-

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

The 3 Skills of Top Trading with Hank Pruden

1 × $6.00

The 3 Skills of Top Trading with Hank Pruden

1 × $6.00 -

×

Trading Indicators for the 21st Century

1 × $6.00

Trading Indicators for the 21st Century

1 × $6.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Technical & Fundamental Courses with Diamant Capital

1 × $5.00

Technical & Fundamental Courses with Diamant Capital

1 × $5.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

TC Top & Bottom Finder with Trader Confident

1 × $93.00

TC Top & Bottom Finder with Trader Confident

1 × $93.00 -

×

Cwesi Forex Trading Bootcamp (Algo Trading)

1 × $13.00

Cwesi Forex Trading Bootcamp (Algo Trading)

1 × $13.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Swing Trading Systems Video Home Study, Presented with Ken Long - Van Tharp Institute

1 × $5.00

Swing Trading Systems Video Home Study, Presented with Ken Long - Van Tharp Institute

1 × $5.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

NY 6 - Jason McDonald – Why Shorts are Hard to Find and How You Can Find Great Shorts

1 × $6.00

NY 6 - Jason McDonald – Why Shorts are Hard to Find and How You Can Find Great Shorts

1 × $6.00 -

×

Back to the Future – Schabacker’s Principles with Linda Raschke

1 × $6.00

Back to the Future – Schabacker’s Principles with Linda Raschke

1 × $6.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Short-Term Traders’ Secrets. Candlesticks, Gaps & Breakout Patterns Revealed with Steve Nison & Ken Calhoun

1 × $6.00

Short-Term Traders’ Secrets. Candlesticks, Gaps & Breakout Patterns Revealed with Steve Nison & Ken Calhoun

1 × $6.00 -

×

Dynamic Swing Trader-NETPICKS (Unlocked)

1 × $54.00

Dynamic Swing Trader-NETPICKS (Unlocked)

1 × $54.00 -

×

Futures & Options 101 with Talkin Options

1 × $8.00

Futures & Options 101 with Talkin Options

1 × $8.00 -

×

Long Term Investing Strategies for Maximizing Returns with Lerone Bleasdille

1 × $5.00

Long Term Investing Strategies for Maximizing Returns with Lerone Bleasdille

1 × $5.00 -

×

The Rare Writings of W.D Gann

1 × $6.00

The Rare Writings of W.D Gann

1 × $6.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

Forex 360 Complete Course

1 × $6.00

Forex 360 Complete Course

1 × $6.00 -

×

DVD Series Trading Course

1 × $15.00

DVD Series Trading Course

1 × $15.00 -

×

Trading High-Momentum Stocks with Landry Persistent Pullbacks

1 × $15.00

Trading High-Momentum Stocks with Landry Persistent Pullbacks

1 × $15.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Intra-Day Trading Strategies. Proven Steps to Short-Term Trading Profits with Jeff Cooper

1 × $4.00

Intra-Day Trading Strategies. Proven Steps to Short-Term Trading Profits with Jeff Cooper

1 × $4.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Pro Trend Trader 2017 with James Orr

1 × $31.00

Pro Trend Trader 2017 with James Orr

1 × $31.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

Examination Book Morning Section (1999)

1 × $6.00

Examination Book Morning Section (1999)

1 × $6.00 -

×

CalendarMAX with Hari Swaminathan

1 × $15.00

CalendarMAX with Hari Swaminathan

1 × $15.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Tradingology Home Study Options Course

1 × $23.00

Tradingology Home Study Options Course

1 × $23.00 -

×

London Super Conference 2018

1 × $54.00

London Super Conference 2018

1 × $54.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

Dominate Stocks 2020 with J. Bravo

1 × $6.00

Dominate Stocks 2020 with J. Bravo

1 × $6.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

The Vital Few vs. the Trivial Many: Invest with the Insiders, Not the Masses with George Muzea

1 × $6.00

The Vital Few vs. the Trivial Many: Invest with the Insiders, Not the Masses with George Muzea

1 × $6.00 -

×

Foreign Exchange

1 × $6.00

Foreign Exchange

1 × $6.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

Football Hedging System with Tony Langley

1 × $54.00

Football Hedging System with Tony Langley

1 × $54.00 -

×

ETFs for the Long Run: What They Are, How They Work, and Simple Strategies for Successful Long-Term Investing - Lawrence Carrel

