-

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

Sacredscience - Sepharial – Your Personal Diurnal Chart

1 × $6.00

Sacredscience - Sepharial – Your Personal Diurnal Chart

1 × $6.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Breakouts with Feibel Trading

1 × $5.00

Breakouts with Feibel Trading

1 × $5.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Hiden Collective Factors in Speculative Trading with Bertrand Roehner

1 × $6.00

Hiden Collective Factors in Speculative Trading with Bertrand Roehner

1 × $6.00 -

×

Market Mindfields - 2 DVDs with Ryan Litchfield

1 × $6.00

Market Mindfields - 2 DVDs with Ryan Litchfield

1 × $6.00 -

×

Mastering the Complex Sale: How to Compete and Win When the Stakes are High! with Jeff Thull

1 × $6.00

Mastering the Complex Sale: How to Compete and Win When the Stakes are High! with Jeff Thull

1 × $6.00 -

×

The Gold Standard in Trading Education with Six Figure Capital

1 × $5.00

The Gold Standard in Trading Education with Six Figure Capital

1 × $5.00 -

×

Millionaire Playbook with Jeremy Lefebvre

1 × $62.00

Millionaire Playbook with Jeremy Lefebvre

1 × $62.00 -

×

Full 2 Day Dark Pool And Market Strategy Training

1 × $6.00

Full 2 Day Dark Pool And Market Strategy Training

1 × $6.00 -

×

Reality Based Trading with Matt Petrallia - Trading Equilibrium

1 × $17.00

Reality Based Trading with Matt Petrallia - Trading Equilibrium

1 × $17.00 -

×

Introduction to the Elliot Wave Principle Seminar - Robert Prechter

1 × $6.00

Introduction to the Elliot Wave Principle Seminar - Robert Prechter

1 × $6.00 -

×

Inside the Mind of Trader Stewie - Art of Trading

1 × $23.00

Inside the Mind of Trader Stewie - Art of Trading

1 × $23.00 -

×

The Realistic Trader - Crypto Currencies

1 × $31.00

The Realistic Trader - Crypto Currencies

1 × $31.00 -

×

How to Trade Stock Options Course

1 × $6.00

How to Trade Stock Options Course

1 × $6.00 -

×

Mathematical Problems in Image Processing with Charles E.Chidume

1 × $6.00

Mathematical Problems in Image Processing with Charles E.Chidume

1 × $6.00 -

×

Dominate Stocks 2020 with J. Bravo

1 × $6.00

Dominate Stocks 2020 with J. Bravo

1 × $6.00 -

×

VSTOPS ProTrader Strategy (Nov 2013)

1 × $6.00

VSTOPS ProTrader Strategy (Nov 2013)

1 × $6.00 -

×

Volume Profile Video Course with Trader Dale

1 × $8.00

Volume Profile Video Course with Trader Dale

1 × $8.00 -

×

NJAT Trading Course with Not Just A Trade

1 × $6.00

NJAT Trading Course with Not Just A Trade

1 × $6.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

MambaFX - Bundle - Trading/Scalping

1 × $23.00

MambaFX - Bundle - Trading/Scalping

1 × $23.00 -

×

Forex Trend Line Strategy with Kelvin Lee

1 × $6.00

Forex Trend Line Strategy with Kelvin Lee

1 × $6.00 -

×

Metastock Online Traders Summit

1 × $5.00

Metastock Online Traders Summit

1 × $5.00 -

×

Middle Market M & A: Handbook for Investment Banking and Business Consulting (1st Edition) - Kenneth Marks

1 × $6.00

Middle Market M & A: Handbook for Investment Banking and Business Consulting (1st Edition) - Kenneth Marks

1 × $6.00 -

×

Introduction to Probability with Charles M.Grinstead, J.Laurie Snell

1 × $6.00

Introduction to Probability with Charles M.Grinstead, J.Laurie Snell

1 × $6.00 -

×

MotiveWave Course with Todd Gordon

1 × $23.00

MotiveWave Course with Todd Gordon

1 × $23.00 -

×

Frank Paul – Fibonacci Swing Trader Foundation Course 2011 (Video, Manuals, 5.1 GB) with Forexmentor

1 × $6.00

Frank Paul – Fibonacci Swing Trader Foundation Course 2011 (Video, Manuals, 5.1 GB) with Forexmentor

