-

×

Technical Analysis for Long-Term Investors with Clay Allen

1 × $6.00

Technical Analysis for Long-Term Investors with Clay Allen

1 × $6.00 -

×

Profits In PJs - Profitably Selling Stock Options for Passive Income with Cam Tucker

1 × $6.00

Profits In PJs - Profitably Selling Stock Options for Passive Income with Cam Tucker

1 × $6.00 -

×

Market Stalkers Level 3 - Intraday Trading University

1 × $8.00

Market Stalkers Level 3 - Intraday Trading University

1 × $8.00 -

×

The Blockchain Bootcamp 2.0 with Gregory (Dapp University)

1 × $15.00

The Blockchain Bootcamp 2.0 with Gregory (Dapp University)

1 × $15.00 -

×

Options University - Ron Ianieri – The Option Pricing Model

1 × $6.00

Options University - Ron Ianieri – The Option Pricing Model

1 × $6.00 -

×

Trading to Win (Seminar WorkBook 2003) with Bruce Gilmore

1 × $6.00

Trading to Win (Seminar WorkBook 2003) with Bruce Gilmore

1 × $6.00 -

×

ICT – Inner Circle Trader 2020 Weekly Review

1 × $20.00

ICT – Inner Circle Trader 2020 Weekly Review

1 × $20.00 -

×

The Afluent Desktop Currency Trader with Amin Sadak

1 × $6.00

The Afluent Desktop Currency Trader with Amin Sadak

1 × $6.00 -

×

TECHNICAL ANALYSIS MODULE

1 × $6.00

TECHNICAL ANALYSIS MODULE

1 × $6.00 -

×

Investment Fables with Aswath Damodaran

1 × $6.00

Investment Fables with Aswath Damodaran

1 × $6.00 -

×

How to Make Money in the Futures Market … and Lots of It with Charles Drummond

1 × $6.00

How to Make Money in the Futures Market … and Lots of It with Charles Drummond

1 × $6.00 -

×

Commodities for Dummies with Amine Bouchentouf

1 × $6.00

Commodities for Dummies with Amine Bouchentouf

1 × $6.00 -

×

Million Dollar Bond Strategies Video with Paul Judd

1 × $6.00

Million Dollar Bond Strategies Video with Paul Judd

1 × $6.00 -

×

Trade with a Day Job USA v2010 with Markets Mastered

1 × $6.00

Trade with a Day Job USA v2010 with Markets Mastered

1 × $6.00 -

×

Basecamptrading - How to Become a More Consistent Trader

1 × $15.00

Basecamptrading - How to Become a More Consistent Trader

1 × $15.00 -

×

Century Capital Group Course with Dylan Forexia

1 × $6.00

Century Capital Group Course with Dylan Forexia

1 × $6.00 -

×

Futures & Options for Dummies with Joe Duarte

1 × $6.00

Futures & Options for Dummies with Joe Duarte

1 × $6.00 -

×

Active Trading Course Notes with Alan Hull

1 × $6.00

Active Trading Course Notes with Alan Hull

1 × $6.00 -

×

Elite Gap Trading with Nick Santiago - InTheMoneyStocks

1 × $93.00

Elite Gap Trading with Nick Santiago - InTheMoneyStocks

1 × $93.00 -

×

FXStreet Unrecorded Webinars Sept & Oct, 2011 with Sam Seiden

1 × $6.00

FXStreet Unrecorded Webinars Sept & Oct, 2011 with Sam Seiden

1 × $6.00 -

×

Option Insanity Strategy with PDS Trader

1 × $69.00

Option Insanity Strategy with PDS Trader

1 × $69.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Buy, Sell or Hold Manage Your Portfolio for Maximum Gain with Michaal Thomsett

1 × $6.00

Buy, Sell or Hold Manage Your Portfolio for Maximum Gain with Michaal Thomsett

1 × $6.00 -

×

Pro Trading Blueprint with Limitless Forex Academy

1 × $5.00

Pro Trading Blueprint with Limitless Forex Academy

1 × $5.00 -

×

CHARTCHAMPIONS Course

1 × $10.00

CHARTCHAMPIONS Course

1 × $10.00 -

×

Forex 360 Complete Course

1 × $6.00

Forex 360 Complete Course

1 × $6.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

ITPM Professional Trading Masterclass (PTM) V2.0 with Anton Kreil

1 × $6.00

ITPM Professional Trading Masterclass (PTM) V2.0 with Anton Kreil

1 × $6.00 -

×

Monthly Newsletter 99-01 with Elliott Wave Theorist

1 × $6.00

Monthly Newsletter 99-01 with Elliott Wave Theorist

1 × $6.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Oportunities in Forex Calendar Trading Patterns with Anduril Analytics

