-

×

Mastering Trading Stress with Ari Kiev

1 × $6.00

Mastering Trading Stress with Ari Kiev

1 × $6.00 -

×

Sharp Edge Institutional Ultimate Trade Program – CompassFX

1 × $101.00

Sharp Edge Institutional Ultimate Trade Program – CompassFX

1 × $101.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Forex Options Trading

1 × $6.00

Forex Options Trading

1 × $6.00 -

×

Ninja Order Flow Trader (NOFT)

1 × $39.00

Ninja Order Flow Trader (NOFT)

1 × $39.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

NetPicks - Universal Market Trader Course

1 × $6.00

NetPicks - Universal Market Trader Course

1 × $6.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

RSI Unleashed Class: Building a Comprehensive Trading Framework

1 × $54.00

RSI Unleashed Class: Building a Comprehensive Trading Framework

1 × $54.00 -

×

Handbook of Computer Vision Algorithms in Image Algebra with Gerhard Ritter & Joseph Wilson

1 × $6.00

Handbook of Computer Vision Algorithms in Image Algebra with Gerhard Ritter & Joseph Wilson

1 × $6.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

A Course in Trading with Donald Mack & Wetsel Market Bureau

1 × $6.00

A Course in Trading with Donald Mack & Wetsel Market Bureau

1 × $6.00 -

×

Making a 2021 Trading Plan and Trading it for 3 Weeks with Sheridan Options Mentoring

1 × $39.00

Making a 2021 Trading Plan and Trading it for 3 Weeks with Sheridan Options Mentoring

1 × $39.00 -

×

Power Cycle Trading The Ultimate Option Guide: When & How to Use Which Option Strategy For the Best Results - Powercycletrading

1 × $69.00

Power Cycle Trading The Ultimate Option Guide: When & How to Use Which Option Strategy For the Best Results - Powercycletrading

1 × $69.00 -

×

Crash or Correction - Top 5 Patterns Every Trader Must Master with Todd Gordon

1 × $6.00

Crash or Correction - Top 5 Patterns Every Trader Must Master with Todd Gordon

1 × $6.00 -

×

Computerized Trading. Maximizing Day Trading and Overnight Profits with Mark Jurik

1 × $6.00

Computerized Trading. Maximizing Day Trading and Overnight Profits with Mark Jurik

1 × $6.00 -

×

Options Plain & Simple with Lenni Jordan

1 × $6.00

Options Plain & Simple with Lenni Jordan

1 × $6.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Scanning for Gold with Doug Sutton

1 × $31.00

Scanning for Gold with Doug Sutton

1 × $31.00 -

×

Expert Forex Systems with Andrew Fields

1 × $6.00

Expert Forex Systems with Andrew Fields

1 × $6.00 -

×

How to Trade Choppy, Sideways Markets with Wayne Gorman - Elliott Wave International

1 × $6.00

How to Trade Choppy, Sideways Markets with Wayne Gorman - Elliott Wave International

1 × $6.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

Mql4 Bundle: Basics, Scripts, Indicators, Experts with Jim Hodges

1 × $15.00

Mql4 Bundle: Basics, Scripts, Indicators, Experts with Jim Hodges

1 × $15.00 -

×

Create Your Own ETF Hedge Fund: A Do-It-Yourself ETF Strategy for Private Wealth Management with David Fry

1 × $6.00

Create Your Own ETF Hedge Fund: A Do-It-Yourself ETF Strategy for Private Wealth Management with David Fry

1 × $6.00 -

×

Intelligent Futures Trading (chickgoslin.com)

1 × $6.00

Intelligent Futures Trading (chickgoslin.com)

1 × $6.00 -

×

Low Stress Options Trading with Low Stress Training

1 × $23.00

Low Stress Options Trading with Low Stress Training

1 × $23.00 -

×

Electronic Trading "TNT" III Technical Trading Stuff with Joe Ross & Mark Cherlin

1 × $6.00

Electronic Trading "TNT" III Technical Trading Stuff with Joe Ross & Mark Cherlin

1 × $6.00 -

×

INSIDER HEDGE FUND FORMULA (IHFF)

1 × $6.00

INSIDER HEDGE FUND FORMULA (IHFF)

1 × $6.00 -

×

Hit & Run Trading II with Jeff Cooper

1 × $4.00

Hit & Run Trading II with Jeff Cooper

1 × $4.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Master Traders: Strategies for Superior Returns from Today's Top Traders with Fari Hamzei & Steve Shobin

