-

×

Pristine - Tom Willard – Creating The Ultimate Trading Psychology Using 3 Key Concepts

1 × $6.00

Pristine - Tom Willard – Creating The Ultimate Trading Psychology Using 3 Key Concepts

1 × $6.00 -

×

Commitments of Traders : Strategies for Tracking the Market and Trading Profitably with Floyd Upperman

1 × $6.00

Commitments of Traders : Strategies for Tracking the Market and Trading Profitably with Floyd Upperman

1 × $6.00 -

×

Optimize Funding Program 2023 with Solo Network Courses

1 × $13.00

Optimize Funding Program 2023 with Solo Network Courses

1 × $13.00 -

×

WealthFRX Trading Mastery Course 2.0

1 × $5.00

WealthFRX Trading Mastery Course 2.0

1 × $5.00 -

×

Momentum Scalping for Profits with Shay Horowitz

1 × $6.00

Momentum Scalping for Profits with Shay Horowitz

1 × $6.00 -

×

George Bayer Soft 1.02

1 × $6.00

George Bayer Soft 1.02

1 × $6.00 -

×

MTPredictor Education Video 10 Gb

1 × $23.00

MTPredictor Education Video 10 Gb

1 × $23.00 -

×

Sovereign Man Confidential

1 × $6.00

Sovereign Man Confidential

1 × $6.00 -

×

Main Online Course with FestX

1 × $5.00

Main Online Course with FestX

1 × $5.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Artificial Neural Networks Technology with Dave Anderson, George McNeill

1 × $6.00

Artificial Neural Networks Technology with Dave Anderson, George McNeill

1 × $6.00 -

×

Fibsdontlie - Fibs Don’t Lie Advanced Course

1 × $15.00

Fibsdontlie - Fibs Don’t Lie Advanced Course

1 × $15.00 -

×

Short Term Trading Strategies with Simon Harris

1 × $6.00

Short Term Trading Strategies with Simon Harris

1 × $6.00 -

×

KP Trading Room w/ Paladin and JadeCapFX

1 × $5.00

KP Trading Room w/ Paladin and JadeCapFX

1 × $5.00 -

×

Gann Course (Video & Audio 1.1 GB)

1 × $6.00

Gann Course (Video & Audio 1.1 GB)

1 × $6.00 -

×

Modern Portfolio Theory and Investment Analysis (7th Edition) with Edwin Elton, Martin Gruber, Stephen Brown & William Goetzmann

1 × $6.00

Modern Portfolio Theory and Investment Analysis (7th Edition) with Edwin Elton, Martin Gruber, Stephen Brown & William Goetzmann

1 × $6.00 -

×

Investment Management

1 × $6.00

Investment Management

1 × $6.00 -

×

IBD Advanced Buying Strategies Home Study Program

1 × $10.00

IBD Advanced Buying Strategies Home Study Program

1 × $10.00 -

×

Connors on Advanced Trading Strategies with Larry Connors

1 × $6.00

Connors on Advanced Trading Strategies with Larry Connors

1 × $6.00 -

×

![ACD Method [Video (6 MP4s)] with Mark Fisher](https://www.totozon.com/wp-content/uploads/2024/05/ACD-Method-Video-6-MP4s-with-Mark-Fisher.jpg) ACD Method [Video (6 MP4s)] with Mark Fisher

1 × $6.00

ACD Method [Video (6 MP4s)] with Mark Fisher

1 × $6.00 -

×

Research And Trade Like The Pros with Lex Van Dam & James Helliwell

1 × $15.00

Research And Trade Like The Pros with Lex Van Dam & James Helliwell

1 × $15.00 -

×

Market Wizards with Jack Schwager

1 × $6.00

Market Wizards with Jack Schwager

1 × $6.00 -

×

Practical Speculation with Victor Niederhoffer, Laurel Kenner

1 × $6.00

Practical Speculation with Victor Niederhoffer, Laurel Kenner

1 × $6.00 -

×

Markets In Motion with Ned Davis

1 × $6.00

Markets In Motion with Ned Davis

1 × $6.00 -

×

Forex Trading Secrets. Trading Strategies for the Forex Market

1 × $6.00

Forex Trading Secrets. Trading Strategies for the Forex Market

1 × $6.00 -

×

Gann Wheel 1.2.15 (globalviewtech.com)

1 × $6.00

Gann Wheel 1.2.15 (globalviewtech.com)

1 × $6.00 -

×

System Building Masterclass with Scott Phillips

1 × $15.00

System Building Masterclass with Scott Phillips

1 × $15.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Introduction To Market Turning Points Caused - The Demand & Supply Of Big Banks Institution - Golden Bridge Trading

1 × $6.00

Introduction To Market Turning Points Caused - The Demand & Supply Of Big Banks Institution - Golden Bridge Trading