1 × $6.00 -

×

Option Income Stream System 2004

1 × $6.00

Option Income Stream System 2004

1 × $6.00 -

×

Option Alpha Signals

1 × $15.00

Option Alpha Signals

1 × $15.00 -

×

Modeling Financial Markets. Using Visual Basic Net & Databases To Create Pricing Trading & Risk Management Models

1 × $6.00

Modeling Financial Markets. Using Visual Basic Net & Databases To Create Pricing Trading & Risk Management Models

1 × $6.00 -

×

Technical Analysis Entry & Exit with Andrew Baxter

1 × $6.00

Technical Analysis Entry & Exit with Andrew Baxter

1 × $6.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

Breakouts with Feibel Trading

$5.00

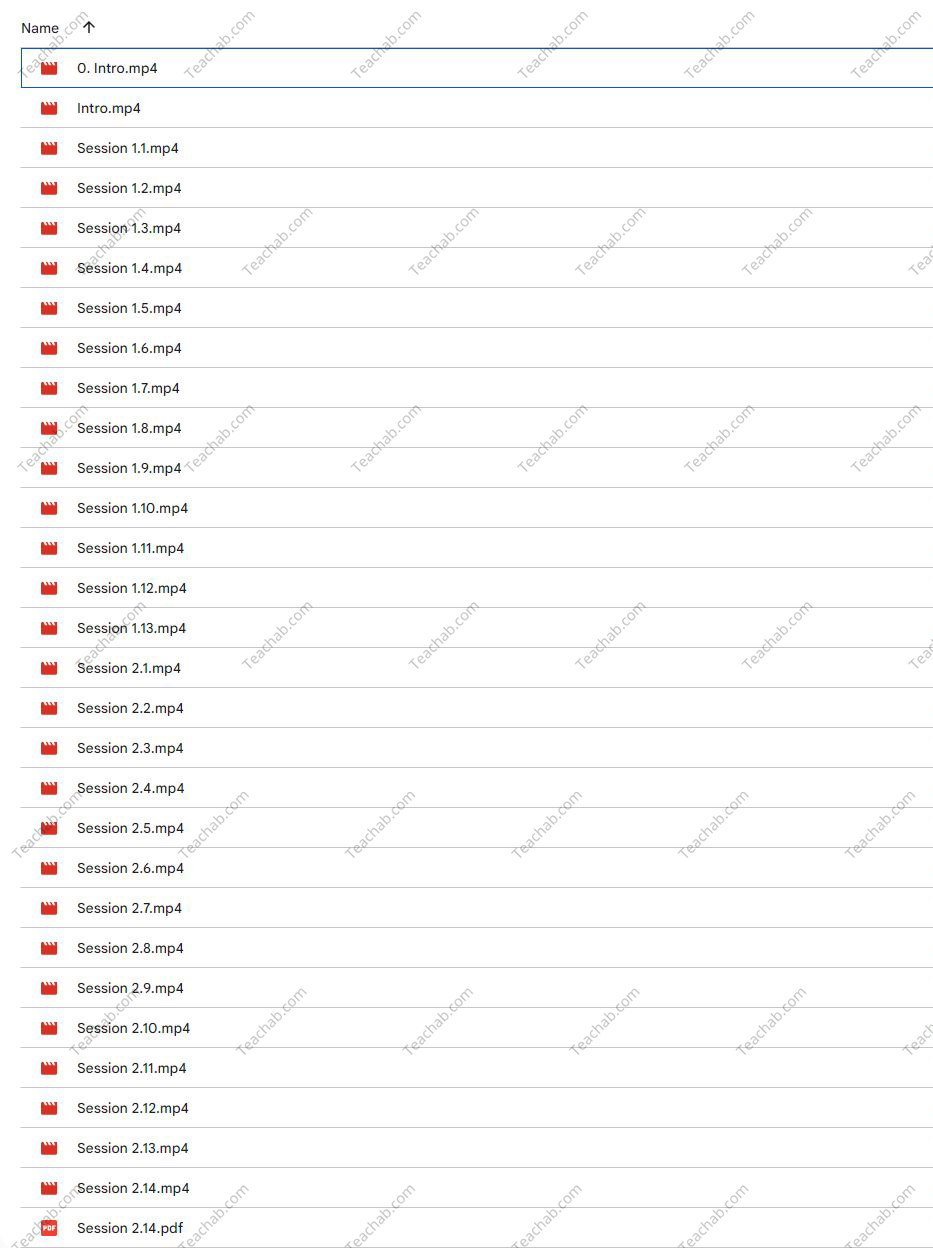

File Size: 1.99 GB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Breakouts with Feibel Trading” below:

