-

×

Tail Hedging - Learn to Insure Stocks Against Large Declines with James Marsh

1 × $15.00

Tail Hedging - Learn to Insure Stocks Against Large Declines with James Marsh

1 × $15.00 -

×

Secrets of the Darvas Trading System

1 × $6.00

Secrets of the Darvas Trading System

1 × $6.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

Module II - Signature Trades with FX MindShift

1 × $6.00

Module II - Signature Trades with FX MindShift

1 × $6.00 -

×

Best Trading Set Ups Playbook with Stacey Burke Trading

1 × $5.00

Best Trading Set Ups Playbook with Stacey Burke Trading

1 × $5.00 -

×

Fibonacci Trading: How to Master the Time and Price Advantage with Carolyn Boroden

1 × $6.00

Fibonacci Trading: How to Master the Time and Price Advantage with Carolyn Boroden

1 × $6.00 -

×

Price Action Trading Volume 2 with Fractal Flow Pro

1 × $6.00

Price Action Trading Volume 2 with Fractal Flow Pro

1 × $6.00 -

×

Using Robert’s Indicators with Rob Hoffman

1 × $6.00

Using Robert’s Indicators with Rob Hoffman

1 × $6.00 -

×

Deep Reinforcement Learning in Trading with Dr. Thomas Starke

1 × $62.00

Deep Reinforcement Learning in Trading with Dr. Thomas Starke

1 × $62.00 -

×

Risk Management Toolkit with Peter Bain

1 × $6.00

Risk Management Toolkit with Peter Bain

1 × $6.00 -

×

Profits In PJs - Profitably Selling Stock Options for Passive Income with Cam Tucker

1 × $6.00

Profits In PJs - Profitably Selling Stock Options for Passive Income with Cam Tucker

1 × $6.00 -

×

Indicator Effectiveness Testing & System Creation with David Vomund

1 × $6.00

Indicator Effectiveness Testing & System Creation with David Vomund

1 × $6.00 -

×

WD Gann’s Master Time Factor DVD With Miles Wilson Walker

1 × $6.00

WD Gann’s Master Time Factor DVD With Miles Wilson Walker

1 × $6.00 -

×

Option Trading: Pricing and Volatility Strategies and Techniques with Euan Sinclair

1 × $6.00

Option Trading: Pricing and Volatility Strategies and Techniques with Euan Sinclair

1 × $6.00 -

×

Traders Trick Advanced Concepts - Recorded Webinar with Joe Ross

1 × $23.00

Traders Trick Advanced Concepts - Recorded Webinar with Joe Ross

1 × $23.00 -

×

How to Make a Living Trading Foreign Exchange: A Guaranteed Income for Life with Courtney Smith

1 × $6.00

How to Make a Living Trading Foreign Exchange: A Guaranteed Income for Life with Courtney Smith

1 × $6.00 -

×

Freak Forex Fundamentals with Ken FX Freak

1 × $6.00

Freak Forex Fundamentals with Ken FX Freak

1 × $6.00 -

×

Arcane 2.0 Course

1 × $6.00

Arcane 2.0 Course

1 × $6.00 -

×

Square The Range Trading System with Michael Jenkins

1 × $6.00

Square The Range Trading System with Michael Jenkins

1 × $6.00 -

×

Winning – Zodiacal Timing Revised 1980 with Joyce Wehrman

1 × $6.00

Winning – Zodiacal Timing Revised 1980 with Joyce Wehrman

1 × $6.00 -

×

Private Ephemeris 1941-1950

1 × $23.00

Private Ephemeris 1941-1950

1 × $23.00 -

×

LARGE CAP MOMENTUM STRATEGY with Nick Radge

1 × $179.00

LARGE CAP MOMENTUM STRATEGY with Nick Radge

1 × $179.00 -

×

HOW TO TRADE GAPS

1 × $15.00

HOW TO TRADE GAPS

1 × $15.00 -

×

Fibonacci Trading & Dynamic Profit Targeting with Base Camp Trading

1 × $15.00

Fibonacci Trading & Dynamic Profit Targeting with Base Camp Trading

1 × $15.00 -

×

Intro To Trading - 3 Module Bundle

1 × $23.00

Intro To Trading - 3 Module Bundle

1 × $23.00 -

×

How To Successfully Trade The Haggerty Slim Jim Strategy for Explosive Gains with Kevin Haggerty