1 × $6.00

ETFs for the Long Run: What They Are, How They Work, and Simple Strategies for Successful Long-Term Investing - Lawrence Carrel

1 × $6.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Start Trading Stocks Using Technical Analysis with Corey Halliday

1 × $6.00

Start Trading Stocks Using Technical Analysis with Corey Halliday

1 × $6.00 -

×

The Day Trader: From the Pit to the PC with Lewis Borsellino

1 × $6.00

The Day Trader: From the Pit to the PC with Lewis Borsellino

1 × $6.00 -

×

Forex and Stocks Trading Course - Set and Forget with Alfonso Moreno

1 × $6.00

Forex and Stocks Trading Course - Set and Forget with Alfonso Moreno

1 × $6.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Options, Futures & Other Derivatives . Solutions Manual

1 × $6.00

Options, Futures & Other Derivatives . Solutions Manual

1 × $6.00 -

×

The Big 3 Squeeze Indicator TOS 2024 with Taylor Horton

1 × $69.00

The Big 3 Squeeze Indicator TOS 2024 with Taylor Horton

1 × $69.00 -

×

Currency Trading System 2003 with Peter Bain

1 × $6.00

Currency Trading System 2003 with Peter Bain

1 × $6.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Dan Sheridan 360 Degrees of Trading Class

1 × $6.00

Dan Sheridan 360 Degrees of Trading Class

1 × $6.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Fast Fibonacci for Day Traders

1 × $15.00

Fast Fibonacci for Day Traders

1 × $15.00 -

×

Trend Following: How Great Traders Make Millions in Up or Down Markets with Michael Covel

1 × $6.00

Trend Following: How Great Traders Make Millions in Up or Down Markets with Michael Covel

1 × $6.00 -

×

ETF Sector Plus Strategy (Course Only) with MarketGauge

1 × $62.00

ETF Sector Plus Strategy (Course Only) with MarketGauge

1 × $62.00 -

×

Trade Like a Stock Market Wizard with Mark Minervini

1 × $6.00

Trade Like a Stock Market Wizard with Mark Minervini

1 × $6.00 -

×

Out of the Pits with Caitlin Zaloom

1 × $6.00

Out of the Pits with Caitlin Zaloom

1 × $6.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Instant Forex Profits Home Study Course

1 × $23.00

Instant Forex Profits Home Study Course

1 × $23.00 -

×

Newsbeat Master Class Recording

1 × $39.00

Newsbeat Master Class Recording

1 × $39.00 -

×

One Week S&P Workshop II with Linda Raschke

1 × $5.00

One Week S&P Workshop II with Linda Raschke

1 × $5.00 -

×

Trading Price Action Reversals (Kindle) with Al Brooks

1 × $6.00

Trading Price Action Reversals (Kindle) with Al Brooks

1 × $6.00 -

×

ETFMax

1 × $31.00

ETFMax

1 × $31.00 -

×

Jason Bond Dvds for Traders (all 4 programs)

1 × $6.00

Jason Bond Dvds for Traders (all 4 programs)

1 × $6.00 -

×

Flex EA Correlated Hedge V1.02

1 × $6.00

Flex EA Correlated Hedge V1.02

1 × $6.00 -

×

Precise Exits & Entries with Charles LeBeau

1 × $6.00

Precise Exits & Entries with Charles LeBeau

1 × $6.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Market Stalkers Level 1 - Swing trading school (2020)

1 × $8.00

Market Stalkers Level 1 - Swing trading school (2020)

1 × $8.00 -

×

Forex Shockwave Analysis with James Bickford

1 × $6.00

Forex Shockwave Analysis with James Bickford

1 × $6.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Markets In Motion with Ned Davis

