-

×

The 10 Essentials of Forex Trading with Jared Martinez

1 × $6.00

The 10 Essentials of Forex Trading with Jared Martinez

1 × $6.00 -

×

The Multi-Fractal Markets Educational Course with Dylan Forexia

1 × $39.00

The Multi-Fractal Markets Educational Course with Dylan Forexia

1 × $39.00 -

×

Toolkit For Thinkorswim with Bigtrends

1 × $54.00

Toolkit For Thinkorswim with Bigtrends

1 × $54.00 -

×

Learn to Make Money Trading Options

1 × $6.00

Learn to Make Money Trading Options

1 × $6.00 -

×

Jtrader - Risk Management 1on1

1 × $23.00

Jtrader - Risk Management 1on1

1 × $23.00 -

×

Valuing Employee Stock Options with Johnathan Mun

1 × $6.00

Valuing Employee Stock Options with Johnathan Mun

1 × $6.00 -

×

Intra-Day Trading Strategies. Proven Steps to Short-Term Trading Profits with Jeff Cooper

1 × $4.00

Intra-Day Trading Strategies. Proven Steps to Short-Term Trading Profits with Jeff Cooper

1 × $4.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

Day Trading Insight with Al Brooks

1 × $10.00

Day Trading Insight with Al Brooks

1 × $10.00 -

×

Unlocking Success in ICT 2022 Mentorship: The Smart Money Guide to The Full ICT Day Trading Model by LumiTraders & Darya Filipenka

1 × $5.00

Unlocking Success in ICT 2022 Mentorship: The Smart Money Guide to The Full ICT Day Trading Model by LumiTraders & Darya Filipenka

1 × $5.00 -

×

DayTrading the S&P Futures Market with Constance Brown

1 × $6.00

DayTrading the S&P Futures Market with Constance Brown

1 × $6.00 -

×

Day Trading MasterClass with Tyrone Abela - FX Evolution

1 × $139.00

Day Trading MasterClass with Tyrone Abela - FX Evolution

1 × $139.00 -

×

The Power Trade System by Arthur Christian & John Prow

1 × $6.00

The Power Trade System by Arthur Christian & John Prow

1 × $6.00 -

×

The 3 Dimensional Trading Breakthrough with Brian Schad

1 × $6.00

The 3 Dimensional Trading Breakthrough with Brian Schad

1 × $6.00 -

×

Trading Analysis Crash Course

1 × $23.00

Trading Analysis Crash Course

1 × $23.00 -

×

XJO Quant - High Probability Trading Setups on ASX 200 Index

1 × $31.00

XJO Quant - High Probability Trading Setups on ASX 200 Index

1 × $31.00 -

×

Intra-Day Trading with Market Internals I with Greg Capra

1 × $6.00

Intra-Day Trading with Market Internals I with Greg Capra

1 × $6.00 -

×

Market Controller Course with Controller FX

1 × $5.00

Market Controller Course with Controller FX

1 × $5.00 -

×

Using Long, Medium and Short Term Trends to Forecast Turning Points (Article)

1 × $6.00

Using Long, Medium and Short Term Trends to Forecast Turning Points (Article)

1 × $6.00 -

×

European Fixed Income Markets with Jonathan Batten

1 × $6.00

European Fixed Income Markets with Jonathan Batten

1 × $6.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00

Bond Market Course with The Macro Compass

$499.00 Original price was: $499.00.$15.00Current price is: $15.00.

