-

×

Learn how to trade Volatility 75 Index Technical Analysis with Patrick Muke

1 × $6.00

Learn how to trade Volatility 75 Index Technical Analysis with Patrick Muke

1 × $6.00 -

×

Forex Robotron (Unlocked)

1 × $6.00

Forex Robotron (Unlocked)

1 × $6.00 -

×

Pattern Cycles with Alan Farley

1 × $6.00

Pattern Cycles with Alan Farley

1 × $6.00 -

×

Intra-day Solar Trader with George Harrison

1 × $17.00

Intra-day Solar Trader with George Harrison

1 × $17.00 -

×

NASDAQ Level II Trading Strategies

1 × $6.00

NASDAQ Level II Trading Strategies

1 × $6.00 -

×

Investing in 401k Plans with Cliffsnotes

1 × $6.00

Investing in 401k Plans with Cliffsnotes

1 × $6.00 -

×

Practical Approach to Amibroker Backtesting with Rajandran R

1 × $6.00

Practical Approach to Amibroker Backtesting with Rajandran R

1 × $6.00 -

×

Lee Gettess’s Package

1 × $6.00

Lee Gettess’s Package

1 × $6.00 -

×

Humbled Trader Academy

1 × $5.00

Humbled Trader Academy

1 × $5.00 -

×

Trading - Candlelight - Ryan Litchfield

1 × $6.00

Trading - Candlelight - Ryan Litchfield

1 × $6.00 -

×

Market Structure Masterclass with Braveheart Trading

1 × $5.00

Market Structure Masterclass with Braveheart Trading

1 × $5.00 -

×

Investment Fables with Aswath Damodaran

1 × $6.00

Investment Fables with Aswath Damodaran

1 × $6.00 -

×

How to Trade the New Single Stock Futures with Jack Bernstein

1 × $6.00

How to Trade the New Single Stock Futures with Jack Bernstein

1 × $6.00 -

×

ICT – Inner Circle Trader 2020 Weekly Review

1 × $20.00

ICT – Inner Circle Trader 2020 Weekly Review

1 × $20.00 -

×

How I use Technical Analysis & Orderflow with Adam Webb - Traderskew

1 × $54.00

How I use Technical Analysis & Orderflow with Adam Webb - Traderskew

1 × $54.00 -

×

Original Curriculum with Home Options Trading Course

1 × $6.00

Original Curriculum with Home Options Trading Course

1 × $6.00 -

×

Investment Madness with John Nofsinger

1 × $6.00

Investment Madness with John Nofsinger

1 × $6.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

Markers System Plus v5 (Oct 2016)

1 × $31.00

Markers System Plus v5 (Oct 2016)

1 × $31.00 -

×

Learn To Trade with Tori Trades

1 × $8.00

Learn To Trade with Tori Trades

1 × $8.00 -

×

Professional Level Trading (IPLT) Online Video Series with Anton Kreil

1 × $6.00

Professional Level Trading (IPLT) Online Video Series with Anton Kreil

1 × $6.00 -

×

Exchange-Traded Derivatives with Erik Banks

1 × $6.00

Exchange-Traded Derivatives with Erik Banks

1 × $6.00 -

×

Forex Masterclass - BKForex

1 × $5.00

Forex Masterclass - BKForex

1 × $5.00 -

×

Naked Trading Part 1 with Base Camp Trading

1 × $6.00

Naked Trading Part 1 with Base Camp Trading

1 × $6.00 -

×

Winning with Options with Michael Thomsett

1 × $6.00

Winning with Options with Michael Thomsett

1 × $6.00 -

×

Simple Trade Strategies

1 × $31.00

Simple Trade Strategies

1 × $31.00 -

×

OFA - Intensive Boot Camp 5 Day Course

1 × $6.00

OFA - Intensive Boot Camp 5 Day Course

1 × $6.00 -

×

How to Pick Hot Reverse Merger Penny Stocks with John Lux

1 × $5.00

How to Pick Hot Reverse Merger Penny Stocks with John Lux

1 × $5.00 -

×

The HV7 Option Trading System with Amy Meissner – Aeromir

1 × $8.00

The HV7 Option Trading System with Amy Meissner – Aeromir

1 × $8.00 -

×

Commodities Rising: The Reality Behind the Hype and How To Really Profit in the Commodities Market - Jeffrey Christian

1 × $6.00

Commodities Rising: The Reality Behind the Hype and How To Really Profit in the Commodities Market - Jeffrey Christian