1 × $6.00

Oportunities in Forex Calendar Trading Patterns with Anduril Analytics

1 × $6.00 -

×

Forex Mastermind with FOREX4NOOBS

1 × $5.00

Forex Mastermind with FOREX4NOOBS

1 × $5.00 -

×

Crash Course Special Edition Set with Chris Martenson

1 × $6.00

Crash Course Special Edition Set with Chris Martenson

1 × $6.00 -

×

THE ART OF ADJUSTING IN 2017

1 × $6.00

THE ART OF ADJUSTING IN 2017

1 × $6.00 -

×

Psycho-Paper 96 with Charles Drummond

1 × $6.00

Psycho-Paper 96 with Charles Drummond

1 × $6.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Private Mentorship with ANICO Capital

1 × $10.00

Private Mentorship with ANICO Capital

1 × $10.00 -

×

Ez-Forex Trading System 4.2 with Beau Diamond

1 × $6.00

Ez-Forex Trading System 4.2 with Beau Diamond

1 × $6.00 -

×

Elliott Wave Simplified with Clif Droke

1 × $6.00

Elliott Wave Simplified with Clif Droke

1 × $6.00 -

×

ICT Trading Models with The Prop Trader

1 × $5.00

ICT Trading Models with The Prop Trader

1 × $5.00 -

×

Andy’s EMini Bar – 40 Min System with Joe Ross

1 × $6.00

Andy’s EMini Bar – 40 Min System with Joe Ross

1 × $6.00 -

×

Gold Trading Academy Video Course

1 × $23.00

Gold Trading Academy Video Course

1 × $23.00 -

×

Mastering the Complex Sale: How to Compete and Win When the Stakes are High! with Jeff Thull

1 × $6.00

Mastering the Complex Sale: How to Compete and Win When the Stakes are High! with Jeff Thull

1 × $6.00 -

×

Mastering the Geometry of Market Energy with Charles Drummond

1 × $6.00

Mastering the Geometry of Market Energy with Charles Drummond

1 × $6.00 -

×

30 Trading Classics with 3T Live

1 × $5.00

30 Trading Classics with 3T Live

1 × $5.00 -

×

Guidelines for Analysis and Establishing a Trading Plan with Charles Drummond

1 × $6.00

Guidelines for Analysis and Establishing a Trading Plan with Charles Drummond

1 × $6.00 -

×

A Complete Guide to Technical Trading Tactics with John Person

1 × $6.00

A Complete Guide to Technical Trading Tactics with John Person

1 × $6.00 -

×

Hedged Strategy Series in Volatile Markets All 4 with Dan Sheridan

1 × $15.00

Hedged Strategy Series in Volatile Markets All 4 with Dan Sheridan

1 × $15.00 -

×

LBFX Academy Training Course

1 × $5.00

LBFX Academy Training Course

1 × $5.00 -

×

Proven Swing Trading Strat & Multiple Time Frame Analysis - Robert Krausz & Thom Hartle

1 × $6.00

Proven Swing Trading Strat & Multiple Time Frame Analysis - Robert Krausz & Thom Hartle

1 × $6.00 -

×

Basic Options Course Cash Flow. Diversification. Flexibility with Michael Drew

1 × $6.00

Basic Options Course Cash Flow. Diversification. Flexibility with Michael Drew

1 × $6.00 -

×

3 Technical Indicators to Help You Ride the Elliott Wave Trend with Chris Carolan

1 × $6.00

3 Technical Indicators to Help You Ride the Elliott Wave Trend with Chris Carolan

1 × $6.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Video On Demand Pathway with Trade With Profile

