-

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Trade What You See, Not What You Believe with Larry Pesavento

1 × $6.00

Trade What You See, Not What You Believe with Larry Pesavento

1 × $6.00 -

×

What Ranks Schema Course with Clint Butler

1 × $23.00

What Ranks Schema Course with Clint Butler

1 × $23.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Pristine - Dan Gibby – Mastering Breakouts & Breakdowns

1 × $6.00

Pristine - Dan Gibby – Mastering Breakouts & Breakdowns

1 × $6.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Trading Decoded with Axia Futures

1 × $31.00

Trading Decoded with Axia Futures

1 × $31.00 -

×

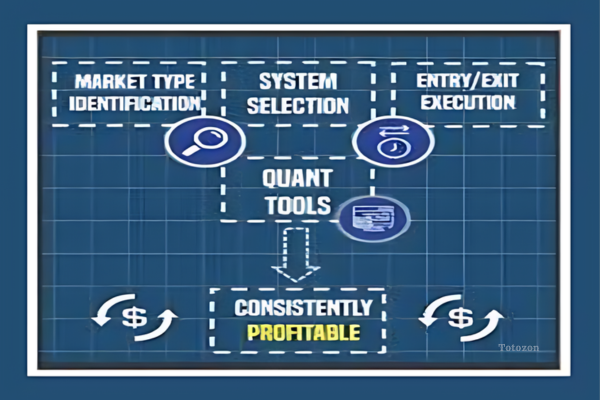

The Profitable Trading System Blueprint with Macro Ops

1 × $6.00

The Profitable Trading System Blueprint with Macro Ops

1 × $6.00 -

×

Trading Strategies with Ambush and Stealth Combined - Joe Ross

1 × $311.00

Trading Strategies with Ambush and Stealth Combined - Joe Ross

1 × $311.00 -

×

Volume Profile Video Course with Trader Dale

1 × $8.00

Volume Profile Video Course with Trader Dale

1 × $8.00 -

×

XJO Quant - High Probability Trading Setups on ASX 200 Index

1 × $31.00

XJO Quant - High Probability Trading Setups on ASX 200 Index

1 × $31.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

Option Express Plugin

1 × $6.00

Option Express Plugin

1 × $6.00 -

×

Evolution Markets (Full Main Course)

1 × $5.00

Evolution Markets (Full Main Course)

1 × $5.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Unusual Options Activity Master Course with Andrew Keene - AlphaShark

1 × $15.00

Unusual Options Activity Master Course with Andrew Keene - AlphaShark

1 × $15.00 -

×

Creating & Using a Trading Plan with Paul Lange

1 × $8.00

Creating & Using a Trading Plan with Paul Lange

1 × $8.00 -

×

ICT Charter 2020 with Inner Circle Trader

1 × $13.00

ICT Charter 2020 with Inner Circle Trader

1 × $13.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

Day Trading Systems & Methods with Charles Le Beau, David Lucas

1 × $6.00

Day Trading Systems & Methods with Charles Le Beau, David Lucas

1 × $6.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Quantitative Finance & Algorithmic Trading II - Time Series with Holczer Balazs

1 × $4.00

Quantitative Finance & Algorithmic Trading II - Time Series with Holczer Balazs

1 × $4.00 -

×

Seven Trading Systems for The S&P Futures with David Bean

1 × $6.00

Seven Trading Systems for The S&P Futures with David Bean

1 × $6.00 -

×

Zero to Hero Course with EVO Capital

1 × $13.00

Zero to Hero Course with EVO Capital

1 × $13.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Great Market Technicians of the 21st Century. Galileo, Fibonacci & Beethoven with Constance Brown

1 × $6.00

Great Market Technicians of the 21st Century. Galileo, Fibonacci & Beethoven with Constance Brown

1 × $6.00 -

×

Expert Forex Systems with Andrew Fields

1 × $6.00

Expert Forex Systems with Andrew Fields

1 × $6.00 -

×

FOREX GENERATION MASTER COURSE

1 × $6.00

FOREX GENERATION MASTER COURSE

1 × $6.00 -

×

Sports Trading Journey with Jack Birkhead

1 × $23.00

Sports Trading Journey with Jack Birkhead

1 × $23.00 -

×

Mechanics of Trading Module

1 × $6.00

Mechanics of Trading Module

1 × $6.00 -

×

Options for Long Term Trading & Hedging with Option Pit

1 × $39.00

Options for Long Term Trading & Hedging with Option Pit

1 × $39.00 -

×

Just What I Said: Bloomberg Economics Columnist Takes on Bonds, Banks, Budgets, and Bubbles with Caroline Baum

