-

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

Complete Day Trading Course with The Trading Floor

1 × $13.00

Complete Day Trading Course with The Trading Floor

1 × $13.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Power Index Method for Profitable Futures Trading with Harold Goldberg

1 × $6.00

Power Index Method for Profitable Futures Trading with Harold Goldberg

1 × $6.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

How to Trade Diagonal Triangles. Superior Risk Reward Trade Setups

1 × $6.00

How to Trade Diagonal Triangles. Superior Risk Reward Trade Setups

1 × $6.00 -

×

Confessions of a Street Addict with James Cramer

1 × $6.00

Confessions of a Street Addict with James Cramer

1 × $6.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

ETF Trading Strategies Revealed with David Vomund

1 × $6.00

ETF Trading Strategies Revealed with David Vomund

1 × $6.00 -

×

How To Flip All Those “Hard To Flip” Deals

1 × $6.00

How To Flip All Those “Hard To Flip” Deals

1 × $6.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Advanced Technical Strategies Home Study Course with T3 LIVE

1 × $31.00

Advanced Technical Strategies Home Study Course with T3 LIVE

1 × $31.00 -

×

A Day In The Life Of A Forex Trader with Vic Noble & Shirley Hudson

1 × $23.00

A Day In The Life Of A Forex Trader with Vic Noble & Shirley Hudson

1 × $23.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

The Raptor 10 Momentum Methodology Course

1 × $6.00

The Raptor 10 Momentum Methodology Course

1 × $6.00 -

×

How to Buy Stocks Before They Skyrocket

1 × $6.00

How to Buy Stocks Before They Skyrocket

1 × $6.00 -

×

Create Your Own Hedge Fund with Mark Wolfinger

1 × $6.00

Create Your Own Hedge Fund with Mark Wolfinger

1 × $6.00 -

×

AllStreet Investing - Master the Market LEVEL 2 - DAYTRADING

1 × $23.00

AllStreet Investing - Master the Market LEVEL 2 - DAYTRADING

1 × $23.00 -

×

Volume Profile 2023 (Order Flow Pack) with Trader Dale

1 × $5.00

Volume Profile 2023 (Order Flow Pack) with Trader Dale

1 × $5.00 -

×

What Works in Online Trading with Mark Etzkorn

1 × $6.00

What Works in Online Trading with Mark Etzkorn

1 × $6.00 -

×

Wyckoff Unleashed Official Online Course (2018) with Wyckoffsmi

1 × $23.00

Wyckoff Unleashed Official Online Course (2018) with Wyckoffsmi

1 × $23.00 -

×

Build a Professional Trading System using Amibroker with Trading Tuitions - Marwood Research

1 × $23.00

Build a Professional Trading System using Amibroker with Trading Tuitions - Marwood Research

1 × $23.00 -

×

Alternative Assets and Strategic Allocation with John Abbink

1 × $6.00

Alternative Assets and Strategic Allocation with John Abbink

1 × $6.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

Profinacci Complete Course with Stephen A.Pierce

1 × $6.00

Profinacci Complete Course with Stephen A.Pierce

1 × $6.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Bubbleology: The New Science of Stock Market Winners and Losers with Kevin Hassett

1 × $6.00

Bubbleology: The New Science of Stock Market Winners and Losers with Kevin Hassett

1 × $6.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

5 Day Bootcamp with AWFX AnthonysWorld

1 × $34.00

5 Day Bootcamp with AWFX AnthonysWorld

1 × $34.00 -

×

Successful Stock Speculation (1922) with John James

1 × $6.00

Successful Stock Speculation (1922) with John James

1 × $6.00 -

×

Learn to Make Money Trading Options

1 × $6.00

Learn to Make Money Trading Options

1 × $6.00 -

×

Stochastic Calculus with Alan Bain

1 × $6.00

Stochastic Calculus with Alan Bain

1 × $6.00 -

×

London Super Conference 2018

1 × $54.00

London Super Conference 2018

1 × $54.00 -

×

Relationship of the StockMarket Fluctuations to the Lunarcycle with Frank J.Guarino

