-

×

A Convicted Stock Manipulators Guide to Investing with Marino Specogna

1 × $6.00

A Convicted Stock Manipulators Guide to Investing with Marino Specogna

1 × $6.00 -

×

Day Trade Futures Online with Larry Williams

1 × $6.00

Day Trade Futures Online with Larry Williams

1 × $6.00 -

×

ART Online 4 Weeks Home Study Course with Bennett McDowell

1 × $78.00

ART Online 4 Weeks Home Study Course with Bennett McDowell

1 × $78.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Defending Options with Simpler Options

1 × $6.00

Defending Options with Simpler Options

1 × $6.00 -

×

Stock Market Winners with Maria Crawford Scott, John Bajkowski

1 × $6.00

Stock Market Winners with Maria Crawford Scott, John Bajkowski

1 × $6.00 -

×

A Seminar On Ocean Theory Home Study Trading Course with Pat Raffalovich

1 × $6.00

A Seminar On Ocean Theory Home Study Trading Course with Pat Raffalovich

1 × $6.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

Game-Maker Forex Trading System

1 × $6.00

Game-Maker Forex Trading System

1 × $6.00 -

×

Cash Flow Investing Course

1 × $20.00

Cash Flow Investing Course

1 × $20.00 -

×

The Complete Lot Flipper System

1 × $6.00

The Complete Lot Flipper System

1 × $6.00 -

×

Practical Portfolio Performance Measurement and Attribution (2nd Ed.) with Carl Bacon

1 × $6.00

Practical Portfolio Performance Measurement and Attribution (2nd Ed.) with Carl Bacon

1 × $6.00 -

×

Complete Forex Training Series with 4 x Made Easy

1 × $6.00

Complete Forex Training Series with 4 x Made Easy

1 × $6.00 -

×

Complete Trading Course with Sean Dekmar

1 × $5.00

Complete Trading Course with Sean Dekmar

1 × $5.00 -

×

Secrets of a Winning Trader with Gareth Soloway

1 × $871.00

Secrets of a Winning Trader with Gareth Soloway

1 × $871.00 -

×

The Tyler Method For Successful Triangle Trading with Chris Tyler

1 × $6.00

The Tyler Method For Successful Triangle Trading with Chris Tyler

1 × $6.00 -

×

Advanced Course with Dimitri Wallace - Gold Minds Global

1 × $6.00

Advanced Course with Dimitri Wallace - Gold Minds Global

1 × $6.00 -

×

After Hour Trading Made Easy with Joe Duarte & Roland Burke

1 × $6.00

After Hour Trading Made Easy with Joe Duarte & Roland Burke

1 × $6.00 -

×

Cotton Trading Manual with Terry Townsend

1 × $6.00

Cotton Trading Manual with Terry Townsend

1 × $6.00 -

×

The Q’s (2nd Ed.) with Darlene Nelson

1 × $6.00

The Q’s (2nd Ed.) with Darlene Nelson

1 × $6.00 -

×

Short-Term Trading with Precision Timing - Jack Bernstein

1 × $6.00

Short-Term Trading with Precision Timing - Jack Bernstein

1 × $6.00 -

×

Predators & Profits with Martin Howell & John Bogle

1 × $6.00

Predators & Profits with Martin Howell & John Bogle

1 × $6.00 -

×

Cecil Robles Advent Forex Course & Indicators with Adventforex

1 × $6.00

Cecil Robles Advent Forex Course & Indicators with Adventforex

1 × $6.00 -

×

Bulletproof Butterflies 2.0 2022 (PREMIUM) with Bruce Marshall

1 × $23.00

Bulletproof Butterflies 2.0 2022 (PREMIUM) with Bruce Marshall

1 × $23.00 -

×

Lifetime Membership

1 × $840.00

Lifetime Membership

1 × $840.00 -

×

Advanced Trading Applications of Candlestick Charting with Gary S.Wagner & Bradley L.Matheny

1 × $6.00

Advanced Trading Applications of Candlestick Charting with Gary S.Wagner & Bradley L.Matheny