1 × $6.00

Markets In Motion with Ned Davis

1 × $6.00 -

×

Intra-Day Trading with Market Internals II with Greg Capra

1 × $6.00

Intra-Day Trading with Market Internals II with Greg Capra

1 × $6.00 -

×

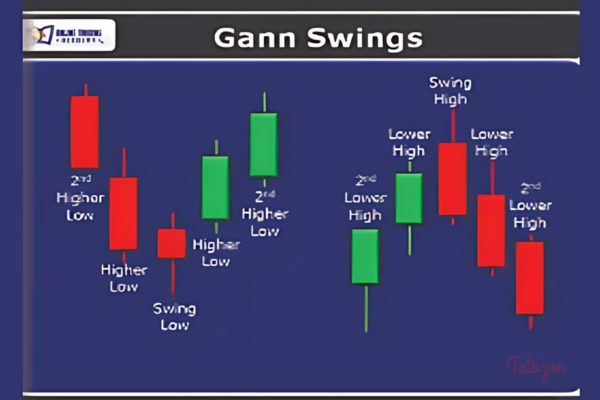

Terry Ashman’s Gann Swings Swing Trading Course (HotTrader Tutorial)

1 × $6.00

Terry Ashman’s Gann Swings Swing Trading Course (HotTrader Tutorial)

1 × $6.00 -

×

Price Ladder Training

1 × $15.00

Price Ladder Training

1 × $15.00 -

×

SMT FX Trading

1 × $5.00

SMT FX Trading

1 × $5.00 -

×

Hit The Mark Trading - Boot Camp 2016 Courses

1 × $23.00

Hit The Mark Trading - Boot Camp 2016 Courses

1 × $23.00 -

×

Pairs Trading: Quantitative Methods and Analysis with Ganapathy Vidyamurthy

1 × $6.00

Pairs Trading: Quantitative Methods and Analysis with Ganapathy Vidyamurthy

1 × $6.00 -

×

Jtrader - Risk Management 1on1

1 × $23.00

Jtrader - Risk Management 1on1

1 × $23.00 -

×

Intra-Day Trading Techniques CD with Greg Capra

1 × $6.00

Intra-Day Trading Techniques CD with Greg Capra

1 × $6.00 -

×

Mastering Level 2 with ClayTrader

1 × $197.00

Mastering Level 2 with ClayTrader

1 × $197.00 -

×

MTI - Scalping Course

1 × $15.00

MTI - Scalping Course

1 × $15.00 -

×

InterMarket Analysis (Ed.2004) with John J.Murphy

1 × $6.00

InterMarket Analysis (Ed.2004) with John J.Murphy

1 × $6.00 -

×

LIVE TRADERS - TECHNICAL STOCK TRADING

1 × $23.00

LIVE TRADERS - TECHNICAL STOCK TRADING

1 × $23.00 -

×

Growth Traders Toolbox Course with Julian Komar

1 × $5.00

Growth Traders Toolbox Course with Julian Komar

1 × $5.00 -

×

Day Trading Smart + David Nassar – Foundational Analysis. Selecting Winning Stock with David Nassar

1 × $6.00

Day Trading Smart + David Nassar – Foundational Analysis. Selecting Winning Stock with David Nassar

1 × $6.00 -

×

The Price Action Method

1 × $15.00

The Price Action Method

1 × $15.00 -

×

Profit Freedom Blueprint with High Performance Trading

1 × $5.00

Profit Freedom Blueprint with High Performance Trading

1 × $5.00 -

×

FX GOAT FOREX TRADING ACADEMY

1 × $8.00

FX GOAT FOREX TRADING ACADEMY

1 × $8.00 -

×

Cyclic Analysis. A BreakThrough in Transaction Timing with Cyclitec Services

1 × $6.00

Cyclic Analysis. A BreakThrough in Transaction Timing with Cyclitec Services

1 × $6.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

Traders Business Plan with Adrienne Laris Toghraie

1 × $6.00

Traders Business Plan with Adrienne Laris Toghraie

1 × $6.00 -

×

Safety in the Markets 9-DVD Series with David Bowden

1 × $6.00

Safety in the Markets 9-DVD Series with David Bowden

1 × $6.00 -

×

Strategy Week: Using High Probability Options Strategies with Don Kaufman

1 × $6.00

Strategy Week: Using High Probability Options Strategies with Don Kaufman

1 × $6.00 -

×

Electronic Trading "TNT" II How - To Win Trading Stuff with Joe Ross & Mark Cherlin

