-

×

CBOT Seminar on Market Profile (101 & 102) with Alex Benjamin

1 × $6.00

CBOT Seminar on Market Profile (101 & 102) with Alex Benjamin

1 × $6.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

MAP. Moving Average Patterns CD with David Elliott

1 × $6.00

MAP. Moving Average Patterns CD with David Elliott

1 × $6.00 -

×

Advanced Bond Trading Course

1 × $62.00

Advanced Bond Trading Course

1 × $62.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

Advanced Strategies for Option Trading Success with James Bittman

1 × $6.00

Advanced Strategies for Option Trading Success with James Bittman

1 × $6.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Practical Elliott Wave Trading Strategies with Robert Miner

1 × $6.00

Practical Elliott Wave Trading Strategies with Robert Miner

1 × $6.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

7 Days Options Masters Course with John Carter

1 × $54.00

7 Days Options Masters Course with John Carter

1 × $54.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Mastertrader – Mastering Swing Trading

1 × $31.00

Mastertrader – Mastering Swing Trading

1 × $31.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

Trading by the Minute - Joe Ross

1 × $6.00

Trading by the Minute - Joe Ross

1 × $6.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Traders Winning Edge (Presentation) with Adrienne Laris Toghraie

1 × $6.00

Traders Winning Edge (Presentation) with Adrienne Laris Toghraie

1 × $6.00 -

×

4×4 Course with Gregoire Dupont

1 × $6.00

4×4 Course with Gregoire Dupont

1 × $6.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

TraderSumo Academy Course

1 × $13.00

TraderSumo Academy Course

1 × $13.00 -

×

4 Strategies That Will Make You a Professional Day Trader with Jerremy Newsome

1 × $6.00

4 Strategies That Will Make You a Professional Day Trader with Jerremy Newsome

1 × $6.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Original Curriculum with Home Options Trading Course

1 × $6.00

Original Curriculum with Home Options Trading Course

1 × $6.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

Trading a Living Thing (Article) with David Bowden

1 × $6.00

Trading a Living Thing (Article) with David Bowden

1 × $6.00 -

×

Advanced Course with Jtrader

1 × $6.00

Advanced Course with Jtrader

1 × $6.00 -

×

How You Can Be Right While the Crowd Loses with Jack Bernstein

1 × $6.00

How You Can Be Right While the Crowd Loses with Jack Bernstein

1 × $6.00 -

×

501 Stock Market Tips & Guidelines with Arshad Khan

1 × $6.00

501 Stock Market Tips & Guidelines with Arshad Khan

1 × $6.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Inefficient Markets with Andrei Shleifer

1 × $6.00

Inefficient Markets with Andrei Shleifer

1 × $6.00 -

×

5 Essential Building Blocks to Successful Trading Workshop with Steve "Slim" Miller

1 × $6.00

5 Essential Building Blocks to Successful Trading Workshop with Steve "Slim" Miller

1 × $6.00 -

×

Traders Secret Success Package. Symmetry Wave Trading with Michael Gur Dillon

1 × $6.00

Traders Secret Success Package. Symmetry Wave Trading with Michael Gur Dillon

1 × $6.00 -

×

Trading double Diagonals 2023 with Dan Sheridan - Sheridan Options Mentoring

1 × $39.00

Trading double Diagonals 2023 with Dan Sheridan - Sheridan Options Mentoring

1 × $39.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

Greatest Trading Tools with Michael Parsons

1 × $6.00

Greatest Trading Tools with Michael Parsons

1 × $6.00 -

×

A-Z Course with InvestiTrade Academy

1 × $5.00

A-Z Course with InvestiTrade Academy

1 × $5.00 -

×

Diary of an Internet Trader with Alpesh Patel

1 × $6.00

Diary of an Internet Trader with Alpesh Patel

1 × $6.00 -

×

Volume Profile 2023 (Order Flow Pack) with Trader Dale

1 × $5.00

Volume Profile 2023 (Order Flow Pack) with Trader Dale

1 × $5.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Advanced Scalping Techniques Home Study Course with Sami Abusaad - T3Live