1 × $6.00 -

×

Elite Mentorship Home Study - 3T Live with Sami Abusaad

1 × $5.00

Elite Mentorship Home Study - 3T Live with Sami Abusaad

1 × $5.00 -

×

Small and Mighty Association with Ryan Lee

1 × $6.00

Small and Mighty Association with Ryan Lee

1 × $6.00 -

×

Psycho-Paper 96 with Charles Drummond

1 × $6.00

Psycho-Paper 96 with Charles Drummond

1 × $6.00 -

×

Mastering Risk Modeling with Excel by Alastair Day

1 × $6.00

Mastering Risk Modeling with Excel by Alastair Day

1 × $6.00 -

×

Forex Trading Like Banks - Step by Step by Live Examples with Taher Assaf

1 × $6.00

Forex Trading Like Banks - Step by Step by Live Examples with Taher Assaf

1 × $6.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Hedges on Hedge Funds: How to Successfully Analyze and Select an Investment with James Hedges

1 × $6.00

Hedges on Hedge Funds: How to Successfully Analyze and Select an Investment with James Hedges

1 × $6.00 -

×

Confidence Game. How a Hadge Fund Manager Called Wall Street’s Bluff with Christine Richard

1 × $6.00

Confidence Game. How a Hadge Fund Manager Called Wall Street’s Bluff with Christine Richard

1 × $6.00 -

×

Beat The Market Maker

1 × $62.00

Beat The Market Maker

1 × $62.00 -

×

Qualitative - Financial Statement Analysis with Sandesh Banger

1 × $5.00

Qualitative - Financial Statement Analysis with Sandesh Banger

1 × $5.00 -

×

Fierce 10 On Demand Coaching Program with High Performance Trading

1 × $5.00

Fierce 10 On Demand Coaching Program with High Performance Trading

1 × $5.00 -

×

Swing Trading (Italian) with Guiuseppe Migliorino

1 × $6.00

Swing Trading (Italian) with Guiuseppe Migliorino

1 × $6.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Candlestick Charts with Clive Lambert

1 × $6.00

Candlestick Charts with Clive Lambert

1 × $6.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Future Energy with Bill Paul

1 × $6.00

Future Energy with Bill Paul

1 × $6.00 -

×

Formula to a Fortune with Steve Briese, Glen Ring

1 × $6.00

Formula to a Fortune with Steve Briese, Glen Ring

1 × $6.00 -

×

Executive Mentoring Elliot Wave Course (Video & Manuals)

1 × $6.00

Executive Mentoring Elliot Wave Course (Video & Manuals)

1 × $6.00 -

×

Essential Stock Picking Strategies with Daniel Strachman

1 × $6.00

Essential Stock Picking Strategies with Daniel Strachman

1 × $6.00 -

×

The Greatest Trade Ever with Gregory Zuckerman

1 × $6.00

The Greatest Trade Ever with Gregory Zuckerman

1 × $6.00 -

×

Small Stocks for Big Profits: Generate Spectacular Returns by Investing in Up-and-Coming Companies with George Angell

1 × $6.00

Small Stocks for Big Profits: Generate Spectacular Returns by Investing in Up-and-Coming Companies with George Angell

1 × $6.00 -

×

How to avoid the GAP

1 × $6.00

How to avoid the GAP

1 × $6.00 -

×

Developing Profitable Systems from Discretionary to Mechanical with Fred Shutzman

1 × $6.00

Developing Profitable Systems from Discretionary to Mechanical with Fred Shutzman

1 × $6.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

The Geography of Money with Benjamin J.Cohen

1 × $6.00

The Geography of Money with Benjamin J.Cohen

1 × $6.00 -

×

Ezaih Academy 2024 Mentorship with Ezaih

1 × $54.00

Ezaih Academy 2024 Mentorship with Ezaih

1 × $54.00 -

×

Electronic Trading "TNT" II How - To Win Trading Stuff with Joe Ross & Mark Cherlin

1 × $6.00

Electronic Trading "TNT" II How - To Win Trading Stuff with Joe Ross & Mark Cherlin

