-

×

Fixed Income Securities (2nd Ed.) with Bruce Tuckman

1 × $10.00

Fixed Income Securities (2nd Ed.) with Bruce Tuckman

1 × $10.00 -

×

CAT 2007 Seminar with Stephen W.Bigalow

1 × $6.00

CAT 2007 Seminar with Stephen W.Bigalow

1 × $6.00 -

×

ProfileTraders - Swing and Price Analysis (May 2014)

1 × $6.00

ProfileTraders - Swing and Price Analysis (May 2014)

1 × $6.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Hedged Strategy Series in Volatile Markets All 4 with Dan Sheridan

1 × $15.00

Hedged Strategy Series in Volatile Markets All 4 with Dan Sheridan

1 × $15.00 -

×

Rocket Science for Traders with John Ehlers

1 × $6.00

Rocket Science for Traders with John Ehlers

1 × $6.00 -

×

The Game In WallStreet & How to Play it Successfully with Hoyle

1 × $6.00

The Game In WallStreet & How to Play it Successfully with Hoyle

1 × $6.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Simple Trade Strategies

1 × $31.00

Simple Trade Strategies

1 × $31.00 -

×

The Great Divergence: China, Europe, and the Making of the Modern World Economy with Kenneth Pomeranz

1 × $6.00

The Great Divergence: China, Europe, and the Making of the Modern World Economy with Kenneth Pomeranz

1 × $6.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

DAY TRADING COURSE 2018

1 × $6.00

DAY TRADING COURSE 2018

1 × $6.00 -

×

Pocketing Premium Master Class (Basic) with Henrry Gambell

1 × $31.00

Pocketing Premium Master Class (Basic) with Henrry Gambell

1 × $31.00 -

×

Commodities Rising: The Reality Behind the Hype and How To Really Profit in the Commodities Market - Jeffrey Christian

1 × $6.00

Commodities Rising: The Reality Behind the Hype and How To Really Profit in the Commodities Market - Jeffrey Christian

1 × $6.00 -

×

From Zero to Trading e-Book with Jermaine McGruder

1 × $15.00

From Zero to Trading e-Book with Jermaine McGruder

1 × $15.00 -

×

Fibonacci Ratios with Pattern Recognition - Larry Pesavento & Steven Shapiro

1 × $6.00

Fibonacci Ratios with Pattern Recognition - Larry Pesavento & Steven Shapiro

1 × $6.00 -

×

The Master Indicator 2023 with Lance Ippolito

1 × $101.00

The Master Indicator 2023 with Lance Ippolito

1 × $101.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Ahead of the Curve with Joseph Ellis

1 × $6.00

Ahead of the Curve with Joseph Ellis

1 × $6.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

NXT Level FX with Investors Domain

1 × $5.00

NXT Level FX with Investors Domain

1 × $5.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Natural Language Processing in Trading with Dr. Terry Benzschawel

1 × $31.00

Natural Language Processing in Trading with Dr. Terry Benzschawel

1 × $31.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

CANDLESTICKS APPLIED with Steve Nison & Syl Desaulniers - Candle Charts

1 × $15.00

CANDLESTICKS APPLIED with Steve Nison & Syl Desaulniers - Candle Charts

1 × $15.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

How To Develop A Winning Trading System That Fits You Home Study + Audio - 2020 with Van Tharp

1 × $62.00

How To Develop A Winning Trading System That Fits You Home Study + Audio - 2020 with Van Tharp

1 × $62.00 -

×

Practical Approach to Trend Following By Rajandran R

1 × $15.00

Practical Approach to Trend Following By Rajandran R

1 × $15.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

Fundamentals 101: A Comprehensive Guide to Macroeconomic, Industry, and Financial Statement Analysis Class with Jeff Bierman

1 × $6.00

Fundamentals 101: A Comprehensive Guide to Macroeconomic, Industry, and Financial Statement Analysis Class with Jeff Bierman

