-

×

Gap Trading for Stock and Options Traders with Damon Verial

1 × $6.00

Gap Trading for Stock and Options Traders with Damon Verial

1 × $6.00 -

×

Futures & Options from A to Z with Russell Wassendorf

1 × $6.00

Futures & Options from A to Z with Russell Wassendorf

1 × $6.00 -

×

Stock Market Crash of 1929 with Aron Abrams

1 × $6.00

Stock Market Crash of 1929 with Aron Abrams

1 × $6.00 -

×

If You Are So Smart Why Aren’t You Rich with Ben Branch

1 × $6.00

If You Are So Smart Why Aren’t You Rich with Ben Branch

1 × $6.00 -

×

Forecasting Profits Using Price & Time with Ed Gately

1 × $6.00

Forecasting Profits Using Price & Time with Ed Gately

1 × $6.00 -

×

Quant Edge with T3 Live

1 × $6.00

Quant Edge with T3 Live

1 × $6.00 -

×

Renko Profits Accelerator

1 × $15.00

Renko Profits Accelerator

1 × $15.00 -

×

Shecantrade – Day Trading Options

1 × $23.00

Shecantrade – Day Trading Options

1 × $23.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Simpler Options - Insider’s Guide to Generating Income using Options Strategies Course (Oct 2014)

1 × $6.00

Simpler Options - Insider’s Guide to Generating Income using Options Strategies Course (Oct 2014)

1 × $6.00 -

×

Signals

1 × $6.00

Signals

1 × $6.00 -

×

Discover the MEM Simple Moving Average Formula with Mary Ellen McGonagle

1 × $15.00

Discover the MEM Simple Moving Average Formula with Mary Ellen McGonagle

1 × $15.00 -

×

Slapped by the Invisible Hand: The Panic of 2007 with Gary Gorton

1 × $6.00

Slapped by the Invisible Hand: The Panic of 2007 with Gary Gorton

1 × $6.00 -

×

New York Institute of Finance – Futures. A Personal Seminar

1 × $6.00

New York Institute of Finance – Futures. A Personal Seminar

1 × $6.00 -

×

Formula to a Fortune with Steve Briese, Glen Ring

1 × $6.00

Formula to a Fortune with Steve Briese, Glen Ring

1 × $6.00 -

×

A Complete Guide to Technical Trading Tactics with John Person

1 × $6.00

A Complete Guide to Technical Trading Tactics with John Person

1 × $6.00 -

×

Exchange-Traded Derivatives with Erik Banks

1 × $6.00

Exchange-Traded Derivatives with Erik Banks

1 × $6.00 -

×

Sang Lucci Master Course 2021 with Sang Lucci

1 × $6.00

Sang Lucci Master Course 2021 with Sang Lucci

1 × $6.00 -

×

Preview of Markets with George Bayer

1 × $6.00

Preview of Markets with George Bayer

1 × $6.00 -

×

HunterFX Video Course with HunterFX

1 × $6.00

HunterFX Video Course with HunterFX

1 × $6.00 -

×

Floor Trader Tools 8.2 with Roy Kelly

1 × $6.00

Floor Trader Tools 8.2 with Roy Kelly

1 × $6.00 -

×

Learn To Profit From The Forex Market with FX Hustle

1 × $6.00

Learn To Profit From The Forex Market with FX Hustle

1 × $6.00 -

×

Naked Trading Mastery

1 × $39.00

Naked Trading Mastery

1 × $39.00 -

×

Market Profile Video with FutexLive

1 × $6.00

Market Profile Video with FutexLive

1 × $6.00 -

×

From Wall Street to the Great Wall with Jonathan Worrall

1 × $6.00

From Wall Street to the Great Wall with Jonathan Worrall

1 × $6.00 -

×

Guide to Scanning for Potential Stock Trades class with Jeff Bierman

1 × $6.00

Guide to Scanning for Potential Stock Trades class with Jeff Bierman

1 × $6.00 -

×

Day One Trader with John Sussex

1 × $6.00

Day One Trader with John Sussex

1 × $6.00 -

×

Insider Buying The Ultimate Leading Indicator with Alex Green

1 × $6.00

Insider Buying The Ultimate Leading Indicator with Alex Green

1 × $6.00 -

×

Forty Cents for Financial Freedom with Darlene Nelson

1 × $6.00

Forty Cents for Financial Freedom with Darlene Nelson

1 × $6.00 -

×

How to Trade the New Single Stock Futures with Jack Bernstein

1 × $6.00

How to Trade the New Single Stock Futures with Jack Bernstein

1 × $6.00 -

×

Technical Analysis for the Trading Professional with Constance Brown

1 × $6.00

Technical Analysis for the Trading Professional with Constance Brown

1 × $6.00 -

×

Technical Analysis 101: A Comprehensive Guide to Becoming a Better Trader Class with Jeff Bierman

1 × $6.00

Technical Analysis 101: A Comprehensive Guide to Becoming a Better Trader Class with Jeff Bierman

