-

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

The Correlation Code with Jason Fielder

1 × $6.00

The Correlation Code with Jason Fielder

1 × $6.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

Active Beta Indexes with Khalid Ghayur

1 × $6.00

Active Beta Indexes with Khalid Ghayur

1 × $6.00 -

×

PFAZoneSuite [Trading Indicator] 2017

1 × $109.00

PFAZoneSuite [Trading Indicator] 2017

1 × $109.00 -

×

Advanced Scalping Techniques Home Study Course with Sami Abusaad - T3Live

1 × $31.00

Advanced Scalping Techniques Home Study Course with Sami Abusaad - T3Live

1 × $31.00 -

×

FX SpeedRunner

1 × $5.00

FX SpeedRunner

1 × $5.00 -

×

Volume Profile 2023 (Elite Pack) with Trader Dale

1 × $5.00

Volume Profile 2023 (Elite Pack) with Trader Dale

1 × $5.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Smart Money Concepts with MFX Trading

1 × $13.00

Smart Money Concepts with MFX Trading

1 × $13.00 -

×

5 Day Bootcamp with AWFX AnthonysWorld

1 × $34.00

5 Day Bootcamp with AWFX AnthonysWorld

1 × $34.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Master Fibonacci, Symmetry & Consistent Profitable Trading with Day Trading Zones

1 × $23.00

Master Fibonacci, Symmetry & Consistent Profitable Trading with Day Trading Zones

1 × $23.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

Supply And Demand Zone Trading Course with Trading180

1 × $5.00

Supply And Demand Zone Trading Course with Trading180

1 × $5.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Picking the Best Stocks & Strategies for every Option Trade with James Bittman

1 × $6.00

Picking the Best Stocks & Strategies for every Option Trade with James Bittman

1 × $6.00 -

×

London Close Trade 2.0 with Shirley Hudson & Vic Noble - Forex Mentor

1 × $5.00

London Close Trade 2.0 with Shirley Hudson & Vic Noble - Forex Mentor

1 × $5.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Algo Trading Strategies 2017 with Autotrading Academy

1 × $6.00

Algo Trading Strategies 2017 with Autotrading Academy

1 × $6.00 -

×

Futures Commodity Trading with G. Scott Martin

1 × $6.00

Futures Commodity Trading with G. Scott Martin

1 × $6.00 -

×

Stock Market Wizards Interviews with America’s Top Stock Traders - Jack Schwager

1 × $6.00

Stock Market Wizards Interviews with America’s Top Stock Traders - Jack Schwager

1 × $6.00 -

×

Discover the MEM Simple Moving Average Formula with Mary Ellen McGonagle

1 × $15.00

Discover the MEM Simple Moving Average Formula with Mary Ellen McGonagle

1 × $15.00 -

×

Covered Calls Income Generation for Your Stocks With Don Kaufman

1 × $6.00

Covered Calls Income Generation for Your Stocks With Don Kaufman

1 × $6.00 -

×

A Comprehensive Guide to Intraday Trading Strategies & Setups Class with Jeff Bierman

1 × $6.00

A Comprehensive Guide to Intraday Trading Strategies & Setups Class with Jeff Bierman

1 × $6.00 -

×

Traders Workshop – Forex Full Course with Jason Stapleton

1 × $6.00

Traders Workshop – Forex Full Course with Jason Stapleton

1 × $6.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

Options 101 - The Basics and Beyond Class A 5-Part Course with Don Kaufman

1 × $6.00

Options 101 - The Basics and Beyond Class A 5-Part Course with Don Kaufman

1 × $6.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Trading Books with Michael Harris

1 × $6.00

Trading Books with Michael Harris

1 × $6.00 -

×

THE ART OF ADJUSTING IN 2017

1 × $6.00

THE ART OF ADJUSTING IN 2017

1 × $6.00 -

×

![ACD Method [Video (6 MP4s)] with Mark Fisher](https://www.totozon.com/wp-content/uploads/2024/05/ACD-Method-Video-6-MP4s-with-Mark-Fisher.jpg) ACD Method [Video (6 MP4s)] with Mark Fisher

