

The Stock Market Course with George Fontanills & Tom Gentile

1 × $6.00

The Stock Market Course with George Fontanills & Tom Gentile

1 × $6.00 -

×

Trading BIG Moves With Options

1 × $31.00

Trading BIG Moves With Options

1 × $31.00 -

×

Thetimefactor - TRADING WITH PRICE

1 × $15.00

Thetimefactor - TRADING WITH PRICE

1 × $15.00 -

×

TTM Directional Day Filter System for TS

1 × $6.00

TTM Directional Day Filter System for TS

1 × $6.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

Weekly Power Options Strategies

1 × $6.00

Weekly Power Options Strategies

1 × $6.00 -

×

Advanced Seminar

1 × $31.00

Advanced Seminar

1 × $31.00 -

×

The Profit-Taker Breakthrough with Don Abrams

1 × $4.00

The Profit-Taker Breakthrough with Don Abrams

1 × $4.00 -

×

Level 3 - AlgoX Trading Tactics

1 × $31.00

Level 3 - AlgoX Trading Tactics

1 × $31.00 -

×

The First Time Investor: How to Start Safe, Invest Smart and Sleep Well (2nd Edition) with Larry Chambers

1 × $6.00

The First Time Investor: How to Start Safe, Invest Smart and Sleep Well (2nd Edition) with Larry Chambers

1 × $6.00 -

×

Expert Option Trading Course with David Vallieres & Tim Warren

1 × $23.00

Expert Option Trading Course with David Vallieres & Tim Warren

1 × $23.00 -

×

The Email Academy

1 × $31.00

The Email Academy

1 × $31.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

ValueSpace. Winning the Battle for Market Leadership with Banwari Mittal, Jagdish N.Sheth

1 × $6.00

ValueSpace. Winning the Battle for Market Leadership with Banwari Mittal, Jagdish N.Sheth

1 × $6.00 -

×

Bradley F.Cowan (Cycle-Trader.com)

1 × $23.00

Bradley F.Cowan (Cycle-Trader.com)

1 × $23.00 -

×

Breakouts: The Quintessential Approach – Feibel Trading

1 × $31.00

Breakouts: The Quintessential Approach – Feibel Trading

1 × $31.00 -

×

Time Factor Digital Course with William McLaren

1 × $6.00

Time Factor Digital Course with William McLaren

1 × $6.00 -

×

TTM Slingshot

1 × $6.00

TTM Slingshot

1 × $6.00 -

×

Vantagepointtrading - Stock Market Swing Trading Video Course

1 × $15.00

Vantagepointtrading - Stock Market Swing Trading Video Course

1 × $15.00 -

×

Momentum Signals Interactive Training Course 2010-2011

1 × $6.00

Momentum Signals Interactive Training Course 2010-2011

1 × $6.00 -

×

Credit Spreads Deep Dive with Jay Bailey - Sheridan Options Mentoring

1 × $31.00

Credit Spreads Deep Dive with Jay Bailey - Sheridan Options Mentoring

1 × $31.00 -

×

Uncover Resilient Stocks in Today’s Market with Peter Worden

1 × $6.00

Uncover Resilient Stocks in Today’s Market with Peter Worden

1 × $6.00 -

×

Trading the Moves - Consistent Gains in All Markets with Ed Downs

1 × $6.00

Trading the Moves - Consistent Gains in All Markets with Ed Downs

1 × $6.00 -

×

Mastering the Trade

1 × $6.00

Mastering the Trade

1 × $6.00 -

×

Trading Hub 4.0 Ebook

1 × $5.00

Trading Hub 4.0 Ebook

1 × $5.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Essential Technical Analysis with Leigh Stevens

