-

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

The Better Butterfly Course with David Vallieres – Tradingology

1 × $39.00

The Better Butterfly Course with David Vallieres – Tradingology

1 × $39.00 -

×

Member Only Videos with Henry W Steele

1 × $27.00

Member Only Videos with Henry W Steele

1 × $27.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Tandem Trader with Investors Underground

1 × $6.00

Tandem Trader with Investors Underground

1 × $6.00 -

×

Advanced Swing Trading with John Crane

1 × $6.00

Advanced Swing Trading with John Crane

1 × $6.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Stocks & Commodities Magazine S&C on DVD 11.26 (1982-2008)

1 × $6.00

Stocks & Commodities Magazine S&C on DVD 11.26 (1982-2008)

1 × $6.00 -

×

Forex Master Class with Falcon Trading Academy

1 × $5.00

Forex Master Class with Falcon Trading Academy

1 × $5.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

Neowave. Inovations that Make Elliott Wave Work Better for You with Glenn Neely

1 × $6.00

Neowave. Inovations that Make Elliott Wave Work Better for You with Glenn Neely

1 × $6.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

International Mergers & Acquisitions Activity Since 1990 with Greg Gregoriou & Luc Renneboog

1 × $6.00

International Mergers & Acquisitions Activity Since 1990 with Greg Gregoriou & Luc Renneboog

1 × $6.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Mechanising Some of the World’s Classic Trading Systems with Murray Ruggiero

1 × $7.00

Mechanising Some of the World’s Classic Trading Systems with Murray Ruggiero

1 × $7.00 -

×

The Traders Battle Plan

1 × $6.00

The Traders Battle Plan

1 × $6.00 -

×

On Board Fanta Sea One Seminar with Felix Homogratus

1 × $6.00

On Board Fanta Sea One Seminar with Felix Homogratus

1 × $6.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

MotiveWave Course with Todd Gordon

1 × $23.00

MotiveWave Course with Todd Gordon

1 × $23.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

The Complete Guide to Technical Indicators with Mark Larson

1 × $6.00

The Complete Guide to Technical Indicators with Mark Larson

1 × $6.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

Options Mastery 32 DVDs

1 × $6.00

Options Mastery 32 DVDs

1 × $6.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

Edges For Ledges 2 with Trader Dante

1 × $5.00

Edges For Ledges 2 with Trader Dante

1 × $5.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Trading Connors VIX Reversals Tradestation Files with Laurence A. Connors & Gregory J. Che

1 × $6.00

Trading Connors VIX Reversals Tradestation Files with Laurence A. Connors & Gregory J. Che

1 × $6.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Chicago Trading Workshop 2017 with Marketdelta

