-

×

Voodoo Lines Indicator

1 × $62.00

Voodoo Lines Indicator

1 × $62.00 -

×

Uncover Resilient Stocks in Today’s Market with Peter Worden

1 × $6.00

Uncover Resilient Stocks in Today’s Market with Peter Worden

1 × $6.00 -

×

ART Online 4 Weeks Home Study Course with Bennett McDowell

1 × $78.00

ART Online 4 Weeks Home Study Course with Bennett McDowell

1 × $78.00 -

×

System Building Masterclass

1 × $31.00

System Building Masterclass

1 × $31.00 -

×

Open Trader Pro Training

1 × $23.00

Open Trader Pro Training

1 × $23.00 -

×

Breakthrough Strategies for Predicting Any Market: Charting Elliott Wave, Lucas, Fibonacci and Time for Profit - Jeff Greenblatt & Dawn Bolton-Smith

1 × $6.00

Breakthrough Strategies for Predicting Any Market: Charting Elliott Wave, Lucas, Fibonacci and Time for Profit - Jeff Greenblatt & Dawn Bolton-Smith

1 × $6.00 -

×

Winning the Losers Game with Charles Ellis

1 × $6.00

Winning the Losers Game with Charles Ellis

1 × $6.00 -

×

The Point of Control and Imbalance Course with Mike Valtos - Orderflows

1 × $15.00

The Point of Control and Imbalance Course with Mike Valtos - Orderflows

1 × $15.00 -

×

ZipTraderU 2022 - Your Map To The Stock Market with ZipTrader

1 × $69.00

ZipTraderU 2022 - Your Map To The Stock Market with ZipTrader

1 × $69.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

The Market Masters: Wall Street's Top Investment Pros Reveal How to Make Money in Both Bull and Bear Markets - Kirk Kazanjian

1 × $6.00

The Market Masters: Wall Street's Top Investment Pros Reveal How to Make Money in Both Bull and Bear Markets - Kirk Kazanjian

1 × $6.00 -

×

Trend Following: How Great Traders Make Millions in Up or Down Markets with Michael Covel

1 × $6.00

Trend Following: How Great Traders Make Millions in Up or Down Markets with Michael Covel

1 × $6.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

Day Trading the Currency Market: Technical and Fundamental Strategies To Profit from Market Swings with Kathy Lien

1 × $6.00

Day Trading the Currency Market: Technical and Fundamental Strategies To Profit from Market Swings with Kathy Lien

1 × $6.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Rapid Cash & Success System

1 × $31.00

Rapid Cash & Success System

1 × $31.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

Complete Set of Members Area Files

1 × $6.00

Complete Set of Members Area Files

1 × $6.00 -

×

PFA SD Model Trading System (Apr 2013)

1 × $31.00

PFA SD Model Trading System (Apr 2013)

1 × $31.00 -

×

Momentum Explained. Vol.1

1 × $6.00

Momentum Explained. Vol.1

1 × $6.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

How to Use Spreads to Construct a Trading Roadmap

1 × $6.00

How to Use Spreads to Construct a Trading Roadmap

1 × $6.00 -

×

Create Winning MT4/MT5 Forex Trading Robots without Coding - Ransom Enupe

1 × $6.00

Create Winning MT4/MT5 Forex Trading Robots without Coding - Ransom Enupe

1 × $6.00 -

×

Longlived Information & Intraday Pattern (Article) with Back and Andersen

1 × $6.00

Longlived Information & Intraday Pattern (Article) with Back and Andersen

1 × $6.00 -

×

Core Strategy Program with Ota Courses

1 × $174.00

Core Strategy Program with Ota Courses

1 × $174.00 -

×

Trend Trading: Timing Market Tides with Kedrick Brown

1 × $6.00

Trend Trading: Timing Market Tides with Kedrick Brown

1 × $6.00 -

×

Trading The Connors Windows Strategy with Larry Connors

1 × $6.00

Trading The Connors Windows Strategy with Larry Connors

1 × $6.00 -

×

Monthly Mastermind

1 × $6.00

Monthly Mastermind

1 × $6.00 -

×

The Septiform System of the Cosmos with Alec Stuart

1 × $6.00

The Septiform System of the Cosmos with Alec Stuart

1 × $6.00 -

×

Forex Trading for Newbies Complete Course with Chuck Low

1 × $6.00

Forex Trading for Newbies Complete Course with Chuck Low

1 × $6.00 -

×

Value Based Power Trading

1 × $6.00

Value Based Power Trading

1 × $6.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Classical Technical Analysis as a Powerful Trading Methodology with John Tirone

