-

×

Fundamentals of Forex Trading with Joshua Garrison

1 × $5.00

Fundamentals of Forex Trading with Joshua Garrison

1 × $5.00 -

×

Trend Commandments with Michael Covel

1 × $6.00

Trend Commandments with Michael Covel

1 × $6.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Newsbeat Master Class Recording

1 × $39.00

Newsbeat Master Class Recording

1 × $39.00 -

×

CM APR (A Pivot Reverse) Trade Method with Austin Passamonte

1 × $6.00

CM APR (A Pivot Reverse) Trade Method with Austin Passamonte

1 × $6.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Trade Australian Share CFDs with Brian Griffin

1 × $6.00

Trade Australian Share CFDs with Brian Griffin

1 × $6.00 -

×

Becoming a Disciplined Trader: Techniques for Achieving Peak Trading Performance with Ari Kiev

1 × $6.00

Becoming a Disciplined Trader: Techniques for Achieving Peak Trading Performance with Ari Kiev

1 × $6.00 -

×

Measuring Risk in Complex Stochastic Systems with J.Franke, W. Hardle, G. Stahl

1 × $6.00

Measuring Risk in Complex Stochastic Systems with J.Franke, W. Hardle, G. Stahl

1 × $6.00 -

×

RTM + Suppy and Demand with Nora Bystra

1 × $6.00

RTM + Suppy and Demand with Nora Bystra

1 × $6.00 -

×

Complete Cryptocurrency Trading 2021

1 × $5.00

Complete Cryptocurrency Trading 2021

1 × $5.00 -

×

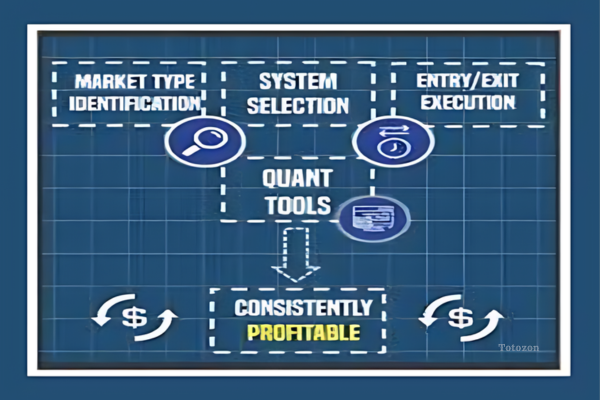

The Profitable Trading System Blueprint with Macro Ops

1 × $6.00

The Profitable Trading System Blueprint with Macro Ops

1 × $6.00 -

×

Hands On Training Bundle with Talkin Options

1 × $23.00

Hands On Training Bundle with Talkin Options

1 × $23.00 -

×

Trading MasterMind Course

1 × $23.00

Trading MasterMind Course

1 × $23.00 -

×

Intra-Day Trading Nasdaq Futures Class with Tony Rago

1 × $6.00

Intra-Day Trading Nasdaq Futures Class with Tony Rago

1 × $6.00 -

×

How to Overlay Technical Indicators with Keith Raphael

1 × $6.00

How to Overlay Technical Indicators with Keith Raphael

1 × $6.00 -

×

Stacey Pigmentation Mentorship

1 × $17.00

Stacey Pigmentation Mentorship

1 × $17.00 -

×

Inside the Minds Leading Wall Street Investors with Aspatore Books

1 × $6.00

Inside the Minds Leading Wall Street Investors with Aspatore Books

1 × $6.00 -

×

Real-Time Course with Rich Swannell

1 × $6.00

Real-Time Course with Rich Swannell

1 × $6.00 -

×

VintagEducation - The Fast Track Forex Bootcamp

1 × $6.00

VintagEducation - The Fast Track Forex Bootcamp

1 × $6.00 -

×

Geometric Angles Applied To Modern Markets with Sean Avidar

1 × $39.00

Geometric Angles Applied To Modern Markets with Sean Avidar

1 × $39.00 -

×

How To Be a Profitable Forex Trader with Corey Halliday

1 × $6.00

How To Be a Profitable Forex Trader with Corey Halliday

1 × $6.00 -

×

Earnings Boot Camp with Big Trends

1 × $6.00

Earnings Boot Camp with Big Trends

1 × $6.00 -

×

Sang Lucci Master Course 2021 with Sang Lucci

1 × $6.00

Sang Lucci Master Course 2021 with Sang Lucci

1 × $6.00 -

×

Developing & Implementing Pattern-Based Trading Systems with Tushar S.Chande

1 × $6.00

Developing & Implementing Pattern-Based Trading Systems with Tushar S.Chande

1 × $6.00 -

×

All Access Online Trading Course with Steve Luke

1 × $6.00

All Access Online Trading Course with Steve Luke

1 × $6.00 -

×

Option Insanity Strategy with PDS Trader

1 × $69.00

Option Insanity Strategy with PDS Trader

