-

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Exacttrading - Price Action Trader Course

1 × $15.00

Exacttrading - Price Action Trader Course

1 × $15.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Trading the Pristine Method 2008 (Videos & Workbooks) with Pristine

1 × $4.00

Trading the Pristine Method 2008 (Videos & Workbooks) with Pristine

1 × $4.00 -

×

The Zone Trader Training Series with Timon Weller

1 × $8.00

The Zone Trader Training Series with Timon Weller

1 × $8.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Market Profile Training with Futexlive

1 × $23.00

Market Profile Training with Futexlive

1 × $23.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

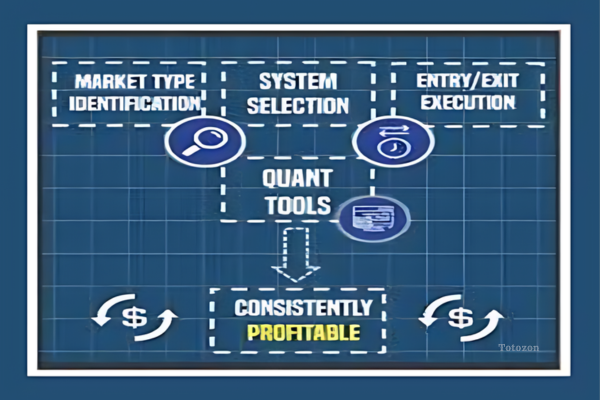

The Profitable Trading System Blueprint with Macro Ops

1 × $6.00

The Profitable Trading System Blueprint with Macro Ops

1 × $6.00 -

×

Day Trading Systems & Methods with Charles Le Beau, David Lucas

1 × $6.00

Day Trading Systems & Methods with Charles Le Beau, David Lucas

1 × $6.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Zen8 Forex Hedging Program with Hugh Kimura - Trading Heroes

1 × $5.00

Zen8 Forex Hedging Program with Hugh Kimura - Trading Heroes

1 × $5.00 -

×

Going Global 2015

1 × $6.00

Going Global 2015

1 × $6.00 -

×

Equity Derivates with Marcus Overhaus, Andrew Ferraris, Thomas Knudsen, Ross Milward, Laurent Nguyen-Ngoc & Gero Schindlmayr

1 × $6.00

Equity Derivates with Marcus Overhaus, Andrew Ferraris, Thomas Knudsen, Ross Milward, Laurent Nguyen-Ngoc & Gero Schindlmayr

1 × $6.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Order Flow Trader Education

1 × $15.00

Order Flow Trader Education

1 × $15.00 -

×

Managing Your Goals with Alec MacKenzie

1 × $6.00

Managing Your Goals with Alec MacKenzie

1 × $6.00 -

×

Swinging For The Fences

1 × $15.00

Swinging For The Fences

1 × $15.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

FOREX MASTER TRADING COURSE with BKFOREX

1 × $5.00

FOREX MASTER TRADING COURSE with BKFOREX

1 × $5.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

INSIDER HEDGE FUND FORMULA (IHFF)

1 × $6.00

INSIDER HEDGE FUND FORMULA (IHFF)

1 × $6.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

Trading the Eclipses

1 × $6.00

Trading the Eclipses

1 × $6.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

Self-Study Day Trading Course

1 × $39.00

Self-Study Day Trading Course

1 × $39.00 -

×

Power Cycle Trading The Ultimate Option Guide: When & How to Use Which Option Strategy For the Best Results - Powercycletrading

1 × $69.00

Power Cycle Trading The Ultimate Option Guide: When & How to Use Which Option Strategy For the Best Results - Powercycletrading

1 × $69.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

The BFI Trading Course

1 × $6.00

The BFI Trading Course

1 × $6.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Trade Like Warren Buffett with James Altucher

1 × $6.00

Trade Like Warren Buffett with James Altucher

1 × $6.00 -

×

The New Technical Trader with Chande Kroll

1 × $6.00

The New Technical Trader with Chande Kroll

1 × $6.00 -

×

W.D.Ganns Astrological Method

1 × $6.00

W.D.Ganns Astrological Method

1 × $6.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Pit Bull with Martin Schwartz