1 × $6.00

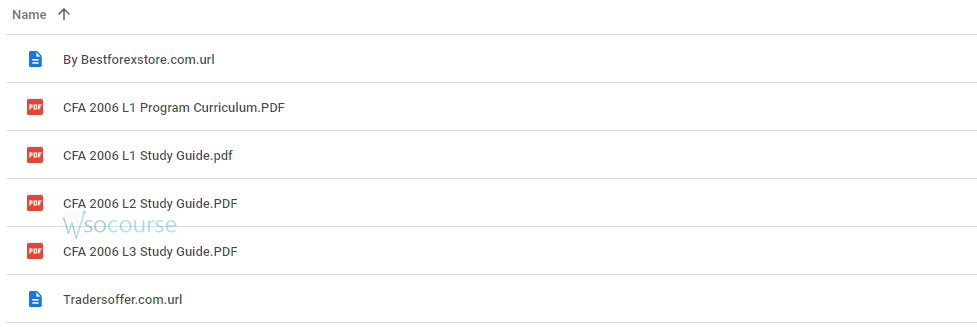

CFA Level 1,2,3 – Study Guides 2006

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “ CFA Level 1,2,3 – Study Guides 2006” below:

Mastering the CFA Level 1, 2, and 3: Comprehensive Study Guides from 2006

Introduction

When preparing for the Chartered Financial Analyst (CFA) exams, access to comprehensive study materials is crucial. The 2006 editions of the CFA Level 1, 2, and 3 study guides remain invaluable resources for candidates aiming to understand the vast landscape of financial analysis and investment management.

Understanding the Structure of CFA Exams

Overview of Levels

The CFA program is structured into three levels, each focusing on integrating a broad range of financial knowledge and practical skills.

Level 1: The Foundation

Level 1 focuses on essential tools and concepts that apply to investment valuation and management.

Level 2: The Application

Level 2 dives deeper into the complex analysis with a focus on asset valuation.

Level 3: The Synthesis

Level 3 synthesizes all knowledge to apply it in a portfolio management and wealth planning context.

Key Features of the 2006 Study Guides

Comprehensiveness

Each guide covers an extensive array of topics, from ethical standards to financial reporting and analysis, ensuring no stone is left unturned.

Practice Questions

End-of-chapter questions in these guides help reinforce the material by testing candidates’ comprehension and retention.

Effective Study Strategies

Create a Study Schedule

Organizing study time efficiently can dramatically increase the retention of complex materials.

Focus on High-Weight Subjects

Prioritizing subjects based on their weight in the exam can yield better results.

Utilizing Study Guides for Each Level

Level 1 Guide: Building the Base

The Level 1 guide is your roadmap to mastering the fundamentals.

Level 2 Guide: Enhancing Analytical Skills

The Level 2 guide enhances your ability to perform detailed investment analysis.

Level 3 Guide: Mastering Management

The Level 3 guide focuses on portfolio management and wealth planning strategies.

Tips for Passing CFA Exams

Master the Ethics Section

Ethical practices form the backbone of the CFA curriculum and are heavily tested.

Practice Regularly

Regular practice using the study guides and mock exams is essential.

Stay Updated

Although the guides are from 2006, it is crucial to complement them with current updates from the CFA Institute.

Challenges and Solutions

Outdated Information

While some information might be outdated, the core principles remain relevant. Supplementing these guides with recent materials can provide a more comprehensive understanding.

Volume of Content

The sheer volume can be overwhelming; breaking down the study sessions into manageable parts can help.

Conclusion

Utilizing the CFA Level 1, 2, and 3 study guides from 2006 can greatly enhance your understanding and preparation for the exams. By integrating these guides with current updates and effective study techniques, you can approach the exams with confidence and clarity.

Frequently Asked Questions:

- Business Model Innovation:

Embrace our legitimate business model! We organize group buys, allowing participants to share costs for popular courses, making them accessible to those with limited financial resources. Our approach ensures affordability and accessibility, despite author concerns. - The Legal Environment:

The legality of our activity is uncertain. While we lack specific permission from course authors, there’s a technicality: authors didn’t impose resale limits upon course purchase. This presents both an opportunity for us and a benefit for individuals seeking low-cost access. - Quality Control:

Unveiling the Truth

Quality is paramount. Purchasing courses directly from sales pages ensures consistency with traditionally obtained materials. However, we’re not official course providers and don’t offer premium services:

- No scheduled coaching calls or sessions with the author.

- No access to the author’s private Facebook group or web portal.

- No entry to the author’s private membership forum.

- Direct email support from the author or their team is unavailable. Operating independently, we aim to bridge the pricing gap without additional services provided by official channels. Your understanding of our unique approach is valued.

Be the first to review “CFA Level 1,2,3 – Study Guides 2006” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Reviews

There are no reviews yet.