-

×

A Conservative Plan to Make $3K Monthly on $25K with Dan Sheridan – Sheridan Options Mentoring

1 × $23.00

A Conservative Plan to Make $3K Monthly on $25K with Dan Sheridan – Sheridan Options Mentoring

1 × $23.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

CBOT Seminar on Market Profile (101 & 102) with Alex Benjamin

1 × $6.00

CBOT Seminar on Market Profile (101 & 102) with Alex Benjamin

1 × $6.00 -

×

Tharp Think Essentials Video Workshop with Van Tharp

1 × $5.00

Tharp Think Essentials Video Workshop with Van Tharp

1 × $5.00 -

×

Julian Robertson: A Tiger in the Land of Bulls and Bears with Daniel Strachman

1 × $6.00

Julian Robertson: A Tiger in the Land of Bulls and Bears with Daniel Strachman

1 × $6.00 -

×

Profit Generating System with Brian Williams

1 × $6.00

Profit Generating System with Brian Williams

1 × $6.00 -

×

Forex Trading Systems Elearning Course - Busted Breakout System with Van Tharp

1 × $6.00

Forex Trading Systems Elearning Course - Busted Breakout System with Van Tharp

1 × $6.00 -

×

Formula to a Fortune with Steve Briese, Glen Ring

1 × $6.00

Formula to a Fortune with Steve Briese, Glen Ring

1 × $6.00 -

×

How To Invest Better

1 × $6.00

How To Invest Better

1 × $6.00 -

×

Forex Trader Package 2010

1 × $15.00

Forex Trader Package 2010

1 × $15.00 -

×

Investing for the Long Term with Peter Bernstein

1 × $6.00

Investing for the Long Term with Peter Bernstein

1 × $6.00 -

×

Handbook of Integral Equations with Andrei D.Polyanin, Alexander V.Manzhirov

1 × $6.00

Handbook of Integral Equations with Andrei D.Polyanin, Alexander V.Manzhirov

1 × $6.00 -

×

Building Your E-Mini Trading Strategy with Daniel Gramza

1 × $6.00

Building Your E-Mini Trading Strategy with Daniel Gramza

1 × $6.00 -

×

The Delphi Scalper 4 - Video + Metatrader Indicators with Jason Fielder

1 × $6.00

The Delphi Scalper 4 - Video + Metatrader Indicators with Jason Fielder

1 × $6.00 -

×

Sequence Trading Course with Kevin Haggerty

1 × $4.00

Sequence Trading Course with Kevin Haggerty

1 × $4.00 -

×

Trading The E-Minis for a Living with Don Miller

1 × $6.00

Trading The E-Minis for a Living with Don Miller

1 × $6.00 -

×

Candlestick Trading for Maximum Profitsn with B.M.Davis

1 × $6.00

Candlestick Trading for Maximum Profitsn with B.M.Davis

1 × $6.00 -

×

Active Investment Management: Finding and Harnessing Investment Skill with Charles Jackson

1 × $6.00

Active Investment Management: Finding and Harnessing Investment Skill with Charles Jackson

1 × $6.00 -

×

Portfolio Management using Machine Learning: Hierarchical Risk Parity

1 × $39.00

Portfolio Management using Machine Learning: Hierarchical Risk Parity

1 × $39.00 -

×

Trading Mindset, and Three Steps To Profitable Trading with Bruce Banks

1 × $6.00

Trading Mindset, and Three Steps To Profitable Trading with Bruce Banks

1 × $6.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

How I Turned 500 USD to 6 Figures in 2 months Trading Options with The Money Printers

1 × $8.00

How I Turned 500 USD to 6 Figures in 2 months Trading Options with The Money Printers

1 × $8.00 -

×

Investment Leadership & Portfolio Management with Brian Singer

1 × $6.00

Investment Leadership & Portfolio Management with Brian Singer

1 × $6.00 -

×

A Comprehensive Guide to Intraday Trading Strategies & Setups Class with Jeff Bierman

1 × $6.00

A Comprehensive Guide to Intraday Trading Strategies & Setups Class with Jeff Bierman

1 × $6.00 -

×

Foundation of Successful Trading - 2 DVDs and Bonus Gann Time Factor 2 DVDs

1 × $31.00

Foundation of Successful Trading - 2 DVDs and Bonus Gann Time Factor 2 DVDs

1 × $31.00 -

×

Online Investing Hacks with Bonnie Biafore

1 × $6.00

Online Investing Hacks with Bonnie Biafore

1 × $6.00 -

×

Behavioral Trading with Woody Dorsey

1 × $6.00

Behavioral Trading with Woody Dorsey

1 × $6.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Indicator Companion for Metastock with Martin Pring

1 × $6.00

Indicator Companion for Metastock with Martin Pring

1 × $6.00 -

×

Outsmarting the Smart Money with Lawrence A.Cunningham

1 × $6.00

Outsmarting the Smart Money with Lawrence A.Cunningham

1 × $6.00 -

×

The Right Stock at the Right Time. Prospering in the Coming Good Years with Larry Williams

1 × $6.00

The Right Stock at the Right Time. Prospering in the Coming Good Years with Larry Williams

