-

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Alternative Assets and Strategic Allocation with John Abbink

1 × $6.00

Alternative Assets and Strategic Allocation with John Abbink

1 × $6.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

All About Stock Market Strategies: The Easy Way To Get Started (All About Series) with David Brown

1 × $6.00

All About Stock Market Strategies: The Easy Way To Get Started (All About Series) with David Brown

1 × $6.00 -

×

Trampoline Trading with Claytrader

1 × $6.00

Trampoline Trading with Claytrader

1 × $6.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Candlesticks MegaPackage Vol 1-4 (CCA) with Candle Charts

1 × $62.00

Candlesticks MegaPackage Vol 1-4 (CCA) with Candle Charts

1 × $62.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

“The Beast” Automated Trading System V2 (Feb 2015)

1 × $15.00

“The Beast” Automated Trading System V2 (Feb 2015)

1 × $15.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Winning Chart Patterns For NASDAQ Traders Version 2 - 1 DVD with Ken Calhoun

1 × $6.00

Winning Chart Patterns For NASDAQ Traders Version 2 - 1 DVD with Ken Calhoun

1 × $6.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

2017 Plan or Get Slaughtered Class with Doc Severson

1 × $6.00

2017 Plan or Get Slaughtered Class with Doc Severson

1 × $6.00 -

×

Zen in the Markets with Edward Allen Toppel

1 × $6.00

Zen in the Markets with Edward Allen Toppel

1 × $6.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Your Next Great Stock: How to Screen the Market for Tomorrow's Top Performers with Jack Hough

1 × $6.00

Your Next Great Stock: How to Screen the Market for Tomorrow's Top Performers with Jack Hough

1 × $6.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Wyckoff Analysis Series. Module 1. Wyckoff Volume Analysis

1 × $6.00

Wyckoff Analysis Series. Module 1. Wyckoff Volume Analysis

1 × $6.00 -

×

The Zurich Axioms with Max Gunther

1 × $6.00

The Zurich Axioms with Max Gunther

1 × $6.00 -

×

Behavioral Trading with Woody Dorsey

1 × $6.00

Behavioral Trading with Woody Dorsey

1 × $6.00 -

×

The Stock Investing Course For Beginners with Matt Dodge

1 × $5.00

The Stock Investing Course For Beginners with Matt Dodge

1 × $5.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Understanding Spreads with Edward Dobson & Roger Reimer

1 × $6.00

Understanding Spreads with Edward Dobson & Roger Reimer

1 × $6.00 -

×

Comfort Zone Investing: How to Tailor Your Portfolio for High Returns and Peace of Mind with Gillette Edmunds

1 × $6.00

Comfort Zone Investing: How to Tailor Your Portfolio for High Returns and Peace of Mind with Gillette Edmunds

1 × $6.00 -

×

Use the News with Maria Bartiromo

1 × $6.00

Use the News with Maria Bartiromo

1 × $6.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

With All Odds Forex System I & II with Barry Thornton

1 × $6.00

With All Odds Forex System I & II with Barry Thornton

1 × $6.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

TTM Slingshot & Value Charts Indicators

1 × $6.00

TTM Slingshot & Value Charts Indicators

1 × $6.00 -

×

Trading Connors VIX Reversals Tradestation Files with Laurence A. Connors & Gregory J. Che

1 × $6.00

Trading Connors VIX Reversals Tradestation Files with Laurence A. Connors & Gregory J. Che

1 × $6.00 -

×

The Investors Guide to Active Asset Allocation with Martin Pring

1 × $6.00

The Investors Guide to Active Asset Allocation with Martin Pring

1 × $6.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

Volume Profile Trading Strategy with Critical Trading

1 × $15.00

Volume Profile Trading Strategy with Critical Trading

1 × $15.00 -

×

Video Bundle - 4d & "Into The Abyss" with Blackrabbitfx

1 × $6.00

Video Bundle - 4d & "Into The Abyss" with Blackrabbitfx

1 × $6.00 -

×

Sovereign Man Confidential

1 × $6.00

Sovereign Man Confidential

1 × $6.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

Cumulative and Comparative TICK (Option TradeStation)

1 × $23.00

Cumulative and Comparative TICK (Option TradeStation)

