-

×

Pro Indicator Pack with Trade Confident

1 × $15.00

Pro Indicator Pack with Trade Confident

1 × $15.00 -

×

Mastering Level 2 with ClayTrader

1 × $197.00

Mastering Level 2 with ClayTrader

1 × $197.00 -

×

Delta Neutral Funding with Bitcoin Trading Practice

1 × $6.00

Delta Neutral Funding with Bitcoin Trading Practice

1 × $6.00 -

×

Bond Trading Success

1 × $6.00

Bond Trading Success

1 × $6.00 -

×

Learning How to Successfully Trade the E-mini & S&P 500 Markets

1 × $6.00

Learning How to Successfully Trade the E-mini & S&P 500 Markets

1 × $6.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

Investment Blunders with John Nofsinger

1 × $6.00

Investment Blunders with John Nofsinger

1 × $6.00 -

×

ICT Charter Complete Course (2019)

1 × $13.00

ICT Charter Complete Course (2019)

1 × $13.00 -

×

Rapid Results Method with Russ Horn

1 × $6.00

Rapid Results Method with Russ Horn

1 × $6.00 -

×

Point and Figure Mentorship Course

1 × $54.00

Point and Figure Mentorship Course

1 × $54.00 -

×

TOP Momentum Bundle with Top Trade Tools

1 × $62.00

TOP Momentum Bundle with Top Trade Tools

1 × $62.00 -

×

VWAP Trading course with Trade With Trend

1 × $6.00

VWAP Trading course with Trade With Trend

1 × $6.00 -

×

The Poor Man’s Gamma Scalp

1 × $54.00

The Poor Man’s Gamma Scalp

1 × $54.00 -

×

Trading with Price Ladder and Order Flow Strategies with Alex Haywood - Axia Futures

1 × $6.00

Trading with Price Ladder and Order Flow Strategies with Alex Haywood - Axia Futures

1 × $6.00 -

×

Active Investing courses notes with Alan Hull

1 × $6.00

Active Investing courses notes with Alan Hull

1 × $6.00 -

×

Advanced Volume Profile + Order Flow Video Course with Trader Dale

1 × $13.00

Advanced Volume Profile + Order Flow Video Course with Trader Dale

1 × $13.00 -

×

Aspectos Generales del Mercado de Valores with A.Bachiller

1 × $6.00

Aspectos Generales del Mercado de Valores with A.Bachiller

1 × $6.00 -

×

The Complete Idiots Guide to Investing in Internet Stocks with Kenneth Little

1 × $6.00

The Complete Idiots Guide to Investing in Internet Stocks with Kenneth Little

1 × $6.00 -

×

The Big Picture Collection with Barbara Rockefeller

1 × $6.00

The Big Picture Collection with Barbara Rockefeller

1 × $6.00 -

×

Building Wealth In Stock Market with David Novac

1 × $6.00

Building Wealth In Stock Market with David Novac

1 × $6.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

The Motley Fool Million Dollar Portfolio: How to Build and Grow a Panic-Proof Investment Portfolio with David Gardner & Tom Gardner

1 × $6.00

The Motley Fool Million Dollar Portfolio: How to Build and Grow a Panic-Proof Investment Portfolio with David Gardner & Tom Gardner

1 × $6.00 -

×

Forex Fortune Factory 2.0 with Nehemiah Douglass & Cottrell Phillip

1 × $6.00

Forex Fortune Factory 2.0 with Nehemiah Douglass & Cottrell Phillip

1 × $6.00 -

×

The Price Action Protocol - 2015 Edition

1 × $15.00

The Price Action Protocol - 2015 Edition

1 × $15.00 -

×

Impulse Trading System with Base Camp Trading

1 × $54.00

Impulse Trading System with Base Camp Trading

1 × $54.00 -

×

Hidden Cash Flow Fortunes

1 × $54.00

Hidden Cash Flow Fortunes

1 × $54.00 -

×

How Charts Can Help You in the Stock Market with William Jiller

1 × $6.00

How Charts Can Help You in the Stock Market with William Jiller

1 × $6.00 -

×

VintagEducation - The Fast Track Forex Bootcamp

1 × $6.00

VintagEducation - The Fast Track Forex Bootcamp

1 × $6.00 -

×

Zanzibar System for the EuroFx with Joe Ross

1 × $4.00

Zanzibar System for the EuroFx with Joe Ross

1 × $4.00 -

×

POS+ Hindi 30 Days Subscription with Surjeetkakkar

1 × $62.00

POS+ Hindi 30 Days Subscription with Surjeetkakkar

1 × $62.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Neowave. Taking Elliott Wave into the 21st Century with Glenn Neely