1 × $5.00

Video On Demand Pathway with Trade With Profile

1 × $5.00 -

×

Reminiscences of a Stock Operator (75th Aniversary Ed.) with Edwin Lefevre

1 × $6.00

Reminiscences of a Stock Operator (75th Aniversary Ed.) with Edwin Lefevre

1 × $6.00 -

×

Evolved Trader with Mark Croock

1 × $69.00

Evolved Trader with Mark Croock

1 × $69.00 -

×

The Trap Trade Workshop with Doc Severson

1 × $6.00

The Trap Trade Workshop with Doc Severson

1 × $6.00 -

×

The Loyalty Effect with Frederick Reichheld

1 × $6.00

The Loyalty Effect with Frederick Reichheld

1 × $6.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

How I Make A Living Daytrading Stocks with David Floyd

1 × $4.00

How I Make A Living Daytrading Stocks with David Floyd

1 × $4.00 -

×

T3 Live - The Simple Art of Trading

1 × $31.00

T3 Live - The Simple Art of Trading

1 × $31.00 -

×

Technical Trading: System and Design Testing Class with Jeff Bierman

1 × $6.00

Technical Trading: System and Design Testing Class with Jeff Bierman

1 × $6.00 -

×

Foreign Exchange

1 × $6.00

Foreign Exchange

1 × $6.00 -

×

Supply and Demand Video Course with JamesFXS

1 × $13.00

Supply and Demand Video Course with JamesFXS

1 × $13.00 -

×

Options Wizardry from A to Z (Video 2.80 GB) with Don Fishback

1 × $6.00

Options Wizardry from A to Z (Video 2.80 GB) with Don Fishback

1 × $6.00 -

×

Advanced GET 8.0 EOD

1 × $6.00

Advanced GET 8.0 EOD

1 × $6.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Master Forex Fundamentals

1 × $15.00

Master Forex Fundamentals

1 × $15.00 -

×

60 Seconds Sure Shot Strategy with Albert E

1 × $6.00

60 Seconds Sure Shot Strategy with Albert E

1 × $6.00 -

×

Most Woke Trading Methods with Hunter FX

1 × $5.00

Most Woke Trading Methods with Hunter FX

1 × $5.00 -

×

Trade Chart Patterns Like The Pros with Suri Duddella

1 × $6.00

Trade Chart Patterns Like The Pros with Suri Duddella

1 × $6.00 -

×

The Bond Book (2nd Ed.) with Annette Thau

1 × $6.00

The Bond Book (2nd Ed.) with Annette Thau

1 × $6.00 -

×

Hedge Fund Investment Management with Izze Nelken

1 × $6.00

Hedge Fund Investment Management with Izze Nelken

1 × $6.00 -

×

Golden Pips Generator - DMA HACK with Hooman

1 × $62.00

Golden Pips Generator - DMA HACK with Hooman

1 × $62.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

The Complete Guide To Futures & Commodities Trading with Stephen Jennings

1 × $6.00

The Complete Guide To Futures & Commodities Trading with Stephen Jennings

1 × $6.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Speculating with Futures and Traditional Commodities Part II (Liverpool Group) - Noble DraKoln

1 × $6.00

Speculating with Futures and Traditional Commodities Part II (Liverpool Group) - Noble DraKoln

1 × $6.00 -

×

Learn Investing & Trading with Danny Devan

1 × $23.00

Learn Investing & Trading with Danny Devan

1 × $23.00 -

×

Stock Traders Almanac 2008 with Jeffrey Hirsch & Yale Hirsch

1 × $6.00

Stock Traders Almanac 2008 with Jeffrey Hirsch & Yale Hirsch

1 × $6.00 -

×

Hedge Funds: Insights in Performance Measurement, Risk Analysis, and Portfolio Allocation (1st Edition) - Greg Gregoriou, Georges Hübner, Nicolas Papageorgiou & Fabrice Rouah

1 × $6.00

Hedge Funds: Insights in Performance Measurement, Risk Analysis, and Portfolio Allocation (1st Edition) - Greg Gregoriou, Georges Hübner, Nicolas Papageorgiou & Fabrice Rouah

1 × $6.00 -

×

Three Tricks, Two Traps, One Truth Real Help for Traders and Investors with D.R.Barton

1 × $6.00

Three Tricks, Two Traps, One Truth Real Help for Traders and Investors with D.R.Barton

1 × $6.00 -

×

Market Profile Training with Futexlive

1 × $23.00

Market Profile Training with Futexlive

1 × $23.00 -

×

5-Step-Trading Stocks II - Avoid Common Trading Mistakes - Online Course (April 2014)

1 × $23.00

5-Step-Trading Stocks II - Avoid Common Trading Mistakes - Online Course (April 2014)

