-

×

Altucher’s Top 1% Advisory Newsletter 2016 with James Altucher

1 × $6.00

Altucher’s Top 1% Advisory Newsletter 2016 with James Altucher

1 × $6.00 -

×

How to Call the Top in a Stock (To the Penny!) and Earn 9-11% Annualized Cash Yields Doing It with Dan Ferris

1 × $6.00

How to Call the Top in a Stock (To the Penny!) and Earn 9-11% Annualized Cash Yields Doing It with Dan Ferris

1 × $6.00 -

×

Secrets of the Darvas Trading System

1 × $6.00

Secrets of the Darvas Trading System

1 × $6.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Relationship of the StockMarket Fluctuations to the Lunarcycle with Frank J.Guarino

1 × $6.00

Relationship of the StockMarket Fluctuations to the Lunarcycle with Frank J.Guarino

1 × $6.00 -

×

Short-Term Trading with Precision Timing - Jack Bernstein

1 × $6.00

Short-Term Trading with Precision Timing - Jack Bernstein

1 × $6.00 -

×

How to Find the Most Profitable Stocks with Mubarak Shah

1 × $6.00

How to Find the Most Profitable Stocks with Mubarak Shah

1 × $6.00 -

×

Square The Range Trading System with Michael Jenkins

1 × $6.00

Square The Range Trading System with Michael Jenkins

1 × $6.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Pattern Recognition: A Fundamental Introduction to Japanese Candlestick Charting Techniques Class with Jeff Bierman

1 × $6.00

Pattern Recognition: A Fundamental Introduction to Japanese Candlestick Charting Techniques Class with Jeff Bierman

1 × $6.00 -

×

Street-Smart Chart Reading – Volume 2 – Digging Deeper with Donald G.Worden

1 × $6.00

Street-Smart Chart Reading – Volume 2 – Digging Deeper with Donald G.Worden

1 × $6.00 -

×

4×4 Course with Gregoire Dupont

1 × $6.00

4×4 Course with Gregoire Dupont

1 × $6.00 -

×

Profit.ly - Bitcoin Basics

1 × $6.00

Profit.ly - Bitcoin Basics

1 × $6.00 -

×

Core Strategy Program + Extended Learning Track with Ota Courses

1 × $124.00

Core Strategy Program + Extended Learning Track with Ota Courses

1 × $124.00 -

×

Simple Forex Profits with Rayy Bannzz

1 × $31.00

Simple Forex Profits with Rayy Bannzz

1 × $31.00 -

×

S&P 500 Secrets + Next Level Risk Management with Tradacc

1 × $8.00

S&P 500 Secrets + Next Level Risk Management with Tradacc

1 × $8.00 -

×

Dan Sheridan Options Mentoring Weekly Webinars

1 × $6.00

Dan Sheridan Options Mentoring Weekly Webinars

1 × $6.00 -

×

Fast Start Barter System with Bob Meyer

1 × $31.00

Fast Start Barter System with Bob Meyer

1 × $31.00 -

×

Day & Position Trading Using DiNapoli Levels with Joe Dinapoli & Merrick Okamoto

1 × $6.00

Day & Position Trading Using DiNapoli Levels with Joe Dinapoli & Merrick Okamoto

1 × $6.00 -

×

Practical Applications of Candlestick Charts with Gary Wagner

1 × $6.00

Practical Applications of Candlestick Charts with Gary Wagner

1 × $6.00 -

×

Day Trading and Swing Trading Futures with Price Action by Humberto Malaspina

1 × $5.00

Day Trading and Swing Trading Futures with Price Action by Humberto Malaspina

1 × $5.00 -

×

RiskDoctor RD1 – Introduction to Options Trading the RiskDoctor Way with Charles Cottle

1 × $6.00

RiskDoctor RD1 – Introduction to Options Trading the RiskDoctor Way with Charles Cottle

1 × $6.00 -

×

Stock Market Crash of 1929 with Aron Abrams

1 × $6.00

Stock Market Crash of 1929 with Aron Abrams

1 × $6.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

The Delphi Scalper 4 - Video + Metatrader Indicators with Jason Fielder

1 × $6.00

The Delphi Scalper 4 - Video + Metatrader Indicators with Jason Fielder

1 × $6.00 -

×

Selective Forex Trading with Don Snellgrove

1 × $6.00

Selective Forex Trading with Don Snellgrove

1 × $6.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Four Dimensional Stock Market Structures & Cycles with Bradley Cowan

