-

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Future DayTrading (German)

1 × $6.00

Future DayTrading (German)

1 × $6.00 -

×

Option Profits Success System

1 × $54.00

Option Profits Success System

1 × $54.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Pro Trend Trader 2017 with James Orr

1 × $31.00

Pro Trend Trader 2017 with James Orr

1 × $31.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

Traders Trick Advanced Concepts - Recorded Webinar with Joe Ross

1 × $23.00

Traders Trick Advanced Concepts - Recorded Webinar with Joe Ross

1 × $23.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

Module III - Peak Formation Trades with FX MindShift

1 × $6.00

Module III - Peak Formation Trades with FX MindShift

1 × $6.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Mechanical Timing Systems. The Key to Consistent Profits & Sharper Trading with Nelson Freeburg

1 × $6.00

Mechanical Timing Systems. The Key to Consistent Profits & Sharper Trading with Nelson Freeburg

1 × $6.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

Sure-thing Options Trading: A Money-Making Guide to the New Listed Stock and Commodity Options Markets - George Angell

1 × $6.00

Sure-thing Options Trading: A Money-Making Guide to the New Listed Stock and Commodity Options Markets - George Angell

1 × $6.00 -

×

Derivate Instruments by Brian A.Eales

1 × $6.00

Derivate Instruments by Brian A.Eales

1 × $6.00 -

×

Dan Sheridan Butterfly Course (Sep 2012)

1 × $6.00

Dan Sheridan Butterfly Course (Sep 2012)

1 × $6.00 -

×

PROFESSIONAL TRADING EDUCATION with The MarketDelta Edge

1 × $78.00

PROFESSIONAL TRADING EDUCATION with The MarketDelta Edge

1 × $78.00 -

×

Practical Approach to Amibroker Scanners and Exploration with Rajandran R

1 × $4.00

Practical Approach to Amibroker Scanners and Exploration with Rajandran R

1 × $4.00 -

×

Mastering the Complex Sale: How to Compete and Win When the Stakes are High! with Jeff Thull

1 × $6.00

Mastering the Complex Sale: How to Compete and Win When the Stakes are High! with Jeff Thull

1 × $6.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Mastering The ICO: Spotting Needles In A Haystack with Alphashark

1 × $39.00

Mastering The ICO: Spotting Needles In A Haystack with Alphashark

1 × $39.00 -

×

Krautgap By John Piper

1 × $6.00

Krautgap By John Piper

1 × $6.00 -

×

Introduction To Market Turning Points Caused - The Demand & Supply Of Big Banks Institution - Golden Bridge Trading

1 × $6.00

Introduction To Market Turning Points Caused - The Demand & Supply Of Big Banks Institution - Golden Bridge Trading

1 × $6.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

The 1% Club with Trader Mike

1 × $5.00

The 1% Club with Trader Mike

1 × $5.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

Market Structure Masterclass with Braveheart Trading

1 × $5.00

Market Structure Masterclass with Braveheart Trading

1 × $5.00 -

×

June 2010 Training Video

1 × $6.00

June 2010 Training Video

1 × $6.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Technical Analysis with Alexander Elder Video Series

1 × $6.00

Technical Analysis with Alexander Elder Video Series

1 × $6.00 -

×

Pristine - Cardinal Rules of Trading

1 × $6.00

Pristine - Cardinal Rules of Trading

1 × $6.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

Introduction to Position Sizing Strategies with Van Tharp Institute

1 × $6.00

Introduction to Position Sizing Strategies with Van Tharp Institute

1 × $6.00 -

×

Forex Education Trading System (Video 469 MB)

1 × $23.00

Forex Education Trading System (Video 469 MB)

1 × $23.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Risk Free Projections Course

1 × $85.00

Risk Free Projections Course

1 × $85.00 -

×

Day Trading with Lines in the Sky By R.L.Muehlberg

1 × $6.00

Day Trading with Lines in the Sky By R.L.Muehlberg

1 × $6.00 -

×

HOW TO TRADE GAPS

1 × $15.00

HOW TO TRADE GAPS

1 × $15.00 -

×

Slim Miller's Cycle Analysis Workshop with Steve "Slim" Miller

1 × $6.00

Slim Miller's Cycle Analysis Workshop with Steve "Slim" Miller

1 × $6.00 -

×

Activedaytrader - Bond Trading Bootcamp

1 × $8.00

Activedaytrader - Bond Trading Bootcamp

1 × $8.00 -

×

Portfolio Management in Practice with Christine Brentani

1 × $6.00

Portfolio Management in Practice with Christine Brentani

1 × $6.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Teresa Lo's PowerTools for eSignal (Dec. 2006) (powerswings.com)

1 × $6.00

Teresa Lo's PowerTools for eSignal (Dec. 2006) (powerswings.com)

1 × $6.00 -

×

Neall Concord-Cushing - Secret of Forecasting Using Wave59 Tools (Book I & II)

1 × $6.00

Neall Concord-Cushing - Secret of Forecasting Using Wave59 Tools (Book I & II)

1 × $6.00 -

×

ZipTraderU 2023 with ZipTrader

1 × $5.00

ZipTraderU 2023 with ZipTrader

1 × $5.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Sector Trading Strategies: Turning Steady Profits Even in Stubborn Markets By Deron Wagner & John Boyer