1 × $6.00

Neowave. Taking Elliott Wave into the 21st Century with Glenn Neely

1 × $6.00 -

×

B.O.S.S. Carbon with Pat Mitchell – Trick Trades

1 × $8.00

B.O.S.S. Carbon with Pat Mitchell – Trick Trades

1 × $8.00 -

×

Day Trading Stocks - Gap Trading

1 × $23.00

Day Trading Stocks - Gap Trading

1 × $23.00 -

×

Hustle Trading FX Course

1 × $10.00

Hustle Trading FX Course

1 × $10.00 -

×

Monetary Mechanics Course 2024 with The Macro Compass

1 × $139.00

Monetary Mechanics Course 2024 with The Macro Compass

1 × $139.00 -

×

Quantitative Technical Analysis: An integrated approach to trading system development and trading management

1 × $6.00

Quantitative Technical Analysis: An integrated approach to trading system development and trading management

1 × $6.00 -

×

Wealthpress Jump Trade Package (Course Only, None-elert)

1 × $85.00

Wealthpress Jump Trade Package (Course Only, None-elert)

1 × $85.00 -

×

Candlesticks MegaPackage Vol 1-4 (CCA) with Candle Charts

1 × $62.00

Candlesticks MegaPackage Vol 1-4 (CCA) with Candle Charts

1 × $62.00 -

×

Investing With Giants: Tried and True Stocks That Have Sustained the Test of Time with Linda T.Mead

1 × $6.00

Investing With Giants: Tried and True Stocks That Have Sustained the Test of Time with Linda T.Mead

1 × $6.00 -

×

FXJake Webinars with Walter Peters

1 × $6.00

FXJake Webinars with Walter Peters

1 × $6.00 -

×

Hubert Senters’ Squeeze Play Strategy & Tradestation Code with Hubert Senters

1 × $6.00

Hubert Senters’ Squeeze Play Strategy & Tradestation Code with Hubert Senters

1 × $6.00 -

×

Radioactive Trading Mastery Course

1 × $6.00

Radioactive Trading Mastery Course

1 × $6.00 -

×

FX Savages Courses Collection

1 × $7.00

FX Savages Courses Collection

1 × $7.00 -

×

Planetary Stock Trading with Bill Meridian

1 × $6.00

Planetary Stock Trading with Bill Meridian

1 × $6.00 -

×

Catching Trend Reversals

1 × $6.00

Catching Trend Reversals

1 × $6.00 -

×

Pristine - Greg Capra – Sentiment Internal Indicators. Winning Swing & Position Trading

1 × $6.00

Pristine - Greg Capra – Sentiment Internal Indicators. Winning Swing & Position Trading

1 × $6.00 -

×

Swing Trading for a Living (7 Video Cds & WorkBook 2.1 GB)

1 × $6.00

Swing Trading for a Living (7 Video Cds & WorkBook 2.1 GB)

1 × $6.00 -

×

True Momentum System Basic Package with Sam Shames

1 × $13.00

True Momentum System Basic Package with Sam Shames

1 × $13.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

The Stock Market Trading Secrets of the Late (1940, scaned)

1 × $6.00

The Stock Market Trading Secrets of the Late (1940, scaned)

1 × $6.00 -

×

DNA Wealth Blueprint 3 (Complete)

1 × $54.00

DNA Wealth Blueprint 3 (Complete)