1 × $6.00

Just What I Said: Bloomberg Economics Columnist Takes on Bonds, Banks, Budgets, and Bubbles with Caroline Baum

1 × $6.00 -

×

Online Trading Academy Professional Trader Series (7 Day Complete)

1 × $6.00

Online Trading Academy Professional Trader Series (7 Day Complete)

1 × $6.00 -

×

CFA Pro Qbank 2007 & 2008 with Schweser

1 × $6.00

CFA Pro Qbank 2007 & 2008 with Schweser

1 × $6.00 -

×

May Madness with LIT Trading

1 × $5.00

May Madness with LIT Trading

1 × $5.00 -

×

Inside the Mind of Trader Stewie - Art of Trading

1 × $23.00

Inside the Mind of Trader Stewie - Art of Trading

1 × $23.00 -

×

Programming in Python For Traders

1 × $78.00

Programming in Python For Traders

1 × $78.00 -

×

AmiBroker Ultimate Pack Pro v6.20.1 x64 (Feb 2017)

1 × $6.00

AmiBroker Ultimate Pack Pro v6.20.1 x64 (Feb 2017)

1 × $6.00 -

×

ICT Mentorship – 2019

1 × $13.00

ICT Mentorship – 2019

1 × $13.00 -

×

Managing Risk in Alternative Investment Strategies with Lars Jaeger

1 × $6.00

Managing Risk in Alternative Investment Strategies with Lars Jaeger

1 × $6.00 -

×

Jtrader - A+ Setups Small Caps

1 × $23.00

Jtrader - A+ Setups Small Caps

1 × $23.00 -

×

FOREX PRECOG SYSTEM FOR MT4 + FULL COURSE

1 × $62.00

FOREX PRECOG SYSTEM FOR MT4 + FULL COURSE

1 × $62.00 -

×

Market Expectations & Option Prices with Martin Mandler

1 × $6.00

Market Expectations & Option Prices with Martin Mandler

1 × $6.00 -

×

Order Flow Analytics

1 × $54.00

Order Flow Analytics

1 × $54.00 -

×

Maximizing Profits with Weekly Options with Optionpit

1 × $15.00

Maximizing Profits with Weekly Options with Optionpit

1 × $15.00 -

×

PayTrading with Eric Shawn

1 × $6.00

PayTrading with Eric Shawn

1 × $6.00 -

×

Markets In Motion with Ned Davis

1 × $6.00

Markets In Motion with Ned Davis

1 × $6.00 -

×

Market Maker’s Method Dec 2010 (PDF, MT4 Indicators, Video 600 MB)

1 × $6.00

Market Maker’s Method Dec 2010 (PDF, MT4 Indicators, Video 600 MB)

1 × $6.00 -

×

A Grand Supercycle Top Webinar with Steven Hochberg

1 × $6.00

A Grand Supercycle Top Webinar with Steven Hochberg

1 × $6.00 -

×

Live Video Revolution

1 × $15.00

Live Video Revolution

1 × $15.00 -

×

Monetary Mechanics Course 2024 with The Macro Compass

1 × $139.00

Monetary Mechanics Course 2024 with The Macro Compass

1 × $139.00 -

×

Price action profits formula v2

1 × $31.00

Price action profits formula v2

1 × $31.00 -

×

Hidden Cash Flow Fortunes

1 × $54.00

Hidden Cash Flow Fortunes

1 × $54.00 -

×

Options Income Generating Blueprint

1 × $31.00

Options Income Generating Blueprint

1 × $31.00 -

×

Pit Bull with Martin Schwartz

1 × $6.00

Pit Bull with Martin Schwartz

1 × $6.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

Gann’s Scientific Methods Unveiled (Vol I, II)

1 × $6.00

Gann’s Scientific Methods Unveiled (Vol I, II)

