-

×

We Fund Traders - The Whale Order

1 × $5.00

We Fund Traders - The Whale Order

1 × $5.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Pristine - Oliver Velez – Swing Trading Tactics 2001

1 × $6.00

Pristine - Oliver Velez – Swing Trading Tactics 2001

1 × $6.00 -

×

Zulu Trading Method for the Soybeans with Joe Ross

1 × $6.00

Zulu Trading Method for the Soybeans with Joe Ross

1 × $6.00 -

×

Tape Reading Trader Program (Full 4 hours) with The Daytrading Room

1 × $6.00

Tape Reading Trader Program (Full 4 hours) with The Daytrading Room

1 × $6.00 -

×

Market Maker Strategy Video Course with Fractal Flow Pro

1 × $6.00

Market Maker Strategy Video Course with Fractal Flow Pro

1 × $6.00 -

×

Trading Without Gambling with Marcel Link

1 × $6.00

Trading Without Gambling with Marcel Link

1 × $6.00 -

×

Pine Script Mastery Course with Matthew Slabosz

1 × $5.00

Pine Script Mastery Course with Matthew Slabosz

1 × $5.00 -

×

Streetsmart Guide To Valuing a Stock (2nd Ed.) with Gary Gray

1 × $6.00

Streetsmart Guide To Valuing a Stock (2nd Ed.) with Gary Gray

1 × $6.00 -

×

Advanced Trading Course with John Person

1 × $6.00

Advanced Trading Course with John Person

1 × $6.00 -

×

Option Trader Magazine (optionstradermag.com) with Magazine

1 × $6.00

Option Trader Magazine (optionstradermag.com) with Magazine

1 × $6.00 -

×

Zap Seminar - Ablesys

1 × $6.00

Zap Seminar - Ablesys

1 × $6.00 -

×

Advanced Management Strategies - Home Study with Pristine Capital

1 × $27.00

Advanced Management Strategies - Home Study with Pristine Capital

1 × $27.00 -

×

E75 Forex System with James de Wet

1 × $6.00

E75 Forex System with James de Wet

1 × $6.00 -

×

The Pocket Mortgage Guide: 60 of the Most Important Questions and Answers About Your Home Loan with Jack Guttentag

1 × $6.00

The Pocket Mortgage Guide: 60 of the Most Important Questions and Answers About Your Home Loan with Jack Guttentag

1 × $6.00 -

×

FX Accelerator

1 × $31.00

FX Accelerator

1 × $31.00 -

×

RiskDoctor RD2 – Intermediate Course to Options Trading the RiskDoctor Way - Charles Cottle

1 × $6.00

RiskDoctor RD2 – Intermediate Course to Options Trading the RiskDoctor Way - Charles Cottle

1 × $6.00 -

×

Tenkei Trading Techniques Programme with Wilson P.Williams

1 × $6.00

Tenkei Trading Techniques Programme with Wilson P.Williams

1 × $6.00 -

×

Artificial Neural Networks Technology with Dave Anderson, George McNeill

1 × $6.00

Artificial Neural Networks Technology with Dave Anderson, George McNeill

1 × $6.00 -

×

Simple Setups For Consistent Profits with Base Camp Trading

1 × $6.00

Simple Setups For Consistent Profits with Base Camp Trading

1 × $6.00 -

×

MACD Divergence Fully Automatic Indicator for ThinkOrSwim TOS

1 × $6.00

MACD Divergence Fully Automatic Indicator for ThinkOrSwim TOS

1 × $6.00 -

×

Modern Darvas Trading

1 × $6.00

Modern Darvas Trading

1 × $6.00 -

×

Vertex Investing Course (2023)

1 × $8.00

Vertex Investing Course (2023)

1 × $8.00 -

×

Layup Trading Strategies and Setups

1 × $54.00

Layup Trading Strategies and Setups

1 × $54.00 -

×

Neural Networks in the Capital Markets with Apostolos Paul Refenes

1 × $6.00

Neural Networks in the Capital Markets with Apostolos Paul Refenes

1 × $6.00 -

×

Rocket Science for Traders with John Ehlers

1 × $6.00

Rocket Science for Traders with John Ehlers

1 × $6.00 -

×

Asset Markets, Portfolio Choice and Macroeconomic Activity: A Keynesian Perspective - Toichiro Asadra, Peter Flaschel, Tarik Mouakil & Christian Proaño

