-

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

Into The Abbys with Black Rabbit

1 × $18.00

Into The Abbys with Black Rabbit

1 × $18.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

Trading Power Tools with Ryan Litchfield

1 × $6.00

Trading Power Tools with Ryan Litchfield

1 × $6.00 -

×

Stock Cycles with Michael Alexander

1 × $6.00

Stock Cycles with Michael Alexander

1 × $6.00 -

×

Levelator Automatic Trading Machines-Russ Horn’s

1 × $23.00

Levelator Automatic Trading Machines-Russ Horn’s

1 × $23.00 -

×

Master Market Movement – Elite Course with Refocus Trading

1 × $5.00

Master Market Movement – Elite Course with Refocus Trading

1 × $5.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

FX Simplified

1 × $5.00

FX Simplified

1 × $5.00 -

×

The Best Way to Trade Fibonacci On Demand

1 × $15.00

The Best Way to Trade Fibonacci On Demand

1 × $15.00 -

×

MASTERING SWING TRADING May 2024 with Roman Bogomazov

1 × $194.00

MASTERING SWING TRADING May 2024 with Roman Bogomazov

1 × $194.00 -

×

Dynamic Swing Trader-NETPICKS (Unlocked)

1 × $54.00

Dynamic Swing Trader-NETPICKS (Unlocked)

1 × $54.00 -

×

One Week S&P Workshop II with Linda Raschke

1 × $5.00

One Week S&P Workshop II with Linda Raschke

1 × $5.00 -

×

Mind & Markets. An Advanced Study Course of Stock Market Education (1951) with Bert Larson

1 × $6.00

Mind & Markets. An Advanced Study Course of Stock Market Education (1951) with Bert Larson

1 × $6.00 -

×

High Yield Investments I & II with Lance Spicer

1 × $6.00

High Yield Investments I & II with Lance Spicer

1 × $6.00 -

×

Mastering the Gaps - Trading Gaps

1 × $15.00

Mastering the Gaps - Trading Gaps

1 × $15.00 -

×

Special Bootcamp with Smart Earners Academy

1 × $5.00

Special Bootcamp with Smart Earners Academy

1 × $5.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Linda Raschke Short Term Trading Strategies with David Vomund

1 × $6.00

Linda Raschke Short Term Trading Strategies with David Vomund

1 × $6.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Shorting for Profit

1 × $31.00

Shorting for Profit

1 × $31.00 -

×

Main Online Course with MadCharts

1 × $5.00

Main Online Course with MadCharts

1 × $5.00 -

×

Forex Xl Course (1.0+2.0+3.0)

1 × $10.00

Forex Xl Course (1.0+2.0+3.0)

1 × $10.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

FX Utopia

1 × $6.00

FX Utopia

1 × $6.00 -

×

Stop Loss Secrets

1 × $6.00

Stop Loss Secrets

1 × $6.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Stock Patterns for DayTrading. Home Study Course

1 × $6.00

Stock Patterns for DayTrading. Home Study Course

1 × $6.00 -

×

Positive Thinking & Stress Management for Trading with Daley Personal Development

1 × $6.00

Positive Thinking & Stress Management for Trading with Daley Personal Development

1 × $6.00 -

×

Forex for Profits with Todd Mitchell

1 × $85.00

Forex for Profits with Todd Mitchell

1 × $85.00 -

×

Fundamental & Technical Analysis Mini Course with Colin Nicholson

1 × $6.00

Fundamental & Technical Analysis Mini Course with Colin Nicholson

1 × $6.00 -

×

Bulk REO 2.0

1 × $23.00

Bulk REO 2.0

1 × $23.00 -

×

Order Flow Trader Education

1 × $15.00

Order Flow Trader Education

1 × $15.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Market Profile E-Course with Charles Gough - Pirate Traders

1 × $17.00

Market Profile E-Course with Charles Gough - Pirate Traders

1 × $17.00 -

×

Introduction to Futures Trading and Live Trade Demonstration with Hari Swaminathan

1 × $6.00

Introduction to Futures Trading and Live Trade Demonstration with Hari Swaminathan

1 × $6.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

Small Account Growth Class – Strategies Course

1 × $23.00

Small Account Growth Class – Strategies Course

1 × $23.00 -

×

Great Market Technicians of the 21st Century. Galileo, Fibonacci & Beethoven with Constance Brown

1 × $6.00

Great Market Technicians of the 21st Century. Galileo, Fibonacci & Beethoven with Constance Brown