1 × $6.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

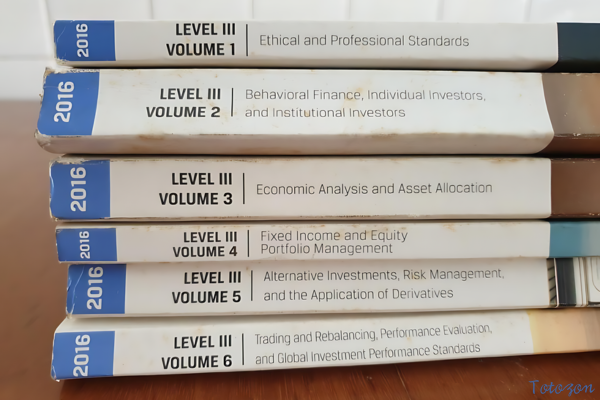

CFA Level 1,2,3 - Study Guides 2006

1 × $6.00

CFA Level 1,2,3 - Study Guides 2006

1 × $6.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

Patterns to Profits with Ryan Mallory - Share Planner

1 × $6.00

Patterns to Profits with Ryan Mallory - Share Planner

1 × $6.00 -

×

How Charts Can Help You in the Stock Market with William Jiller

1 × $6.00

How Charts Can Help You in the Stock Market with William Jiller

1 × $6.00 -

×

Mining for Golden Trading Opportunities with Jake Bernstein

1 × $8.00

Mining for Golden Trading Opportunities with Jake Bernstein

1 × $8.00 -

×

RadioActive Trading Home Study Kit with Power Options

1 × $31.00

RadioActive Trading Home Study Kit with Power Options

1 × $31.00 -

×

TC Top & Bottom Finder with Trader Confident

1 × $93.00

TC Top & Bottom Finder with Trader Confident

1 × $93.00 -

×

DFX Scalping Strategy Course with Disciplined FX

1 × $23.00

DFX Scalping Strategy Course with Disciplined FX

1 × $23.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Naked Trading Mastery

1 × $39.00

Naked Trading Mastery

1 × $39.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Note Buying Blueprint with Scott Carson - We Close Notes

1 × $6.00

Note Buying Blueprint with Scott Carson - We Close Notes

1 × $6.00 -

×

Momentum Signals Training Course with Fulcum Trader

1 × $5.00

Momentum Signals Training Course with Fulcum Trader

1 × $5.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Real Options in Practice with Marion A.Brach

1 × $6.00

Real Options in Practice with Marion A.Brach

1 × $6.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

NodeTrader (+ open code) (Nov 2014)

1 × $6.00

NodeTrader (+ open code) (Nov 2014)

1 × $6.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

ZipTraderU 2023 with ZipTrader

1 × $5.00

ZipTraderU 2023 with ZipTrader

1 × $5.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Set and Forget with Alex Gonzalez - Swing Trading Lab

1 × $5.00

Set and Forget with Alex Gonzalez - Swing Trading Lab

1 × $5.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

Mastering Metatrader 4 in 90 Minutes & Members Site with Alan Benefield

1 × $15.00

Mastering Metatrader 4 in 90 Minutes & Members Site with Alan Benefield

1 × $15.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

Self-Paced Course – Advanced Financial Statements Analysis 2024

1 × $27.00

Self-Paced Course – Advanced Financial Statements Analysis 2024

1 × $27.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

Chart Reading Course with TraderSumo

1 × $5.00

Chart Reading Course with TraderSumo

1 × $5.00 -

×

Wyckoff Analysis Series. Module 2. Wyckoff Candle Volume Analysis

1 × $6.00

Wyckoff Analysis Series. Module 2. Wyckoff Candle Volume Analysis

1 × $6.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Winning Stock Selection Simplified (Vol I, II & III) with Peter Worden

1 × $6.00

Winning Stock Selection Simplified (Vol I, II & III) with Peter Worden

1 × $6.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

The Ultimate Step By Step Guide to Online Currency Trading with Cynthia Marcy, Erol Bortucene

1 × $6.00

The Ultimate Step By Step Guide to Online Currency Trading with Cynthia Marcy, Erol Bortucene

1 × $6.00 -

×

Forex Day Trading Course with Raul Gonzalez

1 × $5.00

Forex Day Trading Course with Raul Gonzalez

1 × $5.00

How to Call the Top in a Stock (To the Penny!) and Earn 9-11% Annualized Cash Yields Doing It with Dan Ferris

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “How to Call the Top in a Stock (To the Penny!) and Earn 9-11% Annualized Cash Yields Doing It with Dan Ferris” below:

How to Call the Top in a Stock (To the Penny!) and Earn 9-11% Annualized Cash Yields Doing It with Dan Ferris

Predicting the exact top of a stock price and earning substantial cash yields might seem like an elusive goal for many investors. However, with the right strategies and guidance, it is achievable. Dan Ferris, a seasoned financial expert, provides insightful techniques to help investors master this skill. In this article, we will explore how to call the top in a stock and earn 9-11% annualized cash yields using Dan Ferris’ proven methods.

Introduction

Who is Dan Ferris?