1 × $6.00

Relationship of the StockMarket Fluctuations to the Lunarcycle with Frank J.Guarino

1 × $6.00 -

×

How to Call the Top in a Stock (To the Penny!) and Earn 9-11% Annualized Cash Yields Doing It with Dan Ferris

1 × $6.00

How to Call the Top in a Stock (To the Penny!) and Earn 9-11% Annualized Cash Yields Doing It with Dan Ferris

1 × $6.00 -

×

HST Mobile

1 × $31.00

HST Mobile

1 × $31.00 -

×

Scientific Forex with Cristina Ciurea

1 × $6.00

Scientific Forex with Cristina Ciurea

1 × $6.00 -

×

Chaos. The New Map for Traders

1 × $15.00

Chaos. The New Map for Traders

1 × $15.00 -

×

Basic of Market Astrophisics with Hans Hannula

1 × $6.00

Basic of Market Astrophisics with Hans Hannula

1 × $6.00 -

×

How to Make a Living Trading Foreign Exchange: A Guaranteed Income for Life with Courtney Smith

1 × $6.00

How to Make a Living Trading Foreign Exchange: A Guaranteed Income for Life with Courtney Smith

1 × $6.00 -

×

Fibonnacci Trader WorkShop (Video 2.38 GB) with Dennis Bolze, Thom Hartle

1 × $6.00

Fibonnacci Trader WorkShop (Video 2.38 GB) with Dennis Bolze, Thom Hartle

1 × $6.00 -

×

Futures Trading Blueprint with Day Trader Next Door

1 × $5.00

Futures Trading Blueprint with Day Trader Next Door

1 × $5.00 -

×

Advanced Trading Course - Footprint Charts, Market Profile & TPO with Jayson Casper

1 × $31.00

Advanced Trading Course - Footprint Charts, Market Profile & TPO with Jayson Casper

1 × $31.00 -

×

Candlesticks Explained with Martin Pring

1 × $6.00

Candlesticks Explained with Martin Pring

1 × $6.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Candlestick Trading for Maximum Profitsn with B.M.Davis

$6.00

File Size: Cooming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

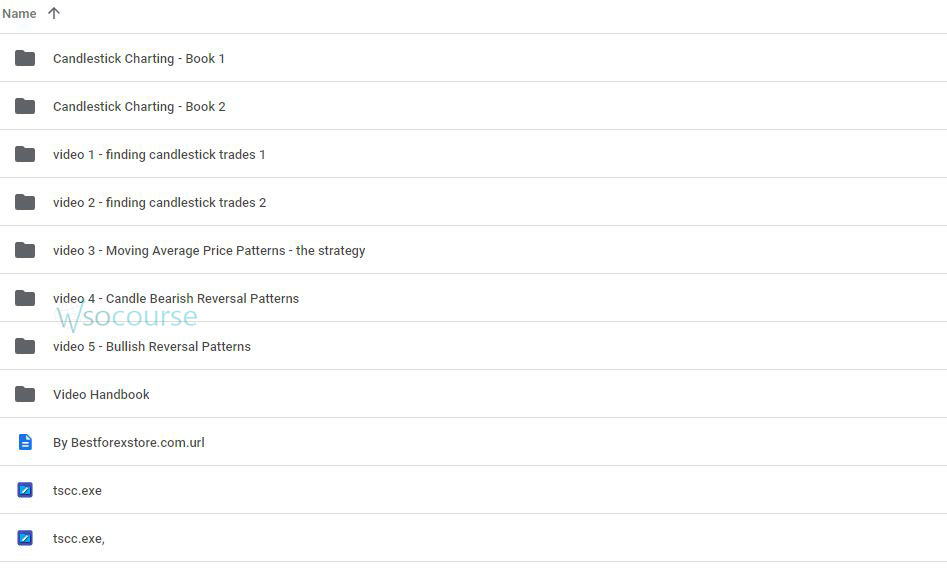

Content Proof: Watch Here!