1 × $23.00 -

×

All Time High Trading Course with TRADEVERSITY

1 × $5.00

All Time High Trading Course with TRADEVERSITY

1 × $5.00 -

×

Info Product Mastery - Ron Douglas & Alice Seba

1 × $6.00

Info Product Mastery - Ron Douglas & Alice Seba

1 × $6.00 -

×

A- Z Educational Trading Course with InvestiTrade

1 × $39.00

A- Z Educational Trading Course with InvestiTrade

1 × $39.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

AnkhFX Academy Course

1 × $17.00

AnkhFX Academy Course

1 × $17.00 -

×

New Blueprints for Gains in Stocks and Grains & One-Way Formula for Trading in Stocks and Commodities (Traders' Masterclass) - William Dunnigan

1 × $6.00

New Blueprints for Gains in Stocks and Grains & One-Way Formula for Trading in Stocks and Commodities (Traders' Masterclass) - William Dunnigan

1 × $6.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Options, Futures, and Other Derivative Securities

1 × $6.00

Options, Futures, and Other Derivative Securities

1 × $6.00 -

×

High Probability Patterns and Rule Based Trading with Jake Bernstein

1 × $6.00

High Probability Patterns and Rule Based Trading with Jake Bernstein

1 × $6.00 -

×

Trading From Your Gut with Curtis Faith

1 × $6.00

Trading From Your Gut with Curtis Faith

1 × $6.00 -

×

All About Dividend Investing with Don Schreiber & Gary Stroik

1 × $6.00

All About Dividend Investing with Don Schreiber & Gary Stroik

1 × $6.00 -

×

Precision Pattern Trading Workbook with Daryl Guppy

1 × $6.00

Precision Pattern Trading Workbook with Daryl Guppy

1 × $6.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Timing Solution Terra Incognita Edition Build 24 (timingsolution.com)

1 × $6.00

Timing Solution Terra Incognita Edition Build 24 (timingsolution.com)

1 × $6.00 -

×

Candlesticks Explained with Martin Pring

1 × $6.00

Candlesticks Explained with Martin Pring

1 × $6.00 -

×

Index Funds with Mark Hebner

1 × $6.00

Index Funds with Mark Hebner

1 × $6.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Coulda, woulda, shoulda with Charles Cottle

1 × $6.00

Coulda, woulda, shoulda with Charles Cottle

1 × $6.00 -

×

Mathematical Problems in Image Processing with Charles E.Chidume

1 × $6.00

Mathematical Problems in Image Processing with Charles E.Chidume

1 × $6.00 -

×

Generating Consistent Profits On Smaller Accounts

1 × $23.00

Generating Consistent Profits On Smaller Accounts

1 × $23.00 -

×

How I Turned 500 USD to 6 Figures in 2 months Trading Options with The Money Printers

1 × $8.00

How I Turned 500 USD to 6 Figures in 2 months Trading Options with The Money Printers

1 × $8.00

B.O.S.S (Break Out Scalping Strategy) with Lee Scholfield

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

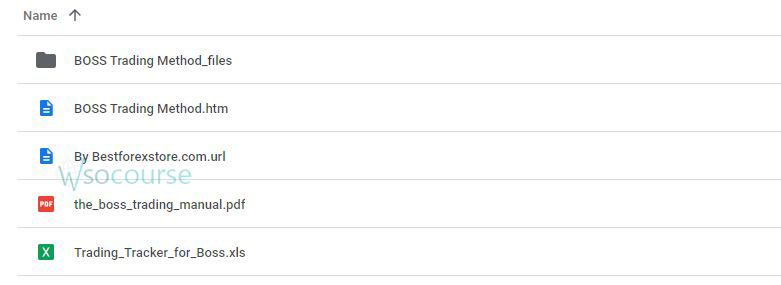

You may check content proof of “B.O.S.S (Break Out Scalping Strategy) with Lee Scholfield” below:

B.O.S.S (Break Out Scalping Strategy) with Lee Scholfield

In the fast-paced world of trading, scalping strategies are popular for their potential to yield quick profits. Lee Scholfield’s Break Out Scalping Strategy (B.O.S.S) is a powerful method that capitalizes on market breakouts. This article delves into the intricacies of B.O.S.S, offering a detailed guide on how to implement it effectively.

Understanding Scalping Strategies

Scalping involves making numerous trades over short periods to capitalize on small price movements.

What is Scalping?

- Definition: A trading style that aims to profit from small price changes.

- Objective: To accumulate numerous small gains over time.

Why Scalping?

- Quick Profits: Scalping allows for fast gains within a trading day.

- Reduced Risk Exposure: Short holding periods mean less exposure to market risk.

Introduction to B.O.S.S

B.O.S.S focuses on identifying and trading market breakouts, a situation where the price moves beyond a defined resistance or support level.