1 × $6.00 -

×

Trading Forex Exchange with Clifford Bennett

1 × $6.00

Trading Forex Exchange with Clifford Bennett

1 × $6.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Mql4 Bundle: Basics, Scripts, Indicators, Experts with Jim Hodges

1 × $15.00

Mql4 Bundle: Basics, Scripts, Indicators, Experts with Jim Hodges

1 × $15.00 -

×

Forex Supreme Course with Ethan Wilson

1 × $6.00

Forex Supreme Course with Ethan Wilson

1 × $6.00 -

×

Basic Options Course Cash Flow. Diversification. Flexibility with Michael Drew

1 × $6.00

Basic Options Course Cash Flow. Diversification. Flexibility with Michael Drew

1 × $6.00 -

×

The New Electronic Traders with Jonathan R.Aspartore

1 × $6.00

The New Electronic Traders with Jonathan R.Aspartore

1 × $6.00 -

×

Fractal Based Point Processes with Steven Bradley Lowen & Malvin Carl Teich

1 × $6.00

Fractal Based Point Processes with Steven Bradley Lowen & Malvin Carl Teich

1 × $6.00 -

×

Altcoin Investing Course with Rekt Capital

1 × $5.00

Altcoin Investing Course with Rekt Capital

1 × $5.00 -

×

The Banker’s Edge Webinar & Extras

1 × $6.00

The Banker’s Edge Webinar & Extras

1 × $6.00 -

×

A Treasure House of Bayer. 32 Articles and Forecasts with George Bayer

1 × $6.00

A Treasure House of Bayer. 32 Articles and Forecasts with George Bayer

1 × $6.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

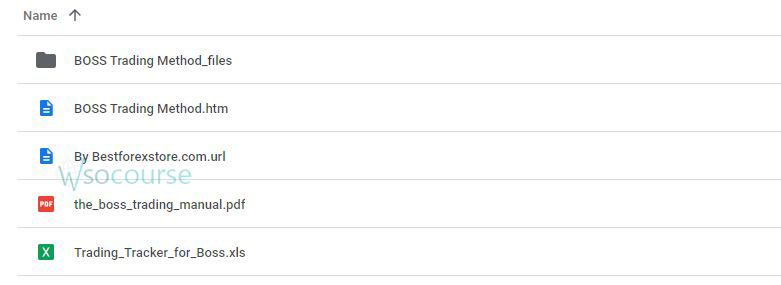

B.O.S.S (Break Out Scalping Strategy) with Lee Scholfield

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “B.O.S.S (Break Out Scalping Strategy) with Lee Scholfield” below:

B.O.S.S (Break Out Scalping Strategy) with Lee Scholfield

In the fast-paced world of trading, scalping strategies are popular for their potential to yield quick profits. Lee Scholfield’s Break Out Scalping Strategy (B.O.S.S) is a powerful method that capitalizes on market breakouts. This article delves into the intricacies of B.O.S.S, offering a detailed guide on how to implement it effectively.

Understanding Scalping Strategies

Scalping involves making numerous trades over short periods to capitalize on small price movements.

What is Scalping?

- Definition: A trading style that aims to profit from small price changes.

- Objective: To accumulate numerous small gains over time.

Why Scalping?

- Quick Profits: Scalping allows for fast gains within a trading day.

- Reduced Risk Exposure: Short holding periods mean less exposure to market risk.

Introduction to B.O.S.S

B.O.S.S focuses on identifying and trading market breakouts, a situation where the price moves beyond a defined resistance or support level.

What is B.O.S.S?

- Break Out Scalping Strategy: A technique that targets breakout points for quick trades.

- Creator: Developed by trading expert Lee Scholfield.

Why Use B.O.S.S?

- High Probability Trades: Breakouts often lead to significant price movements.

- Clear Entry and Exit Points: Defined levels make it easier to plan trades.

Key Concepts of B.O.S.S

Understanding the key concepts behind B.O.S.S is crucial for successful implementation.