1 × $6.00

ACD Method [Video (6 MP4s)] with Mark Fisher

1 × $6.00 -

×

Trading for a Living with Alexander Elder

1 × $6.00

Trading for a Living with Alexander Elder

1 × $6.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

3 Swing Trading Examples, With Charts, Instructions, And Definitions To Get You Started by Alan Farley

1 × $6.00

3 Swing Trading Examples, With Charts, Instructions, And Definitions To Get You Started by Alan Farley

1 × $6.00 -

×

Scalp Trading using the Hybrid System with Traders Reality

1 × $27.00

Scalp Trading using the Hybrid System with Traders Reality

1 × $27.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Complete Times Course with Afshin Taghechian

1 × $6.00

Complete Times Course with Afshin Taghechian

1 × $6.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

5 Essential Building Blocks to Successful Trading Workshop with Steve "Slim" Miller

1 × $6.00

5 Essential Building Blocks to Successful Trading Workshop with Steve "Slim" Miller

1 × $6.00 -

×

Ahead of the Curve with Joseph Ellis

1 × $6.00

Ahead of the Curve with Joseph Ellis

1 × $6.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Managing By The Greeks (6 Classes) Sept 2010 [9 Videos(mp4) 11 docs(pdf)] by Dan Sheridan

1 × $6.00

Managing By The Greeks (6 Classes) Sept 2010 [9 Videos(mp4) 11 docs(pdf)] by Dan Sheridan

1 × $6.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

An Empirical Ananlysis of Stock Market Sentiment (Article) with Andrea Terzi

1 × $6.00

An Empirical Ananlysis of Stock Market Sentiment (Article) with Andrea Terzi

1 × $6.00 -

×

Elliott Wave Indicator Suite for ThinkorSwim

1 × $15.00

Elliott Wave Indicator Suite for ThinkorSwim

1 × $15.00 -

×

Options Trading. The Hidden Reality Course with Charles Cottle

1 × $6.00

Options Trading. The Hidden Reality Course with Charles Cottle

1 × $6.00 -

×

Contrarian Investment Strategies: The Next Generation with David Dreman

1 × $4.00

Contrarian Investment Strategies: The Next Generation with David Dreman

1 × $4.00 -

×

10 Pips Anytime you Want with Karl Dittmann

1 × $6.00

10 Pips Anytime you Want with Karl Dittmann

1 × $6.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Candlestick Trading for Maximum Profitsn with B.M.Davis

$6.00

File Size: Cooming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

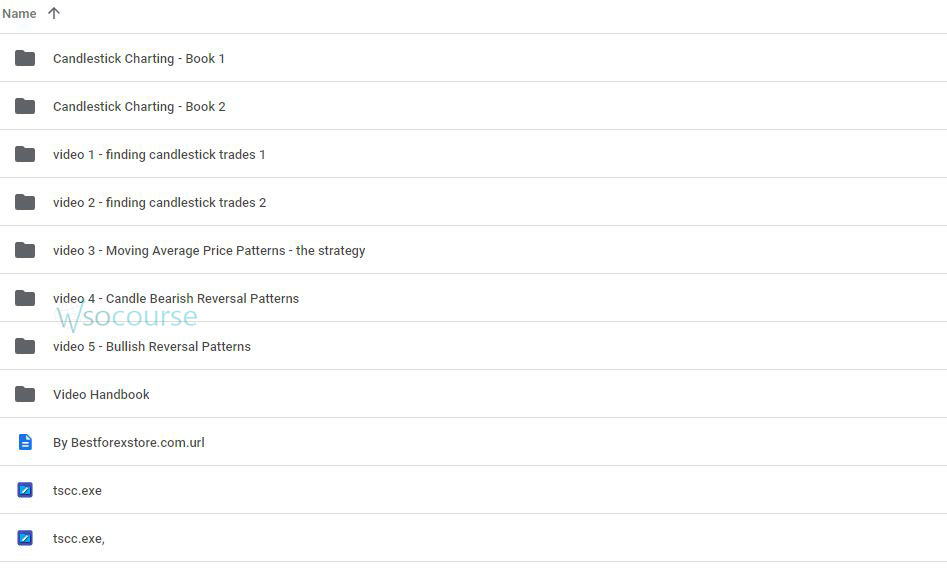

You may check content proof of “Candlestick Trading for Maximum Profitsn with B.M.Davis” below:

