-

×

Advanced Technical Strategies Home Study Course with T3 LIVE

1 × $31.00

Advanced Technical Strategies Home Study Course with T3 LIVE

1 × $31.00 -

×

The Key to Profits in Tough Times

1 × $6.00

The Key to Profits in Tough Times

1 × $6.00 -

×

A Traders Astrological Almanac (2001 – 2006) with Jeanne Long

1 × $6.00

A Traders Astrological Almanac (2001 – 2006) with Jeanne Long

1 × $6.00 -

×

Simple Trade Strategies

1 × $31.00

Simple Trade Strategies

1 × $31.00 -

×

Trading Connors VIX Reversals Tradestation Files with Laurence A. Connors & Gregory J. Che

1 × $6.00

Trading Connors VIX Reversals Tradestation Files with Laurence A. Connors & Gregory J. Che

1 × $6.00 -

×

Quantitative Finance & Algorithmic Trading II - Time Series with Holczer Balazs

1 × $4.00

Quantitative Finance & Algorithmic Trading II - Time Series with Holczer Balazs

1 × $4.00 -

×

Introduction to the Elliot Wave Principle Seminar - Robert Prechter

1 × $6.00

Introduction to the Elliot Wave Principle Seminar - Robert Prechter

1 × $6.00 -

×

MOJO TOOLBOX with ProTrader Mike

1 × $23.00

MOJO TOOLBOX with ProTrader Mike

1 × $23.00 -

×

Tape Reading Trader Program (Full 4 hours) with The Daytrading Room

1 × $6.00

Tape Reading Trader Program (Full 4 hours) with The Daytrading Room

1 × $6.00 -

×

Getting Started in Forex Trading Strategies with Michael Duane Archer

1 × $6.00

Getting Started in Forex Trading Strategies with Michael Duane Archer

1 × $6.00 -

×

Fixed Income Securities (2nd Ed.) with Bruce Tuckman

1 × $10.00

Fixed Income Securities (2nd Ed.) with Bruce Tuckman

1 × $10.00 -

×

Value, Price & Profit with Karl Marx

1 × $6.00

Value, Price & Profit with Karl Marx

1 × $6.00 -

×

Classic Trading Tactics Theory and Practice with Linda Raschke

1 × $13.00

Classic Trading Tactics Theory and Practice with Linda Raschke

1 × $13.00 -

×

Point and Figure Mentorship Course

1 × $54.00

Point and Figure Mentorship Course

1 × $54.00 -

×

Technical Trader Workshop with Jason Stapleton

1 × $5.00

Technical Trader Workshop with Jason Stapleton

1 × $5.00 -

×

Access All Areas with Marwood Research

1 × $54.00

Access All Areas with Marwood Research

1 × $54.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

Quantitative Business Valuation with Jay Abrams

1 × $6.00

Quantitative Business Valuation with Jay Abrams

1 × $6.00 -

×

The Four Biggest Mistakes in Futures Trading (1st Edition) with Jay Kaeppel

1 × $6.00

The Four Biggest Mistakes in Futures Trading (1st Edition) with Jay Kaeppel

1 × $6.00 -

×

Bollinger Bands Trading Strategies That Work

1 × $6.00

Bollinger Bands Trading Strategies That Work

1 × $6.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Researching your Trade

1 × $6.00

Researching your Trade

1 × $6.00 -

×

PiScaled

1 × $6.00

PiScaled

1 × $6.00 -

×

Simple Methods for Detecting Buying and Selling Points in Securities with James Liveright

1 × $6.00

Simple Methods for Detecting Buying and Selling Points in Securities with James Liveright

1 × $6.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Tradingmarkets - Introduction to AmiBroker Programming