1 × $6.00 -

×

Hit & Run Trading: The Short-Term Stock Traders Bible (1996) with Jeff Cooper

1 × $6.00

Hit & Run Trading: The Short-Term Stock Traders Bible (1996) with Jeff Cooper

1 × $6.00 -

×

Scalping the Nasdaq Emini Futures Method (Includes Indicators) with Ryan Watts

1 × $4.00

Scalping the Nasdaq Emini Futures Method (Includes Indicators) with Ryan Watts

1 × $4.00 -

×

Power Charting - Robert’s Indicator Webinar

1 × $6.00

Power Charting - Robert’s Indicator Webinar

1 × $6.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

PROFESSIONAL TRADING EDUCATION with The MarketDelta Edge

1 × $78.00

PROFESSIONAL TRADING EDUCATION with The MarketDelta Edge

1 × $78.00 -

×

8 Successful Iron Condor Methodologies with Dan Sheridan

1 × $23.00

8 Successful Iron Condor Methodologies with Dan Sheridan

1 × $23.00 -

×

Managing Investment Portfolios (3rd Ed.) with John Maginn

1 × $6.00

Managing Investment Portfolios (3rd Ed.) with John Maginn

1 × $6.00 -

×

Lessons 1-30 & Tradestation Code with Charles Drummond

1 × $6.00

Lessons 1-30 & Tradestation Code with Charles Drummond

1 × $6.00 -

×

Trading Full Circle the Complete Underground Trader System for Timing with Jea Yu

1 × $6.00

Trading Full Circle the Complete Underground Trader System for Timing with Jea Yu

1 × $6.00 -

×

BD FX Course with FX Learning

1 × $6.00

BD FX Course with FX Learning

1 × $6.00 -

×

Getting Started in Forex Trading Strategies with Michael Duane Archer

1 × $6.00

Getting Started in Forex Trading Strategies with Michael Duane Archer

1 × $6.00 -

×

Sample Item Sets 2003 - CFA Level 3

1 × $6.00

Sample Item Sets 2003 - CFA Level 3

1 × $6.00 -

×

Stable Adaptive Control for Nonlinear Systems with Jeffrey Spooner

1 × $6.00

Stable Adaptive Control for Nonlinear Systems with Jeffrey Spooner

1 × $6.00 -

×

Option Buying Course

1 × $5.00

Option Buying Course

1 × $5.00 -

×

Investor’s Guide to Charting By Alistair Blair

1 × $6.00

Investor’s Guide to Charting By Alistair Blair

1 × $6.00 -

×

Futures Trading Secrets Home Study Course 2004 with Bill McCready

1 × $7.00

Futures Trading Secrets Home Study Course 2004 with Bill McCready

1 × $7.00 -

×

Orderflows Gems 2-Private Sessions with Mike Valtos

1 × $20.00

Orderflows Gems 2-Private Sessions with Mike Valtos

1 × $20.00 -

×

Power Combo with Random Walk Trading

1 × $15.00

Power Combo with Random Walk Trading

1 × $15.00 -

×

How To Trade Fundamental News Release 2022 with Patrick Muke

1 × $6.00

How To Trade Fundamental News Release 2022 with Patrick Muke

1 × $6.00 -

×

6-2-4 Winning Strategies & Systems with Jack Bernstein

1 × $6.00

6-2-4 Winning Strategies & Systems with Jack Bernstein

1 × $6.00 -

×

Planetary Economic Forecasting with Bill Meridian

1 × $6.00

Planetary Economic Forecasting with Bill Meridian

1 × $6.00 -

×

Start Trading Stocks Using Technical Analysis Part 2 with Corey Halliday

1 × $15.00

Start Trading Stocks Using Technical Analysis Part 2 with Corey Halliday

1 × $15.00 -

×

Gold & Silver Profit System with Bill Poulos

1 × $6.00

Gold & Silver Profit System with Bill Poulos

1 × $6.00 -

×

Pring on Price Patterns with Martin Pring

1 × $6.00

Pring on Price Patterns with Martin Pring

1 × $6.00 -

×

Technical Trader Workshop with Jason Stapleton

1 × $5.00

Technical Trader Workshop with Jason Stapleton

1 × $5.00 -

×

Signature Trade from Forexia with Dylan Forexia

1 × $85.00

Signature Trade from Forexia with Dylan Forexia

1 × $85.00 -

×

Trading Secrets of the Inner Circle with Andrew Goodwin

1 × $6.00

Trading Secrets of the Inner Circle with Andrew Goodwin

1 × $6.00 -

×

Level 1 - Japanese Candlesticks Trading Mastery Program with Rohit Musale & Rashmi Musale

1 × $5.00

Level 1 - Japanese Candlesticks Trading Mastery Program with Rohit Musale & Rashmi Musale

