-

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

FX Savages Courses Collection

1 × $7.00

FX Savages Courses Collection

1 × $7.00 -

×

Options Trading Business with The Daytrading Room

1 × $23.00

Options Trading Business with The Daytrading Room

1 × $23.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

Bank Financial Model with Cash Flow Investing Pro

1 × $15.00

Bank Financial Model with Cash Flow Investing Pro

1 × $15.00 -

×

Hot Commodities: How Anyone Can Invest Profitably in the World's Best Market with Jim Rogers

1 × $6.00

Hot Commodities: How Anyone Can Invest Profitably in the World's Best Market with Jim Rogers

1 × $6.00 -

×

Fig Combo Course

1 × $5.00

Fig Combo Course

1 × $5.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Ichimokutrade - Ichimoku 101

1 × $15.00

Ichimokutrade - Ichimoku 101

1 × $15.00 -

×

ICT Charter 2020 with Inner Circle Trader

1 × $13.00

ICT Charter 2020 with Inner Circle Trader

1 × $13.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

The Day Trader’s Course with Lewis Borsellino

1 × $6.00

The Day Trader’s Course with Lewis Borsellino

1 × $6.00 -

×

One Week S&P Workshop II with Linda Raschke

1 × $5.00

One Week S&P Workshop II with Linda Raschke

1 × $5.00 -

×

FOREX STRATEGY #1 with Steven Primo

1 × $39.00

FOREX STRATEGY #1 with Steven Primo

1 × $39.00 -

×

The LP Trading Course

1 × $13.00

The LP Trading Course

1 × $13.00 -

×

Robotic Trading: Skill Sharpening with Claytrader

1 × $23.00

Robotic Trading: Skill Sharpening with Claytrader

1 × $23.00 -

×

Stocks, Options & Collars with J.L.Lord

1 × $6.00

Stocks, Options & Collars with J.L.Lord

1 × $6.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

The Future of Technology with Tom Standage

1 × $4.00

The Future of Technology with Tom Standage

1 × $4.00 -

×

Real Motion Trading with MarketGauge

1 × $62.00

Real Motion Trading with MarketGauge

1 × $62.00 -

×

The Golden Rule with Jim Gibbons

1 × $6.00

The Golden Rule with Jim Gibbons

1 × $6.00 -

×

FOREX GENERATION MASTER COURSE

1 × $6.00

FOREX GENERATION MASTER COURSE

1 × $6.00 -

×

How To Trade the Best Currency Pairs Using The Ichimoku Cloud with Alphashark

1 × $31.00

How To Trade the Best Currency Pairs Using The Ichimoku Cloud with Alphashark

1 × $31.00 -

×

Mastering the Gaps - Trading Gaps

1 × $15.00

Mastering the Gaps - Trading Gaps

1 × $15.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Stocks with Strauss

1 × $31.00

Stocks with Strauss

1 × $31.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

MACD Divergence Fully Automatic Indicator for ThinkOrSwim TOS

1 × $6.00

MACD Divergence Fully Automatic Indicator for ThinkOrSwim TOS

1 × $6.00 -

×

Overnight Profit Strategy PRO with Allison Ostrander

1 × $6.00

Overnight Profit Strategy PRO with Allison Ostrander

1 × $6.00 -

×

Protecting your Retirement Account in a Correction with Dan Sheridan - Sheridan Options Mentoring

1 × $31.00

Protecting your Retirement Account in a Correction with Dan Sheridan - Sheridan Options Mentoring

1 × $31.00 -

×

Optionpit - Mastering Iron Condors and Butterflies

1 × $15.00

Optionpit - Mastering Iron Condors and Butterflies

1 × $15.00 -

×

Position Dissection with Charles Cottle

1 × $4.00

Position Dissection with Charles Cottle

1 × $4.00 -

×

Gold Nuggets for Stock and Commodity Traders with George Bayer

1 × $6.00

Gold Nuggets for Stock and Commodity Traders with George Bayer

1 × $6.00 -

×

European Fixed Income Markets with Jonathan Batten

1 × $6.00

European Fixed Income Markets with Jonathan Batten

1 × $6.00 -

×

Investing in the stock market

1 × $6.00

Investing in the stock market

1 × $6.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Forex Ulitmatum with Matt Jordan & Patrick Cuthbert