1 × $6.00

Asset Markets, Portfolio Choice and Macroeconomic Activity: A Keynesian Perspective - Toichiro Asadra, Peter Flaschel, Tarik Mouakil & Christian Proaño

1 × $6.00 -

×

Beating the Financial Futures Market

1 × $6.00

Beating the Financial Futures Market

1 × $6.00 -

×

Astro-Cycles and Speculative Markets with L.J.Jensen

1 × $6.00

Astro-Cycles and Speculative Markets with L.J.Jensen

1 × $6.00 -

×

Inner Cicle Trader - ICT Methods with Michael Huddleston

1 × $5.00

Inner Cicle Trader - ICT Methods with Michael Huddleston

1 × $5.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

Sacredscience - Edward Johndro – Collected Articles

1 × $6.00

Sacredscience - Edward Johndro – Collected Articles

1 × $6.00 -

×

Candlesticks MegaPackage Vol 1-4 (CCA) with Candle Charts

1 × $62.00

Candlesticks MegaPackage Vol 1-4 (CCA) with Candle Charts

1 × $62.00 -

×

Tharp Think Essentials Video Workshop with Van Tharp

1 × $5.00

Tharp Think Essentials Video Workshop with Van Tharp

1 × $5.00 -

×

The Holy Grail Forex Strategy - 7 Setups To Conquer The Kingdom with Justin Whitebread-Lanaro - 1 Minute Master

1 × $15.00

The Holy Grail Forex Strategy - 7 Setups To Conquer The Kingdom with Justin Whitebread-Lanaro - 1 Minute Master

1 × $15.00 -

×

Learn Plan Profit 2.0 with Ricky Gutierrez

1 × $39.00

Learn Plan Profit 2.0 with Ricky Gutierrez

1 × $39.00 -

×

Tail Hedging - Learn to Insure Stocks Against Large Declines with James Marsh

1 × $15.00

Tail Hedging - Learn to Insure Stocks Against Large Declines with James Marsh

1 × $15.00 -

×

6 Dynamic Trader Real Time and End Of Day

1 × $39.00

6 Dynamic Trader Real Time and End Of Day

1 × $39.00 -

×

Top Ultimate Breakout with Top Trade Tools

1 × $6.00

Top Ultimate Breakout with Top Trade Tools

1 × $6.00 -

×

Day Trading Insight with Al Brooks

1 × $10.00

Day Trading Insight with Al Brooks

1 × $10.00 -

×

Stocks with Strauss

1 × $31.00

Stocks with Strauss

1 × $31.00 -

×

Field of Vision Program – Digital Download

1 × $31.00

Field of Vision Program – Digital Download

1 × $31.00 -

×

7 DAY INTENSIVE ONLINE TRADER TRAINING PROGRAMME with The Trading Framework

1 × $15.00

7 DAY INTENSIVE ONLINE TRADER TRAINING PROGRAMME with The Trading Framework

1 × $15.00 -

×

Complete Best Practices - Weekly Options Income Trading System with Weekly Options Academy

1 × $23.00

Complete Best Practices - Weekly Options Income Trading System with Weekly Options Academy

1 × $23.00 -

×

Preparing for the Worst: Incorporating Downside Risk in Stock Market Investments with Hrishikesh Vinod & Derrick Reagle

1 × $6.00

Preparing for the Worst: Incorporating Downside Risk in Stock Market Investments with Hrishikesh Vinod & Derrick Reagle

1 × $6.00 -

×

Romeo’s University of Turtle Soup with Romeo

1 × $6.00

Romeo’s University of Turtle Soup with Romeo

1 × $6.00 -

×

Vom Einsteiger zum Mastertrader 2.0 with Mehrwert Garantier

1 × $109.00

Vom Einsteiger zum Mastertrader 2.0 with Mehrwert Garantier

1 × $109.00 -

×

Short Term Trading Strategies with Simon Harris

1 × $6.00

Short Term Trading Strategies with Simon Harris

1 × $6.00 -

×

BSAPPS FX Course with Ben Barker

1 × $6.00

BSAPPS FX Course with Ben Barker

1 × $6.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Fundamentals of Forex Trading with Joshua Garrison