1 × $15.00

Tradingmarkets - Introduction to AmiBroker Programming

1 × $15.00 -

×

Trader BO Divergence System with Aleg A.Bot

1 × $6.00

Trader BO Divergence System with Aleg A.Bot

1 × $6.00 -

×

Options, Futures & Other Derivatives . Solutions Manual

1 × $6.00

Options, Futures & Other Derivatives . Solutions Manual

1 × $6.00 -

×

Offensive & Defensive Strengths of Stocks, Groups & Sectors Gary Anderson

1 × $6.00

Offensive & Defensive Strengths of Stocks, Groups & Sectors Gary Anderson

1 × $6.00 -

×

Scanning For Gold with Doug Sutton

1 × $6.00

Scanning For Gold with Doug Sutton

1 × $6.00 -

×

Simpler Options - Stock Trading Patterns

1 × $6.00

Simpler Options - Stock Trading Patterns

1 × $6.00 -

×

HOW TO TRADE GAPS

1 × $15.00

HOW TO TRADE GAPS

1 × $15.00 -

×

Charting Made Easy with John J.Murphy

1 × $6.00

Charting Made Easy with John J.Murphy

1 × $6.00 -

×

Investing Smart. How to Pick Stocks with Investors Business Daily By Dhun H.Sethna

1 × $4.00

Investing Smart. How to Pick Stocks with Investors Business Daily By Dhun H.Sethna

1 × $4.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Module IV - Day Trading to Short Term Swing Trades with FX MindShift

1 × $6.00

Module IV - Day Trading to Short Term Swing Trades with FX MindShift

1 × $6.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Edge Trading Group with Edge Elite

1 × $6.00

Edge Trading Group with Edge Elite

1 × $6.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

Newtonian Trading Strategy Video Course with Fractal Flow Pro

1 × $6.00

Newtonian Trading Strategy Video Course with Fractal Flow Pro

1 × $6.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Programming in Python For Traders with Trading Markets

1 × $15.00

Programming in Python For Traders with Trading Markets

1 × $15.00 -

×

Value Investing King of Trading Methods in the Commodity Markets - Hal Masover

1 × $6.00

Value Investing King of Trading Methods in the Commodity Markets - Hal Masover

1 × $6.00 -

×

How To Trade Weeklys Using The Ichimoku Cloud with Alphashark

1 × $31.00

How To Trade Weeklys Using The Ichimoku Cloud with Alphashark

1 × $31.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

SpbankBook - Trendway Prime Two Day-Trading System

1 × $6.00

SpbankBook - Trendway Prime Two Day-Trading System

1 × $6.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Weekly Options Trading Advantage Class with Doc Severson

1 × $6.00

Weekly Options Trading Advantage Class with Doc Severson

1 × $6.00 -

×

Create Your Trade Plan with Yuri Shramenko

1 × $6.00

Create Your Trade Plan with Yuri Shramenko

1 × $6.00 -

×

Wyckoff Stock Market Institute

1 × $5.00

Wyckoff Stock Market Institute

1 × $5.00 -

×

Investors Live Textbook Trading DVD

1 × $15.00

Investors Live Textbook Trading DVD

1 × $15.00 -

×

Three Tricks, Two Traps, One Truth Real Help for Traders and Investors with D.R.Barton

1 × $6.00

Three Tricks, Two Traps, One Truth Real Help for Traders and Investors with D.R.Barton

1 × $6.00 -

×

TREND/REV BLOCK AND EA FOREX SYSTEM (No MT4 Indicator) with IFXSuccess

1 × $69.00

TREND/REV BLOCK AND EA FOREX SYSTEM (No MT4 Indicator) with IFXSuccess

1 × $69.00 -

×

War Room Psychology Vol. 4 with Pat Mitchell – Trick Trades

1 × $23.00

War Room Psychology Vol. 4 with Pat Mitchell – Trick Trades

1 × $23.00 -

×

Myths of the Free Market with Kenneth Friedman

1 × $6.00

Myths of the Free Market with Kenneth Friedman

1 × $6.00 -

×

NodeTrader (+ open code) (Nov 2014)

1 × $6.00

NodeTrader (+ open code) (Nov 2014)