1 × $5.00 -

×

The Four Biggest Mistakes in Futures Trading (1st Edition) with Jay Kaeppel

1 × $6.00

The Four Biggest Mistakes in Futures Trading (1st Edition) with Jay Kaeppel

1 × $6.00 -

×

ETF Trend Trading Mentorship Course

1 × $15.00

ETF Trend Trading Mentorship Course

1 × $15.00 -

×

Sovereign Man Confidential

1 × $6.00

Sovereign Man Confidential

1 × $6.00 -

×

Traders Trick Advanced Concepts - Recorded Webinar with Joe Ross

1 × $23.00

Traders Trick Advanced Concepts - Recorded Webinar with Joe Ross

1 × $23.00 -

×

Professional Trading Strategies 2023 with Jared Wesley - Live Traders

1 × $5.00

Professional Trading Strategies 2023 with Jared Wesley - Live Traders

1 × $5.00 -

×

Stock Market–Swing Trading Strategies for Wall Street with Bill Wermin

1 × $6.00

Stock Market–Swing Trading Strategies for Wall Street with Bill Wermin

1 × $6.00 -

×

A Traders Astrological Almanac (2001 – 2006) with Jeanne Long

1 × $6.00

A Traders Astrological Almanac (2001 – 2006) with Jeanne Long

1 × $6.00 -

×

GLOBAL MACRO PRO TRADING COURSE

1 × $31.00

GLOBAL MACRO PRO TRADING COURSE

1 × $31.00 -

×

Neural Networks in Trading with Dr. Ernest P. Chan

1 × $31.00

Neural Networks in Trading with Dr. Ernest P. Chan

1 × $31.00 -

×

Learning KST

1 × $6.00

Learning KST

1 × $6.00 -

×

Creating the Optimal Trade for Explosive Profits with George A.Fontanills

1 × $6.00

Creating the Optimal Trade for Explosive Profits with George A.Fontanills

1 × $6.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Real Options in Practice with Marion A.Brach

1 × $6.00

Real Options in Practice with Marion A.Brach

1 × $6.00 -

×

Forex Powerband Dominator

1 × $6.00

Forex Powerband Dominator

1 × $6.00 -

×

LARGE CAP MOMENTUM STRATEGY with Nick Radge

1 × $179.00

LARGE CAP MOMENTUM STRATEGY with Nick Radge

1 × $179.00 -

×

Rich in America: Secrets to Creating and Preserving Wealth with Jeffrey Maurer

1 × $6.00

Rich in America: Secrets to Creating and Preserving Wealth with Jeffrey Maurer

1 × $6.00 -

×

Practical Approach to Ninjatrader 8 Platform with Rajandran R

1 × $6.00

Practical Approach to Ninjatrader 8 Platform with Rajandran R

1 × $6.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

Investment Mathematics with Andrew Adams

1 × $6.00

Investment Mathematics with Andrew Adams

1 × $6.00 -

×

Mastering Income Spread Trading with Dave Aquino - Base Camp Trading

1 × $23.00

Mastering Income Spread Trading with Dave Aquino - Base Camp Trading

1 × $23.00 -

×

Trading to Win (Seminar WorkBook 2003) with Bruce Gilmore

1 × $6.00

Trading to Win (Seminar WorkBook 2003) with Bruce Gilmore

1 × $6.00 -

×

Day Trade Futures Online with Larry Williams

1 × $6.00

Day Trade Futures Online with Larry Williams

1 × $6.00 -

×

Trading Price Action Trading Ranges (Kindle) with Al Brooks

1 × $6.00

Trading Price Action Trading Ranges (Kindle) with Al Brooks

1 × $6.00 -

×

Seven Principles of Great Trading (Audio CD) By Van Tharp

1 × $6.00

Seven Principles of Great Trading (Audio CD) By Van Tharp

1 × $6.00

Bollinger Bands Trading Strategies That Work

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Bollinger Bands Trading Strategies That Work

Understanding Bollinger Bands

Bollinger Bands, created by John Bollinger, are one of the most versatile and effective tools in a trader’s arsenal. These bands consist of a middle band (usually a 20-day simple moving average), an upper band (2 standard deviations above the middle band), and a lower band (2 standard deviations below the middle band). They help traders identify overbought and oversold conditions in the market.

How Bollinger Bands Work

The Concept of Volatility

Volatility is a key aspect of Bollinger Bands. The bands expand and contract based on market volatility. When the market is volatile, the bands widen, and when the market is stable, they contract. This behavior makes Bollinger Bands an excellent indicator for anticipating price movements.

The Middle Band

The middle band, which is typically a 20-day simple moving average, serves as the baseline for the upper and lower bands. It represents the average price over a specific period and helps in identifying the overall trend.

The Upper and Lower Bands

The upper and lower bands are set at 2 standard deviations away from the middle band. These bands act as dynamic support and resistance levels, which help traders make informed decisions.