1 × $6.00

Essential Technical Analysis with Leigh Stevens

1 × $6.00 -

×

Hit & Run Trading II with Jeff Cooper

1 × $4.00

Hit & Run Trading II with Jeff Cooper

1 × $4.00 -

×

Aspectos Generales del Mercado de Valores with A.Bachiller

1 × $6.00

Aspectos Generales del Mercado de Valores with A.Bachiller

1 × $6.00 -

×

Trading on the Edge with Guido J.Deboeck

1 × $6.00

Trading on the Edge with Guido J.Deboeck

1 × $6.00 -

×

The Winning Secret

1 × $23.00

The Winning Secret

1 × $23.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

WyseTrade Trading Masterclass Course

1 × $5.00

WyseTrade Trading Masterclass Course

1 × $5.00 -

×

Ultimate Day Trading Program with Maroun4x

1 × $5.00

Ultimate Day Trading Program with Maroun4x

1 × $5.00 -

×

Turtle Soup Course with ICT Trader Romeo

1 × $5.00

Turtle Soup Course with ICT Trader Romeo

1 × $5.00 -

×

A Forex System For Catching Pips All Day Long with Forex Pip Fishing

1 × $4.00

A Forex System For Catching Pips All Day Long with Forex Pip Fishing

1 × $4.00 -

×

The Unified Theory of Markets with Earik Beann

1 × $78.00

The Unified Theory of Markets with Earik Beann

1 × $78.00 -

×

Professional Trader Series DVD Set (Full)

1 × $23.00

Professional Trader Series DVD Set (Full)

1 × $23.00 -

×

Forex Masterclass with 20 Minute Trader

1 × $23.00

Forex Masterclass with 20 Minute Trader

1 × $23.00 -

×

Voodoo Lines Indicator

1 × $62.00

Voodoo Lines Indicator

1 × $62.00 -

×

Using EasyLanguage 2000 with Arthur G.Putt, William Brower

1 × $4.00

Using EasyLanguage 2000 with Arthur G.Putt, William Brower

1 × $4.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

FXCharger

1 × $23.00

FXCharger

1 × $23.00 -

×

DayTradeMax

1 × $31.00

DayTradeMax

1 × $31.00 -

×

Tradeonix Trading System

1 × $31.00

Tradeonix Trading System

1 × $31.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

TotalTheo 12 Month Mentorship

1 × $54.00

TotalTheo 12 Month Mentorship

1 × $54.00 -

×

Ultra Blue Forex 2024 with Russ Horn

1 × $17.00

Ultra Blue Forex 2024 with Russ Horn

1 × $17.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Insiders guide to Trading Weekly Options with John Carter

1 × $54.00

Insiders guide to Trading Weekly Options with John Carter

1 × $54.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

ZCFX Trading Course 2023 with ZCFX Trading

1 × $5.00

ZCFX Trading Course 2023 with ZCFX Trading

1 × $5.00 -

×

The Squeeze Pro System: How to Catch Bigger and Faster Squeezes More Often

1 × $54.00

The Squeeze Pro System: How to Catch Bigger and Faster Squeezes More Often

1 × $54.00 -

×

Trading Earnings Using Measured-Move Targets with AlphaShark

1 × $23.00

Trading Earnings Using Measured-Move Targets with AlphaShark

1 × $23.00 -

×

FX GOAT FOREX TRADING ACADEMY

1 × $8.00

FX GOAT FOREX TRADING ACADEMY

1 × $8.00 -

×

The Engulfing Trader Video Series 2014 with Timon Weller

1 × $6.00

The Engulfing Trader Video Series 2014 with Timon Weller

1 × $6.00 -

×

Trading Power Tools with Ryan Litchfield

1 × $6.00

Trading Power Tools with Ryan Litchfield

1 × $6.00 -

×

The Volatility Course + The Volatility Course Workbook with George Fontanills & Tom Gentile

1 × $6.00

The Volatility Course + The Volatility Course Workbook with George Fontanills & Tom Gentile

1 × $6.00 -

×

Cyber trading university - Pro Strategies for Trading Stocks or Options Workshop

1 × $15.00

Cyber trading university - Pro Strategies for Trading Stocks or Options Workshop

1 × $15.00 -

×

Iron Condor - Advanced

1 × $31.00

Iron Condor - Advanced

1 × $31.00 -

×

The Foundation with Dan Maxwell

1 × $6.00

The Foundation with Dan Maxwell

1 × $6.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Credit Spread Trading In 2018 with Dan Sheridan