1 × $4.00

Classical Technical Analysis as a Powerful Trading Methodology with John Tirone

1 × $4.00 -

×

Best & Simple Forex day trading strategy with Forex day trading

1 × $5.00

Best & Simple Forex day trading strategy with Forex day trading

1 × $5.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

ZCFX Trading Course 2023 with ZCFX Trading

1 × $5.00

ZCFX Trading Course 2023 with ZCFX Trading

1 × $5.00 -

×

Read the Greed. Take the Money & Teleseminar

1 × $6.00

Read the Greed. Take the Money & Teleseminar

1 × $6.00 -

×

London Super Conference 2019

1 × $62.00

London Super Conference 2019

1 × $62.00 -

×

Trading Trend Pullbacks - 3-Step Technical Analysis Method with Richard Deutsch

1 × $6.00

Trading Trend Pullbacks - 3-Step Technical Analysis Method with Richard Deutsch

1 × $6.00 -

×

Beat The Binaries

1 × $15.00

Beat The Binaries

1 × $15.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

Market Geometry Mentoring Sessions with Timothy Morge

1 × $69.00

Market Geometry Mentoring Sessions with Timothy Morge

1 × $69.00 -

×

Sacredscience - Sepharial – Your Personal Diurnal Chart

1 × $6.00

Sacredscience - Sepharial – Your Personal Diurnal Chart

1 × $6.00 -

×

The Ultimate Option Guide When & How to Use Which Strategy for The Best Results with Larry Gaines - Power Cycle Trading

1 × $39.00

The Ultimate Option Guide When & How to Use Which Strategy for The Best Results with Larry Gaines - Power Cycle Trading

1 × $39.00 -

×

DayTradeMax

1 × $31.00

DayTradeMax

1 × $31.00 -

×

Intermediate Stock Course

1 × $54.00

Intermediate Stock Course

1 × $54.00 -

×

The SPX 35-40 Day Delta Neutral Unbalanced Butterfly with Sheridan Options Mentoring

1 × $15.00

The SPX 35-40 Day Delta Neutral Unbalanced Butterfly with Sheridan Options Mentoring

1 × $15.00 -

×

Enhancing Technical Analysis with Planetary Price & Price Factors

1 × $6.00

Enhancing Technical Analysis with Planetary Price & Price Factors

1 × $6.00 -

×

Trading High-Momentum Stocks with Landry Persistent Pullbacks

1 × $15.00

Trading High-Momentum Stocks with Landry Persistent Pullbacks

1 × $15.00 -

×

Regression Diagnostics: Identifying Influential Data and Sources of Collinearity with David Belsey, Edwin Kuh & Roy Welsch

1 × $6.00

Regression Diagnostics: Identifying Influential Data and Sources of Collinearity with David Belsey, Edwin Kuh & Roy Welsch

1 × $6.00

Bond Market Course with The Macro Compass

$499.00 Original price was: $499.00.$15.00Current price is: $15.00.