1 × $6.00

Forex Ulitmatum with Matt Jordan & Patrick Cuthbert

1 × $6.00 -

×

How To Trade Fundamental News Release 2022 with Patrick Muke

1 × $6.00

How To Trade Fundamental News Release 2022 with Patrick Muke

1 × $6.00 -

×

PIPSOCIETY - FOREX AMAZING STRATEGY

1 × $15.00

PIPSOCIETY - FOREX AMAZING STRATEGY

1 × $15.00 -

×

LARGE CAP MOMENTUM STRATEGY with Nick Radge

1 × $179.00

LARGE CAP MOMENTUM STRATEGY with Nick Radge

1 × $179.00 -

×

Hit and Run Trading Updated Version with Jeff Cooper

1 × $6.00

Hit and Run Trading Updated Version with Jeff Cooper

1 × $6.00 -

×

Evolved Traders with Riley Coleman

1 × $5.00

Evolved Traders with Riley Coleman

1 × $5.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

IncomeMAX Spreads and Straddles with Hari Swaminathan

1 × $15.00

IncomeMAX Spreads and Straddles with Hari Swaminathan

1 × $15.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Read the Greed. Take the Money & Teleseminar

1 × $6.00

Read the Greed. Take the Money & Teleseminar

1 × $6.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

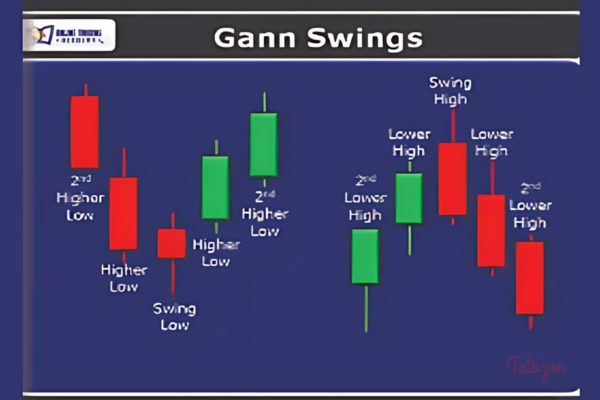

Terry Ashman’s Gann Swings Swing Trading Course (HotTrader Tutorial)

1 × $6.00

Terry Ashman’s Gann Swings Swing Trading Course (HotTrader Tutorial)

1 × $6.00 -

×

Going Global 2015

1 × $6.00

Going Global 2015

1 × $6.00 -

×

Market Profile Course

1 × $54.00

Market Profile Course

1 × $54.00 -

×

Consistent Intraday Strategies and Setups Class with Don Kaufman

1 × $6.00

Consistent Intraday Strategies and Setups Class with Don Kaufman

1 × $6.00 -

×

Ichimokutrade - Elliot Wave 101

1 × $15.00

Ichimokutrade - Elliot Wave 101

1 × $15.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

FX SpeedRunner

1 × $5.00

FX SpeedRunner

1 × $5.00 -

×

Market Trader Forecasting Modeling Course

1 × $6.00

Market Trader Forecasting Modeling Course

1 × $6.00 -

×

TCG Educational Course Bundle Entries & Exits + Trading

1 × $23.00

TCG Educational Course Bundle Entries & Exits + Trading

1 × $23.00 -

×

Special Webinars Module 2 with Trader Dante

1 × $6.00

Special Webinars Module 2 with Trader Dante

1 × $6.00 -

×

Jesse Livermore Trading System with Joe Marwood - Marwood Research

1 × $15.00

Jesse Livermore Trading System with Joe Marwood - Marwood Research

1 × $15.00 -

×

Neall Concord-Cushing - Secret of Forecasting Using Wave59 Tools (Book I & II)

1 × $6.00

Neall Concord-Cushing - Secret of Forecasting Using Wave59 Tools (Book I & II)

1 × $6.00 -

×

From Walden to Wall Street: Frontiers of Conservation Finance with James Levitt

1 × $6.00

From Walden to Wall Street: Frontiers of Conservation Finance with James Levitt

1 × $6.00 -

×

Introduction To Advanced Options Trading 201

1 × $23.00

Introduction To Advanced Options Trading 201

1 × $23.00 -

×

Introduction to Fibonacci Time Analysis with Carolyn Boroden

1 × $6.00

Introduction to Fibonacci Time Analysis with Carolyn Boroden

1 × $6.00 -

×

Gold XAUUSD Trading Strategy - The Gold Box with The Trading Guide

1 × $5.00

Gold XAUUSD Trading Strategy - The Gold Box with The Trading Guide

1 × $5.00 -

×

MMfx Course August 2011 + MT4 Ind. Jan 2012

1 × $15.00

MMfx Course August 2011 + MT4 Ind. Jan 2012

1 × $15.00 -

×

Forex Course with Forever Blue

1 × $6.00

Forex Course with Forever Blue

1 × $6.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

How to Consistently Win Trading Stocks in 30 Days or Less

1 × $15.00

How to Consistently Win Trading Stocks in 30 Days or Less

1 × $15.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

How To Day-Trade Micro Eminis with Dr. Stoxx

1 × $5.00

How To Day-Trade Micro Eminis with Dr. Stoxx

1 × $5.00 -

×

Basic Astrotech

1 × $6.00

Basic Astrotech

1 × $6.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00

Chaos. The New Map for Traders

$15.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Chaos Theory Trading: Harness Market Patterns for Success

In the dynamic world of trading, chaos theory has emerged as a powerful tool for understanding market complexities. This guide explores how traders can harness chaos to navigate market unpredictability effectively.