1 × $69.00 -

×

Beginner's Forex Course with Jossenia Pomare

1 × $60.00

Beginner's Forex Course with Jossenia Pomare

1 × $60.00 -

×

Fundamental & Technical Analysis Mini Course with Colin Nicholson

1 × $6.00

Fundamental & Technical Analysis Mini Course with Colin Nicholson

1 × $6.00 -

×

Hubert Senters’ Squeeze Play Strategy & Tradestation Code with Hubert Senters

1 × $6.00

Hubert Senters’ Squeeze Play Strategy & Tradestation Code with Hubert Senters

1 × $6.00 -

×

Monthly Income with Short Strangles, Dan's Way - Dan Sheridan - Sheridan Options Mentoring

1 × $69.00

Monthly Income with Short Strangles, Dan's Way - Dan Sheridan - Sheridan Options Mentoring

1 × $69.00 -

×

Futures Commodity Trading with G. Scott Martin

1 × $6.00

Futures Commodity Trading with G. Scott Martin

1 × $6.00 -

×

Mastering Collar Trades Pro with Vince Vora - TradingWins

1 × $6.00

Mastering Collar Trades Pro with Vince Vora - TradingWins

1 × $6.00 -

×

Intra-day Trading Strategies. Proven Steps to Trading Profits

1 × $6.00

Intra-day Trading Strategies. Proven Steps to Trading Profits

1 × $6.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Forex Strategy Course with Angel Traders

1 × $6.00

Forex Strategy Course with Angel Traders

1 × $6.00 -

×

How to Lose Money Profitably with Mark D.Cook

1 × $6.00

How to Lose Money Profitably with Mark D.Cook

1 × $6.00 -

×

MotiveWave Ultimate v5.1.3 (OFA, OFA AlgoX), (Aug 2017)

1 × $101.00

MotiveWave Ultimate v5.1.3 (OFA, OFA AlgoX), (Aug 2017)

1 × $101.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Market Stalkers Level 3 - Intraday Trading University

1 × $8.00

Market Stalkers Level 3 - Intraday Trading University

1 × $8.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

Stock Traders Almanac 2008 with Jeffrey Hirsch & Yale Hirsch

1 × $6.00

Stock Traders Almanac 2008 with Jeffrey Hirsch & Yale Hirsch

1 × $6.00 -

×

Fibonacci Mastery Course: Complete Guide to Trading with Fib By Todd Gordon

1 × $62.00

Fibonacci Mastery Course: Complete Guide to Trading with Fib By Todd Gordon

1 × $62.00 -

×

Investing in stocks: Avoid stock market loss

1 × $15.00

Investing in stocks: Avoid stock market loss

1 × $15.00 -

×

Index Funds with Mark Hebner

1 × $6.00

Index Funds with Mark Hebner

1 × $6.00 -

×

The Mango Butterfly Deep Dive 2023 with Jay Bailey - Sheridan Options Mentoring

1 × $31.00

The Mango Butterfly Deep Dive 2023 with Jay Bailey - Sheridan Options Mentoring

1 × $31.00 -

×

Getting Started in Forex Trading Strategies with Michael Duane Archer

1 × $6.00

Getting Started in Forex Trading Strategies with Michael Duane Archer

1 × $6.00 -

×

High Yield Investments I & II with Lance Spicer

1 × $6.00

High Yield Investments I & II with Lance Spicer

1 × $6.00 -

×

The Gorilla Game (Revised Ed.) with Greoffrey A.Moore & Paul Johnson

1 × $6.00

The Gorilla Game (Revised Ed.) with Greoffrey A.Moore & Paul Johnson

1 × $6.00 -

×

Day Trading and Swing Trading Futures with Price Action by Humberto Malaspina

1 × $5.00

Day Trading and Swing Trading Futures with Price Action by Humberto Malaspina

1 × $5.00 -

×

CarterFX Membership with Duran Carter

1 × $23.00

CarterFX Membership with Duran Carter

1 × $23.00 -

×

Forex in Five Full Time Strategies for Part Time Traders (fxstreet.com) - Raghee Horner