1 × $6.00

Master Traders: Strategies for Superior Returns from Today's Top Traders with Fari Hamzei & Steve Shobin

1 × $6.00 -

×

Mark Sebastian – Gamma Trading Class

1 × $6.00

Mark Sebastian – Gamma Trading Class

1 × $6.00 -

×

VSA Advanced Mentorship Course

1 × $31.00

VSA Advanced Mentorship Course

1 × $31.00 -

×

LinkedIn Lead Challenge with Jimmy Coleman

1 × $15.00

LinkedIn Lead Challenge with Jimmy Coleman

1 × $15.00 -

×

Orderflows - The Imbalance Course

1 × $8.00

Orderflows - The Imbalance Course

1 × $8.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

Nico FX Journal (SMC)

1 × $5.00

Nico FX Journal (SMC)

1 × $5.00

Breakouts with Feibel Trading

$5.00

File Size: 1.99 GB

Delivery Time: 1–12 hours

Media Type: Online Course

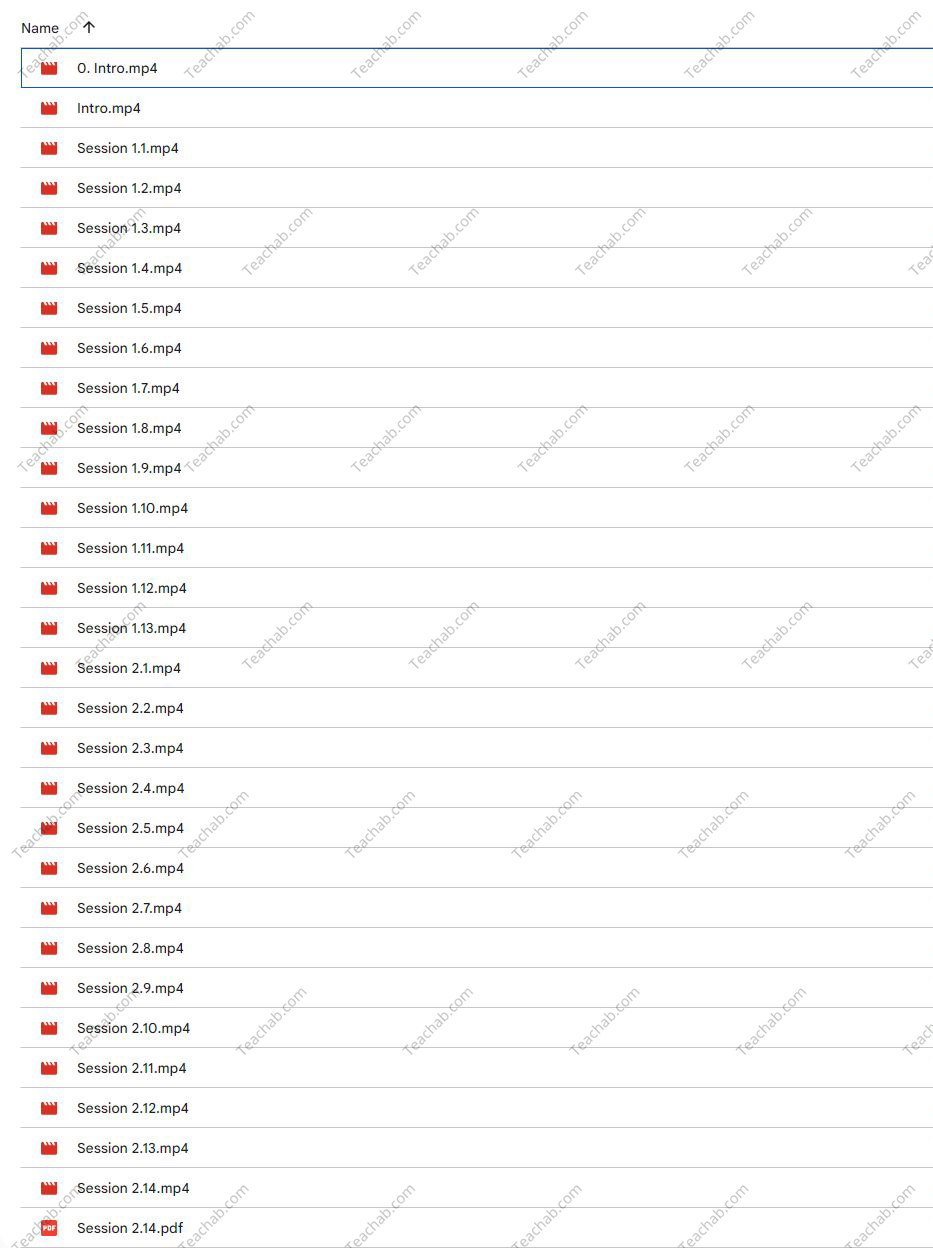

Content Proof: Watch Here!