Breakouts

- Definition: A breakout occurs when the price moves above a resistance level or below a support level.

- Significance: Indicates potential for strong price movements.

Support and Resistance Levels

- Support: A price level where buying interest is strong enough to prevent the price from falling further.

- Resistance: A price level where selling interest is strong enough to prevent the price from rising further.

Implementing B.O.S.S

To implement B.O.S.S effectively, follow these steps:

1. Identify Key Levels

- Chart Analysis: Use technical analysis to identify support and resistance levels.

- Historical Data: Analyze past price movements to determine these levels.

2. Monitor for Breakouts

- Real-Time Analysis: Monitor price movements in real-time to spot potential breakouts.

- Confirmation: Wait for confirmation of the breakout before entering a trade.

3. Entering Trades

- Buy Breakouts: Enter a buy trade when the price breaks above a resistance level.

- Sell Breakouts: Enter a sell trade when the price breaks below a support level.

4. Setting Stop-Loss Orders

- Risk Management: Place stop-loss orders to limit potential losses.

- Strategic Placement: Position stop-loss orders just below the breakout level for buy trades and just above for sell trades.

5. Taking Profits

- Profit Targets: Set clear profit targets based on the size of the breakout.

- Trailing Stops: Use trailing stops to lock in profits as the price moves in your favor.

Tools and Indicators for B.O.S.S

Several tools and indicators can enhance the effectiveness of B.O.S.S.

Moving Averages

- Simple Moving Average (SMA): Helps identify the overall trend.

- Exponential Moving Average (EMA): Gives more weight to recent price movements, useful for detecting breakouts.

Volume Indicators

- Volume Analysis: High volume can confirm the strength of a breakout.

- On-Balance Volume (OBV): Measures buying and selling pressure.

Relative Strength Index (RSI)

- Overbought/Oversold Conditions: Helps identify potential reversal points that can lead to breakouts.

Common Mistakes in Scalping

Avoid these common pitfalls to maximize your success with B.O.S.S.

Overtrading

- Quality Over Quantity: Focus on high-probability trades rather than making numerous low-quality trades.

Ignoring Risk Management

- Set Stop-Loss Orders: Always use stop-loss orders to manage risk.

- Limit Exposure: Avoid risking too much capital on a single trade.

Failing to Adapt

- Market Conditions: Adapt your strategy to changing market conditions.

- Continuous Learning: Stay updated with new techniques and market trends.

The Psychology of Scalping

Successful scalping requires the right mindset.

Discipline

- Stick to the Plan: Follow your trading plan without deviation.

- Emotional Control: Manage emotions to avoid impulsive decisions.

Patience

- Wait for Confirmations: Be patient and wait for clear breakout signals before entering trades.

- Consistent Effort: Scalping requires consistent monitoring and effort.

Conclusion

The Break Out Scalping Strategy (B.O.S.S) by Lee Scholfield offers a structured approach to capitalize on market breakouts. By understanding and implementing the key concepts, tools, and techniques outlined in this article, traders can enhance their trading performance and achieve consistent profits. Remember, success in scalping requires discipline, patience, and continuous learning.

FAQs

1. What is the Break Out Scalping Strategy (B.O.S.S)?

B.O.S.S is a trading strategy that focuses on identifying and trading breakouts from support and resistance levels to capitalize on significant price movements.

2. Why are support and resistance levels important in B.O.S.S?

Support and resistance levels help identify potential breakout points, providing clear entry and exit signals for trades.

3. How can I confirm a breakout?

Confirm a breakout by monitoring real-time price movements and volume. High volume often indicates a stronger breakout.

4. What tools can enhance the B.O.S.S strategy?

Tools like moving averages, volume indicators, and RSI can help identify and confirm breakouts, enhancing the effectiveness of the B.O.S.S strategy.

5. How important is risk management in scalping?

Risk management is crucial in scalping to protect your capital and minimize losses. Always use stop-loss orders and avoid overtrading.

Be the first to review “B.O.S.S (Break Out Scalping Strategy) with Lee Scholfield” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Reviews

There are no reviews yet.