1 × $5.00

Fundamentals of Forex Trading with Joshua Garrison

1 × $5.00 -

×

Bar Ipro v9.1 for MT4 11XX

1 × $23.00

Bar Ipro v9.1 for MT4 11XX

1 × $23.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

Day Trading Futures, Stocks, and Crypto

1 × $5.00

Day Trading Futures, Stocks, and Crypto

1 × $5.00 -

×

Adaptation in Sports Training (1995) with Atko Viru

1 × $23.00

Adaptation in Sports Training (1995) with Atko Viru

1 × $23.00 -

×

Matrix Options

1 × $6.00

Matrix Options

1 × $6.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

Breakouts with Feibel Trading

$5.00

File Size: 1.99 GB

Delivery Time: 1–12 hours

Media Type: Online Course

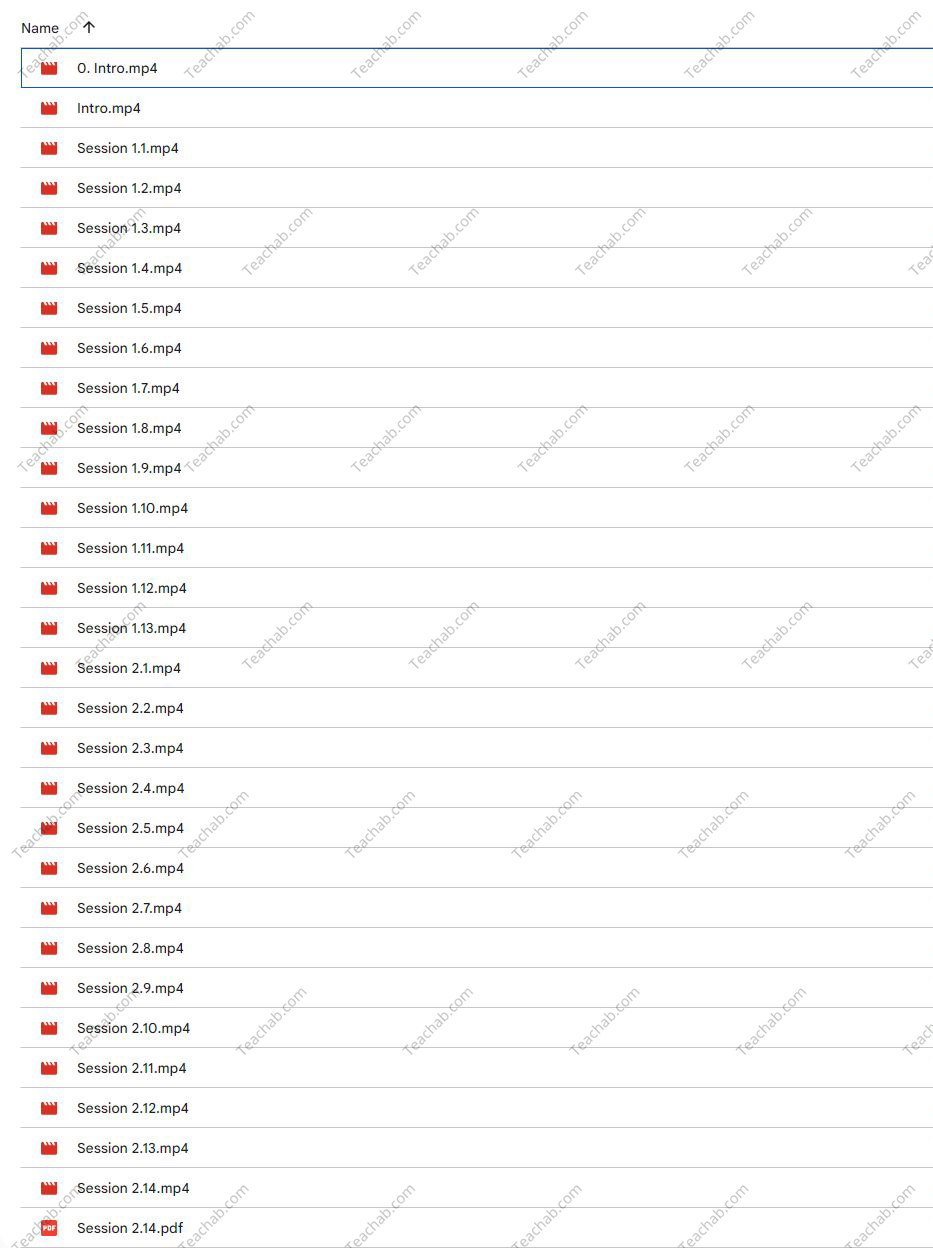

Content Proof: Watch Here!