1 × $6.00 -

×

Order Flow With The Power Of Point Of Control Course and The Imbalance

1 × $6.00

Order Flow With The Power Of Point Of Control Course and The Imbalance

1 × $6.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Market Stalkers Level 2 - Daytrading College (2020)

1 × $8.00

Market Stalkers Level 2 - Daytrading College (2020)

1 × $8.00 -

×

Introduction To Advanced Options Trading 201

1 × $23.00

Introduction To Advanced Options Trading 201

1 × $23.00 -

×

How to Trade Options 101 2021 with The Travel Trader

1 × $54.00

How to Trade Options 101 2021 with The Travel Trader

1 × $54.00 -

×

Master Stock Course

1 × $6.00

Master Stock Course

1 × $6.00 -

×

Long Term Investing Strategies for Maximizing Returns with Lerone Bleasdille

1 × $5.00

Long Term Investing Strategies for Maximizing Returns with Lerone Bleasdille

1 × $5.00 -

×

Forex Fundamentals Course with Bkforex

1 × $23.00

Forex Fundamentals Course with Bkforex

1 × $23.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Reading & Understanding Charts with Andrew Baxter

1 × $6.00

Reading & Understanding Charts with Andrew Baxter

1 × $6.00 -

×

Fibsdontlie - Fibs Don’t Lie Advanced Course

1 × $15.00

Fibsdontlie - Fibs Don’t Lie Advanced Course

1 × $15.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

Ichimokutrade - Ichimoku 101

1 × $15.00

Ichimokutrade - Ichimoku 101

1 × $15.00 -

×

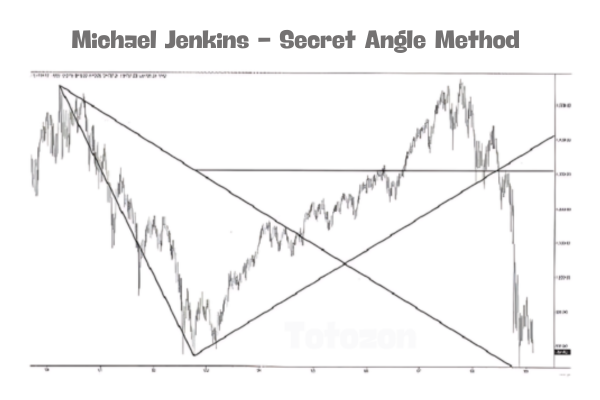

Secret Angle Method with Michael Jenkins

1 × $4.00

Secret Angle Method with Michael Jenkins

1 × $4.00 -

×

Investing in the stock market

1 × $6.00

Investing in the stock market

1 × $6.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Module 1 & 2 Swing Trading Forex and Financial Futures with Trader Dante

1 × $15.00

Module 1 & 2 Swing Trading Forex and Financial Futures with Trader Dante

1 × $15.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Market Energy Trader with Top Trade Tools

1 × $5.00

Market Energy Trader with Top Trade Tools

1 × $5.00 -

×

Master Trader Course

1 × $23.00

Master Trader Course

1 × $23.00

The C3PO Forex Trading Strategy with Jared Passey

$4.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

The C3PO Forex Trading Strategy with Jared Passey

Introduction

Forex trading offers numerous strategies for traders to capitalize on market movements. One such strategy is the C3PO Forex Trading Strategy by Jared Passey. This article explores the intricacies of the C3PO strategy, providing insights and practical tips to help traders enhance their forex trading performance.

What is the C3PO Forex Trading Strategy?

Defining the C3PO Strategy

The C3PO Forex Trading Strategy is a systematic approach to trading forex that combines multiple technical indicators and market analysis techniques to identify high-probability trading opportunities.

Why Use the C3PO Strategy?

This strategy aims to provide traders with a clear framework for making informed decisions, reducing the emotional aspect of trading, and improving overall profitability.

Jared Passey: The Mind Behind the Strategy

Who is Jared Passey?

Jared Passey is a seasoned forex trader and educator known for his innovative trading strategies and commitment to helping traders succeed in the forex market.

Passey’s Trading Philosophy

Passey emphasizes a disciplined approach to trading, integrating technical analysis with a solid understanding of market dynamics and risk management.

Key Components of the C3PO Strategy

1. Technical Indicators

Moving Averages

The strategy uses moving averages to identify the overall trend and potential reversal points. Commonly used averages include the 50-day and 200-day moving averages.

RSI (Relative Strength Index)

RSI helps identify overbought and oversold conditions, providing signals for potential entry and exit points.

MACD (Moving Average Convergence Divergence)

MACD is used to spot changes in the strength, direction, momentum, and duration of a trend.