1 × $23.00

Chicago Trading Workshop 2017 with Marketdelta

1 × $23.00 -

×

Hiden Collective Factors in Speculative Trading with Bertrand Roehner

1 × $6.00

Hiden Collective Factors in Speculative Trading with Bertrand Roehner

1 × $6.00 -

×

How to Create & Manage a Mutal Fund or ETF with Melinda Gerber

1 × $6.00

How to Create & Manage a Mutal Fund or ETF with Melinda Gerber

1 × $6.00 -

×

FX GOAT NASDAQ COURSE 2.0

1 × $13.00

FX GOAT NASDAQ COURSE 2.0

1 × $13.00 -

×

Cyber Trading University - Power Trading 7 CD

1 × $8.00

Cyber Trading University - Power Trading 7 CD

1 × $8.00

Breakouts with Feibel Trading

$5.00

File Size: 1.99 GB

Delivery Time: 1–12 hours

Media Type: Online Course

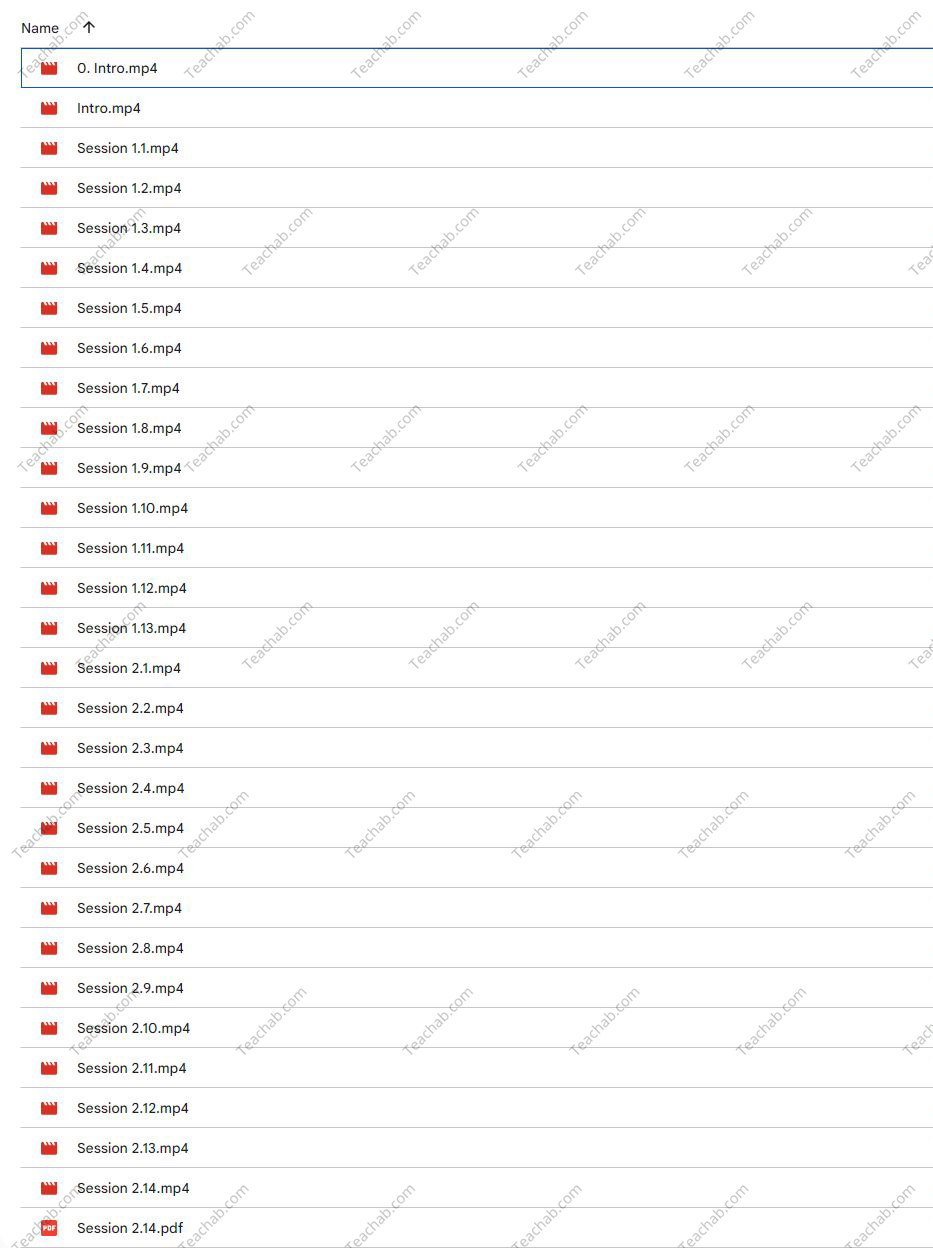

Content Proof: Watch Here!

You may check content proof of “Breakouts with Feibel Trading” below:

Mastering Breakouts with Feibel Trading: A Comprehensive Guide

In the dynamic world of trading, mastering breakout strategies is a crucial skill for achieving substantial gains. Feibel Trading has developed a reputation for expertly teaching techniques that help traders identify and capitalize on breakout opportunities. This article delves into the “Breakouts with Feibel Trading” program, exploring how it equips traders with the tools needed for success in various markets.

Introduction to Breakout Trading

What is a Breakout?

A breakout occurs when the price of an asset moves outside a defined support or resistance area with increased volume. Understanding this fundamental concept is key to harnessing its potential.

The Feibel Trading Approach

Philosophy Behind Feibel Trading

At the core of Feibel Trading’s philosophy is a commitment to clarity and precision, which is critical in teaching traders to recognize and act on breakout signals effectively.

Why Focus on Breakouts?

Breakouts are significant because they signify a potential change in market sentiment and can lead to substantial price movements.

Preparing for Breakout Trading

Technical Setup and Tools

Learn about the technical setups and trading tools essential for effectively identifying breakouts, including charting software and indicators favored by Feibel Trading.

Understanding Market Conditions

Not all market conditions are conducive to breakout trading. This section discusses how to discern the right time to employ breakout strategies.

Identifying Potential Breakouts

Key Indicators Used in Breakout Strategies

Explore the indicators that can signal an impending breakout, such as volume, volatility, and price trends.

Chart Patterns for Breakout Trading

Detailed examination of chart patterns that frequently precede breakouts, such as triangles, flags, and wedges.

Executing a Breakout Trade

Entry Strategies for Breakouts

Guidance on how to enter the market at the right moment to capitalize on a breakout.

Setting Stop Losses and Profit Targets

Crucial advice on setting stop losses to protect investments and profit targets to secure gains.

Risk Management in Breakout Trading

Assessing and Managing Risk

Strategies to assess and manage the risks associated with breakout trading, ensuring traders maintain a healthy risk-reward ratio.

The Importance of Position Sizing

Discussion on how to determine the appropriate position size based on the breakout’s strength and the trader’s risk tolerance.

Advanced Breakout Techniques

Multi-Time Frame Analysis

Utilizing multiple time frames to confirm breakout signals and increase the likelihood of successful trades.

Psychological Factors in Breakout Trading

Understanding the psychological pressures that come with trading breakouts and how to remain disciplined.

Learning from Trading Breakouts

Analyzing Successful and Unsuccessful Trades

Techniques for analyzing both successful and unsuccessful breakout trades to refine strategies and improve future performance.

Continued Education and Adaptation

The importance of continued learning and adaptation in the ever-evolving trading landscape to keep strategies effective.

Feibel Trading Community and Support

Joining the Feibel Trading Community

Benefits of joining the Feibel Trading community, including support from fellow traders and ongoing advice from experienced professionals.

Access to Advanced Resources

Information on how to access more advanced trading resources and tools through Feibel Trading.

Conclusion

“Breakouts with Feibel Trading” offers traders a solid foundation in one of the most exciting and potentially profitable areas of the market. With expert guidance and a comprehensive approach, traders can learn to navigate breakout scenarios with greater confidence and precision.

FAQs

- What initial capital is needed to start breakout trading?

- While it varies by individual risk tolerance and market conditions, starting with a capital that you are comfortable losing is advisable.

- How long does it take to master breakout strategies?

- Mastery can take several months of practice and learning, depending on the trader’s dedication and adaptability.

- Can breakout strategies be applied to all markets?

- Yes, breakout strategies can be effectively applied across different markets, including forex, stocks, and cryptocurrencies.

- What is the success rate of breakout trading?

- The success rate can vary widely among traders but improving with quality education and practice.

- How can I sign up for the Feibel Trading program?

- Visit Feibel Trading’s official website for details on enrollment, program schedules, and pricing.

Be the first to review “Breakouts with Feibel Trading” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.