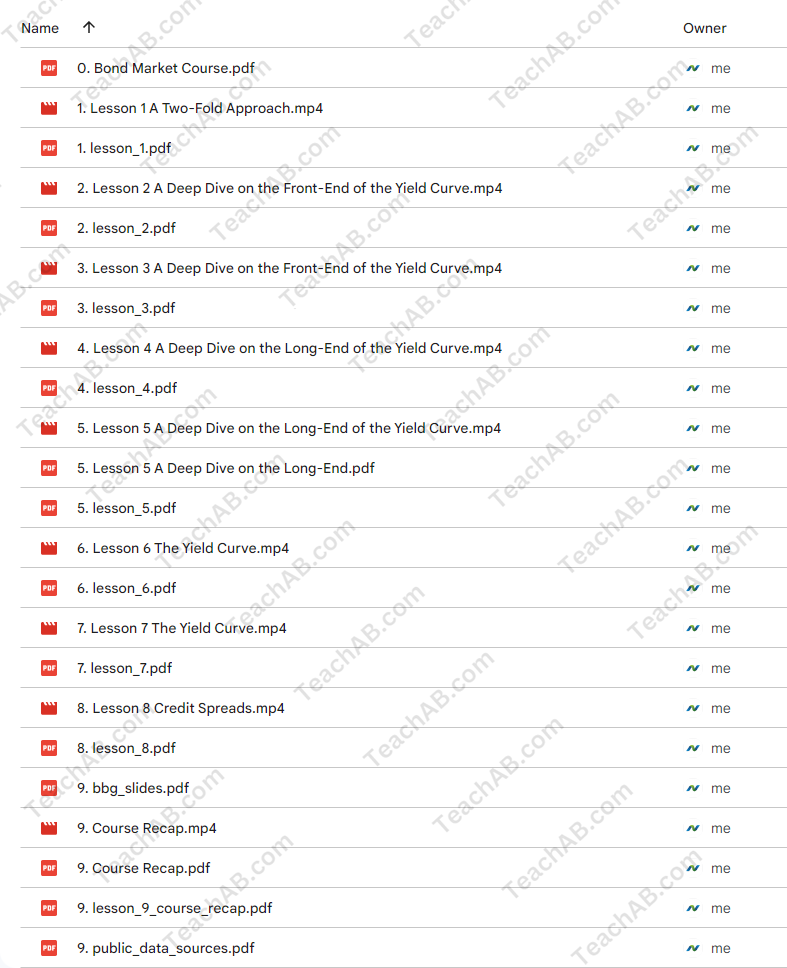

You may check content proof of “Bond Market Course with The Macro Compass ” below:

Course on Bond Markets

Without a thorough understanding of the bond market, macroinvesting is like trying to eat soup with a fork—you can make it, but it’s difficult and unsatisfactory.

Many people are put off by the bond market because of its insider knowledge and language, but that is all changing today with Alf’s Bond Market Course!

Course Synopsis

Lesson 1:

A Dual Method To Truly Comprehend The Bond Market

Your comprehension of the principles underlying bond yields will soar thanks to Alf’s blend of his technical and macro strategies.

Lesson 2+3:

An Extensive Examination of the Yield Curve’s Front End

The front end of the yield curve is where it all begins:

Although central banks have a significant impact on short-term yields, there are other subtleties to take into consideration.

Repo markets, interbank rates, government bonds, OIS, etc.Are you prepared to do it?

Lesson 4+5:

An In-Depth Exam of the Yield Curve’s Long End

Let’s move our attention to the long end of the bond market and examine the factors that influence the world’s largest purchasers’ decisions, the macro factors that influence long-end rates, and how to use bond yields to your advantage when analyzing the macro cycle!

The Yield Curve in Lesson 6-7:

Yes, we have Dr. Yield Curve here! This lesson serves as an introduction to the concepts behind how the yield curve’s structure influences the economic cycle.

Furthermore, we will research every yield curve regime and how it affects other asset classes to make sure your portfolio is always ready for the next big boom!

Lesson 8:

Spreads of Credit

Since credit spreads influence how expensive or inexpensive leverage is for the private sector, they are a crucial macro variable to monitor. We explore the macro and technical facets of credit markets in this lesson!

Course Summary

A brief rundown of all you learned.

Additionally, you’ll get a really helpful collection of slides that walk you through all the (public) data sources so you can monitor all these variables and put all you’ve learned in this bond market course to work!

Frequently Asked Questions:

- Business Model Innovation:

Embrace our legitimate business model! We organize group buys, allowing participants to share costs for popular courses, making them accessible to those with limited financial resources. Our approach ensures affordability and accessibility, despite author concerns. - The Legal Environment:

The legality of our activity is uncertain. While we lack specific permission from course authors, there’s a technicality: authors didn’t impose resale limits upon course purchase. This presents both an opportunity for us and a benefit for individuals seeking low-cost access. - Quality Control:

Unveiling the Truth

Quality is paramount. Purchasing courses directly from sales pages ensures consistency with traditionally obtained materials. However, we’re not official course providers and don’t offer premium services:

- No scheduled coaching calls or sessions with the author.

- No access to the author’s private Facebook group or web portal.

- No entry to the author’s private membership forum.

- Direct email support from the author or their team is unavailable.Operating independently, we aim to bridge the pricing gap without additional services provided by official channels. Your understanding of our unique approach is valued.

Be the first to review “Bond Market Course with The Macro Compass” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.