Mastering Breakouts with Feibel Trading: A Comprehensive Guide

In the dynamic world of trading, mastering breakout strategies is a crucial skill for achieving substantial gains. Feibel Trading has developed a reputation for expertly teaching techniques that help traders identify and capitalize on breakout opportunities. This article delves into the “Breakouts with Feibel Trading” program, exploring how it equips traders with the tools needed for success in various markets.

Introduction to Breakout Trading

What is a Breakout?

A breakout occurs when the price of an asset moves outside a defined support or resistance area with increased volume. Understanding this fundamental concept is key to harnessing its potential.

The Feibel Trading Approach

Philosophy Behind Feibel Trading

At the core of Feibel Trading’s philosophy is a commitment to clarity and precision, which is critical in teaching traders to recognize and act on breakout signals effectively.

Why Focus on Breakouts?

Breakouts are significant because they signify a potential change in market sentiment and can lead to substantial price movements.

Preparing for Breakout Trading

Technical Setup and Tools

Learn about the technical setups and trading tools essential for effectively identifying breakouts, including charting software and indicators favored by Feibel Trading.

Understanding Market Conditions

Not all market conditions are conducive to breakout trading. This section discusses how to discern the right time to employ breakout strategies.

Identifying Potential Breakouts

Key Indicators Used in Breakout Strategies

Explore the indicators that can signal an impending breakout, such as volume, volatility, and price trends.

Chart Patterns for Breakout Trading

Detailed examination of chart patterns that frequently precede breakouts, such as triangles, flags, and wedges.

Executing a Breakout Trade

Entry Strategies for Breakouts

Guidance on how to enter the market at the right moment to capitalize on a breakout.

Setting Stop Losses and Profit Targets

Crucial advice on setting stop losses to protect investments and profit targets to secure gains.

Risk Management in Breakout Trading

Assessing and Managing Risk

Strategies to assess and manage the risks associated with breakout trading, ensuring traders maintain a healthy risk-reward ratio.

The Importance of Position Sizing

Discussion on how to determine the appropriate position size based on the breakout’s strength and the trader’s risk tolerance.

Advanced Breakout Techniques

Multi-Time Frame Analysis

Utilizing multiple time frames to confirm breakout signals and increase the likelihood of successful trades.

Psychological Factors in Breakout Trading

Understanding the psychological pressures that come with trading breakouts and how to remain disciplined.

Learning from Trading Breakouts

Analyzing Successful and Unsuccessful Trades

Techniques for analyzing both successful and unsuccessful breakout trades to refine strategies and improve future performance.

Continued Education and Adaptation

The importance of continued learning and adaptation in the ever-evolving trading landscape to keep strategies effective.

Feibel Trading Community and Support

Joining the Feibel Trading Community

Benefits of joining the Feibel Trading community, including support from fellow traders and ongoing advice from experienced professionals.

Access to Advanced Resources

Information on how to access more advanced trading resources and tools through Feibel Trading.

Conclusion

“Breakouts with Feibel Trading” offers traders a solid foundation in one of the most exciting and potentially profitable areas of the market. With expert guidance and a comprehensive approach, traders can learn to navigate breakout scenarios with greater confidence and precision.

FAQs

- What initial capital is needed to start breakout trading?

- While it varies by individual risk tolerance and market conditions, starting with a capital that you are comfortable losing is advisable.

- How long does it take to master breakout strategies?

- Mastery can take several months of practice and learning, depending on the trader’s dedication and adaptability.

- Can breakout strategies be applied to all markets?

- Yes, breakout strategies can be effectively applied across different markets, including forex, stocks, and cryptocurrencies.

- What is the success rate of breakout trading?

- The success rate can vary widely among traders but improving with quality education and practice.

- How can I sign up for the Feibel Trading program?

- Visit Feibel Trading’s official website for details on enrollment, program schedules, and pricing.

Be the first to review “Breakouts with Feibel Trading” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.