1 × $6.00

Forex in Five Full Time Strategies for Part Time Traders (fxstreet.com) - Raghee Horner

1 × $6.00 -

×

CFA Core Video on Quantitative Finance with Connel Fullenkamp

1 × $6.00

CFA Core Video on Quantitative Finance with Connel Fullenkamp

1 × $6.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Investing Classroom 2022 with Danny Devan

1 × $15.00

Investing Classroom 2022 with Danny Devan

1 × $15.00 -

×

Trading with Wave59 with Earik Beann

1 × $6.00

Trading with Wave59 with Earik Beann

1 × $6.00 -

×

S&P Market Timing Course For E-mini & Options Traders

1 × $6.00

S&P Market Timing Course For E-mini & Options Traders

1 × $6.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

Commodity Trading Video Course with Bob Buran

1 × $6.00

Commodity Trading Video Course with Bob Buran

1 × $6.00 -

×

SOAP. Served On A Platter CD with David Elliott

1 × $6.00

SOAP. Served On A Platter CD with David Elliott

1 × $6.00 -

×

Trading Trainer - 6 Percent Protocol

1 × $39.00

Trading Trainer - 6 Percent Protocol

1 × $39.00 -

×

Forex Trading Bootcamp For Traders & Investors (2020)

1 × $6.00

Forex Trading Bootcamp For Traders & Investors (2020)

1 × $6.00 -

×

ICT Mentorship – 2019

1 × $13.00

ICT Mentorship – 2019

1 × $13.00 -

×

Trading Masterclass POTM + PFTM + PTMI with Anton Kreil

1 × $6.00

Trading Masterclass POTM + PFTM + PTMI with Anton Kreil

1 × $6.00 -

×

6 Dynamic Trader Real Time and End Of Day

1 × $39.00

6 Dynamic Trader Real Time and End Of Day

1 × $39.00 -

×

Rocking Wall Street with Gary Marks

1 × $6.00

Rocking Wall Street with Gary Marks

1 × $6.00 -

×

Blank Check Trade

1 × $31.00

Blank Check Trade

1 × $31.00 -

×

Commitment Workshop for Traders by Adrienne Laris Toghraie

1 × $6.00

Commitment Workshop for Traders by Adrienne Laris Toghraie

1 × $6.00 -

×

Heiken Ashi 101

1 × $15.00

Heiken Ashi 101

1 × $15.00 -

×

The Aggressive Investor. Case Studies with Colin Nicholson

1 × $6.00

The Aggressive Investor. Case Studies with Colin Nicholson

1 × $6.00 -

×

3 Steps To Supply/Demand + 3 Steps To Market Profile 10% Off Combined Price

1 × $23.00

3 Steps To Supply/Demand + 3 Steps To Market Profile 10% Off Combined Price

1 × $23.00 -

×

Pattern Cycles with Alan Farley

1 × $6.00

Pattern Cycles with Alan Farley

1 × $6.00 -

×

Spread Trading E-Trading Stagionale (Italian) with Joe Ross

1 × $6.00

Spread Trading E-Trading Stagionale (Italian) with Joe Ross

1 × $6.00 -

×

Dynamic Gann Levels with Don Fisher

1 × $6.00

Dynamic Gann Levels with Don Fisher

1 × $6.00 -

×

Candlesticks Explained with Martin Pring

1 × $6.00

Candlesticks Explained with Martin Pring

1 × $6.00 -

×

Yarimi University Course

1 × $56.00

Yarimi University Course

1 × $56.00 -

×

The Complete Short Course on Ripple Cryptocurrency with Saad Hameed

1 × $5.00

The Complete Short Course on Ripple Cryptocurrency with Saad Hameed

1 × $5.00 -

×

Tech Stock Valuation with Mark Hirschey

1 × $6.00

Tech Stock Valuation with Mark Hirschey

1 × $6.00 -

×

Capital with Charles D.Ellis

1 × $6.00

Capital with Charles D.Ellis

1 × $6.00 -

×

Complete Short Black Scholes Options Trading Pricing Course

1 × $6.00

Complete Short Black Scholes Options Trading Pricing Course

1 × $6.00 -

×

Lepus Proprietary Trading with Richard Jackson

1 × $6.00

Lepus Proprietary Trading with Richard Jackson

1 × $6.00 -

×

Theo Trade - 128 Course Bundle

1 × $93.00

Theo Trade - 128 Course Bundle

1 × $93.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

All About Mutual Funds with Bruce Jacobs

1 × $6.00

All About Mutual Funds with Bruce Jacobs

1 × $6.00 -

×

TenfoldFX Academy Course with Kenneth John

1 × $17.00

TenfoldFX Academy Course with Kenneth John

1 × $17.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

Market Risk Analysis, Volume IV, Value at Risk Models with Carol Alexander

$78.00 Original price was: $78.00.$6.00Current price is: $6.00.