Candlestick Trading for Maximum Profits by B.M. Davis

Candlestick trading is not just a technique but an art form that B.M. Davis has mastered to maximize profits in the financial markets. This comprehensive guide breaks down the fundamentals of candlestick trading, providing actionable strategies for traders at all levels. Whether you’re a beginner or an experienced trader, understanding the nuances of candlestick patterns can significantly enhance your trading performance.

Introduction to Candlestick Trading

Candlestick patterns are a cornerstone of technical analysis, offering deep insights into market psychology and potential price movements.

What is Candlestick Trading?

Candlestick trading involves analyzing specific price patterns to forecast future market behavior.

History of Candlesticks

Originating from Japan over 200 years ago, candlestick patterns have been a reliable tool for traders ever since.

The Basics of Candlestick Patterns

Understanding the building blocks of candlestick patterns is essential for their effective application.

Single Candlestick Patterns

These include simple patterns like the Hammer, Doji, and Spinning Tops, each providing unique market insights.

Multi-Candlestick Patterns

More complex formations like the Engulfing, Piercing Line, and Harami play critical roles in predicting market reversals.

Strategies for Maximum Profits

B.M. Davis emphasizes strategies that capitalize on the predictive power of candlestick patterns.

Trend Identification

Identifying trends using candlestick patterns can guide traders in making profitable trading decisions.

Entry and Exit Points

Learn how to determine the best times to enter and exit trades based on candlestick formations.

Advanced Candlestick Trading Techniques

For those looking to refine their trading skills, advanced techniques provide greater precision and control.

Combining with Technical Indicators

Integrating candlestick patterns with indicators like RSI, MACD, and moving averages enhances accuracy.

Breakout Strategies

Recognizing and acting on breakout patterns can lead to significant profits.

Risk Management in Candlestick Trading

Effective risk management is crucial to maximizing profits and minimizing losses.

Setting Stop-Loss Orders

Learn how to set stop-loss orders strategically based on candlestick patterns.

Managing Trade Size

Adjusting trade size according to the strength of the candlestick signal is a key tactic.

Psychological Aspects of Trading

Understanding the psychology behind market movements can provide a competitive edge.

Market Sentiment Analysis

Candlestick patterns often reflect the psychological state of the market, providing clues about future movements.

Trader Behavior

Recognizing common behavioral patterns can help anticipate market reactions.

Candlestick Trading in Different Markets

Candlestick patterns are versatile and can be applied across various financial markets.

Stocks and Forex

Specific strategies for stocks and Forex markets using candlesticks.

Commodities and Cryptocurrencies

Adapting candlestick strategies for commodities and cryptocurrencies.

Conclusion

Candlestick trading offers a robust framework for understanding market dynamics and enhancing trading decisions. With the strategies discussed by B.M. Davis, traders can harness these patterns for maximum profit while effectively managing risk.

Frequently Asked Questions:

- What are the best candlestick patterns for beginners to learn?

The Hammer, Doji, and Engulfing patterns are ideal for beginners due to their simplicity and effectiveness. - How can candlestick patterns be used for day trading?

Candlestick patterns are extremely useful in day trading for identifying short-term price movements. - Can candlestick patterns be the sole basis for trading decisions?

While powerful, it’s advisable to use candlestick patterns in conjunction with other forms of analysis. - What is the biggest mistake traders make with candlestick patterns?

Over-reliance without considering market context or other technical indicators can lead to poor trading decisions. - How important is timing in trading with candlestick patterns?

Timing is crucial; accurate interpretation of patterns can significantly impact the success of trades.

Be the first to review “Candlestick Trading for Maximum Profitsn with B.M.Davis” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.