1 × $54.00 -

×

Bookmap Masterclass with Trading To Win

1 × $6.00

Bookmap Masterclass with Trading To Win

1 × $6.00 -

×

Inside the Minds Leading Wall Street Investors with Aspatore Books

1 × $6.00

Inside the Minds Leading Wall Street Investors with Aspatore Books

1 × $6.00 -

×

Mastering Daily Option Trading with Option Pit

1 × $93.00

Mastering Daily Option Trading with Option Pit

1 × $93.00 -

×

FX Capital Online

1 × $5.00

FX Capital Online

1 × $5.00 -

×

Asset Markets, Portfolio Choice and Macroeconomic Activity: A Keynesian Perspective - Toichiro Asadra, Peter Flaschel, Tarik Mouakil & Christian Proaño

1 × $6.00

Asset Markets, Portfolio Choice and Macroeconomic Activity: A Keynesian Perspective - Toichiro Asadra, Peter Flaschel, Tarik Mouakil & Christian Proaño

1 × $6.00 -

×

BTC Market Profile

1 × $34.00

BTC Market Profile

1 × $34.00 -

×

Right Line Trading IndicatorSuite (May 2015)

1 × $31.00

Right Line Trading IndicatorSuite (May 2015)

1 × $31.00 -

×

ActiveBeta Indexes. Capturing Systematic Sources of Active Equity Returns (HTML) with Andrew Lo

1 × $6.00

ActiveBeta Indexes. Capturing Systematic Sources of Active Equity Returns (HTML) with Andrew Lo

1 × $6.00 -

×

6 Dynamic Trader Real Time and End Of Day

1 × $39.00

6 Dynamic Trader Real Time and End Of Day

1 × $39.00 -

×

Power FX Xtreme BuySell EA

1 × $23.00

Power FX Xtreme BuySell EA

1 × $23.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00

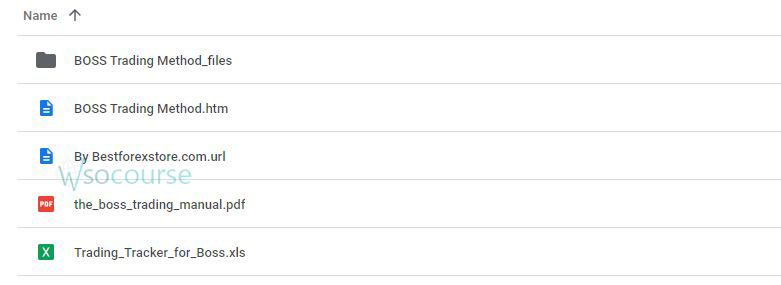

B.O.S.S (Break Out Scalping Strategy) with Lee Scholfield

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “B.O.S.S (Break Out Scalping Strategy) with Lee Scholfield” below:

B.O.S.S (Break Out Scalping Strategy) with Lee Scholfield

In the fast-paced world of trading, scalping strategies are popular for their potential to yield quick profits. Lee Scholfield’s Break Out Scalping Strategy (B.O.S.S) is a powerful method that capitalizes on market breakouts. This article delves into the intricacies of B.O.S.S, offering a detailed guide on how to implement it effectively.

Understanding Scalping Strategies

Scalping involves making numerous trades over short periods to capitalize on small price movements.

What is Scalping?

- Definition: A trading style that aims to profit from small price changes.

- Objective: To accumulate numerous small gains over time.

Why Scalping?

- Quick Profits: Scalping allows for fast gains within a trading day.

- Reduced Risk Exposure: Short holding periods mean less exposure to market risk.

Introduction to B.O.S.S

B.O.S.S focuses on identifying and trading market breakouts, a situation where the price moves beyond a defined resistance or support level.

What is B.O.S.S?

- Break Out Scalping Strategy: A technique that targets breakout points for quick trades.

- Creator: Developed by trading expert Lee Scholfield.

Why Use B.O.S.S?

- High Probability Trades: Breakouts often lead to significant price movements.

- Clear Entry and Exit Points: Defined levels make it easier to plan trades.

Key Concepts of B.O.S.S

Understanding the key concepts behind B.O.S.S is crucial for successful implementation.