1 × $6.00 -

×

Evolve MasterClass with Irek Piekarski

1 × $13.00

Evolve MasterClass with Irek Piekarski

1 × $13.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Foreign Exchange

1 × $6.00

Foreign Exchange

1 × $6.00 -

×

Sacredscience - W.F.Whitehead – Occultism Simplified

1 × $6.00

Sacredscience - W.F.Whitehead – Occultism Simplified

1 × $6.00 -

×

Workshop: The Best Way to Trade Stock Movement

1 × $6.00

Workshop: The Best Way to Trade Stock Movement

1 × $6.00 -

×

Earnings Engine with Sami Abusaad - T3 Live

1 × $6.00

Earnings Engine with Sami Abusaad - T3 Live

1 × $6.00 -

×

FOREX STRATEGY #1 with Steven Primo

1 × $39.00

FOREX STRATEGY #1 with Steven Primo

1 × $39.00 -

×

The Tyler Method For Successful Triangle Trading with Chris Tyler

1 × $6.00

The Tyler Method For Successful Triangle Trading with Chris Tyler

1 × $6.00 -

×

Secret Day - Swing Trading Strategy For Stock, Forex, Crypto with Value Stocks

1 × $5.00

Secret Day - Swing Trading Strategy For Stock, Forex, Crypto with Value Stocks

1 × $5.00 -

×

Price Action Room - The Scalper’s Boot Camp

1 × $15.00

Price Action Room - The Scalper’s Boot Camp

1 × $15.00 -

×

Floor Trader Tools 8.2 with Roy Kelly

1 × $6.00

Floor Trader Tools 8.2 with Roy Kelly

1 × $6.00 -

×

ZCFX Trading Course 2023 with ZCFX Trading

1 × $5.00

ZCFX Trading Course 2023 with ZCFX Trading

1 × $5.00 -

×

News Profiteer System Manual & Members Area Videos with Henry Liu

1 × $6.00

News Profiteer System Manual & Members Area Videos with Henry Liu

1 × $6.00 -

×

How To Backtest Bootcamp

1 × $17.00

How To Backtest Bootcamp

1 × $17.00 -

×

Basecamptrading - Naked Trading Part 2

1 × $6.00

Basecamptrading - Naked Trading Part 2

1 × $6.00 -

×

Bear Market Success Workshop with Base Camp Trading

1 × $15.00

Bear Market Success Workshop with Base Camp Trading

1 × $15.00 -

×

Price Analysis Webinar with Carolyn Boroden

1 × $6.00

Price Analysis Webinar with Carolyn Boroden

1 × $6.00 -

×

Romeo’s University of Turtle Soup with Romeo

1 × $6.00

Romeo’s University of Turtle Soup with Romeo

1 × $6.00 -

×

Boomerang Day Trader (Aug 2012)

1 × $54.00

Boomerang Day Trader (Aug 2012)

1 × $54.00 -

×

Investing in 401k Plans with Cliffsnotes

1 × $6.00

Investing in 401k Plans with Cliffsnotes

1 × $6.00 -

×

How to avoid the GAP

1 × $6.00

How to avoid the GAP

1 × $6.00 -

×

Traders Secret Library

1 × $6.00

Traders Secret Library

1 × $6.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

MTA - Technically Speaking Newsletters

1 × $6.00

MTA - Technically Speaking Newsletters

1 × $6.00 -

×

Judgemental Trend Following (Audio) with Russell Sands

1 × $6.00

Judgemental Trend Following (Audio) with Russell Sands

1 × $6.00 -

×

RiskIllustrator By Charles Cottle - The Risk Doctor

1 × $31.00

RiskIllustrator By Charles Cottle - The Risk Doctor

1 × $31.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Monthly Newsletter 99-01 with Elliott Wave Theorist

1 × $6.00

Monthly Newsletter 99-01 with Elliott Wave Theorist

1 × $6.00 -

×

Modern Portfolio Theory and Investment Analysis (7th Edition) with Edwin Elton, Martin Gruber, Stephen Brown & William Goetzmann