2. Chart Patterns

Reversal Patterns

Patterns like head and shoulders, double tops, and double bottoms indicate potential trend reversals.

Continuation Patterns

Patterns such as flags, pennants, and wedges suggest the continuation of the current trend.

3. Fibonacci Retracements

Using Fibonacci Levels

Fibonacci retracement levels help identify potential reversal points by measuring the prior move’s length and dividing it by key Fibonacci ratios.

4. Price Action Analysis

Candlestick Patterns

Candlestick patterns like doji, engulfing bars, and hammers provide insights into market sentiment and potential price reversals.

Support and Resistance Levels

Identifying key support and resistance levels helps traders determine optimal entry and exit points.

Implementing the C3PO Strategy

Setting Up Your Charts

Choosing the Right Tools

Select a trading platform that supports advanced charting capabilities and includes the necessary technical indicators.

Customizing Indicators

Customize your charts to highlight key indicators like moving averages, RSI, MACD, and Fibonacci levels, making it easier to spot trading opportunities.

Identifying Trade Opportunities

Pattern Recognition

Look for specific chart patterns that align with the C3PO Strategy’s criteria. Confirm these patterns with technical indicators for higher accuracy.

Entry and Exit Points

Use support and resistance levels, along with confirmed technical signals, to determine optimal entry and exit points.

Risk Management

Setting Stop-Loss Orders

Place stop-loss orders just beyond key support or resistance levels to limit potential losses.

Position Sizing

Determine the size of each trade based on your total capital and risk tolerance to manage exposure effectively.

Case Studies Using the C3PO Strategy

Case Study 1: Identifying a Reversal

Setup and Execution

Identify a head and shoulders pattern at a major resistance level, confirmed by a bearish RSI divergence.

Outcome and Analysis

Review the trade outcome, noting how the reversal signal played out and the effectiveness of the entry and exit strategy.

Case Study 2: Riding a Trend

Setup and Execution

Spot a flag pattern in an uptrend. Enter the trade on a breakout above the pattern’s resistance.

Outcome and Analysis

Analyze the trade, focusing on how well the trend continued and the role of technical indicators in managing the trade.

Benefits of the C3PO Strategy

1. Enhanced Accuracy

The strategy’s reliance on technical indicators and pattern recognition improves the accuracy of trading signals.

2. Better Risk Management

Incorporating strict risk management rules helps protect capital and minimize losses.

3. Flexibility

The strategy can be adapted to different market conditions, making it versatile and robust.

4. Discipline

Following a structured approach promotes discipline, which is crucial for long-term trading success.

5. Comprehensive Analysis

Combining multiple technical indicators with price action analysis provides a holistic view of the market, leading to more informed decisions.

Challenges of the C3PO Strategy

1. Complexity in Pattern Recognition

Identifying specific patterns can be challenging and requires practice and experience.

2. Market Volatility

High volatility can lead to false signals, requiring traders to be vigilant and adaptable.

3. Emotional Discipline

Maintaining discipline and sticking to the strategy’s rules, especially during drawdowns, can be difficult.

Conclusion

The C3PO Forex Trading Strategy by Jared Passey offers a comprehensive approach to trading forex by integrating multiple technical indicators and market analysis techniques. By understanding and implementing this strategy, traders can enhance their decision-making, manage risks effectively, and achieve better trading outcomes. Embrace the principles of the C3PO Strategy and take your forex trading to new heights.

Commonly Asked Questions:

- Business Model Innovation: Accept the truth of a legitimate business! Our strategy is organising a group buy in which participants share the costs. We use these cash to acquire popular courses from sale pages and make them available to people with limited financial resources. Despite the authors’ worries, our clients love the cost and accessibility we give.

- The Legal Environment: Yes or No The legality of our activity is ambiguous. While we don’t have specific permission from the course authors to resell the material, there is a technicality at work. The author did not specify any limits on resale when purchasing the course. This legal intricacy is both an opportunity for us and a boon for individuals looking for low-cost access.

- Quality Control: Uncovering the Truth

Getting to the heart of the issue – quality. Purchasing the course straight from the sale page guarantees that all documents and resources are the same as those obtained through traditional channels.

However, we distinguish ourselves by going beyond personal research and resale. It is crucial to note that we are not the official course providers, which means that the following premium services are not included in our package:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not permitted.

- No access to the author’s private membership forum.

- There is no direct email support available from the author or their team.

We operate independently, with the goal of bridging the pricing gap without the extra services provided by official course channels. Your comprehension of our distinct approach is much appreciated.

Be the first to review “The C3PO Forex Trading Strategy with Jared Passey” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.