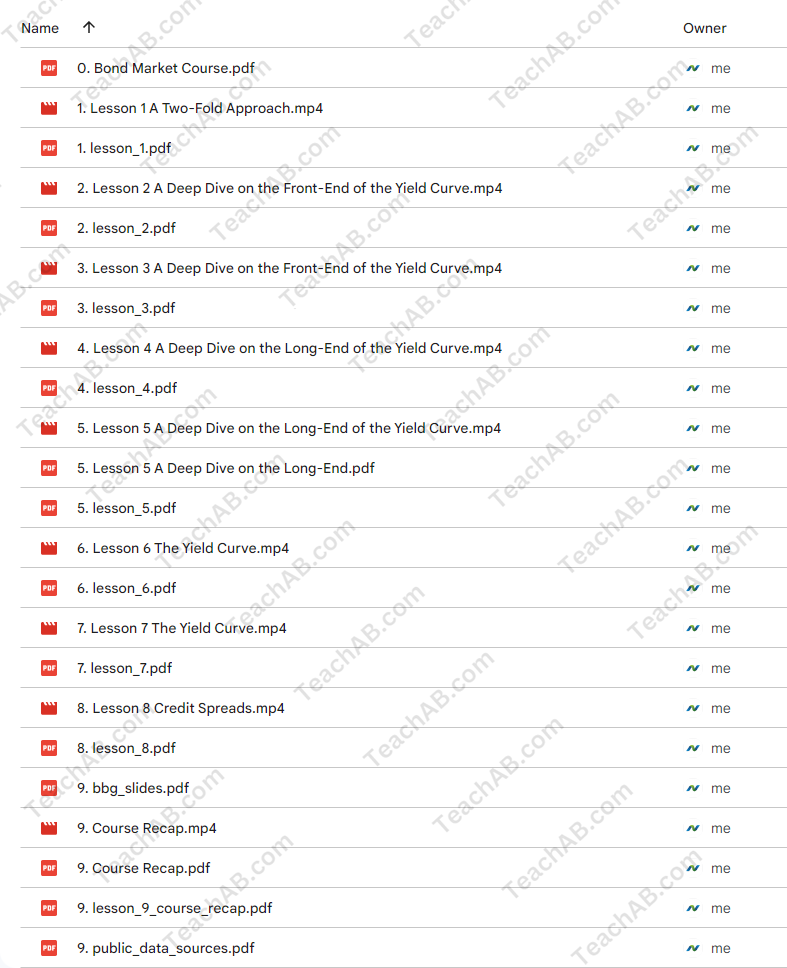

You may check content proof of “Bond Market Course with The Macro Compass ” below:

Course on Bond Markets

Without a thorough understanding of the bond market, macroinvesting is like trying to eat soup with a fork—you can make it, but it’s difficult and unsatisfactory.

Many people are put off by the bond market because of its insider knowledge and language, but that is all changing today with Alf’s Bond Market Course!

Course Synopsis

Lesson 1:

A Dual Method To Truly Comprehend The Bond Market

Your comprehension of the principles underlying bond yields will soar thanks to Alf’s blend of his technical and macro strategies.

Lesson 2+3:

An Extensive Examination of the Yield Curve’s Front End

The front end of the yield curve is where it all begins:

Although central banks have a significant impact on short-term yields, there are other subtleties to take into consideration.

Repo markets, interbank rates, government bonds, OIS, etc.Are you prepared to do it?

Lesson 4+5:

An In-Depth Exam of the Yield Curve’s Long End

Let’s move our attention to the long end of the bond market and examine the factors that influence the world’s largest purchasers’ decisions, the macro factors that influence long-end rates, and how to use bond yields to your advantage when analyzing the macro cycle!

The Yield Curve in Lesson 6-7:

Yes, we have Dr. Yield Curve here! This lesson serves as an introduction to the concepts behind how the yield curve’s structure influences the economic cycle.

Furthermore, we will research every yield curve regime and how it affects other asset classes to make sure your portfolio is always ready for the next big boom!

Lesson 8:

Spreads of Credit

Since credit spreads influence how expensive or inexpensive leverage is for the private sector, they are a crucial macro variable to monitor. We explore the macro and technical facets of credit markets in this lesson!

Course Summary

A brief rundown of all you learned.

Additionally, you’ll get a really helpful collection of slides that walk you through all the (public) data sources so you can monitor all these variables and put all you’ve learned in this bond market course to work!

Frequently Asked Questions:

- Business Model Innovation:

Embrace our legitimate business model! We organize group buys, allowing participants to share costs for popular courses, making them accessible to those with limited financial resources. Our approach ensures affordability and accessibility, despite author concerns. - The Legal Environment:

The legality of our activity is uncertain. While we lack specific permission from course authors, there’s a technicality: authors didn’t impose resale limits upon course purchase. This presents both an opportunity for us and a benefit for individuals seeking low-cost access. - Quality Control:

Unveiling the Truth

Quality is paramount. Purchasing courses directly from sales pages ensures consistency with traditionally obtained materials. However, we’re not official course providers and don’t offer premium services:

- No scheduled coaching calls or sessions with the author.

- No access to the author’s private Facebook group or web portal.

- No entry to the author’s private membership forum.

- Direct email support from the author or their team is unavailable.Operating independently, we aim to bridge the pricing gap without additional services provided by official channels. Your understanding of our unique approach is valued.

Be the first to review “Bond Market Course with The Macro Compass” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.