1 × $6.00

Electronic Trading "TNT" II How - To Win Trading Stuff with Joe Ross & Mark Cherlin

1 × $6.00 -

×

Intra-Day Trading Nasdaq Futures Class with Tony Rago - Theo Trade

1 × $4.00

Intra-Day Trading Nasdaq Futures Class with Tony Rago - Theo Trade

1 × $4.00 -

×

Options Trading Business with The Daytrading Room

1 × $23.00

Options Trading Business with The Daytrading Room

1 × $23.00 -

×

How to Use Spreads to Construct a Trading Roadmap

1 × $6.00

How to Use Spreads to Construct a Trading Roadmap

1 × $6.00 -

×

Quantitative Finance & Algorithmic Trading II - Time Series with Holczer Balazs

1 × $4.00

Quantitative Finance & Algorithmic Trading II - Time Series with Holczer Balazs

1 × $4.00 -

×

Stealth Trader (Ebook) with Andy Jordan - Trading Educators

1 × $132.00

Stealth Trader (Ebook) with Andy Jordan - Trading Educators

1 × $132.00 -

×

Levelator Automatic Trading Machines-Russ Horn’s

1 × $23.00

Levelator Automatic Trading Machines-Russ Horn’s

1 × $23.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Making a 2021 Trading Plan and Trading it for 3 Weeks with Sheridan Options Mentoring

1 × $39.00

Making a 2021 Trading Plan and Trading it for 3 Weeks with Sheridan Options Mentoring

1 × $39.00 -

×

How To Day-Trade Micro Eminis with Dr. Stoxx

1 × $5.00

How To Day-Trade Micro Eminis with Dr. Stoxx

1 × $5.00 -

×

Harmonic Patterns for ThinkorSwim Bat, Butterfly, Crab, and Gartley

1 × $6.00

Harmonic Patterns for ThinkorSwim Bat, Butterfly, Crab, and Gartley

1 × $6.00 -

×

LinkedIn Lead Challenge with Jimmy Coleman

1 × $15.00

LinkedIn Lead Challenge with Jimmy Coleman

1 × $15.00 -

×

Kase StatWare 9.7.3

1 × $23.00

Kase StatWare 9.7.3

1 × $23.00 -

×

MTI - Trend Trader Course (Feb 2014)

1 × $23.00

MTI - Trend Trader Course (Feb 2014)

1 × $23.00 -

×

Investing With Giants: Tried and True Stocks That Have Sustained the Test of Time with Linda T.Mead

1 × $6.00

Investing With Giants: Tried and True Stocks That Have Sustained the Test of Time with Linda T.Mead

1 × $6.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

How to Call the Top in a Stock (To the Penny!) and Earn 9-11% Annualized Cash Yields Doing It with Dan Ferris

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “How to Call the Top in a Stock (To the Penny!) and Earn 9-11% Annualized Cash Yields Doing It with Dan Ferris” below:

How to Call the Top in a Stock (To the Penny!) and Earn 9-11% Annualized Cash Yields Doing It with Dan Ferris

Predicting the exact top of a stock price and earning substantial cash yields might seem like an elusive goal for many investors. However, with the right strategies and guidance, it is achievable. Dan Ferris, a seasoned financial expert, provides insightful techniques to help investors master this skill. In this article, we will explore how to call the top in a stock and earn 9-11% annualized cash yields using Dan Ferris’ proven methods.

Introduction

Who is Dan Ferris?

Dan Ferris is a respected financial analyst and editor of the Extreme Value newsletter. With years of experience in stock market analysis and investment strategies, he is known for his ability to identify high-value investment opportunities.

Why Aim to Call the Top?

Identifying the top of a stock allows investors to maximize profits and avoid potential losses from subsequent declines. This strategy, when executed correctly, can significantly enhance portfolio returns.

Understanding Stock Tops

What is a Stock Top?

A stock top is the highest price point that a stock reaches before it starts to decline. Recognizing this point is crucial for selling at the optimal time.

Indicators of a Stock Top

Technical Indicators

Technical analysis involves studying price charts and patterns. Common indicators include moving averages, relative strength index (RSI), and Bollinger Bands.

Fundamental Indicators

Fundamental analysis focuses on a company’s financial health. Key metrics include earnings reports, price-to-earnings (P/E) ratios, and revenue growth.