1 × $6.00

Pit Bull with Martin Schwartz

1 × $6.00 -

×

Ichimokutrade - Ichimoku 101

1 × $15.00

Ichimokutrade - Ichimoku 101

1 × $15.00 -

×

Buy the Fear Sell the Greed

1 × $6.00

Buy the Fear Sell the Greed

1 × $6.00 -

×

Options Trading Course with Consistent Options Income

1 × $5.00

Options Trading Course with Consistent Options Income

1 × $5.00 -

×

How to Make Money in Deflationary Markets with Gary Shilling

1 × $6.00

How to Make Money in Deflationary Markets with Gary Shilling

1 × $6.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Module III - Peak Formation Trades with FX MindShift

1 × $6.00

Module III - Peak Formation Trades with FX MindShift

1 × $6.00 -

×

John Bollinger on Bollinger Bands

1 × $6.00

John Bollinger on Bollinger Bands

1 × $6.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Introduction to the Elliot Wave Principle Seminar - Robert Prechter

1 × $6.00

Introduction to the Elliot Wave Principle Seminar - Robert Prechter

1 × $6.00 -

×

Backtrade Marathon NEW with Real Life Trading

1 × $23.00

Backtrade Marathon NEW with Real Life Trading

1 × $23.00 -

×

Option Hydra - June 2020 Edition - Basics By Rajandran R

1 × $23.00

Option Hydra - June 2020 Edition - Basics By Rajandran R

1 × $23.00 -

×

M3-4u Trading System with John Locke

1 × $5.00

M3-4u Trading System with John Locke

1 × $5.00 -

×

FOREX PRECOG SYSTEM FOR MT4 + FULL COURSE

1 × $62.00

FOREX PRECOG SYSTEM FOR MT4 + FULL COURSE

1 × $62.00 -

×

Expectations Investing with Alfred Rappaport

1 × $6.00

Expectations Investing with Alfred Rappaport

1 × $6.00 -

×

Zero to Hero Course with EVO Capital

1 × $13.00

Zero to Hero Course with EVO Capital

1 × $13.00 -

×

Beginners Guide to Swing Trading Growth Stocks with Brandon Chapman

1 × $5.00

Beginners Guide to Swing Trading Growth Stocks with Brandon Chapman

1 × $5.00 -

×

Forex Nitty Gritty Course with Bill & Greg Poulos

1 × $6.00

Forex Nitty Gritty Course with Bill & Greg Poulos

1 × $6.00 -

×

Fibonacci Trading Course - Money Management & Trend Analysis

1 × $6.00

Fibonacci Trading Course - Money Management & Trend Analysis

1 × $6.00 -

×

Market Profile Course

1 × $54.00

Market Profile Course

1 × $54.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

How To Develop A Winning Trading System That Fits You Home Study + Audio - 2020 with Van Tharp

1 × $62.00

How To Develop A Winning Trading System That Fits You Home Study + Audio - 2020 with Van Tharp

1 × $62.00 -

×

How to Trade a Vertical Market

1 × $93.00

How to Trade a Vertical Market

1 × $93.00 -

×

P&L Accumulation Distribution with Charles Drummond

1 × $4.00

P&L Accumulation Distribution with Charles Drummond

1 × $4.00 -

×

T.A.M.E. Home Study Course with Doug Sutton

1 × $6.00

T.A.M.E. Home Study Course with Doug Sutton

1 × $6.00 -

×

The Psychology of the Foreign Exchange Market with Thomas Oberlechner

1 × $6.00

The Psychology of the Foreign Exchange Market with Thomas Oberlechner

1 × $6.00 -

×

Reedstrader 101: Mechanical Trading Strategy Workshop - REEDSTRADER

1 × $31.00

Reedstrader 101: Mechanical Trading Strategy Workshop - REEDSTRADER

1 × $31.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Full-Day Platinum Pursuits Basic Option Seminar Manual