1 × $15.00

Credit Spread Trading In 2018 with Dan Sheridan

1 × $15.00 -

×

Trading Patterns for Producing Huge Profits with Barry Burns

1 × $4.00

Trading Patterns for Producing Huge Profits with Barry Burns

1 × $4.00 -

×

Tick By Tick By Alphonso Esposito - TradeSmart

1 × $6.00

Tick By Tick By Alphonso Esposito - TradeSmart

1 × $6.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

Trading Price Action Reversals (Kindle) with Al Brooks

1 × $6.00

Trading Price Action Reversals (Kindle) with Al Brooks

1 × $6.00 -

×

TTM Trading with the Anchor Indicators Video

1 × $6.00

TTM Trading with the Anchor Indicators Video

1 × $6.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Winning Chart Patterns. 7 Patterns That Really Work with Ed Downs

1 × $6.00

Winning Chart Patterns. 7 Patterns That Really Work with Ed Downs

1 × $6.00 -

×

Becoming Rich with Mark Tier

1 × $6.00

Becoming Rich with Mark Tier

1 × $6.00 -

×

Volume Analysis – Smart Money

1 × $6.00

Volume Analysis – Smart Money

1 × $6.00 -

×

Getting Started in Currency Trading with Michael Duarne Archer, James L.Bickford

1 × $6.00

Getting Started in Currency Trading with Michael Duarne Archer, James L.Bickford

1 × $6.00 -

×

The Septiform System of the Cosmos with Alec Stuart

1 × $6.00

The Septiform System of the Cosmos with Alec Stuart

1 × $6.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

The Best Way to Trade Fibonacci On Demand

1 × $15.00

The Best Way to Trade Fibonacci On Demand

1 × $15.00 -

×

King Zulfan Academy – Course with Malaysian Trader

1 × $5.00

King Zulfan Academy – Course with Malaysian Trader

1 × $5.00 -

×

The Spiral Calendar and Its Effect on Financial Markets and Human Events with Christopher Carolan

1 × $6.00

The Spiral Calendar and Its Effect on Financial Markets and Human Events with Christopher Carolan

1 × $6.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Claytrader – Risk vs Reward Trading

$347.00 Original price was: $347.00.$23.00Current price is: $23.00.

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Master Risk vs Reward Trading Strategies

Introduction

Welcome to our comprehensive guide on Claytrader – Risk vs Reward Trading. This article explores the crucial concept of risk vs reward in trading, as taught by Claytrader. We will delve into the core principles, strategies, and practical applications to help you enhance your trading performance. Whether you’re a beginner or an experienced trader, understanding risk vs reward is essential for consistent success in the markets.

Who is Claytrader?

Background and Expertise

Claytrader, a renowned trader and educator, has built a reputation for his straightforward and practical approach to trading. With years of experience in the financial markets, he offers valuable insights and strategies to traders of all levels.

Trading Philosophy

Claytrader emphasizes the importance of risk management and strategic planning. His philosophy revolves around making informed decisions based on a clear understanding of risk and reward dynamics.

What is Risk vs Reward Trading?

Definition

Risk vs reward trading involves evaluating the potential risk and reward of a trade before entering a position. This ratio helps traders determine whether a trade is worth taking based on its potential return relative to its risk.

Importance

- Decision Making: Helps in making informed trading decisions.

- Risk Management: Ensures that risks are controlled and managed effectively.

- Profit Maximization: Aids in maximizing potential returns while minimizing risks.

Core Concepts of Risk vs Reward

1. Calculating Risk

Stop-Loss Orders

Setting stop-loss orders is crucial for defining the maximum risk on a trade. This helps in limiting losses if the market moves against your position.

Position Sizing

Determine the size of your position based on your risk tolerance and account size. Proper position sizing ensures that you do not risk too much on any single trade.

2. Calculating Reward

Profit Targets

Set realistic profit targets to determine the potential reward of a trade. This involves identifying key levels where you plan to take profits.

Risk-Reward Ratio

Calculate the risk-reward ratio by comparing the potential profit to the potential loss. A favorable ratio typically means that the potential reward is greater than the risk.

Strategies for Risk vs Reward Trading

1. Trend Following

Strategy Overview

Follow the prevailing market trend to increase the likelihood of profitable trades.

Implementation

Use technical indicators such as moving averages and trend lines to identify and follow trends.