1 × $6.00 -

×

Investor’s Guide to Charting By Alistair Blair

1 × $6.00

Investor’s Guide to Charting By Alistair Blair

1 × $6.00 -

×

How You Can Be Right While the Crowd Loses with Jack Bernstein

1 × $6.00

How You Can Be Right While the Crowd Loses with Jack Bernstein

1 × $6.00 -

×

Andy’s EMini Bar – 40 Min System with Joe Ross

1 × $6.00

Andy’s EMini Bar – 40 Min System with Joe Ross

1 × $6.00 -

×

Secrets of the Darvas Trading System

1 × $6.00

Secrets of the Darvas Trading System

1 × $6.00 -

×

FOREX MASTER TRADING COURSE with BKFOREX

1 × $5.00

FOREX MASTER TRADING COURSE with BKFOREX

1 × $5.00 -

×

All About Bonds & Mutual Funds with Esme Faerber

1 × $6.00

All About Bonds & Mutual Funds with Esme Faerber

1 × $6.00 -

×

Commodity Options: Trading and Hedging Volatility in the World’s Most Lucrative Market with Carley Garner & Paul Brittain

1 × $6.00

Commodity Options: Trading and Hedging Volatility in the World’s Most Lucrative Market with Carley Garner & Paul Brittain

1 × $6.00 -

×

The Deadly 7 Sins of Investing with Maury Fertig

1 × $6.00

The Deadly 7 Sins of Investing with Maury Fertig

1 × $6.00 -

×

Forex Eye

1 × $5.00

Forex Eye

1 × $5.00 -

×

The Dynamic Trading Master Course with Robert Miner

1 × $54.00

The Dynamic Trading Master Course with Robert Miner

1 × $54.00 -

×

All in One Forex Course with VintagEducation

1 × $31.00

All in One Forex Course with VintagEducation

1 × $31.00 -

×

EFT – The Art of Delivery with Gary Craig

1 × $5.00

EFT – The Art of Delivery with Gary Craig

1 × $5.00 -

×

Traders Secret Success Package. Symmetry Wave Trading with Michael Gur Dillon

1 × $6.00

Traders Secret Success Package. Symmetry Wave Trading with Michael Gur Dillon

1 × $6.00 -

×

PRO COURSE Order Flow Strategy with Gova Trading Academy

1 × $5.00

PRO COURSE Order Flow Strategy with Gova Trading Academy

1 × $5.00 -

×

The Chaos Course. Cash in on Chaos with Hans Hannula

1 × $6.00

The Chaos Course. Cash in on Chaos with Hans Hannula

1 × $6.00 -

×

Blank Check Trade

1 × $31.00

Blank Check Trade

1 × $31.00 -

×

The Crypto Code with Joel Peterson - Adam Short

1 × $15.00

The Crypto Code with Joel Peterson - Adam Short

1 × $15.00 -

×

Forex in Five Full Time Strategies for Part Time Traders (fxstreet.com) - Raghee Horner

1 × $6.00

Forex in Five Full Time Strategies for Part Time Traders (fxstreet.com) - Raghee Horner

1 × $6.00 -

×

Advanced Cycles with Nick Santiago - InTheMoneyStocks

1 × $171.00

Advanced Cycles with Nick Santiago - InTheMoneyStocks

1 × $171.00 -

×

Futures Spreads Crash Course with Base Camp Trading

1 × $54.00

Futures Spreads Crash Course with Base Camp Trading

1 × $54.00 -

×

Forex Education Trading System (Video 469 MB)

1 × $23.00

Forex Education Trading System (Video 469 MB)

1 × $23.00 -

×

The City Traders Course with Andrew Lockwood

1 × $10.00

The City Traders Course with Andrew Lockwood

1 × $10.00 -

×

Learn To Profit From The Forex Market with FX Hustle

1 × $6.00

Learn To Profit From The Forex Market with FX Hustle

1 × $6.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

E75 Forex System with James de Wet

1 × $6.00

E75 Forex System with James de Wet

1 × $6.00 -

×

Trade Like a Pro in Currency Trading with Don Schellenberg

1 × $6.00

Trade Like a Pro in Currency Trading with Don Schellenberg

1 × $6.00 -

×

Divorcing the Dow: Using Revolutionary Market Indicators to Profit from the Stealth Boom Ahead - Jim Troup & Sharon Michalsky

1 × $6.00

Divorcing the Dow: Using Revolutionary Market Indicators to Profit from the Stealth Boom Ahead - Jim Troup & Sharon Michalsky