Breakouts

- Definition: A breakout occurs when the price moves above a resistance level or below a support level.

- Significance: Indicates potential for strong price movements.

Support and Resistance Levels

- Support: A price level where buying interest is strong enough to prevent the price from falling further.

- Resistance: A price level where selling interest is strong enough to prevent the price from rising further.

Implementing B.O.S.S

To implement B.O.S.S effectively, follow these steps:

1. Identify Key Levels

- Chart Analysis: Use technical analysis to identify support and resistance levels.

- Historical Data: Analyze past price movements to determine these levels.

2. Monitor for Breakouts

- Real-Time Analysis: Monitor price movements in real-time to spot potential breakouts.

- Confirmation: Wait for confirmation of the breakout before entering a trade.

3. Entering Trades

- Buy Breakouts: Enter a buy trade when the price breaks above a resistance level.

- Sell Breakouts: Enter a sell trade when the price breaks below a support level.

4. Setting Stop-Loss Orders

- Risk Management: Place stop-loss orders to limit potential losses.

- Strategic Placement: Position stop-loss orders just below the breakout level for buy trades and just above for sell trades.

5. Taking Profits

- Profit Targets: Set clear profit targets based on the size of the breakout.

- Trailing Stops: Use trailing stops to lock in profits as the price moves in your favor.

Tools and Indicators for B.O.S.S

Several tools and indicators can enhance the effectiveness of B.O.S.S.

Moving Averages

- Simple Moving Average (SMA): Helps identify the overall trend.

- Exponential Moving Average (EMA): Gives more weight to recent price movements, useful for detecting breakouts.

Volume Indicators

- Volume Analysis: High volume can confirm the strength of a breakout.

- On-Balance Volume (OBV): Measures buying and selling pressure.

Relative Strength Index (RSI)

- Overbought/Oversold Conditions: Helps identify potential reversal points that can lead to breakouts.

Common Mistakes in Scalping

Avoid these common pitfalls to maximize your success with B.O.S.S.

Overtrading

- Quality Over Quantity: Focus on high-probability trades rather than making numerous low-quality trades.

Ignoring Risk Management

- Set Stop-Loss Orders: Always use stop-loss orders to manage risk.

- Limit Exposure: Avoid risking too much capital on a single trade.

Failing to Adapt

- Market Conditions: Adapt your strategy to changing market conditions.

- Continuous Learning: Stay updated with new techniques and market trends.

The Psychology of Scalping

Successful scalping requires the right mindset.

Discipline

- Stick to the Plan: Follow your trading plan without deviation.

- Emotional Control: Manage emotions to avoid impulsive decisions.

Patience

- Wait for Confirmations: Be patient and wait for clear breakout signals before entering trades.

- Consistent Effort: Scalping requires consistent monitoring and effort.

Conclusion

The Break Out Scalping Strategy (B.O.S.S) by Lee Scholfield offers a structured approach to capitalize on market breakouts. By understanding and implementing the key concepts, tools, and techniques outlined in this article, traders can enhance their trading performance and achieve consistent profits. Remember, success in scalping requires discipline, patience, and continuous learning.

FAQs

1. What is the Break Out Scalping Strategy (B.O.S.S)?

B.O.S.S is a trading strategy that focuses on identifying and trading breakouts from support and resistance levels to capitalize on significant price movements.

2. Why are support and resistance levels important in B.O.S.S?

Support and resistance levels help identify potential breakout points, providing clear entry and exit signals for trades.

3. How can I confirm a breakout?

Confirm a breakout by monitoring real-time price movements and volume. High volume often indicates a stronger breakout.

4. What tools can enhance the B.O.S.S strategy?

Tools like moving averages, volume indicators, and RSI can help identify and confirm breakouts, enhancing the effectiveness of the B.O.S.S strategy.

5. How important is risk management in scalping?

Risk management is crucial in scalping to protect your capital and minimize losses. Always use stop-loss orders and avoid overtrading.

Be the first to review “B.O.S.S (Break Out Scalping Strategy) with Lee Scholfield” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Reviews

There are no reviews yet.