Bollinger Bands Trading Strategies

Strategy 1: Bollinger Bounce

What is the Bollinger Bounce?

The Bollinger Bounce strategy relies on the concept that prices tend to revert to the mean. When the price touches the upper or lower band, it often bounces back towards the middle band.

How to Trade the Bollinger Bounce

- Identify the Touch: Wait for the price to touch the upper or lower band.

- Confirm the Bounce: Look for a reversal candlestick pattern to confirm the bounce.

- Enter the Trade: Enter the trade once the bounce is confirmed, aiming for the middle band as the target.

Strategy 2: Bollinger Squeeze

What is the Bollinger Squeeze?

The Bollinger Squeeze occurs when the bands contract, indicating low volatility. This situation often precedes a significant price movement, making it a great setup for breakout trades.

How to Trade the Bollinger Squeeze

- Identify the Squeeze: Look for the bands to contract tightly.

- Confirm the Breakout: Use additional indicators like the Relative Strength Index (RSI) to confirm the breakout direction.

- Enter the Trade: Enter the trade in the direction of the breakout, placing stop-loss orders just outside the bands.

Strategy 3: Riding the Bands

What is Riding the Bands?

Riding the Bands involves trading with the trend, where the price stays close to the upper or lower band for an extended period.

How to Trade by Riding the Bands

- Identify the Trend: Use the middle band to determine the trend direction.

- Confirm the Trend: Ensure the price consistently touches the upper or lower band without significant pullbacks.

- Enter the Trade: Enter the trade in the direction of the trend, using the opposite band as a trailing stop.

Strategy 4: Bollinger Band Breakouts

What are Bollinger Band Breakouts?

Breakouts occur when the price moves outside the bands, indicating a strong directional movement.

How to Trade Bollinger Band Breakouts

- Identify the Breakout: Look for the price to close outside the bands.

- Confirm the Strength: Use volume indicators to confirm the strength of the breakout.

- Enter the Trade: Enter the trade in the direction of the breakout, setting stop-loss orders within the bands.

Combining Bollinger Bands with Other Indicators

Relative Strength Index (RSI)

Combining Bollinger Bands with the RSI can enhance the reliability of trading signals. The RSI helps confirm overbought or oversold conditions, providing additional context for Bollinger Band signals.

Moving Averages

Using moving averages alongside Bollinger Bands can help in identifying the overall trend. For example, a 50-day moving average can be used to confirm long-term trends.

Volume Indicators

Volume indicators, such as the On-Balance Volume (OBV), can confirm the strength of breakouts and bounces, making them valuable tools in conjunction with Bollinger Bands.

Risk Management in Bollinger Bands Trading

Setting Stop-Loss Orders

Stop-loss orders are crucial in Bollinger Bands trading to manage risk effectively. Place stop-loss orders just outside the bands to minimize losses in case of false signals.

Position Sizing

Proper position sizing ensures that you do not risk too much on a single trade. Use a fixed percentage of your trading capital for each trade to manage risk effectively.

Regular Review and Adjustment

Regularly review your trading strategy and adjust the parameters of the Bollinger Bands to suit changing market conditions. This ongoing adjustment helps in maintaining the effectiveness of the strategy.

Conclusion

Bollinger Bands Trading Strategies are powerful tools for both novice and experienced traders. By understanding the principles behind Bollinger Bands and implementing these strategies, you can enhance your trading performance and achieve consistent results. Remember to combine Bollinger Bands with other indicators, practice risk management, and stay disciplined in your trading approach.

FAQs

What are Bollinger Bands?

Bollinger Bands are a technical analysis tool that consists of a middle band (usually a 20-day simple moving average) and two outer bands set at 2 standard deviations away from the middle band. They help identify overbought and oversold conditions.

How do Bollinger Bands help in trading?

Bollinger Bands help in identifying volatility and potential price reversals. They provide dynamic support and resistance levels, making them useful for various trading strategies.

What is the Bollinger Bounce strategy?

The Bollinger Bounce strategy involves trading based on the idea that prices tend to revert to the mean. When the price touches the upper or lower band, it often bounces back towards the middle band.

Can Bollinger Bands be used with other indicators?

Yes, Bollinger Bands can be combined with indicators like the Relative Strength Index (RSI), moving averages, and volume indicators to enhance the reliability of trading signals.

What is the Bollinger Squeeze?

The Bollinger Squeeze occurs when the bands contract, indicating low volatility. This situation often precedes a significant price movement, making it a great setup for breakout trades.

Be the first to review “Bollinger Bands Trading Strategies That Work” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.