-

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

7 Figures Forex Course

1 × $15.00

7 Figures Forex Course

1 × $15.00 -

×

ADR Pro For Metatrader 4.0 with Compass FX

1 × $15.00

ADR Pro For Metatrader 4.0 with Compass FX

1 × $15.00 -

×

Alternative Beta Strategies & Hedge Fund Replication with Lars Jaeger & Jeffrey Pease

1 × $6.00

Alternative Beta Strategies & Hedge Fund Replication with Lars Jaeger & Jeffrey Pease

1 × $6.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

An Ultimate Guide to Successful Investing with Trading Tuitions

1 × $23.00

An Ultimate Guide to Successful Investing with Trading Tuitions

1 × $23.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

A Really Friendly Guide to Wavelets with C.Vallens

1 × $6.00

A Really Friendly Guide to Wavelets with C.Vallens

1 × $6.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

How to Build Fortune. Trading Stock Index Futures with Dennis Minogue

1 × $6.00

How to Build Fortune. Trading Stock Index Futures with Dennis Minogue

1 × $6.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Trading Aplications of Japanese Candlestick Charting with Gary S.Wagner & Bradley L.Matheny

1 × $6.00

Trading Aplications of Japanese Candlestick Charting with Gary S.Wagner & Bradley L.Matheny

1 × $6.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

TradingMind Course with Jack Bernstein

1 × $6.00

TradingMind Course with Jack Bernstein

1 × $6.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Basic Options Course Cash Flow. Diversification. Flexibility with Michael Drew

1 × $6.00

Basic Options Course Cash Flow. Diversification. Flexibility with Michael Drew

1 × $6.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Gann Trade Real Time with Larry B.Jacobs

1 × $6.00

Gann Trade Real Time with Larry B.Jacobs

1 × $6.00 -

×

Cash Flow Investing Course

1 × $20.00

Cash Flow Investing Course

1 × $20.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

Wyckoff Unleashed Official Online Course (2018) with Wyckoffsmi

1 × $23.00

Wyckoff Unleashed Official Online Course (2018) with Wyckoffsmi

1 × $23.00 -

×

Advances in International Investments: Traditional and Alternative Approaches with Hung-Gay Fung, Xiaoqing Eleanor Xu & Jot Yau

1 × $6.00

Advances in International Investments: Traditional and Alternative Approaches with Hung-Gay Fung, Xiaoqing Eleanor Xu & Jot Yau

1 × $6.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

3 Volatility Strategies with Quantified Strategies

1 × $23.00

3 Volatility Strategies with Quantified Strategies

1 × $23.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

The Dynamic Trading Master Course with Robert Miner

1 × $54.00

The Dynamic Trading Master Course with Robert Miner

1 × $54.00 -

×

A+ Setups Big Caps Options with Jtrader

1 × $6.00

A+ Setups Big Caps Options with Jtrader

1 × $6.00 -

×

The Raptor 10 Momentum Methodology Course

1 × $6.00

The Raptor 10 Momentum Methodology Course

1 × $6.00 -

×

Master Forex Fundamentals

1 × $15.00

Master Forex Fundamentals

1 × $15.00 -

×

How to Use Gann Techniques to Implement a Trading System

1 × $6.00

How to Use Gann Techniques to Implement a Trading System

1 × $6.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Advanced Trading System - How To 10x Your Trading Skillsets & Results with The Trade Academy

1 × $6.00

Advanced Trading System - How To 10x Your Trading Skillsets & Results with The Trade Academy

1 × $6.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Slapped by the Invisible Hand: The Panic of 2007 with Gary Gorton

1 × $6.00

Slapped by the Invisible Hand: The Panic of 2007 with Gary Gorton

1 × $6.00 -

×

Advanced Strategies for Option Trading Success with James Bittman

1 × $6.00

Advanced Strategies for Option Trading Success with James Bittman

1 × $6.00 -

×

Quantitative Trading and Money Management, Revised Edition (5th Edition) with Fred Gehm

1 × $6.00

Quantitative Trading and Money Management, Revised Edition (5th Edition) with Fred Gehm

1 × $6.00 -

×

CarterFX Membership with Duran Carter

1 × $23.00

CarterFX Membership with Duran Carter

1 × $23.00 -

×

Harmonic Elliott Wave: The Case for Modification of R. N. Elliott's Impulsive Wave Structure with Ian Copsey