2. Breakout Trading

Strategy Overview

Trade breakouts when the price moves beyond a key support or resistance level.

Implementation

Use volume indicators to confirm the strength of a breakout and set stop-loss orders below the breakout level.

3. Reversal Trading

Strategy Overview

Trade reversals when the price changes direction after reaching an extreme level.

Implementation

Use technical indicators such as RSI and candlestick patterns to identify potential reversals.

Practical Application of Risk vs Reward

Step-by-Step Guide

- Set Up Your Charts: Configure your trading platform to display relevant charts and indicators.

- Identify Key Levels: Draw support and resistance levels on your charts.

- Calculate Risk: Determine the risk for each trade by setting stop-loss orders.

- Calculate Reward: Set profit targets to determine the potential reward.

- Execute Trades: Enter trades based on your analysis and strategy.

- Monitor and Adjust: Continuously monitor your positions and adjust your strategy as needed.

Example Trade

Bullish Breakout Trade

- Identify Resistance Level: Look for a significant resistance level.

- Wait for Breakout: Enter a trade when the price breaks above the resistance level.

- Set Stop-Loss: Place a stop-loss below the breakout level to manage risk.

- Set Profit Target: Determine a profit target based on the risk-reward ratio.

Bearish Reversal Trade

- Identify Support Level: Look for a significant support level.

- Look for Reversal Pattern: Enter a trade when a bearish reversal pattern forms at the support level.

- Set Stop-Loss: Place a stop-loss above the reversal pattern to manage risk.

- Set Profit Target: Determine a profit target based on the risk-reward ratio.

Benefits of Risk vs Reward Trading

Consistency

Provides a structured approach to trading, reducing emotional decision-making.

Risk Management

Enhances the ability to manage risks effectively, protecting your capital.

Profitability

Increases the potential for profitable trades by focusing on favorable risk-reward ratios.

Common Mistakes to Avoid

Ignoring Risk Management

Failing to set stop-loss orders and calculate risk can lead to significant losses.

Overtrading

Avoid the temptation to trade too frequently. Focus on high-probability setups.

Unrealistic Expectations

Set realistic profit targets and avoid expecting massive returns from every trade.

Tools and Resources for Risk vs Reward Trading

Trading Platforms

Choose a platform with advanced charting tools and risk management features.

Educational Resources

Continuously learn and update your knowledge through books, courses, and webinars.

Success Stories from Claytrader

Trader A’s Journey

Trader A used Claytrader’s risk vs reward strategies to transform their trading approach, achieving consistent profits and minimizing losses.

Trader B’s Experience

Trader B found the emphasis on risk management and strategic planning invaluable for making informed trading decisions.

Conclusion

The Claytrader – Risk vs Reward Trading approach offers a robust framework for making informed and profitable trading decisions. By understanding and implementing the core concepts and strategies outlined in this guide, you can enhance your trading performance and achieve your financial goals. Remember to stay disciplined, continuously learn, and manage your risks effectively.

Commonly Asked Questions:

- Business Model Innovation: Accept the truth of a legitimate business! Our strategy is organising a group buy in which participants share the costs. We use these cash to acquire popular courses from sale pages and make them available to people with limited financial resources. Despite the authors’ worries, our clients love the cost and accessibility we give.

- The Legal Environment: Yes or No The legality of our activity is ambiguous. While we don’t have specific permission from the course authors to resell the material, there is a technicality at work. The author did not specify any limits on resale when purchasing the course. This legal intricacy is both an opportunity for us and a boon for individuals looking for low-cost access.

- Quality Control: Uncovering the Truth

Getting to the heart of the issue – quality. Purchasing the course straight from the sale page guarantees that all documents and resources are the same as those obtained through traditional channels.

However, we distinguish ourselves by going beyond personal research and resale. It is crucial to note that we are not the official course providers, which means that the following premium services are not included in our package:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not permitted.

- No access to the author’s private membership forum.

- There is no direct email support available from the author or their team.

We operate independently, with the goal of bridging the pricing gap without the extra services provided by official course channels. Your comprehension of our distinct approach is much appreciated.

Be the first to review “Claytrader – Risk vs Reward Trading” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.