1 × $6.00

Full-Day Platinum Pursuits Basic Option Seminar Manual

1 × $6.00 -

×

Building Cryptocurrencies with JavaScript By Stone River eLearning

1 × $6.00

Building Cryptocurrencies with JavaScript By Stone River eLearning

1 × $6.00 -

×

Forex Rebellion Trading System

1 × $5.00

Forex Rebellion Trading System

1 × $5.00 -

×

Quantifiable Edges - 3 Course Bundle

1 × $31.00

Quantifiable Edges - 3 Course Bundle

1 × $31.00 -

×

iMF Tracker – Order Flow Program 2023

1 × $5.00

iMF Tracker – Order Flow Program 2023

1 × $5.00 -

×

THE FULL PACKAGE! 8 COURSES with InTheMoneyStocks

1 × $443.00

THE FULL PACKAGE! 8 COURSES with InTheMoneyStocks

1 × $443.00 -

×

Scanning for Gold with Doug Sutton

1 × $31.00

Scanning for Gold with Doug Sutton

1 × $31.00 -

×

The Realistic Trader - Crypto Currencies

1 × $31.00

The Realistic Trader - Crypto Currencies

1 × $31.00 -

×

Macro to Micro Volatility Trading with Mark Whistler

1 × $5.00

Macro to Micro Volatility Trading with Mark Whistler

1 × $5.00 -

×

6-2-4 Winning Strategies & Systems with Jack Bernstein

1 × $6.00

6-2-4 Winning Strategies & Systems with Jack Bernstein

1 × $6.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

Trade from Anywhere

1 × $6.00

Trade from Anywhere

1 × $6.00 -

×

TOP Gamma Bundle with TopTrade Tools

1 × $69.00

TOP Gamma Bundle with TopTrade Tools

1 × $69.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Advanced Gap Trading Strategies with Master Trader

1 × $31.00

Advanced Gap Trading Strategies with Master Trader

1 × $31.00 -

×

VWAP Trading course with Trade With Trend

1 × $6.00

VWAP Trading course with Trade With Trend

1 × $6.00 -

×

Advanced Technical Strategies Home Study Course with T3 LIVE

1 × $31.00

Advanced Technical Strategies Home Study Course with T3 LIVE

1 × $31.00

Bollinger Bands Trading Strategies That Work

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Bollinger Bands Trading Strategies That Work

Understanding Bollinger Bands

Bollinger Bands, created by John Bollinger, are one of the most versatile and effective tools in a trader’s arsenal. These bands consist of a middle band (usually a 20-day simple moving average), an upper band (2 standard deviations above the middle band), and a lower band (2 standard deviations below the middle band). They help traders identify overbought and oversold conditions in the market.

How Bollinger Bands Work

The Concept of Volatility

Volatility is a key aspect of Bollinger Bands. The bands expand and contract based on market volatility. When the market is volatile, the bands widen, and when the market is stable, they contract. This behavior makes Bollinger Bands an excellent indicator for anticipating price movements.

The Middle Band

The middle band, which is typically a 20-day simple moving average, serves as the baseline for the upper and lower bands. It represents the average price over a specific period and helps in identifying the overall trend.

The Upper and Lower Bands

The upper and lower bands are set at 2 standard deviations away from the middle band. These bands act as dynamic support and resistance levels, which help traders make informed decisions.

Bollinger Bands Trading Strategies

Strategy 1: Bollinger Bounce

What is the Bollinger Bounce?

The Bollinger Bounce strategy relies on the concept that prices tend to revert to the mean. When the price touches the upper or lower band, it often bounces back towards the middle band.

How to Trade the Bollinger Bounce

- Identify the Touch: Wait for the price to touch the upper or lower band.

- Confirm the Bounce: Look for a reversal candlestick pattern to confirm the bounce.

- Enter the Trade: Enter the trade once the bounce is confirmed, aiming for the middle band as the target.