1 × $6.00 -

×

The Cash Flow Bootcamp with John Macgregor

1 × $233.00

The Cash Flow Bootcamp with John Macgregor

1 × $233.00 -

×

Market Forecasting. Stocks and Grain

1 × $6.00

Market Forecasting. Stocks and Grain

1 × $6.00 -

×

How to Buy Stocks Before They Skyrocket

1 × $6.00

How to Buy Stocks Before They Skyrocket

1 × $6.00 -

×

Gold Trading Boot Camp: How to Master the Basics and Become a Successful Commodities Investor - Gregory Weldon & Dennis Gartman

1 × $6.00

Gold Trading Boot Camp: How to Master the Basics and Become a Successful Commodities Investor - Gregory Weldon & Dennis Gartman

1 × $6.00 -

×

A PLAN TO MAKE $4K MONTHLY ON $20K with Dan Sheridan - Sheridan Options Mentoring

1 × $15.00

A PLAN TO MAKE $4K MONTHLY ON $20K with Dan Sheridan - Sheridan Options Mentoring

1 × $15.00 -

×

Hands On Training Bundle with Talkin Options

1 × $23.00

Hands On Training Bundle with Talkin Options

1 × $23.00 -

×

From Walden to Wall Street: Frontiers of Conservation Finance with James Levitt

1 × $6.00

From Walden to Wall Street: Frontiers of Conservation Finance with James Levitt

1 × $6.00 -

×

Long/Short Market Dynamics: Trading Strategies for Today's Markets with Clive Corcoran

1 × $6.00

Long/Short Market Dynamics: Trading Strategies for Today's Markets with Clive Corcoran

1 × $6.00 -

×

Short-Term Trading with Precision Timing - Jack Bernstein

1 × $6.00

Short-Term Trading with Precision Timing - Jack Bernstein

1 × $6.00 -

×

The Raptor 10 Momentum Methodology Course

1 × $6.00

The Raptor 10 Momentum Methodology Course

1 × $6.00 -

×

Intra-day Trading Strategies. Proven Steps to Trading Profits

1 × $6.00

Intra-day Trading Strategies. Proven Steps to Trading Profits

1 × $6.00 -

×

Freedom Challenge Course with Steven Dux

1 × $5.00

Freedom Challenge Course with Steven Dux

1 × $5.00 -

×

MTA Master Trader Academy with Junior Charles

1 × $5.00

MTA Master Trader Academy with Junior Charles

1 × $5.00 -

×

DFX Scalping Strategy Course with Disciplined FX

1 × $23.00

DFX Scalping Strategy Course with Disciplined FX

1 × $23.00 -

×

Secret $100k Meeting with Russell Brunson

1 × $6.00

Secret $100k Meeting with Russell Brunson

1 × $6.00 -

×

Pattern- Price & Time. Using Gann Theory in Trading Systems (2nd Ed.)

1 × $6.00

Pattern- Price & Time. Using Gann Theory in Trading Systems (2nd Ed.)