1 × $6.00

How To Successfully Trade The Haggerty Slim Jim Strategy for Explosive Gains with Kevin Haggerty

1 × $6.00 -

×

Spread Trading

1 × $6.00

Spread Trading

1 × $6.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

Patterns of Speculation with Bertrand M.Roehner

1 × $6.00

Patterns of Speculation with Bertrand M.Roehner

1 × $6.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

KASH-FX JOURNAL

1 × $10.00

KASH-FX JOURNAL

1 × $10.00 -

×

How Big Money Trades A Key Aspect of Systems Thinking - Van Tharp and Chuck Whitman – Van Tharp

1 × $46.00

How Big Money Trades A Key Aspect of Systems Thinking - Van Tharp and Chuck Whitman – Van Tharp

1 × $46.00 -

×

Applications of Abstract Algebra with Maple - Richard E.Kline, Neil Sigmon, Ernst Stitzinger

1 × $6.00

Applications of Abstract Algebra with Maple - Richard E.Kline, Neil Sigmon, Ernst Stitzinger

1 × $6.00 -

×

Virtual Intensive Trader Training

1 × $31.00

Virtual Intensive Trader Training

1 × $31.00 -

×

7 Things You MUST Know about Forex Candlesticks

1 × $4.00

7 Things You MUST Know about Forex Candlesticks

1 × $4.00 -

×

One Shot One Kill Trading with John Netto

1 × $6.00

One Shot One Kill Trading with John Netto

1 × $6.00 -

×

Rounded Bottom Breakout Multimedia Course

1 × $31.00

Rounded Bottom Breakout Multimedia Course

1 × $31.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

ABCs of Trading and Tech Analysis (Online Investor Expo, Las Vegas 2000) with Tom Bierovic

1 × $6.00

ABCs of Trading and Tech Analysis (Online Investor Expo, Las Vegas 2000) with Tom Bierovic

1 × $6.00 -

×

Exacttrading - Price Action Trader Course

1 × $15.00

Exacttrading - Price Action Trader Course

1 × $15.00 -

×

The Tyler Method For Successful Triangle Trading with Chris Tyler

1 × $6.00

The Tyler Method For Successful Triangle Trading with Chris Tyler

1 × $6.00 -

×

How I Make A Living Daytrading Stocks with David Floyd

1 × $4.00

How I Make A Living Daytrading Stocks with David Floyd

1 × $4.00 -

×

Forex Mentor 2007 with Peter Bain

1 × $6.00

Forex Mentor 2007 with Peter Bain

1 × $6.00 -

×

The Amazing Common Sense Guide To Investment Success with John Thomchick

1 × $6.00

The Amazing Common Sense Guide To Investment Success with John Thomchick

1 × $6.00 -

×

Forex Power Strategy Course with Jason Steele

1 × $6.00

Forex Power Strategy Course with Jason Steele

1 × $6.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

RiskDoctor RD1 – Introduction to Options Trading the RiskDoctor Way with Charles Cottle

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

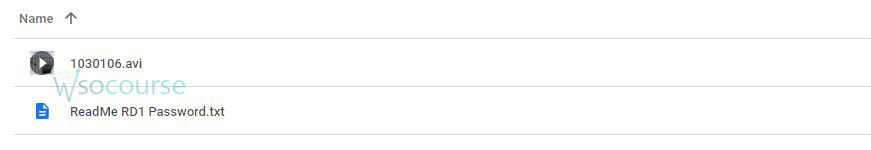

Content Proof: Watch Here!