You may check content proof of “Breakouts with Feibel Trading” below:

Mastering Breakouts with Feibel Trading: A Comprehensive Guide

In the dynamic world of trading, mastering breakout strategies is a crucial skill for achieving substantial gains. Feibel Trading has developed a reputation for expertly teaching techniques that help traders identify and capitalize on breakout opportunities. This article delves into the “Breakouts with Feibel Trading” program, exploring how it equips traders with the tools needed for success in various markets.

Introduction to Breakout Trading

What is a Breakout?

A breakout occurs when the price of an asset moves outside a defined support or resistance area with increased volume. Understanding this fundamental concept is key to harnessing its potential.

The Feibel Trading Approach

Philosophy Behind Feibel Trading

At the core of Feibel Trading’s philosophy is a commitment to clarity and precision, which is critical in teaching traders to recognize and act on breakout signals effectively.

Why Focus on Breakouts?

Breakouts are significant because they signify a potential change in market sentiment and can lead to substantial price movements.

Preparing for Breakout Trading

Technical Setup and Tools

Learn about the technical setups and trading tools essential for effectively identifying breakouts, including charting software and indicators favored by Feibel Trading.

Understanding Market Conditions

Not all market conditions are conducive to breakout trading. This section discusses how to discern the right time to employ breakout strategies.

Identifying Potential Breakouts

Key Indicators Used in Breakout Strategies

Explore the indicators that can signal an impending breakout, such as volume, volatility, and price trends.

Chart Patterns for Breakout Trading

Detailed examination of chart patterns that frequently precede breakouts, such as triangles, flags, and wedges.

Executing a Breakout Trade

Entry Strategies for Breakouts

Guidance on how to enter the market at the right moment to capitalize on a breakout.

Setting Stop Losses and Profit Targets

Crucial advice on setting stop losses to protect investments and profit targets to secure gains.

Risk Management in Breakout Trading

Assessing and Managing Risk

Strategies to assess and manage the risks associated with breakout trading, ensuring traders maintain a healthy risk-reward ratio.

The Importance of Position Sizing

Discussion on how to determine the appropriate position size based on the breakout’s strength and the trader’s risk tolerance.

Advanced Breakout Techniques

Multi-Time Frame Analysis

Utilizing multiple time frames to confirm breakout signals and increase the likelihood of successful trades.

Psychological Factors in Breakout Trading

Understanding the psychological pressures that come with trading breakouts and how to remain disciplined.

Learning from Trading Breakouts

Analyzing Successful and Unsuccessful Trades

Techniques for analyzing both successful and unsuccessful breakout trades to refine strategies and improve future performance.

Continued Education and Adaptation

The importance of continued learning and adaptation in the ever-evolving trading landscape to keep strategies effective.

Feibel Trading Community and Support

Joining the Feibel Trading Community

Benefits of joining the Feibel Trading community, including support from fellow traders and ongoing advice from experienced professionals.

Access to Advanced Resources

Information on how to access more advanced trading resources and tools through Feibel Trading.

Conclusion

“Breakouts with Feibel Trading” offers traders a solid foundation in one of the most exciting and potentially profitable areas of the market. With expert guidance and a comprehensive approach, traders can learn to navigate breakout scenarios with greater confidence and precision.

FAQs

- What initial capital is needed to start breakout trading?

- While it varies by individual risk tolerance and market conditions, starting with a capital that you are comfortable losing is advisable.

- How long does it take to master breakout strategies?

- Mastery can take several months of practice and learning, depending on the trader’s dedication and adaptability.

- Can breakout strategies be applied to all markets?

- Yes, breakout strategies can be effectively applied across different markets, including forex, stocks, and cryptocurrencies.

- What is the success rate of breakout trading?

- The success rate can vary widely among traders but improving with quality education and practice.

- How can I sign up for the Feibel Trading program?

- Visit Feibel Trading’s official website for details on enrollment, program schedules, and pricing.

Be the first to review “Breakouts with Feibel Trading” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Reviews

There are no reviews yet.