1 × $6.00

Sector Trading Strategies: Turning Steady Profits Even in Stubborn Markets By Deron Wagner & John Boyer

1 × $6.00 -

×

Market Mindfields - 2 DVDs with Ryan Litchfield

1 × $6.00

Market Mindfields - 2 DVDs with Ryan Litchfield

1 × $6.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Evolutionary Decision Trees for Stock Index Options and Futures Arbitrage by S.Markose, E.Tsang,H.Er

1 × $6.00

Evolutionary Decision Trees for Stock Index Options and Futures Arbitrage by S.Markose, E.Tsang,H.Er

1 × $6.00

RiskDoctor RD1 – Introduction to Options Trading the RiskDoctor Way with Charles Cottle

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

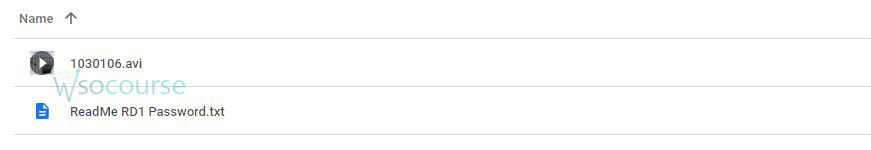

Content Proof: Watch Here!

You may check content proof of “RiskDoctor RD1 – Introduction to Options Trading the RiskDoctor Way with Charles Cottle” below:

RiskDoctor RD1 – Introduction to Options Trading the RiskDoctor Way with Charles Cottle

Introduction

Options trading can be a daunting venture for many, but with the guidance of Charles Cottle, also known as the Risk Doctor, it becomes an accessible and rewarding financial strategy. The “RiskDoctor RD1 – Introduction to Options Trading the RiskDoctor Way” course is designed to equip beginners with the foundational skills needed to navigate the options market successfully.

Who is Charles Cottle?

Background and Expertise

Charles Cottle, revered in the trading community as the Risk Doctor, brings decades of trading experience and education to the table. His approach simplifies complex trading concepts, making them accessible to traders at all levels.

Philosophy on Options Trading

Cottle’s teaching philosophy emphasizes the importance of risk management and understanding the intrinsic behaviors of the options market.

Overview of the RD1 Course

Course Objectives

The RD1 course aims to:

- Demystify the basics of options trading

- Teach practical risk management strategies

- Introduce Cottle’s unique methods and insights

Module Breakdown

The course is structured into several detailed modules, each focusing on different aspects of options trading:

- Module 1: Options Basics

- Module 2: Calls and Puts

- Module 3: Trading Strategies

- Module 4: Risk Management

Key Concepts Covered

Understanding Options

Options are financial instruments that provide the holder the right, but not the obligation, to buy or sell an asset at a predetermined price within a specific time period.

Calls and Puts

The course delves deep into calls and puts, the two primary types of options, and how they can be used strategically in trading portfolios.

The RiskDoctor’s Strategies

Cottle introduces participants to his proprietary trading strategies that have helped many traders minimize risks while maximizing potential returns.

Benefits of Learning from Charles Cottle

Expert Guidance

Learning from a seasoned trader like Cottle provides insights that are typically not available in textbooks or regular courses.

Practical Skills

Participants gain practical skills that can be applied in real-world trading scenarios, not just theoretical knowledge.

Community and Support

Students of the RD1 course often form a community, providing support and networking opportunities that are invaluable in the trading world.

Who Should Take This Course?

Target Audience

- Beginners who are new to options trading

- Intermediate traders who want to refine their strategies

- Finance professionals looking to expand their skill sets

Course Materials and Resources

Comprehensive Study Guides

The RD1 course includes a series of study guides that are easy to follow and rich in content.

Interactive Learning Sessions

Cottle’s interactive sessions enhance understanding and retention of the trading concepts discussed.

How to Enroll

Registration Process

Details on how to enroll in the RD1 course are available on the Risk Doctor’s official website, including session timings and fees.

Success Stories and Testimonials

Feedback from Alumni

Many alumni of the RD1 course have gone on to achieve success in the options market, attributing their accomplishments to the solid foundation built during their training.

Conclusion

The “RiskDoctor RD1 – Introduction to Options Trading the RiskDoctor Way” is a comprehensive course that serves as a gateway into the world of options trading. Under Charles Cottle’s expert tutelage, participants are well-prepared to tackle the markets with confidence and a robust toolkit of trading strategies.

Frequently Asked Questions:

- What prerequisites are needed for the RD1 course?

A basic understanding of finance and markets is helpful, but not required. - How long is the RD1 course?

The course duration can vary, but typically spans several weeks with multiple sessions. - Can I take the course online?

Yes, the RD1 course is available online, allowing participants to learn from anywhere in the world. - What makes Charles Cottle’s teaching unique?

Cottle’s methods focus on practical risk management and the psychological aspects of trading, which are often overlooked in other programs. - Is there a certification upon completion?

Yes, participants receive a certificate of completion which is highly regarded in the trading community.

Be the first to review “RiskDoctor RD1 – Introduction to Options Trading the RiskDoctor Way with Charles Cottle” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Reviews

There are no reviews yet.