1 × $6.00

Harmonic Elliott Wave: The Case for Modification of R. N. Elliott's Impulsive Wave Structure with Ian Copsey

1 × $6.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

Small Account Options Trading Workshop Package with Doc Severson

1 × $6.00

Small Account Options Trading Workshop Package with Doc Severson

1 × $6.00 -

×

All About Stock Market Strategies: The Easy Way To Get Started (All About Series) with David Brown

1 × $6.00

All About Stock Market Strategies: The Easy Way To Get Started (All About Series) with David Brown

1 × $6.00 -

×

ProfileTraders - 5 course bundle

1 × $23.00

ProfileTraders - 5 course bundle

1 × $23.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

Volume Profile 2023 (Order Flow Pack) with Trader Dale

1 × $5.00

Volume Profile 2023 (Order Flow Pack) with Trader Dale

1 × $5.00 -

×

Natural Language Processing in Trading with Dr. Terry Benzschawel

1 × $31.00

Natural Language Processing in Trading with Dr. Terry Benzschawel

1 × $31.00 -

×

The Internet Trading Course with Alpesh Patel

1 × $6.00

The Internet Trading Course with Alpesh Patel

1 × $6.00 -

×

A PLAN TO MAKE $4K MONTHLY ON $20K with Dan Sheridan - Sheridan Options Mentoring

1 × $15.00

A PLAN TO MAKE $4K MONTHLY ON $20K with Dan Sheridan - Sheridan Options Mentoring

1 × $15.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Volume Profile 2023 (Elite Pack) with Trader Dale

1 × $5.00

Volume Profile 2023 (Elite Pack) with Trader Dale

1 × $5.00 -

×

PRO COURSE Order Flow Strategy with Gova Trading Academy

1 × $5.00

PRO COURSE Order Flow Strategy with Gova Trading Academy

1 × $5.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

Dan Sheridan Delta Force

1 × $6.00

Dan Sheridan Delta Force

1 × $6.00 -

×

How to Analyze Multifamily Investment Opportunities with Symon He & Brandon Young

1 × $6.00

How to Analyze Multifamily Investment Opportunities with Symon He & Brandon Young

1 × $6.00 -

×

Options Bootcamp with Sid Woolfolk

1 × $6.00

Options Bootcamp with Sid Woolfolk

1 × $6.00 -

×

Limitless Trading Academy with Lorenzo Corrado

1 × $10.00

Limitless Trading Academy with Lorenzo Corrado

1 × $10.00

B.O.S.S (Break Out Scalping Strategy) with Lee Scholfield

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

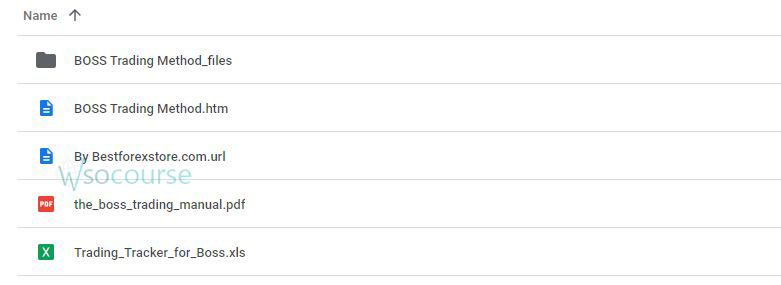

You may check content proof of “B.O.S.S (Break Out Scalping Strategy) with Lee Scholfield” below:

B.O.S.S (Break Out Scalping Strategy) with Lee Scholfield

In the fast-paced world of trading, scalping strategies are popular for their potential to yield quick profits. Lee Scholfield’s Break Out Scalping Strategy (B.O.S.S) is a powerful method that capitalizes on market breakouts. This article delves into the intricacies of B.O.S.S, offering a detailed guide on how to implement it effectively.

Understanding Scalping Strategies

Scalping involves making numerous trades over short periods to capitalize on small price movements.

What is Scalping?

- Definition: A trading style that aims to profit from small price changes.

- Objective: To accumulate numerous small gains over time.

Why Scalping?

- Quick Profits: Scalping allows for fast gains within a trading day.

- Reduced Risk Exposure: Short holding periods mean less exposure to market risk.

Introduction to B.O.S.S

B.O.S.S focuses on identifying and trading market breakouts, a situation where the price moves beyond a defined resistance or support level.

What is B.O.S.S?

- Break Out Scalping Strategy: A technique that targets breakout points for quick trades.