1 × $6.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00

Candlestick Trading for Maximum Profitsn with B.M.Davis

$6.00

File Size: Cooming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

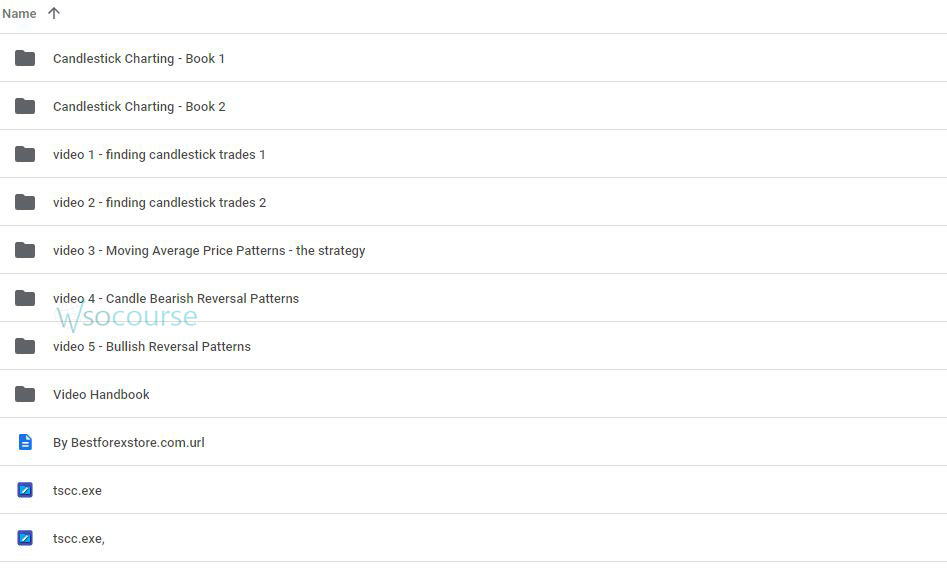

Content Proof: Watch Here!

You may check content proof of “Candlestick Trading for Maximum Profitsn with B.M.Davis” below:

Candlestick Trading for Maximum Profits by B.M. Davis

Candlestick trading is not just a technique but an art form that B.M. Davis has mastered to maximize profits in the financial markets. This comprehensive guide breaks down the fundamentals of candlestick trading, providing actionable strategies for traders at all levels. Whether you’re a beginner or an experienced trader, understanding the nuances of candlestick patterns can significantly enhance your trading performance.

Introduction to Candlestick Trading

Candlestick patterns are a cornerstone of technical analysis, offering deep insights into market psychology and potential price movements.

What is Candlestick Trading?

Candlestick trading involves analyzing specific price patterns to forecast future market behavior.

History of Candlesticks

Originating from Japan over 200 years ago, candlestick patterns have been a reliable tool for traders ever since.

The Basics of Candlestick Patterns

Understanding the building blocks of candlestick patterns is essential for their effective application.

Single Candlestick Patterns

These include simple patterns like the Hammer, Doji, and Spinning Tops, each providing unique market insights.

Multi-Candlestick Patterns

More complex formations like the Engulfing, Piercing Line, and Harami play critical roles in predicting market reversals.

Strategies for Maximum Profits

B.M. Davis emphasizes strategies that capitalize on the predictive power of candlestick patterns.

Trend Identification

Identifying trends using candlestick patterns can guide traders in making profitable trading decisions.

Entry and Exit Points

Learn how to determine the best times to enter and exit trades based on candlestick formations.

Advanced Candlestick Trading Techniques

For those looking to refine their trading skills, advanced techniques provide greater precision and control.

Combining with Technical Indicators

Integrating candlestick patterns with indicators like RSI, MACD, and moving averages enhances accuracy.

Breakout Strategies

Recognizing and acting on breakout patterns can lead to significant profits.

Risk Management in Candlestick Trading

Effective risk management is crucial to maximizing profits and minimizing losses.

Setting Stop-Loss Orders

Learn how to set stop-loss orders strategically based on candlestick patterns.

Managing Trade Size

Adjusting trade size according to the strength of the candlestick signal is a key tactic.

Psychological Aspects of Trading

Understanding the psychology behind market movements can provide a competitive edge.

Market Sentiment Analysis

Candlestick patterns often reflect the psychological state of the market, providing clues about future movements.

Trader Behavior

Recognizing common behavioral patterns can help anticipate market reactions.

Candlestick Trading in Different Markets

Candlestick patterns are versatile and can be applied across various financial markets.

Stocks and Forex

Specific strategies for stocks and Forex markets using candlesticks.

Commodities and Cryptocurrencies

Adapting candlestick strategies for commodities and cryptocurrencies.

Conclusion

Candlestick trading offers a robust framework for understanding market dynamics and enhancing trading decisions. With the strategies discussed by B.M. Davis, traders can harness these patterns for maximum profit while effectively managing risk.

Frequently Asked Questions:

- What are the best candlestick patterns for beginners to learn?

The Hammer, Doji, and Engulfing patterns are ideal for beginners due to their simplicity and effectiveness. - How can candlestick patterns be used for day trading?

Candlestick patterns are extremely useful in day trading for identifying short-term price movements. - Can candlestick patterns be the sole basis for trading decisions?

While powerful, it’s advisable to use candlestick patterns in conjunction with other forms of analysis. - What is the biggest mistake traders make with candlestick patterns?

Over-reliance without considering market context or other technical indicators can lead to poor trading decisions. - How important is timing in trading with candlestick patterns?

Timing is crucial; accurate interpretation of patterns can significantly impact the success of trades.

Be the first to review “Candlestick Trading for Maximum Profitsn with B.M.Davis” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.