1 × $6.00 -

×

Practical Approach to Ninjatrader 8 Platform with Rajandran R

1 × $6.00

Practical Approach to Ninjatrader 8 Platform with Rajandran R

1 × $6.00 -

×

RSI Basic with Andrew Cardwell

1 × $54.00

RSI Basic with Andrew Cardwell

1 × $54.00 -

×

Mutual Funds: Fifty Years of Research Findings by Seth C. Anderson

1 × $6.00

Mutual Funds: Fifty Years of Research Findings by Seth C. Anderson

1 × $6.00 -

×

Option Alpha Signals

1 × $15.00

Option Alpha Signals

1 × $15.00 -

×

Cashing in on Covered Calls Cash DVD

1 × $6.00

Cashing in on Covered Calls Cash DVD

1 × $6.00 -

×

Introduction to Fibonacci Time Analysis with Carolyn Boroden

1 × $6.00

Introduction to Fibonacci Time Analysis with Carolyn Boroden

1 × $6.00 -

×

Swing Trader Pro with Top Trade Tools

1 × $54.00

Swing Trader Pro with Top Trade Tools

1 × $54.00 -

×

Mastering Fundamental Analysis with Michael Thomsett

1 × $6.00

Mastering Fundamental Analysis with Michael Thomsett

1 × $6.00 -

×

Sun Tzu and the Art of War for Traders with Dean Lundell

1 × $6.00

Sun Tzu and the Art of War for Traders with Dean Lundell

1 × $6.00 -

×

The Dynamic Trading Master Course with Robert Miner

1 × $54.00

The Dynamic Trading Master Course with Robert Miner

1 × $54.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00

Candlestick Trading for Maximum Profitsn with B.M.Davis

$6.00

File Size: Cooming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

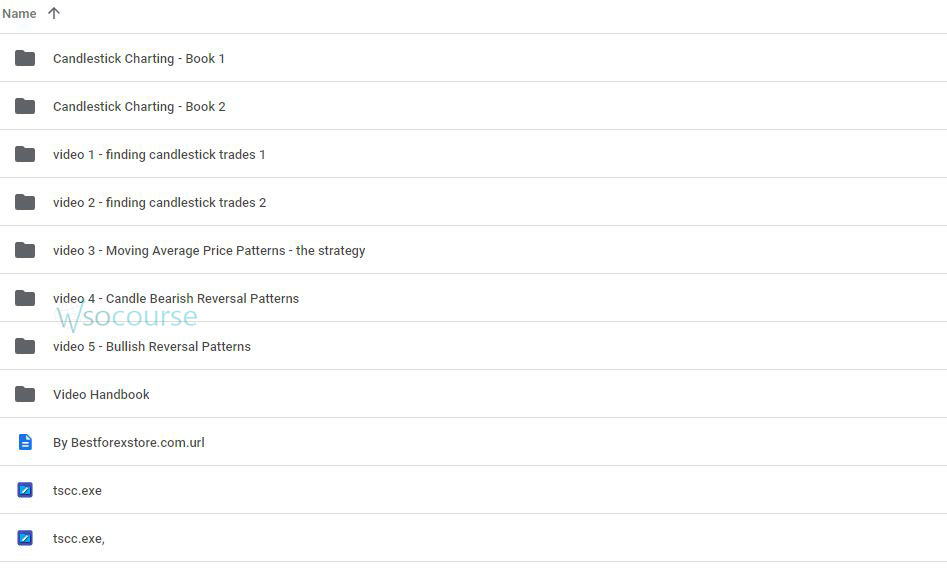

You may check content proof of “Candlestick Trading for Maximum Profitsn with B.M.Davis” below:

Candlestick Trading for Maximum Profits by B.M. Davis

Candlestick trading is not just a technique but an art form that B.M. Davis has mastered to maximize profits in the financial markets. This comprehensive guide breaks down the fundamentals of candlestick trading, providing actionable strategies for traders at all levels. Whether you’re a beginner or an experienced trader, understanding the nuances of candlestick patterns can significantly enhance your trading performance.

Introduction to Candlestick Trading

Candlestick patterns are a cornerstone of technical analysis, offering deep insights into market psychology and potential price movements.

What is Candlestick Trading?

Candlestick trading involves analyzing specific price patterns to forecast future market behavior.

History of Candlesticks

Originating from Japan over 200 years ago, candlestick patterns have been a reliable tool for traders ever since.

The Basics of Candlestick Patterns

Understanding the building blocks of candlestick patterns is essential for their effective application.

Single Candlestick Patterns

These include simple patterns like the Hammer, Doji, and Spinning Tops, each providing unique market insights.

Multi-Candlestick Patterns

More complex formations like the Engulfing, Piercing Line, and Harami play critical roles in predicting market reversals.

Strategies for Maximum Profits

B.M. Davis emphasizes strategies that capitalize on the predictive power of candlestick patterns.

Trend Identification

Identifying trends using candlestick patterns can guide traders in making profitable trading decisions.

Entry and Exit Points

Learn how to determine the best times to enter and exit trades based on candlestick formations.

Advanced Candlestick Trading Techniques

For those looking to refine their trading skills, advanced techniques provide greater precision and control.

Combining with Technical Indicators

Integrating candlestick patterns with indicators like RSI, MACD, and moving averages enhances accuracy.

Breakout Strategies

Recognizing and acting on breakout patterns can lead to significant profits.

Risk Management in Candlestick Trading

Effective risk management is crucial to maximizing profits and minimizing losses.

Setting Stop-Loss Orders

Learn how to set stop-loss orders strategically based on candlestick patterns.

Managing Trade Size

Adjusting trade size according to the strength of the candlestick signal is a key tactic.

Psychological Aspects of Trading

Understanding the psychology behind market movements can provide a competitive edge.

Market Sentiment Analysis

Candlestick patterns often reflect the psychological state of the market, providing clues about future movements.

Trader Behavior

Recognizing common behavioral patterns can help anticipate market reactions.

Candlestick Trading in Different Markets

Candlestick patterns are versatile and can be applied across various financial markets.

Stocks and Forex

Specific strategies for stocks and Forex markets using candlesticks.

Commodities and Cryptocurrencies

Adapting candlestick strategies for commodities and cryptocurrencies.

Conclusion

Candlestick trading offers a robust framework for understanding market dynamics and enhancing trading decisions. With the strategies discussed by B.M. Davis, traders can harness these patterns for maximum profit while effectively managing risk.

Frequently Asked Questions:

- What are the best candlestick patterns for beginners to learn?

The Hammer, Doji, and Engulfing patterns are ideal for beginners due to their simplicity and effectiveness. - How can candlestick patterns be used for day trading?

Candlestick patterns are extremely useful in day trading for identifying short-term price movements. - Can candlestick patterns be the sole basis for trading decisions?

While powerful, it’s advisable to use candlestick patterns in conjunction with other forms of analysis. - What is the biggest mistake traders make with candlestick patterns?

Over-reliance without considering market context or other technical indicators can lead to poor trading decisions. - How important is timing in trading with candlestick patterns?

Timing is crucial; accurate interpretation of patterns can significantly impact the success of trades.

Be the first to review “Candlestick Trading for Maximum Profitsn with B.M.Davis” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.