Dan Ferris’ Strategies for Calling the Top

Technical Analysis Techniques

Moving Averages

Moving averages smooth out price data to identify trends. Ferris recommends using both short-term and long-term moving averages to spot potential tops.

Relative Strength Index (RSI)

RSI measures the speed and change of price movements. An RSI above 70 often indicates that a stock is overbought and may be nearing its top.

Fundamental Analysis Techniques

Earnings Reports

Earnings reports provide insights into a company’s profitability. Significant earnings beats or misses can signal potential tops.

Price-to-Earnings Ratio (P/E)

A high P/E ratio may indicate that a stock is overvalued. Ferris suggests monitoring P/E ratios relative to industry averages.

Combining Technical and Fundamental Analysis

Why Combine Both Analyses?

Using both technical and fundamental analyses provides a comprehensive view of a stock’s potential top. This dual approach reduces the risk of relying on a single method.

Example of Combined Analysis

Ferris often uses a combination of moving averages and P/E ratios to identify stock tops. For instance, a stock with a high P/E ratio and an RSI above 70 could be approaching its top.

Earning 9-11% Annualized Cash Yields

Dividend Stocks

High-Yield Dividends

Investing in high-yield dividend stocks can generate consistent cash flow. Ferris recommends focusing on companies with a history of stable and increasing dividends.

Dividend Reinvestment

Reinvesting dividends can enhance overall returns. This strategy allows investors to purchase more shares and benefit from compounding.

Selling Covered Calls

What are Covered Calls?

Selling covered calls involves writing call options on stocks you already own. This strategy generates income through option premiums.

Benefits of Covered Calls

Covered calls provide additional income and can enhance overall yields, especially in a flat or mildly bullish market.

Utilizing Real Estate Investment Trusts (REITs)

Understanding REITs

REITs are companies that own and operate income-generating real estate. They are required to distribute a significant portion of their earnings as dividends.

High-Yield Opportunities in REITs

Investing in high-yield REITs can provide steady cash flow. Ferris suggests looking for REITs with strong portfolios and consistent dividend payments.

Risk Management

Diversification

Why Diversify?

Diversification reduces risk by spreading investments across various assets. Ferris emphasizes the importance of not putting all your eggs in one basket.

How to Diversify

Invest in a mix of stocks, bonds, REITs, and other assets. This strategy helps protect your portfolio from significant losses.

Setting Stop-Loss Orders

What are Stop-Loss Orders?

Stop-loss orders automatically sell a stock when it reaches a certain price. This technique helps limit potential losses.

Implementing Stop-Loss Orders

Ferris advises setting stop-loss orders at strategic points to protect gains and minimize losses.

Practical Application of Strategies

Step-by-Step Guide

- Identify Potential Tops: Use a combination of technical and fundamental analyses.

- Invest in High-Yield Assets: Focus on dividend stocks, REITs, and covered calls.

- Manage Risks: Diversify your portfolio and set stop-loss orders.

Real-World Examples

Ferris provides case studies in his newsletter, demonstrating how these strategies have successfully called tops and generated high yields.

Conclusion

Why Follow Dan Ferris’ Methods?

Dan Ferris’ methods offer a well-rounded approach to calling stock tops and earning substantial cash yields. His strategies are based on years of experience and proven results.

FAQs

1. What is the primary goal of calling a stock top?

The primary goal is to maximize profits by selling at the highest price before the stock begins to decline.

2. How do technical indicators help in identifying stock tops?

Technical indicators, such as moving averages and RSI, help identify overbought conditions and potential reversal points.

3. What are covered calls, and how do they generate income?

Covered calls involve writing call options on stocks you own, generating income through option premiums.

4. Why is diversification important in managing a portfolio?

Diversification reduces risk by spreading investments across various assets, protecting the portfolio from significant losses.

5. How can high-yield REITs contribute to annualized cash yields?

High-yield REITs provide consistent dividend payments, contributing to steady cash flow and overall portfolio yields.

Be the first to review “How to Call the Top in a Stock (To the Penny!) and Earn 9-11% Annualized Cash Yields Doing It with Dan Ferris” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Reviews

There are no reviews yet.