-

×

Mastering The ICO: Spotting Needles In A Haystack with Alphashark

1 × $39.00

Mastering The ICO: Spotting Needles In A Haystack with Alphashark

1 × $39.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

FX Masterclass 2.0 with Uprise Academy

1 × $26.00

FX Masterclass 2.0 with Uprise Academy

1 × $26.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

Indian Time Cycles and Market Forecasting with Barry William Rosen

1 × $7.00

Indian Time Cycles and Market Forecasting with Barry William Rosen

1 × $7.00 -

×

Learn how to trade Volatility 75 Index Technical Analysis with Patrick Muke

1 × $6.00

Learn how to trade Volatility 75 Index Technical Analysis with Patrick Muke

1 × $6.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

Forex & Fibonacci Day Trading Seminar - $695

1 × $6.00

Forex & Fibonacci Day Trading Seminar - $695

1 × $6.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

The Sixth Market. The Electronic Investor Revolution with Howard Abell

1 × $6.00

The Sixth Market. The Electronic Investor Revolution with Howard Abell

1 × $6.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Lifespan Investing with Clifford Pistolese

1 × $6.00

Lifespan Investing with Clifford Pistolese

1 × $6.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

Self-Destructing Trader with Ryan Jonesc

1 × $6.00

Self-Destructing Trader with Ryan Jonesc

1 × $6.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

The Options Applications Handbook: Hedging and Speculating Techniques for Professional Investors - Erik Banks & Paul Siegel

1 × $6.00

The Options Applications Handbook: Hedging and Speculating Techniques for Professional Investors - Erik Banks & Paul Siegel

1 × $6.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

60 Seconds Sure Shot Strategy with Albert E

1 × $6.00

60 Seconds Sure Shot Strategy with Albert E

1 × $6.00 -

×

5 Part Daytrading Course with Kevin Haggerty

1 × $6.00

5 Part Daytrading Course with Kevin Haggerty

1 × $6.00 -

×

The Stock Investor's Pocket Calculator with Michael Thomsett

1 × $6.00

The Stock Investor's Pocket Calculator with Michael Thomsett

1 × $6.00 -

×

Forecasting Profits Using Price & Time with Ed Gately

1 × $6.00

Forecasting Profits Using Price & Time with Ed Gately

1 × $6.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

Introduction to Fibonacci Time Analysis with Carolyn Boroden

1 × $6.00

Introduction to Fibonacci Time Analysis with Carolyn Boroden

1 × $6.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

Bond Market Course with The Macro Compass

$499.00 Original price was: $499.00.$15.00Current price is: $15.00.