You may check content proof of “RiskDoctor RD1 – Introduction to Options Trading the RiskDoctor Way with Charles Cottle” below:

RiskDoctor RD1 – Introduction to Options Trading the RiskDoctor Way with Charles Cottle

Introduction

Options trading can be a daunting venture for many, but with the guidance of Charles Cottle, also known as the Risk Doctor, it becomes an accessible and rewarding financial strategy. The “RiskDoctor RD1 – Introduction to Options Trading the RiskDoctor Way” course is designed to equip beginners with the foundational skills needed to navigate the options market successfully.

Who is Charles Cottle?

Background and Expertise

Charles Cottle, revered in the trading community as the Risk Doctor, brings decades of trading experience and education to the table. His approach simplifies complex trading concepts, making them accessible to traders at all levels.

Philosophy on Options Trading

Cottle’s teaching philosophy emphasizes the importance of risk management and understanding the intrinsic behaviors of the options market.

Overview of the RD1 Course

Course Objectives

The RD1 course aims to:

- Demystify the basics of options trading

- Teach practical risk management strategies

- Introduce Cottle’s unique methods and insights

Module Breakdown

The course is structured into several detailed modules, each focusing on different aspects of options trading:

- Module 1: Options Basics

- Module 2: Calls and Puts

- Module 3: Trading Strategies

- Module 4: Risk Management

Key Concepts Covered

Understanding Options

Options are financial instruments that provide the holder the right, but not the obligation, to buy or sell an asset at a predetermined price within a specific time period.

Calls and Puts

The course delves deep into calls and puts, the two primary types of options, and how they can be used strategically in trading portfolios.

The RiskDoctor’s Strategies

Cottle introduces participants to his proprietary trading strategies that have helped many traders minimize risks while maximizing potential returns.

Benefits of Learning from Charles Cottle

Expert Guidance

Learning from a seasoned trader like Cottle provides insights that are typically not available in textbooks or regular courses.

Practical Skills

Participants gain practical skills that can be applied in real-world trading scenarios, not just theoretical knowledge.

Community and Support

Students of the RD1 course often form a community, providing support and networking opportunities that are invaluable in the trading world.

Who Should Take This Course?

Target Audience

- Beginners who are new to options trading

- Intermediate traders who want to refine their strategies

- Finance professionals looking to expand their skill sets

Course Materials and Resources

Comprehensive Study Guides

The RD1 course includes a series of study guides that are easy to follow and rich in content.

Interactive Learning Sessions

Cottle’s interactive sessions enhance understanding and retention of the trading concepts discussed.

How to Enroll

Registration Process

Details on how to enroll in the RD1 course are available on the Risk Doctor’s official website, including session timings and fees.

Success Stories and Testimonials

Feedback from Alumni

Many alumni of the RD1 course have gone on to achieve success in the options market, attributing their accomplishments to the solid foundation built during their training.

Conclusion

The “RiskDoctor RD1 – Introduction to Options Trading the RiskDoctor Way” is a comprehensive course that serves as a gateway into the world of options trading. Under Charles Cottle’s expert tutelage, participants are well-prepared to tackle the markets with confidence and a robust toolkit of trading strategies.

Frequently Asked Questions:

- What prerequisites are needed for the RD1 course?

A basic understanding of finance and markets is helpful, but not required. - How long is the RD1 course?

The course duration can vary, but typically spans several weeks with multiple sessions. - Can I take the course online?

Yes, the RD1 course is available online, allowing participants to learn from anywhere in the world. - What makes Charles Cottle’s teaching unique?

Cottle’s methods focus on practical risk management and the psychological aspects of trading, which are often overlooked in other programs. - Is there a certification upon completion?

Yes, participants receive a certificate of completion which is highly regarded in the trading community.

Be the first to review “RiskDoctor RD1 – Introduction to Options Trading the RiskDoctor Way with Charles Cottle” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.