1 × $23.00 -

×

VIP - One on One Coursework with Talkin Options

1 × $15.00

VIP - One on One Coursework with Talkin Options

1 × $15.00 -

×

Two Options Strategies for Every Investor with Karim Rahemtulla

1 × $6.00

Two Options Strategies for Every Investor with Karim Rahemtulla

1 × $6.00

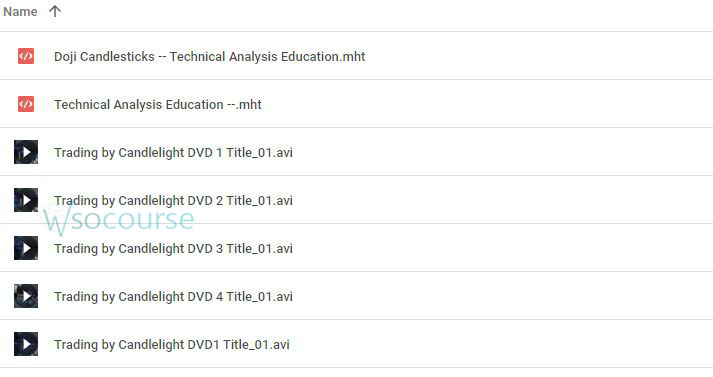

Trading – Candlelight – Ryan Litchfield

$6.00

File Size: Cooming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Trading – Candlelight – Ryan Litchfield” below:

Trading by Candlelight: Mastering the Market with Ryan Litchfield

Introduction

When we delve into the art of trading, mastering the intricacies of market patterns is crucial. Ryan Litchfield’s approach in “Trading by Candlelight” offers an enlightening perspective on reading market signals through candlestick patterns. This guide explores his techniques, ensuring traders at any level can harness these insights to make informed decisions.

The Essence of Candlestick Trading

Candlestick patterns are not just charts; they are stories of price movements and market sentiment. Each candle provides a visual snapshot of the trading activity within a specific timeframe, offering clues about potential market directions.

What is a Candlestick?

Candlesticks are graphical representations of price movements within a set period. Each candle consists of a body and wicks, reflecting the open, close, high, and low prices.

Why Candlestick Patterns Matter

Understanding these patterns helps traders anticipate possible price movements based on past trends. It’s not about predictions but about probabilities.

Key Patterns in Candlestick Trading

Ryan Litchfield emphasizes the importance of recognizing both bullish and bearish patterns to navigate the markets effectively.

Bullish Candlestick Patterns

- The Hammer: Signifying a reversal after a price decline.

- The Inverted Hammer: Shows potential upward momentum.

- The Bullish Engulfing: Indicates a strong buying pressure.

Bearish Candlestick Patterns

- The Hanging Man: Warns of a potential downturn.

- The Shooting Star: Suggests a reversal after an uptrend.

- The Bearish Engulfing: Highlights increasing selling pressure.

Advanced Techniques in Candlestick Analysis

Beyond basic patterns, Litchfield teaches advanced strategies to decode more complex market signals.

Combining Patterns for Stronger Signals

Utilizing combinations of candlestick patterns can lead to a higher probability of predicting future moves accurately.

The Role of Volume

Volume plays a pivotal role in confirming the strength of candlestick patterns. A pattern backed by high volume provides a more reliable signal.

Candlestick Patterns in Different Timeframes

Trading strategies can vary dramatically depending on the timeframe. Litchfield’s techniques adapt to everything from minute charts to monthly charts, providing versatility in trading.

Short-term Trading

Intraday traders might focus on minute-to-minute patterns to capture quick gains.

Long-term Trading

Longer-term traders look at daily to monthly charts to understand broader market trends.

Psychological Aspects of Candlestick Trading

The psychological element of trading is as crucial as the technical aspects. Candlestick patterns often reflect mass psychology and can indicate shifts in sentiment.

Fear and Greed

These emotions can drive the market and are often reflected in candlestick formations.

Market Trends and Reversals

Recognizing these can help traders manage risk and maximize returns.

Conclusion

“Trading by Candlelight” by Ryan Litchfield serves as a comprehensive guide to understanding and applying candlestick patterns in trading. With clear explanations and practical examples, traders can enhance their market analysis skills and improve their trading decisions.

FAQs

What is the best way to start learning candlestick patterns?

Start with basic patterns and gradually integrate more complex formations as you gain confidence.

Can candlestick patterns be applied to all financial markets?

Yes, these patterns are versatile and can be used in stocks, forex, commodities, and more.

How important is it to use other indicators with candlestick patterns?

It’s vital to use other technical indicators for confirmation to increase the reliability of the patterns.

What common mistakes should beginners avoid when using candlestick patterns?

Avoid trading on patterns without confirmation from additional indicators or volume.

How can one handle the emotional aspect of trading?

Developing a trading plan and sticking to it can help manage emotions and make more disciplined decisions.

Be the first to review “Trading – Candlelight – Ryan Litchfield” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Reviews

There are no reviews yet.