1 × $6.00 -

×

The Management of Equity Investments with Dimitris Chorafas

1 × $6.00

The Management of Equity Investments with Dimitris Chorafas

1 × $6.00 -

×

The Aggressive Investor. Case Studies with Colin Nicholson

1 × $6.00

The Aggressive Investor. Case Studies with Colin Nicholson

1 × $6.00 -

×

Math Trading Course 2023

1 × $34.00

Math Trading Course 2023

1 × $34.00 -

×

Selling Options For A Living Class with Don Kaufman

1 × $6.00

Selling Options For A Living Class with Don Kaufman

1 × $6.00 -

×

Options Plain & Simple with Lenni Jordan

1 × $6.00

Options Plain & Simple with Lenni Jordan

1 × $6.00 -

×

5 Day Bootcamp with AWFX AnthonysWorld

1 × $34.00

5 Day Bootcamp with AWFX AnthonysWorld

1 × $34.00 -

×

Complete Forex Training Series with 4 x Made Easy

1 × $6.00

Complete Forex Training Series with 4 x Made Easy

1 × $6.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

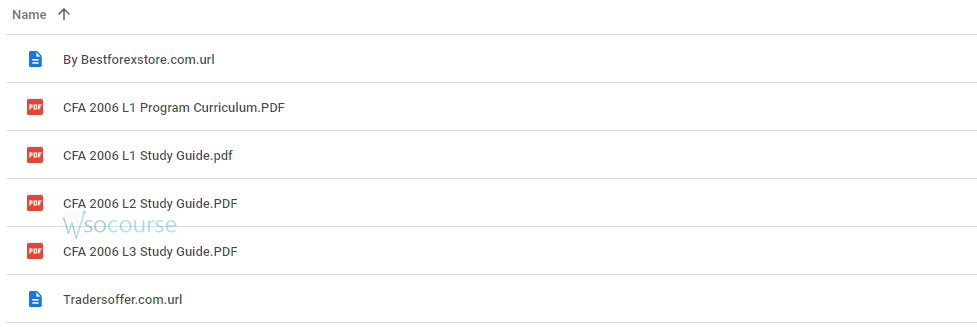

CFA Level 1,2,3 – Study Guides 2006

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “ CFA Level 1,2,3 – Study Guides 2006” below:

Mastering the CFA Level 1, 2, and 3: Comprehensive Study Guides from 2006

Introduction

When preparing for the Chartered Financial Analyst (CFA) exams, access to comprehensive study materials is crucial. The 2006 editions of the CFA Level 1, 2, and 3 study guides remain invaluable resources for candidates aiming to understand the vast landscape of financial analysis and investment management.

Understanding the Structure of CFA Exams

Overview of Levels

The CFA program is structured into three levels, each focusing on integrating a broad range of financial knowledge and practical skills.

Level 1: The Foundation

Level 1 focuses on essential tools and concepts that apply to investment valuation and management.

Level 2: The Application

Level 2 dives deeper into the complex analysis with a focus on asset valuation.

Level 3: The Synthesis

Level 3 synthesizes all knowledge to apply it in a portfolio management and wealth planning context.

Key Features of the 2006 Study Guides

Comprehensiveness

Each guide covers an extensive array of topics, from ethical standards to financial reporting and analysis, ensuring no stone is left unturned.

Practice Questions

End-of-chapter questions in these guides help reinforce the material by testing candidates’ comprehension and retention.

Effective Study Strategies

Create a Study Schedule

Organizing study time efficiently can dramatically increase the retention of complex materials.

Focus on High-Weight Subjects

Prioritizing subjects based on their weight in the exam can yield better results.

Utilizing Study Guides for Each Level

Level 1 Guide: Building the Base

The Level 1 guide is your roadmap to mastering the fundamentals.

Level 2 Guide: Enhancing Analytical Skills

The Level 2 guide enhances your ability to perform detailed investment analysis.

Level 3 Guide: Mastering Management

The Level 3 guide focuses on portfolio management and wealth planning strategies.

Tips for Passing CFA Exams

Master the Ethics Section

Ethical practices form the backbone of the CFA curriculum and are heavily tested.

Practice Regularly

Regular practice using the study guides and mock exams is essential.

Stay Updated

Although the guides are from 2006, it is crucial to complement them with current updates from the CFA Institute.

Challenges and Solutions

Outdated Information

While some information might be outdated, the core principles remain relevant. Supplementing these guides with recent materials can provide a more comprehensive understanding.

Volume of Content

The sheer volume can be overwhelming; breaking down the study sessions into manageable parts can help.

Conclusion

Utilizing the CFA Level 1, 2, and 3 study guides from 2006 can greatly enhance your understanding and preparation for the exams. By integrating these guides with current updates and effective study techniques, you can approach the exams with confidence and clarity.

Frequently Asked Questions:

- Business Model Innovation:

Embrace our legitimate business model! We organize group buys, allowing participants to share costs for popular courses, making them accessible to those with limited financial resources. Our approach ensures affordability and accessibility, despite author concerns. - The Legal Environment:

The legality of our activity is uncertain. While we lack specific permission from course authors, there’s a technicality: authors didn’t impose resale limits upon course purchase. This presents both an opportunity for us and a benefit for individuals seeking low-cost access. - Quality Control:

Unveiling the Truth

Quality is paramount. Purchasing courses directly from sales pages ensures consistency with traditionally obtained materials. However, we’re not official course providers and don’t offer premium services:

- No scheduled coaching calls or sessions with the author.

- No access to the author’s private Facebook group or web portal.

- No entry to the author’s private membership forum.

- Direct email support from the author or their team is unavailable. Operating independently, we aim to bridge the pricing gap without additional services provided by official channels. Your understanding of our unique approach is valued.

Be the first to review “CFA Level 1,2,3 – Study Guides 2006” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.