Understanding Chaos Theory

Chaos theory delves into the behavior of complex systems where small changes can lead to significant impacts. In trading, this means even minor market fluctuations can drastically alter outcomes.

The Basics of Chaos Theory

Chaos theory asserts that markets are highly sensitive to initial conditions. This sensitivity, known as the butterfly effect, implies that predicting long-term market behavior is nearly impossible.

Historical Context

Chaos theory originated in meteorology, with Edward Lorenz’s discovery in the 1960s. Its principles, however, have profound implications for financial markets.

Why Traders Should Care About Chaos

Understanding chaos helps traders prepare for market volatility. By acknowledging unpredictability, traders can develop flexible strategies.

Implementing Chaos Theory in Trading

Applying chaos theory in trading involves several steps, from recognizing patterns to adjusting strategies based on market behavior.

Identifying Market Patterns

Chaos theory helps in identifying seemingly random patterns in market data. These patterns can offer insights into future movements.

Tools for Pattern Recognition

- Fractals: Repeating patterns that are self-similar across different scales.

- Lyapunov Exponents: Measures the rate of separation of infinitesimally close trajectories.

Developing a Chaos-Based Strategy

Creating a trading strategy based on chaos theory involves understanding fractals, leveraging computational models, and continuously adapting to market changes.

Step-by-Step Guide

- Data Collection: Gather extensive market data for analysis.

- Pattern Analysis: Use tools to identify fractals and other chaotic patterns.

- Model Creation: Develop models to predict potential market movements.

- Strategy Testing: Backtest strategies against historical data.

- Continuous Adjustment: Refine strategies based on real-time market feedback.

Case Studies of Chaos Theory in Trading

Exploring real-world examples can illustrate the practical application of chaos theory in trading.

Case Study 1: Forex Market

Forex traders often utilize chaos theory to predict currency price movements. By identifying fractal patterns, traders can make informed decisions.

Case Study 2: Stock Market

In the stock market, chaos theory helps in understanding price movements during high volatility periods. Traders use it to adjust their portfolios dynamically.

Advantages and Challenges

While chaos theory offers unique insights, it also presents challenges.

Advantages

- Enhanced Predictive Ability: Better understanding of market volatility.

- Informed Decision Making: Data-driven strategies based on pattern recognition.

Challenges

- Complexity: Requires advanced mathematical and computational skills.

- Data Intensity: Needs extensive data for accurate analysis.

Practical Tips for Traders

Adopting chaos theory in trading involves practical steps to integrate its principles into daily trading activities.

Tip 1: Stay Informed

Regularly update your knowledge on chaos theory and its applications in trading.

Tip 2: Use Advanced Tools

Leverage sophisticated software and analytical tools for pattern recognition and model creation.

Tip 3: Backtest Regularly

Consistently backtest your strategies to ensure they remain effective under changing market conditions.

The Future of Chaos Theory in Trading

As technology advances, the application of chaos theory in trading is likely to expand. AI and machine learning can enhance pattern recognition and predictive accuracy.

Emerging Trends

- AI Integration: Combining chaos theory with AI for improved market predictions.

- Big Data Analytics: Utilizing large datasets for more accurate fractal analysis.

Conclusion

Chaos theory provides a new map for traders, offering a deeper understanding of market dynamics and improving trading strategies. By embracing chaos, traders can navigate market uncertainties with greater confidence and adaptability.

Commonly Asked Questions:

- Business Model Innovation: Accept the truth of a legitimate business! Our strategy is organising a group buy in which participants share the costs. We use these cash to acquire popular courses from sale pages and make them available to people with limited financial resources. Despite the authors’ worries, our clients love the cost and accessibility we give.

- The Legal Environment: Yes or No The legality of our activity is ambiguous. While we don’t have specific permission from the course authors to resell the material, there is a technicality at work. The author did not specify any limits on resale when purchasing the course. This legal intricacy is both an opportunity for us and a boon for individuals looking for low-cost access.

- Quality Control: Uncovering the Truth

Getting to the heart of the issue – quality. Purchasing the course straight from the sale page guarantees that all documents and resources are the same as those obtained through traditional channels.

However, we distinguish ourselves by going beyond personal research and resale. It is crucial to note that we are not the official course providers, which means that the following premium services are not included in our package:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not permitted.

- No access to the author’s private membership forum.

- There is no direct email support available from the author or their team.

We operate independently, with the goal of bridging the pricing gap without the extra services provided by official course channels. Your comprehension of our distinct approach is much appreciated.

Be the first to review “Chaos. The New Map for Traders” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.