-

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Optionetics 2007 - Home Study Course, MP3

1 × $6.00

Optionetics 2007 - Home Study Course, MP3

1 × $6.00 -

×

Inefficient Markets with Andrei Shleifer

1 × $6.00

Inefficient Markets with Andrei Shleifer

1 × $6.00 -

×

Trade the OEX with Arthur Darack

1 × $6.00

Trade the OEX with Arthur Darack

1 × $6.00 -

×

How to Trade the New Single Stock Futures with Jack Bernstein

1 × $6.00

How to Trade the New Single Stock Futures with Jack Bernstein

1 × $6.00 -

×

Forex Avenger Trading System with David Curran

1 × $6.00

Forex Avenger Trading System with David Curran

1 × $6.00 -

×

WEBINAR series 5 – EXECUTION: A DETAILED PROCESS with FuturesTrader71

1 × $4.00

WEBINAR series 5 – EXECUTION: A DETAILED PROCESS with FuturesTrader71

1 × $4.00 -

×

Advanced Options Trading Strategies Explained

1 × $23.00

Advanced Options Trading Strategies Explained

1 × $23.00 -

×

Monthly Cash Flow Trading Options (Intermediate Option Trading Course) with Randy Perez

1 × $85.00

Monthly Cash Flow Trading Options (Intermediate Option Trading Course) with Randy Perez

1 × $85.00 -

×

Complete Best Practices - Weekly Options Income Trading System with Weekly Options Academy

1 × $23.00

Complete Best Practices - Weekly Options Income Trading System with Weekly Options Academy

1 × $23.00 -

×

Double Top Trader Trading System with Anthony Gibson

1 × $6.00

Double Top Trader Trading System with Anthony Gibson

1 × $6.00 -

×

Price Action Trader Training

1 × $6.00

Price Action Trader Training

1 × $6.00 -

×

SOAP. Served On A Platter CD with David Elliott

1 × $6.00

SOAP. Served On A Platter CD with David Elliott

1 × $6.00 -

×

The Dark Side Of Valuation with Aswath Damodaran

1 × $6.00

The Dark Side Of Valuation with Aswath Damodaran

1 × $6.00 -

×

Forex Ulitmatum with Matt Jordan & Patrick Cuthbert

1 × $6.00

Forex Ulitmatum with Matt Jordan & Patrick Cuthbert

1 × $6.00 -

×

Measuring Market Risk (2nd Edition) with Kevin Dowd

1 × $6.00

Measuring Market Risk (2nd Edition) with Kevin Dowd

1 × $6.00 -

×

The Value Connection with Marc Gerstein

1 × $5.00

The Value Connection with Marc Gerstein

1 × $5.00 -

×

Sure Fire Forex Trading with Mark McRae

1 × $6.00

Sure Fire Forex Trading with Mark McRae

1 × $6.00 -

×

The Alvarez Factor

1 × $23.00

The Alvarez Factor

1 × $23.00 -

×

Price Action Trading with Bill Eykyn

1 × $6.00

Price Action Trading with Bill Eykyn

1 × $6.00 -

×

How To Scale Up Your Trading - Online Trading Seminar Replay with Austin Silver - ASFX

1 × $31.00

How To Scale Up Your Trading - Online Trading Seminar Replay with Austin Silver - ASFX

1 × $31.00 -

×

Advance Courses for Members

1 × $15.00

Advance Courses for Members

1 × $15.00 -

×

3 Short Selling Strategies - Trading Strategy Bundles – Quantified Strategies

1 × $39.00

3 Short Selling Strategies - Trading Strategy Bundles – Quantified Strategies

1 × $39.00 -

×

Marder Videos Reports 2019 with Kevin Marder

1 × $34.00

Marder Videos Reports 2019 with Kevin Marder

1 × $34.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Options for Long Term Trading & Hedging with Option Pit

1 × $39.00

Options for Long Term Trading & Hedging with Option Pit

1 × $39.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

ASFX Beginner Training Course & VIP Chat with ASFX Day Trading

1 × $31.00

ASFX Beginner Training Course & VIP Chat with ASFX Day Trading

1 × $31.00 -

×

Theotrade - Essential Skills for Consistency in Trading Class

1 × $15.00

Theotrade - Essential Skills for Consistency in Trading Class

1 × $15.00 -

×

Sample and Mock Exams 2008 with CFA Institute

1 × $6.00

Sample and Mock Exams 2008 with CFA Institute

1 × $6.00 -

×

Math Trading Course 2023

1 × $34.00

Math Trading Course 2023

1 × $34.00 -

×

Wyckoff 2.0: Structures, Volume Profile and Order Flow (Trading and Investing Course: Advanced Technical Analysis) by Rubén Villahermosa