- Creator: Developed by trading expert Lee Scholfield.

Why Use B.O.S.S?

- High Probability Trades: Breakouts often lead to significant price movements.

- Clear Entry and Exit Points: Defined levels make it easier to plan trades.

Key Concepts of B.O.S.S

Understanding the key concepts behind B.O.S.S is crucial for successful implementation.

Breakouts

- Definition: A breakout occurs when the price moves above a resistance level or below a support level.

- Significance: Indicates potential for strong price movements.

Support and Resistance Levels

- Support: A price level where buying interest is strong enough to prevent the price from falling further.

- Resistance: A price level where selling interest is strong enough to prevent the price from rising further.

Implementing B.O.S.S

To implement B.O.S.S effectively, follow these steps:

1. Identify Key Levels

- Chart Analysis: Use technical analysis to identify support and resistance levels.

- Historical Data: Analyze past price movements to determine these levels.

2. Monitor for Breakouts

- Real-Time Analysis: Monitor price movements in real-time to spot potential breakouts.

- Confirmation: Wait for confirmation of the breakout before entering a trade.

3. Entering Trades

- Buy Breakouts: Enter a buy trade when the price breaks above a resistance level.

- Sell Breakouts: Enter a sell trade when the price breaks below a support level.

4. Setting Stop-Loss Orders

- Risk Management: Place stop-loss orders to limit potential losses.

- Strategic Placement: Position stop-loss orders just below the breakout level for buy trades and just above for sell trades.

5. Taking Profits

- Profit Targets: Set clear profit targets based on the size of the breakout.

- Trailing Stops: Use trailing stops to lock in profits as the price moves in your favor.

Tools and Indicators for B.O.S.S

Several tools and indicators can enhance the effectiveness of B.O.S.S.

Moving Averages

- Simple Moving Average (SMA): Helps identify the overall trend.

- Exponential Moving Average (EMA): Gives more weight to recent price movements, useful for detecting breakouts.

Volume Indicators

- Volume Analysis: High volume can confirm the strength of a breakout.

- On-Balance Volume (OBV): Measures buying and selling pressure.

Relative Strength Index (RSI)

- Overbought/Oversold Conditions: Helps identify potential reversal points that can lead to breakouts.

Common Mistakes in Scalping

Avoid these common pitfalls to maximize your success with B.O.S.S.

Overtrading

- Quality Over Quantity: Focus on high-probability trades rather than making numerous low-quality trades.

Ignoring Risk Management

- Set Stop-Loss Orders: Always use stop-loss orders to manage risk.

- Limit Exposure: Avoid risking too much capital on a single trade.

Failing to Adapt

- Market Conditions: Adapt your strategy to changing market conditions.

- Continuous Learning: Stay updated with new techniques and market trends.

The Psychology of Scalping

Successful scalping requires the right mindset.

Discipline

- Stick to the Plan: Follow your trading plan without deviation.

- Emotional Control: Manage emotions to avoid impulsive decisions.

Patience

- Wait for Confirmations: Be patient and wait for clear breakout signals before entering trades.

- Consistent Effort: Scalping requires consistent monitoring and effort.

Conclusion

The Break Out Scalping Strategy (B.O.S.S) by Lee Scholfield offers a structured approach to capitalize on market breakouts. By understanding and implementing the key concepts, tools, and techniques outlined in this article, traders can enhance their trading performance and achieve consistent profits. Remember, success in scalping requires discipline, patience, and continuous learning.

FAQs

1. What is the Break Out Scalping Strategy (B.O.S.S)?

B.O.S.S is a trading strategy that focuses on identifying and trading breakouts from support and resistance levels to capitalize on significant price movements.

2. Why are support and resistance levels important in B.O.S.S?

Support and resistance levels help identify potential breakout points, providing clear entry and exit signals for trades.

3. How can I confirm a breakout?

Confirm a breakout by monitoring real-time price movements and volume. High volume often indicates a stronger breakout.

4. What tools can enhance the B.O.S.S strategy?

Tools like moving averages, volume indicators, and RSI can help identify and confirm breakouts, enhancing the effectiveness of the B.O.S.S strategy.

5. How important is risk management in scalping?

Risk management is crucial in scalping to protect your capital and minimize losses. Always use stop-loss orders and avoid overtrading.

Be the first to review “B.O.S.S (Break Out Scalping Strategy) with Lee Scholfield” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.