Strategy 2: Bollinger Squeeze

What is the Bollinger Squeeze?

The Bollinger Squeeze occurs when the bands contract, indicating low volatility. This situation often precedes a significant price movement, making it a great setup for breakout trades.

How to Trade the Bollinger Squeeze

- Identify the Squeeze: Look for the bands to contract tightly.

- Confirm the Breakout: Use additional indicators like the Relative Strength Index (RSI) to confirm the breakout direction.

- Enter the Trade: Enter the trade in the direction of the breakout, placing stop-loss orders just outside the bands.

Strategy 3: Riding the Bands

What is Riding the Bands?

Riding the Bands involves trading with the trend, where the price stays close to the upper or lower band for an extended period.

How to Trade by Riding the Bands

- Identify the Trend: Use the middle band to determine the trend direction.

- Confirm the Trend: Ensure the price consistently touches the upper or lower band without significant pullbacks.

- Enter the Trade: Enter the trade in the direction of the trend, using the opposite band as a trailing stop.

Strategy 4: Bollinger Band Breakouts

What are Bollinger Band Breakouts?

Breakouts occur when the price moves outside the bands, indicating a strong directional movement.

How to Trade Bollinger Band Breakouts

- Identify the Breakout: Look for the price to close outside the bands.

- Confirm the Strength: Use volume indicators to confirm the strength of the breakout.

- Enter the Trade: Enter the trade in the direction of the breakout, setting stop-loss orders within the bands.

Combining Bollinger Bands with Other Indicators

Relative Strength Index (RSI)

Combining Bollinger Bands with the RSI can enhance the reliability of trading signals. The RSI helps confirm overbought or oversold conditions, providing additional context for Bollinger Band signals.

Moving Averages

Using moving averages alongside Bollinger Bands can help in identifying the overall trend. For example, a 50-day moving average can be used to confirm long-term trends.

Volume Indicators

Volume indicators, such as the On-Balance Volume (OBV), can confirm the strength of breakouts and bounces, making them valuable tools in conjunction with Bollinger Bands.

Risk Management in Bollinger Bands Trading

Setting Stop-Loss Orders

Stop-loss orders are crucial in Bollinger Bands trading to manage risk effectively. Place stop-loss orders just outside the bands to minimize losses in case of false signals.

Position Sizing

Proper position sizing ensures that you do not risk too much on a single trade. Use a fixed percentage of your trading capital for each trade to manage risk effectively.

Regular Review and Adjustment

Regularly review your trading strategy and adjust the parameters of the Bollinger Bands to suit changing market conditions. This ongoing adjustment helps in maintaining the effectiveness of the strategy.

Conclusion

Bollinger Bands Trading Strategies are powerful tools for both novice and experienced traders. By understanding the principles behind Bollinger Bands and implementing these strategies, you can enhance your trading performance and achieve consistent results. Remember to combine Bollinger Bands with other indicators, practice risk management, and stay disciplined in your trading approach.

FAQs

What are Bollinger Bands?

Bollinger Bands are a technical analysis tool that consists of a middle band (usually a 20-day simple moving average) and two outer bands set at 2 standard deviations away from the middle band. They help identify overbought and oversold conditions.

How do Bollinger Bands help in trading?

Bollinger Bands help in identifying volatility and potential price reversals. They provide dynamic support and resistance levels, making them useful for various trading strategies.

What is the Bollinger Bounce strategy?

The Bollinger Bounce strategy involves trading based on the idea that prices tend to revert to the mean. When the price touches the upper or lower band, it often bounces back towards the middle band.

Can Bollinger Bands be used with other indicators?

Yes, Bollinger Bands can be combined with indicators like the Relative Strength Index (RSI), moving averages, and volume indicators to enhance the reliability of trading signals.

What is the Bollinger Squeeze?

The Bollinger Squeeze occurs when the bands contract, indicating low volatility. This situation often precedes a significant price movement, making it a great setup for breakout trades.

Be the first to review “Bollinger Bands Trading Strategies That Work” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.