You may check content proof of “Candlestick Trading for Maximum Profitsn with B.M.Davis” below:

Candlestick Trading for Maximum Profits by B.M. Davis

Candlestick trading is not just a technique but an art form that B.M. Davis has mastered to maximize profits in the financial markets. This comprehensive guide breaks down the fundamentals of candlestick trading, providing actionable strategies for traders at all levels. Whether you’re a beginner or an experienced trader, understanding the nuances of candlestick patterns can significantly enhance your trading performance.

Introduction to Candlestick Trading

Candlestick patterns are a cornerstone of technical analysis, offering deep insights into market psychology and potential price movements.

What is Candlestick Trading?

Candlestick trading involves analyzing specific price patterns to forecast future market behavior.

History of Candlesticks

Originating from Japan over 200 years ago, candlestick patterns have been a reliable tool for traders ever since.

The Basics of Candlestick Patterns

Understanding the building blocks of candlestick patterns is essential for their effective application.

Single Candlestick Patterns

These include simple patterns like the Hammer, Doji, and Spinning Tops, each providing unique market insights.

Multi-Candlestick Patterns

More complex formations like the Engulfing, Piercing Line, and Harami play critical roles in predicting market reversals.

Strategies for Maximum Profits

B.M. Davis emphasizes strategies that capitalize on the predictive power of candlestick patterns.

Trend Identification

Identifying trends using candlestick patterns can guide traders in making profitable trading decisions.

Entry and Exit Points

Learn how to determine the best times to enter and exit trades based on candlestick formations.

Advanced Candlestick Trading Techniques

For those looking to refine their trading skills, advanced techniques provide greater precision and control.

Combining with Technical Indicators

Integrating candlestick patterns with indicators like RSI, MACD, and moving averages enhances accuracy.

Breakout Strategies

Recognizing and acting on breakout patterns can lead to significant profits.

Risk Management in Candlestick Trading

Effective risk management is crucial to maximizing profits and minimizing losses.

Setting Stop-Loss Orders

Learn how to set stop-loss orders strategically based on candlestick patterns.

Managing Trade Size

Adjusting trade size according to the strength of the candlestick signal is a key tactic.

Psychological Aspects of Trading

Understanding the psychology behind market movements can provide a competitive edge.

Market Sentiment Analysis

Candlestick patterns often reflect the psychological state of the market, providing clues about future movements.

Trader Behavior

Recognizing common behavioral patterns can help anticipate market reactions.

Candlestick Trading in Different Markets

Candlestick patterns are versatile and can be applied across various financial markets.

Stocks and Forex

Specific strategies for stocks and Forex markets using candlesticks.

Commodities and Cryptocurrencies

Adapting candlestick strategies for commodities and cryptocurrencies.

Conclusion

Candlestick trading offers a robust framework for understanding market dynamics and enhancing trading decisions. With the strategies discussed by B.M. Davis, traders can harness these patterns for maximum profit while effectively managing risk.

Frequently Asked Questions:

- What are the best candlestick patterns for beginners to learn?

The Hammer, Doji, and Engulfing patterns are ideal for beginners due to their simplicity and effectiveness. - How can candlestick patterns be used for day trading?

Candlestick patterns are extremely useful in day trading for identifying short-term price movements. - Can candlestick patterns be the sole basis for trading decisions?

While powerful, it’s advisable to use candlestick patterns in conjunction with other forms of analysis. - What is the biggest mistake traders make with candlestick patterns?

Over-reliance without considering market context or other technical indicators can lead to poor trading decisions. - How important is timing in trading with candlestick patterns?

Timing is crucial; accurate interpretation of patterns can significantly impact the success of trades.

Be the first to review “Candlestick Trading for Maximum Profitsn with B.M.Davis” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.