1 × $31.00

Advanced Scalping Techniques Home Study Course with Sami Abusaad - T3Live

1 × $31.00 -

×

DFX Scalping Strategy Course with Disciplined FX

1 × $23.00

DFX Scalping Strategy Course with Disciplined FX

1 × $23.00 -

×

Core Strategy Program + Extended Learning Track with Ota Courses

1 × $124.00

Core Strategy Program + Extended Learning Track with Ota Courses

1 × $124.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

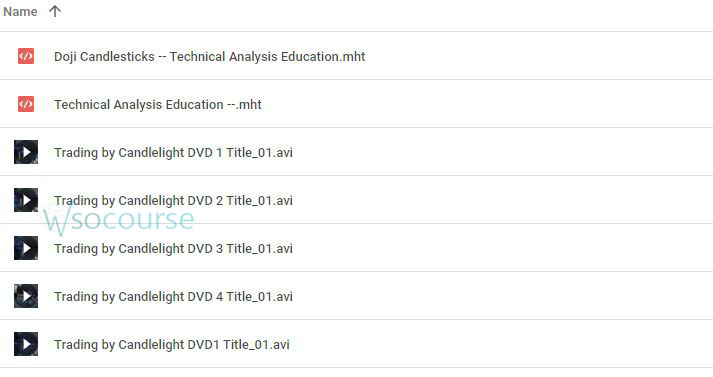

Trading – Candlelight – Ryan Litchfield

$6.00

File Size: Cooming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Trading – Candlelight – Ryan Litchfield” below:

Trading by Candlelight: Mastering the Market with Ryan Litchfield

Introduction

When we delve into the art of trading, mastering the intricacies of market patterns is crucial. Ryan Litchfield’s approach in “Trading by Candlelight” offers an enlightening perspective on reading market signals through candlestick patterns. This guide explores his techniques, ensuring traders at any level can harness these insights to make informed decisions.

The Essence of Candlestick Trading

Candlestick patterns are not just charts; they are stories of price movements and market sentiment. Each candle provides a visual snapshot of the trading activity within a specific timeframe, offering clues about potential market directions.

What is a Candlestick?

Candlesticks are graphical representations of price movements within a set period. Each candle consists of a body and wicks, reflecting the open, close, high, and low prices.

Why Candlestick Patterns Matter

Understanding these patterns helps traders anticipate possible price movements based on past trends. It’s not about predictions but about probabilities.

Key Patterns in Candlestick Trading

Ryan Litchfield emphasizes the importance of recognizing both bullish and bearish patterns to navigate the markets effectively.

Bullish Candlestick Patterns

- The Hammer: Signifying a reversal after a price decline.

- The Inverted Hammer: Shows potential upward momentum.

- The Bullish Engulfing: Indicates a strong buying pressure.

Bearish Candlestick Patterns

- The Hanging Man: Warns of a potential downturn.

- The Shooting Star: Suggests a reversal after an uptrend.

- The Bearish Engulfing: Highlights increasing selling pressure.

Advanced Techniques in Candlestick Analysis

Beyond basic patterns, Litchfield teaches advanced strategies to decode more complex market signals.

Combining Patterns for Stronger Signals

Utilizing combinations of candlestick patterns can lead to a higher probability of predicting future moves accurately.

The Role of Volume

Volume plays a pivotal role in confirming the strength of candlestick patterns. A pattern backed by high volume provides a more reliable signal.

Candlestick Patterns in Different Timeframes

Trading strategies can vary dramatically depending on the timeframe. Litchfield’s techniques adapt to everything from minute charts to monthly charts, providing versatility in trading.

Short-term Trading

Intraday traders might focus on minute-to-minute patterns to capture quick gains.

Long-term Trading

Longer-term traders look at daily to monthly charts to understand broader market trends.

Psychological Aspects of Candlestick Trading

The psychological element of trading is as crucial as the technical aspects. Candlestick patterns often reflect mass psychology and can indicate shifts in sentiment.

Fear and Greed

These emotions can drive the market and are often reflected in candlestick formations.

Market Trends and Reversals

Recognizing these can help traders manage risk and maximize returns.

Conclusion

“Trading by Candlelight” by Ryan Litchfield serves as a comprehensive guide to understanding and applying candlestick patterns in trading. With clear explanations and practical examples, traders can enhance their market analysis skills and improve their trading decisions.

FAQs

What is the best way to start learning candlestick patterns?

Start with basic patterns and gradually integrate more complex formations as you gain confidence.

Can candlestick patterns be applied to all financial markets?

Yes, these patterns are versatile and can be used in stocks, forex, commodities, and more.

How important is it to use other indicators with candlestick patterns?

It’s vital to use other technical indicators for confirmation to increase the reliability of the patterns.

What common mistakes should beginners avoid when using candlestick patterns?

Avoid trading on patterns without confirmation from additional indicators or volume.

How can one handle the emotional aspect of trading?

Developing a trading plan and sticking to it can help manage emotions and make more disciplined decisions.

Be the first to review “Trading – Candlelight – Ryan Litchfield” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.