Dan Ferris is a respected financial analyst and editor of the Extreme Value newsletter. With years of experience in stock market analysis and investment strategies, he is known for his ability to identify high-value investment opportunities.

Why Aim to Call the Top?

Identifying the top of a stock allows investors to maximize profits and avoid potential losses from subsequent declines. This strategy, when executed correctly, can significantly enhance portfolio returns.

Understanding Stock Tops

What is a Stock Top?

A stock top is the highest price point that a stock reaches before it starts to decline. Recognizing this point is crucial for selling at the optimal time.

Indicators of a Stock Top

Technical Indicators

Technical analysis involves studying price charts and patterns. Common indicators include moving averages, relative strength index (RSI), and Bollinger Bands.

Fundamental Indicators

Fundamental analysis focuses on a company’s financial health. Key metrics include earnings reports, price-to-earnings (P/E) ratios, and revenue growth.

Dan Ferris’ Strategies for Calling the Top

Technical Analysis Techniques

Moving Averages

Moving averages smooth out price data to identify trends. Ferris recommends using both short-term and long-term moving averages to spot potential tops.

Relative Strength Index (RSI)

RSI measures the speed and change of price movements. An RSI above 70 often indicates that a stock is overbought and may be nearing its top.

Fundamental Analysis Techniques

Earnings Reports

Earnings reports provide insights into a company’s profitability. Significant earnings beats or misses can signal potential tops.

Price-to-Earnings Ratio (P/E)

A high P/E ratio may indicate that a stock is overvalued. Ferris suggests monitoring P/E ratios relative to industry averages.

Combining Technical and Fundamental Analysis

Why Combine Both Analyses?

Using both technical and fundamental analyses provides a comprehensive view of a stock’s potential top. This dual approach reduces the risk of relying on a single method.

Example of Combined Analysis

Ferris often uses a combination of moving averages and P/E ratios to identify stock tops. For instance, a stock with a high P/E ratio and an RSI above 70 could be approaching its top.

Earning 9-11% Annualized Cash Yields

Dividend Stocks

High-Yield Dividends

Investing in high-yield dividend stocks can generate consistent cash flow. Ferris recommends focusing on companies with a history of stable and increasing dividends.

Dividend Reinvestment

Reinvesting dividends can enhance overall returns. This strategy allows investors to purchase more shares and benefit from compounding.

Selling Covered Calls

What are Covered Calls?

Selling covered calls involves writing call options on stocks you already own. This strategy generates income through option premiums.

Benefits of Covered Calls

Covered calls provide additional income and can enhance overall yields, especially in a flat or mildly bullish market.

Utilizing Real Estate Investment Trusts (REITs)

Understanding REITs

REITs are companies that own and operate income-generating real estate. They are required to distribute a significant portion of their earnings as dividends.

High-Yield Opportunities in REITs

Investing in high-yield REITs can provide steady cash flow. Ferris suggests looking for REITs with strong portfolios and consistent dividend payments.

Risk Management

Diversification

Why Diversify?

Diversification reduces risk by spreading investments across various assets. Ferris emphasizes the importance of not putting all your eggs in one basket.

How to Diversify

Invest in a mix of stocks, bonds, REITs, and other assets. This strategy helps protect your portfolio from significant losses.

Setting Stop-Loss Orders

What are Stop-Loss Orders?

Stop-loss orders automatically sell a stock when it reaches a certain price. This technique helps limit potential losses.

Implementing Stop-Loss Orders

Ferris advises setting stop-loss orders at strategic points to protect gains and minimize losses.

Practical Application of Strategies

Step-by-Step Guide

- Identify Potential Tops: Use a combination of technical and fundamental analyses.

- Invest in High-Yield Assets: Focus on dividend stocks, REITs, and covered calls.

- Manage Risks: Diversify your portfolio and set stop-loss orders.

Real-World Examples

Ferris provides case studies in his newsletter, demonstrating how these strategies have successfully called tops and generated high yields.

Conclusion

Why Follow Dan Ferris’ Methods?

Dan Ferris’ methods offer a well-rounded approach to calling stock tops and earning substantial cash yields. His strategies are based on years of experience and proven results.

FAQs

1. What is the primary goal of calling a stock top?

The primary goal is to maximize profits by selling at the highest price before the stock begins to decline.

2. How do technical indicators help in identifying stock tops?

Technical indicators, such as moving averages and RSI, help identify overbought conditions and potential reversal points.

3. What are covered calls, and how do they generate income?

Covered calls involve writing call options on stocks you own, generating income through option premiums.

4. Why is diversification important in managing a portfolio?

Diversification reduces risk by spreading investments across various assets, protecting the portfolio from significant losses.

5. How can high-yield REITs contribute to annualized cash yields?

High-yield REITs provide consistent dividend payments, contributing to steady cash flow and overall portfolio yields.

Be the first to review “How to Call the Top in a Stock (To the Penny!) and Earn 9-11% Annualized Cash Yields Doing It with Dan Ferris” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.