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Market Risk Analysis, Volume IV: Value at Risk Models with Carol Alexander

In the comprehensive world of market risk analysis, understanding and implementing effective risk management models is paramount. Carol Alexander’s “Market Risk Analysis, Volume IV: Value at Risk Models” provides an exhaustive exploration into Value at Risk (VaR) models, a cornerstone for financial risk assessment. This volume is a critical resource for finance professionals seeking to master VaR methodologies and apply them effectively in their risk management strategies.

Introduction to Value at Risk

Value at Risk is a statistical technique used to measure and quantify the level of financial risk within a firm or investment portfolio over a specific time frame.

What is Value at Risk?

- Definition: VaR estimates the maximum potential loss in value of a risky asset or portfolio over a defined period for a given confidence interval.

- Importance: It helps financial institutions limit their exposure to market risks.

Historical Context of VaR

Carol Alexander begins with a historical overview of VaR, tracing its development and integration into financial practice, highlighting its significance in contemporary finance.

Evolution of VaR

- Early Adoption: Initially used by major financial firms in the 1990s.

- Regulatory Endorsement: Later endorsed by regulators for its effectiveness in risk management.

Core Concepts of VaR Models

Understanding the core concepts is crucial for implementing VaR models effectively. Alexander dissects these models to provide a clear understanding of their function and utility.

Types of VaR Models

- Parametric VaR

- Historical Simulation VaR

- Monte Carlo Simulation VaR

Application of VaR in Financial Markets

Alexander thoroughly discusses the application of VaR in various financial markets, providing practical insights into managing market risks.

Using VaR in Different Sectors

- Banking

- Investment Management

- Insurance

Methodological Insights

Alexander offers in-depth methodological insights that help readers understand the complexities of VaR models, emphasizing accuracy in risk estimation.

Advanced Techniques

- Stress Testing

- Backtesting VaR Models

Case Studies and Examples

To illustrate the practical application, Alexander includes multiple case studies showing how VaR models function in real-world scenarios.

Real-World Applications

- Case Study: Global Financial Crisis

- Analysis: VaR Model Adaptation

Challenges and Critiques of VaR

Despite its widespread use, VaR is not without its critics. Alexander addresses these critiques head-on, discussing the model’s limitations and areas for improvement.

Limitations of VaR

- Risk of Underestimation

- Model Assumption Flaws

Implementing VaR Models

For practitioners, implementing VaR models effectively is crucial. Alexander provides a step-by-step guide to integration and operation.

Implementation Strategies

- Data Collection

- Model Selection

- Risk Assessment Procedures

Conclusion

Carol Alexander’s Volume IV of “Market Risk Analysis” is an invaluable resource for anyone involved in financial risk management. It provides a detailed, nuanced understanding of VaR models, equipping professionals with the knowledge to implement these models effectively.

Key Takeaways

- VaR is an essential tool in risk management.

- Understanding different VaR models can enhance risk assessment strategies.

- Continuous evaluation and adaptation are crucial for effective risk management.

Frequently Asked Questions

- What makes VaR models unique in risk management?

- VaR models provide a probabilistic estimate of potential losses, which is crucial for effective risk management.

- How often should VaR calculations be updated?

- VaR calculations should be updated regularly to reflect current market conditions and portfolio changes.

- Can small businesses use VaR models effectively?

- Yes, with the right data and tools, small businesses can implement VaR models to manage financial risks.

- What are common pitfalls in implementing VaR models?

- Common pitfalls include reliance on outdated data and incorrect model assumptions.

- Where can I learn more about advanced VaR techniques?

- Carol Alexander’s other volumes and publications provide extensive insights into advanced VaR techniques.

Be the first to review “Market Risk Analysis, Volume IV, Value at Risk Models with Carol Alexander” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.