1 × $5.00

Wyckoff 2.0: Structures, Volume Profile and Order Flow (Trading and Investing Course: Advanced Technical Analysis) by Rubén Villahermosa

1 × $5.00 -

×

The STRAT Execution Basics with Jermaine McGruder

1 × $31.00

The STRAT Execution Basics with Jermaine McGruder

1 × $31.00 -

×

Programming in Python For Traders

1 × $78.00

Programming in Python For Traders

1 × $78.00 -

×

Day Trading 101 How To Day Trade Stocks for Passive Income

1 × $6.00

Day Trading 101 How To Day Trade Stocks for Passive Income

1 × $6.00 -

×

Quantitative Finance & Algorithmic Trading II - Time Series with Holczer Balazs

1 × $4.00

Quantitative Finance & Algorithmic Trading II - Time Series with Holczer Balazs

1 × $4.00 -

×

Practical Approach to Amibroker Scanners and Exploration with Rajandran R

1 × $4.00

Practical Approach to Amibroker Scanners and Exploration with Rajandran R

1 × $4.00 -

×

Handbook of Computer Vision Algorithms in Image Algebra with Gerhard Ritter & Joseph Wilson

1 × $6.00

Handbook of Computer Vision Algorithms in Image Algebra with Gerhard Ritter & Joseph Wilson

1 × $6.00 -

×

Trade Setups And Strategies Program with The Daytrading Room

1 × $23.00

Trade Setups And Strategies Program with The Daytrading Room

1 × $23.00 -

×

My General Counsel™

1 × $23.00

My General Counsel™

1 × $23.00 -

×

Profit Wave Trade Strategy with Base Camp Trading

1 × $4.00

Profit Wave Trade Strategy with Base Camp Trading

1 × $4.00 -

×

Foreign Exchange Option Pricing: A Practitioner's Guide with Iain Clark

1 × $6.00

Foreign Exchange Option Pricing: A Practitioner's Guide with Iain Clark

1 × $6.00 -

×

Market Profile E-Course with Charles Gough - Pirate Traders

1 × $17.00

Market Profile E-Course with Charles Gough - Pirate Traders

1 × $17.00 -

×

Tandem Trader - The Ultimate Day Trading Course with Nathan Michaud - Investors Underground

1 × $54.00

Tandem Trader - The Ultimate Day Trading Course with Nathan Michaud - Investors Underground

1 × $54.00 -

×

Intro To Short Selling with Madaz Money

1 × $31.00

Intro To Short Selling with Madaz Money

1 × $31.00 -

×

BSAPPS FX Course with Ben Barker

1 × $6.00

BSAPPS FX Course with Ben Barker

1 × $6.00 -

×

Practical Approach to Amibroker Backtesting with Rajandran R

1 × $6.00

Practical Approach to Amibroker Backtesting with Rajandran R

1 × $6.00 -

×

BETT Strategy with TopTradeTools

1 × $35.00

BETT Strategy with TopTradeTools

1 × $35.00 -

×

The Handbook of Equity Style Management (3rd Ed) with Daniel Coggin & Frank Fabozzi

1 × $6.00

The Handbook of Equity Style Management (3rd Ed) with Daniel Coggin & Frank Fabozzi

1 × $6.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Mesa & Trading Market Cycles (1st Edition) with John Ehlers & Perry Kaufman

1 × $6.00

Mesa & Trading Market Cycles (1st Edition) with John Ehlers & Perry Kaufman

1 × $6.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

FX Prosperity Academy with Leonard Williams Jr

1 × $5.00

FX Prosperity Academy with Leonard Williams Jr

1 × $5.00 -

×

Advanced Options Trading with Lucas Downey

1 × $15.00

Advanced Options Trading with Lucas Downey

1 × $15.00 -

×

Traders Positioning System with Lee Gettess

1 × $4.00

Traders Positioning System with Lee Gettess

1 × $4.00 -

×

GLOBAL MACRO PRO TRADING COURSE

1 × $31.00

GLOBAL MACRO PRO TRADING COURSE

1 × $31.00 -

×

Fractal Market Analysis with Edgar Peters

1 × $6.00

Fractal Market Analysis with Edgar Peters

1 × $6.00 -

×

The Stock Index Futures Market with B.Thomas Byme Jr.

1 × $6.00

The Stock Index Futures Market with B.Thomas Byme Jr.