1 × $6.00

Four Dimensional Stock Market Structures & Cycles with Bradley Cowan

1 × $6.00 -

×

How To Invest Better

1 × $6.00

How To Invest Better

1 × $6.00 -

×

How to Analyze Multifamily Investment Opportunities with Symon He & Brandon Young

1 × $6.00

How to Analyze Multifamily Investment Opportunities with Symon He & Brandon Young

1 × $6.00 -

×

The 4 Horsemen CD with David Elliott

1 × $6.00

The 4 Horsemen CD with David Elliott

1 × $6.00 -

×

Traders: Risks, Decisions, and Management in Financial Markets - Mark Fenton-O’Creevy, Nigel Nicholson, Emma Soane & Paul Willman

1 × $6.00

Traders: Risks, Decisions, and Management in Financial Markets - Mark Fenton-O’Creevy, Nigel Nicholson, Emma Soane & Paul Willman

1 × $6.00 -

×

Swift Trader, Perfecting the Art of DayTrading with Charles Kim

1 × $6.00

Swift Trader, Perfecting the Art of DayTrading with Charles Kim

1 × $6.00 -

×

Forex Strategy Course with Angel Traders

1 × $6.00

Forex Strategy Course with Angel Traders

1 × $6.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

How Do You See Risk? A Guide to Evaluating & Applying Technical Volatility Indicators class with Jeff Bierman

1 × $6.00

How Do You See Risk? A Guide to Evaluating & Applying Technical Volatility Indicators class with Jeff Bierman

1 × $6.00 -

×

Options 201: Vertical and Calendar Spread Essentials 5 Part Class with Don Kaufman On Demand Replay

1 × $6.00

Options 201: Vertical and Calendar Spread Essentials 5 Part Class with Don Kaufman On Demand Replay

1 × $6.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

Elite Price Action Tutorials with Wmd4x

1 × $8.00

Elite Price Action Tutorials with Wmd4x

1 × $8.00 -

×

Simpler Options - Ultimate Guide to Debit Spreads – Nov 2014

1 × $6.00

Simpler Options - Ultimate Guide to Debit Spreads – Nov 2014

1 × $6.00 -

×

Neall Concord-Cushing - Secret of Forecasting Using Wave59 Tools (Book I & II)

1 × $6.00

Neall Concord-Cushing - Secret of Forecasting Using Wave59 Tools (Book I & II)

1 × $6.00 -

×

Peter Borish Online Trader Program

1 × $15.00

Peter Borish Online Trader Program

1 × $15.00 -

×

3-Line Break Method For Daytrading Eminis with Chris Curran

1 × $6.00

3-Line Break Method For Daytrading Eminis with Chris Curran

1 × $6.00 -

×

Finding Astrocycles with an Ephemeris - Hans Hannula

1 × $6.00

Finding Astrocycles with an Ephemeris - Hans Hannula

1 × $6.00 -

×

Quantitative Trading Strategies (1st Edition) with Lars Kestner

1 × $6.00

Quantitative Trading Strategies (1st Edition) with Lars Kestner

1 × $6.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Secrets of An Electronic Futures Trader with Larry Levin

1 × $6.00

Secrets of An Electronic Futures Trader with Larry Levin

1 × $6.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

Gold Trading Boot Camp: How to Master the Basics and Become a Successful Commodities Investor - Gregory Weldon & Dennis Gartman

1 × $6.00

Gold Trading Boot Camp: How to Master the Basics and Become a Successful Commodities Investor - Gregory Weldon & Dennis Gartman