You may check content proof of “Breakouts with Feibel Trading” below:

Mastering Breakouts with Feibel Trading: A Comprehensive Guide

In the dynamic world of trading, mastering breakout strategies is a crucial skill for achieving substantial gains. Feibel Trading has developed a reputation for expertly teaching techniques that help traders identify and capitalize on breakout opportunities. This article delves into the “Breakouts with Feibel Trading” program, exploring how it equips traders with the tools needed for success in various markets.

Introduction to Breakout Trading

What is a Breakout?

A breakout occurs when the price of an asset moves outside a defined support or resistance area with increased volume. Understanding this fundamental concept is key to harnessing its potential.

The Feibel Trading Approach

Philosophy Behind Feibel Trading

At the core of Feibel Trading’s philosophy is a commitment to clarity and precision, which is critical in teaching traders to recognize and act on breakout signals effectively.

Why Focus on Breakouts?

Breakouts are significant because they signify a potential change in market sentiment and can lead to substantial price movements.

Preparing for Breakout Trading

Technical Setup and Tools

Learn about the technical setups and trading tools essential for effectively identifying breakouts, including charting software and indicators favored by Feibel Trading.

Understanding Market Conditions

Not all market conditions are conducive to breakout trading. This section discusses how to discern the right time to employ breakout strategies.

Identifying Potential Breakouts

Key Indicators Used in Breakout Strategies

Explore the indicators that can signal an impending breakout, such as volume, volatility, and price trends.

Chart Patterns for Breakout Trading

Detailed examination of chart patterns that frequently precede breakouts, such as triangles, flags, and wedges.

Executing a Breakout Trade

Entry Strategies for Breakouts

Guidance on how to enter the market at the right moment to capitalize on a breakout.

Setting Stop Losses and Profit Targets

Crucial advice on setting stop losses to protect investments and profit targets to secure gains.

Risk Management in Breakout Trading

Assessing and Managing Risk

Strategies to assess and manage the risks associated with breakout trading, ensuring traders maintain a healthy risk-reward ratio.

The Importance of Position Sizing

Discussion on how to determine the appropriate position size based on the breakout’s strength and the trader’s risk tolerance.

Advanced Breakout Techniques

Multi-Time Frame Analysis

Utilizing multiple time frames to confirm breakout signals and increase the likelihood of successful trades.

Psychological Factors in Breakout Trading

Understanding the psychological pressures that come with trading breakouts and how to remain disciplined.

Learning from Trading Breakouts

Analyzing Successful and Unsuccessful Trades

Techniques for analyzing both successful and unsuccessful breakout trades to refine strategies and improve future performance.

Continued Education and Adaptation

The importance of continued learning and adaptation in the ever-evolving trading landscape to keep strategies effective.

Feibel Trading Community and Support

Joining the Feibel Trading Community

Benefits of joining the Feibel Trading community, including support from fellow traders and ongoing advice from experienced professionals.

Access to Advanced Resources

Information on how to access more advanced trading resources and tools through Feibel Trading.

Conclusion

“Breakouts with Feibel Trading” offers traders a solid foundation in one of the most exciting and potentially profitable areas of the market. With expert guidance and a comprehensive approach, traders can learn to navigate breakout scenarios with greater confidence and precision.

FAQs

- What initial capital is needed to start breakout trading?

- While it varies by individual risk tolerance and market conditions, starting with a capital that you are comfortable losing is advisable.

- How long does it take to master breakout strategies?

- Mastery can take several months of practice and learning, depending on the trader’s dedication and adaptability.

- Can breakout strategies be applied to all markets?

- Yes, breakout strategies can be effectively applied across different markets, including forex, stocks, and cryptocurrencies.

- What is the success rate of breakout trading?

- The success rate can vary widely among traders but improving with quality education and practice.

- How can I sign up for the Feibel Trading program?

- Visit Feibel Trading’s official website for details on enrollment, program schedules, and pricing.

Be the first to review “Breakouts with Feibel Trading” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Reviews

There are no reviews yet.