1 × $6.00 -

×

IncomeMax Spreads with Hari Swaminathan

1 × $23.00

IncomeMax Spreads with Hari Swaminathan

1 × $23.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

Trading Connors VIX Reversals & Tradestation Files with Larry Connors

1 × $6.00

Trading Connors VIX Reversals & Tradestation Files with Larry Connors

1 × $6.00 -

×

Best Trading Set Ups Playbook with Stacey Burke Trading

1 × $5.00

Best Trading Set Ups Playbook with Stacey Burke Trading

1 × $5.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00

RiskDoctor RD1 – Introduction to Options Trading the RiskDoctor Way with Charles Cottle

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

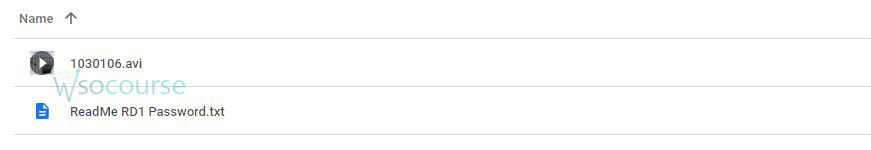

Content Proof: Watch Here!

You may check content proof of “RiskDoctor RD1 – Introduction to Options Trading the RiskDoctor Way with Charles Cottle” below:

RiskDoctor RD1 – Introduction to Options Trading the RiskDoctor Way with Charles Cottle

Introduction

Options trading can be a daunting venture for many, but with the guidance of Charles Cottle, also known as the Risk Doctor, it becomes an accessible and rewarding financial strategy. The “RiskDoctor RD1 – Introduction to Options Trading the RiskDoctor Way” course is designed to equip beginners with the foundational skills needed to navigate the options market successfully.

Who is Charles Cottle?

Background and Expertise

Charles Cottle, revered in the trading community as the Risk Doctor, brings decades of trading experience and education to the table. His approach simplifies complex trading concepts, making them accessible to traders at all levels.

Philosophy on Options Trading

Cottle’s teaching philosophy emphasizes the importance of risk management and understanding the intrinsic behaviors of the options market.

Overview of the RD1 Course

Course Objectives

The RD1 course aims to:

- Demystify the basics of options trading

- Teach practical risk management strategies

- Introduce Cottle’s unique methods and insights

Module Breakdown

The course is structured into several detailed modules, each focusing on different aspects of options trading:

- Module 1: Options Basics

- Module 2: Calls and Puts

- Module 3: Trading Strategies

- Module 4: Risk Management

Key Concepts Covered

Understanding Options

Options are financial instruments that provide the holder the right, but not the obligation, to buy or sell an asset at a predetermined price within a specific time period.

Calls and Puts

The course delves deep into calls and puts, the two primary types of options, and how they can be used strategically in trading portfolios.

The RiskDoctor’s Strategies

Cottle introduces participants to his proprietary trading strategies that have helped many traders minimize risks while maximizing potential returns.

Benefits of Learning from Charles Cottle

Expert Guidance

Learning from a seasoned trader like Cottle provides insights that are typically not available in textbooks or regular courses.

Practical Skills

Participants gain practical skills that can be applied in real-world trading scenarios, not just theoretical knowledge.

Community and Support

Students of the RD1 course often form a community, providing support and networking opportunities that are invaluable in the trading world.

Who Should Take This Course?

Target Audience

- Beginners who are new to options trading

- Intermediate traders who want to refine their strategies

- Finance professionals looking to expand their skill sets

Course Materials and Resources

Comprehensive Study Guides

The RD1 course includes a series of study guides that are easy to follow and rich in content.

Interactive Learning Sessions

Cottle’s interactive sessions enhance understanding and retention of the trading concepts discussed.

How to Enroll

Registration Process

Details on how to enroll in the RD1 course are available on the Risk Doctor’s official website, including session timings and fees.

Success Stories and Testimonials

Feedback from Alumni

Many alumni of the RD1 course have gone on to achieve success in the options market, attributing their accomplishments to the solid foundation built during their training.

Conclusion

The “RiskDoctor RD1 – Introduction to Options Trading the RiskDoctor Way” is a comprehensive course that serves as a gateway into the world of options trading. Under Charles Cottle’s expert tutelage, participants are well-prepared to tackle the markets with confidence and a robust toolkit of trading strategies.

Frequently Asked Questions:

- What prerequisites are needed for the RD1 course?

A basic understanding of finance and markets is helpful, but not required. - How long is the RD1 course?

The course duration can vary, but typically spans several weeks with multiple sessions. - Can I take the course online?

Yes, the RD1 course is available online, allowing participants to learn from anywhere in the world. - What makes Charles Cottle’s teaching unique?

Cottle’s methods focus on practical risk management and the psychological aspects of trading, which are often overlooked in other programs. - Is there a certification upon completion?

Yes, participants receive a certificate of completion which is highly regarded in the trading community.

Be the first to review “RiskDoctor RD1 – Introduction to Options Trading the RiskDoctor Way with Charles Cottle” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.