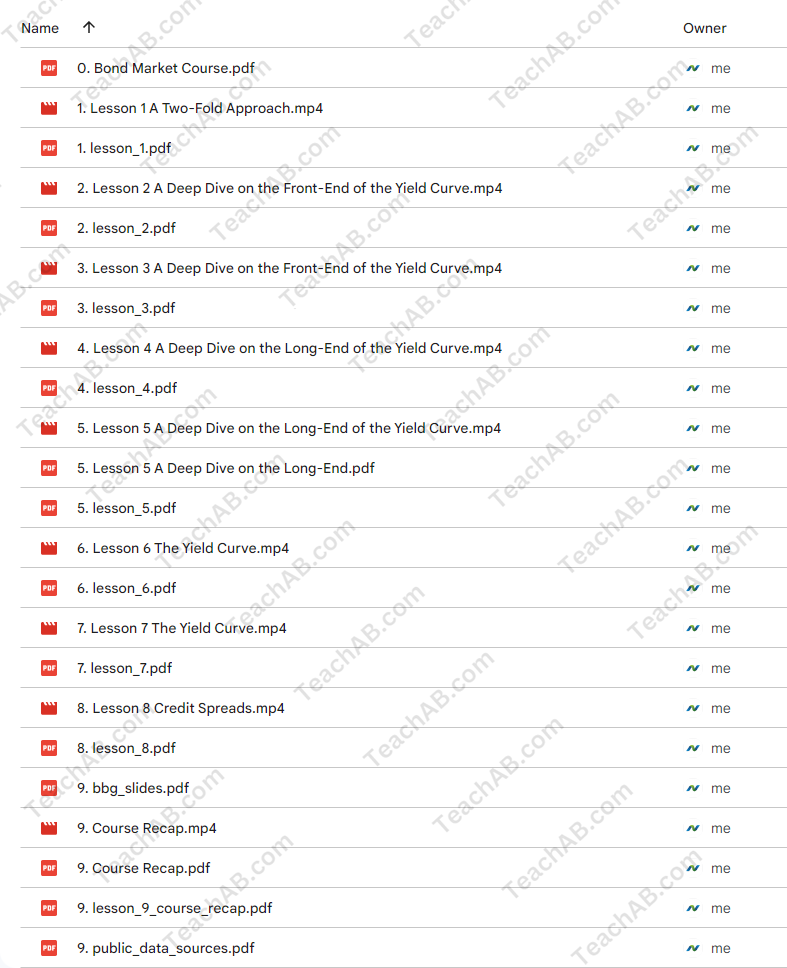

You may check content proof of “Bond Market Course with The Macro Compass ” below:

Course on Bond Markets

Without a thorough understanding of the bond market, macroinvesting is like trying to eat soup with a fork—you can make it, but it’s difficult and unsatisfactory.

Many people are put off by the bond market because of its insider knowledge and language, but that is all changing today with Alf’s Bond Market Course!

Course Synopsis

Lesson 1:

A Dual Method To Truly Comprehend The Bond Market

Your comprehension of the principles underlying bond yields will soar thanks to Alf’s blend of his technical and macro strategies.

Lesson 2+3:

An Extensive Examination of the Yield Curve’s Front End

The front end of the yield curve is where it all begins:

Although central banks have a significant impact on short-term yields, there are other subtleties to take into consideration.

Repo markets, interbank rates, government bonds, OIS, etc.Are you prepared to do it?

Lesson 4+5:

An In-Depth Exam of the Yield Curve’s Long End

Let’s move our attention to the long end of the bond market and examine the factors that influence the world’s largest purchasers’ decisions, the macro factors that influence long-end rates, and how to use bond yields to your advantage when analyzing the macro cycle!

The Yield Curve in Lesson 6-7:

Yes, we have Dr. Yield Curve here! This lesson serves as an introduction to the concepts behind how the yield curve’s structure influences the economic cycle.

Furthermore, we will research every yield curve regime and how it affects other asset classes to make sure your portfolio is always ready for the next big boom!

Lesson 8:

Spreads of Credit

Since credit spreads influence how expensive or inexpensive leverage is for the private sector, they are a crucial macro variable to monitor. We explore the macro and technical facets of credit markets in this lesson!

Course Summary

A brief rundown of all you learned.

Additionally, you’ll get a really helpful collection of slides that walk you through all the (public) data sources so you can monitor all these variables and put all you’ve learned in this bond market course to work!

Frequently Asked Questions:

- Business Model Innovation:

Embrace our legitimate business model! We organize group buys, allowing participants to share costs for popular courses, making them accessible to those with limited financial resources. Our approach ensures affordability and accessibility, despite author concerns. - The Legal Environment:

The legality of our activity is uncertain. While we lack specific permission from course authors, there’s a technicality: authors didn’t impose resale limits upon course purchase. This presents both an opportunity for us and a benefit for individuals seeking low-cost access. - Quality Control:

Unveiling the Truth

Quality is paramount. Purchasing courses directly from sales pages ensures consistency with traditionally obtained materials. However, we’re not official course providers and don’t offer premium services:

- No scheduled coaching calls or sessions with the author.

- No access to the author’s private Facebook group or web portal.

- No entry to the author’s private membership forum.

- Direct email support from the author or their team is unavailable.Operating independently, we aim to bridge the pricing gap without additional services provided by official channels. Your understanding of our unique approach is valued.

Be the first to review “Bond Market Course with The Macro Compass” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.