What is B.O.S.S?

- Break Out Scalping Strategy: A technique that targets breakout points for quick trades.

- Creator: Developed by trading expert Lee Scholfield.

Why Use B.O.S.S?

- High Probability Trades: Breakouts often lead to significant price movements.

- Clear Entry and Exit Points: Defined levels make it easier to plan trades.

Key Concepts of B.O.S.S

Understanding the key concepts behind B.O.S.S is crucial for successful implementation.

Breakouts

- Definition: A breakout occurs when the price moves above a resistance level or below a support level.

- Significance: Indicates potential for strong price movements.

Support and Resistance Levels

- Support: A price level where buying interest is strong enough to prevent the price from falling further.

- Resistance: A price level where selling interest is strong enough to prevent the price from rising further.

Implementing B.O.S.S

To implement B.O.S.S effectively, follow these steps:

1. Identify Key Levels

- Chart Analysis: Use technical analysis to identify support and resistance levels.

- Historical Data: Analyze past price movements to determine these levels.

2. Monitor for Breakouts

- Real-Time Analysis: Monitor price movements in real-time to spot potential breakouts.

- Confirmation: Wait for confirmation of the breakout before entering a trade.

3. Entering Trades

- Buy Breakouts: Enter a buy trade when the price breaks above a resistance level.

- Sell Breakouts: Enter a sell trade when the price breaks below a support level.

4. Setting Stop-Loss Orders

- Risk Management: Place stop-loss orders to limit potential losses.

- Strategic Placement: Position stop-loss orders just below the breakout level for buy trades and just above for sell trades.

5. Taking Profits

- Profit Targets: Set clear profit targets based on the size of the breakout.

- Trailing Stops: Use trailing stops to lock in profits as the price moves in your favor.

Tools and Indicators for B.O.S.S

Several tools and indicators can enhance the effectiveness of B.O.S.S.

Moving Averages

- Simple Moving Average (SMA): Helps identify the overall trend.

- Exponential Moving Average (EMA): Gives more weight to recent price movements, useful for detecting breakouts.

Volume Indicators

- Volume Analysis: High volume can confirm the strength of a breakout.

- On-Balance Volume (OBV): Measures buying and selling pressure.

Relative Strength Index (RSI)

- Overbought/Oversold Conditions: Helps identify potential reversal points that can lead to breakouts.

Common Mistakes in Scalping

Avoid these common pitfalls to maximize your success with B.O.S.S.

Overtrading

- Quality Over Quantity: Focus on high-probability trades rather than making numerous low-quality trades.

Ignoring Risk Management

- Set Stop-Loss Orders: Always use stop-loss orders to manage risk.

- Limit Exposure: Avoid risking too much capital on a single trade.

Failing to Adapt

- Market Conditions: Adapt your strategy to changing market conditions.

- Continuous Learning: Stay updated with new techniques and market trends.

The Psychology of Scalping

Successful scalping requires the right mindset.

Discipline

- Stick to the Plan: Follow your trading plan without deviation.

- Emotional Control: Manage emotions to avoid impulsive decisions.

Patience

- Wait for Confirmations: Be patient and wait for clear breakout signals before entering trades.

- Consistent Effort: Scalping requires consistent monitoring and effort.

Conclusion

The Break Out Scalping Strategy (B.O.S.S) by Lee Scholfield offers a structured approach to capitalize on market breakouts. By understanding and implementing the key concepts, tools, and techniques outlined in this article, traders can enhance their trading performance and achieve consistent profits. Remember, success in scalping requires discipline, patience, and continuous learning.

FAQs

1. What is the Break Out Scalping Strategy (B.O.S.S)?

B.O.S.S is a trading strategy that focuses on identifying and trading breakouts from support and resistance levels to capitalize on significant price movements.

2. Why are support and resistance levels important in B.O.S.S?

Support and resistance levels help identify potential breakout points, providing clear entry and exit signals for trades.

3. How can I confirm a breakout?

Confirm a breakout by monitoring real-time price movements and volume. High volume often indicates a stronger breakout.

4. What tools can enhance the B.O.S.S strategy?

Tools like moving averages, volume indicators, and RSI can help identify and confirm breakouts, enhancing the effectiveness of the B.O.S.S strategy.

5. How important is risk management in scalping?

Risk management is crucial in scalping to protect your capital and minimize losses. Always use stop-loss orders and avoid overtrading.

Be the first to review “B.O.S.S (Break Out Scalping Strategy) with Lee Scholfield” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.