1 × $6.00 -

×

How I Trade for a Living with Gary Smith

1 × $6.00

How I Trade for a Living with Gary Smith

1 × $6.00 -

×

Multi Asset Class Investment Strategy with Guy Fraser-Sampson

1 × $6.00

Multi Asset Class Investment Strategy with Guy Fraser-Sampson

1 × $6.00 -

×

An Introduction to Option Trading Success with James Bittman

1 × $6.00

An Introduction to Option Trading Success with James Bittman

1 × $6.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

Elite Core Advance Course with Urban Forex

1 × $5.00

Elite Core Advance Course with Urban Forex

1 × $5.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00

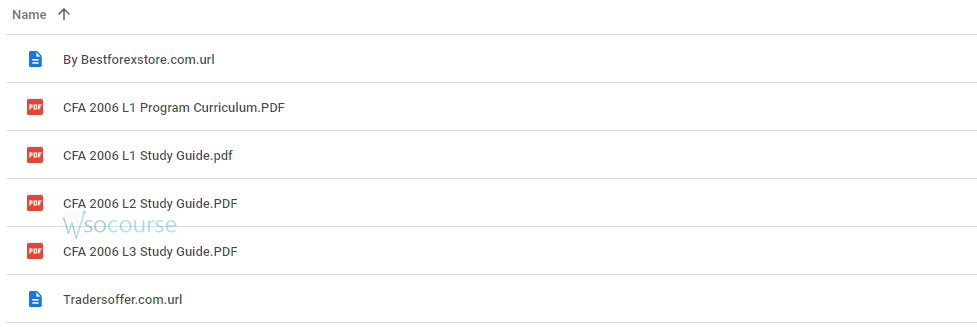

CFA Level 1,2,3 – Study Guides 2006

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “ CFA Level 1,2,3 – Study Guides 2006” below:

Mastering the CFA Level 1, 2, and 3: Comprehensive Study Guides from 2006

Introduction

When preparing for the Chartered Financial Analyst (CFA) exams, access to comprehensive study materials is crucial. The 2006 editions of the CFA Level 1, 2, and 3 study guides remain invaluable resources for candidates aiming to understand the vast landscape of financial analysis and investment management.

Understanding the Structure of CFA Exams

Overview of Levels

The CFA program is structured into three levels, each focusing on integrating a broad range of financial knowledge and practical skills.

Level 1: The Foundation

Level 1 focuses on essential tools and concepts that apply to investment valuation and management.

Level 2: The Application

Level 2 dives deeper into the complex analysis with a focus on asset valuation.

Level 3: The Synthesis

Level 3 synthesizes all knowledge to apply it in a portfolio management and wealth planning context.

Key Features of the 2006 Study Guides

Comprehensiveness

Each guide covers an extensive array of topics, from ethical standards to financial reporting and analysis, ensuring no stone is left unturned.

Practice Questions

End-of-chapter questions in these guides help reinforce the material by testing candidates’ comprehension and retention.

Effective Study Strategies

Create a Study Schedule

Organizing study time efficiently can dramatically increase the retention of complex materials.

Focus on High-Weight Subjects

Prioritizing subjects based on their weight in the exam can yield better results.

Utilizing Study Guides for Each Level

Level 1 Guide: Building the Base

The Level 1 guide is your roadmap to mastering the fundamentals.

Level 2 Guide: Enhancing Analytical Skills

The Level 2 guide enhances your ability to perform detailed investment analysis.

Level 3 Guide: Mastering Management

The Level 3 guide focuses on portfolio management and wealth planning strategies.

Tips for Passing CFA Exams

Master the Ethics Section

Ethical practices form the backbone of the CFA curriculum and are heavily tested.

Practice Regularly

Regular practice using the study guides and mock exams is essential.

Stay Updated

Although the guides are from 2006, it is crucial to complement them with current updates from the CFA Institute.

Challenges and Solutions

Outdated Information

While some information might be outdated, the core principles remain relevant. Supplementing these guides with recent materials can provide a more comprehensive understanding.

Volume of Content

The sheer volume can be overwhelming; breaking down the study sessions into manageable parts can help.

Conclusion

Utilizing the CFA Level 1, 2, and 3 study guides from 2006 can greatly enhance your understanding and preparation for the exams. By integrating these guides with current updates and effective study techniques, you can approach the exams with confidence and clarity.

Frequently Asked Questions:

- Business Model Innovation:

Embrace our legitimate business model! We organize group buys, allowing participants to share costs for popular courses, making them accessible to those with limited financial resources. Our approach ensures affordability and accessibility, despite author concerns. - The Legal Environment:

The legality of our activity is uncertain. While we lack specific permission from course authors, there’s a technicality: authors didn’t impose resale limits upon course purchase. This presents both an opportunity for us and a benefit for individuals seeking low-cost access. - Quality Control:

Unveiling the Truth

Quality is paramount. Purchasing courses directly from sales pages ensures consistency with traditionally obtained materials. However, we’re not official course providers and don’t offer premium services:

- No scheduled coaching calls or sessions with the author.

- No access to the author’s private Facebook group or web portal.

- No entry to the author’s private membership forum.

- Direct email support from the author or their team is unavailable. Operating independently, we aim to bridge the pricing gap without additional services provided by official channels. Your understanding of our unique approach is valued.

Be the first to review “CFA Level 1,2,3 – Study Guides 2006” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.