1 × $6.00

Modern Portfolio Theory and Investment Analysis (7th Edition) with Edwin Elton, Martin Gruber, Stephen Brown & William Goetzmann

1 × $6.00 -

×

CM Pivot Power Trade Method with Austin Passamonte

1 × $6.00

CM Pivot Power Trade Method with Austin Passamonte

1 × $6.00 -

×

Mastering Debit Spreads with Vince Vora

1 × $15.00

Mastering Debit Spreads with Vince Vora

1 × $15.00 -

×

Trading System Building Blocks with John Hill

1 × $6.00

Trading System Building Blocks with John Hill

1 × $6.00 -

×

New Market Timing Techniques

1 × $6.00

New Market Timing Techniques

1 × $6.00 -

×

Winning on Wall Street (Updated & Revised Ed.) with Martin Zweig

1 × $6.00

Winning on Wall Street (Updated & Revised Ed.) with Martin Zweig

1 × $6.00 -

×

The Pocket Mortgage Guide: 60 of the Most Important Questions and Answers About Your Home Loan with Jack Guttentag

1 × $6.00

The Pocket Mortgage Guide: 60 of the Most Important Questions and Answers About Your Home Loan with Jack Guttentag

1 × $6.00 -

×

Trading Halls Of Knowledge - Road to Consistent Trading Profits with Jarrod Goodwin

1 × $6.00

Trading Halls Of Knowledge - Road to Consistent Trading Profits with Jarrod Goodwin

1 × $6.00 -

×

4 Class Bundle

1 × $31.00

4 Class Bundle

1 × $31.00 -

×

Making Sense of Price Action: Price Action Profits with Scott Foster

1 × $54.00

Making Sense of Price Action: Price Action Profits with Scott Foster

1 × $54.00 -

×

Combo 4 New Courses From AmiBroker

1 × $54.00

Combo 4 New Courses From AmiBroker

1 × $54.00 -

×

Outsmarting the Smart Money with Lawrence A.Cunningham

1 × $6.00

Outsmarting the Smart Money with Lawrence A.Cunningham

1 × $6.00 -

×

Trade from Anywhere

1 × $6.00

Trade from Anywhere

1 × $6.00 -

×

Mean Reversion Strategy with The Chartist

1 × $78.00

Mean Reversion Strategy with The Chartist

1 × $78.00 -

×

Trade Queen Pro with Tamia Johnson

1 × $54.00

Trade Queen Pro with Tamia Johnson

1 × $54.00 -

×

Practical Approach to Trend Following By Rajandran R

1 × $15.00

Practical Approach to Trend Following By Rajandran R

1 × $15.00 -

×

7 Commandments of Stock Investing with Gene Marcial

1 × $6.00

7 Commandments of Stock Investing with Gene Marcial

1 × $6.00 -

×

Statistics of Extremes: Theory and Applications with Jan Beirlant, Yuri Goegebeur, Jozef Teugels & Johan Segers

1 × $6.00

Statistics of Extremes: Theory and Applications with Jan Beirlant, Yuri Goegebeur, Jozef Teugels & Johan Segers

1 × $6.00 -

×

Traders Seminars – 7 CD

1 × $31.00

Traders Seminars – 7 CD

1 × $31.00 -

×

Portfolio Management in Practice with Christine Brentani

1 × $6.00

Portfolio Management in Practice with Christine Brentani

1 × $6.00 -

×

War Room Technicals Volume 2 with Pat Mitchell – Trick Trades

1 × $6.00

War Room Technicals Volume 2 with Pat Mitchell – Trick Trades

1 × $6.00 -

×

Seller Specialist Program with Chris Prefontaine

1 × $62.00

Seller Specialist Program with Chris Prefontaine

1 × $62.00 -

×

Short and Simple Guide to Smart Investing with Alan Lavine

1 × $6.00

Short and Simple Guide to Smart Investing with Alan Lavine

1 × $6.00 -

×

WYCKOFF TRADING COURSE (WTC) PART I – ANALYSIS (Fall 2021) with Roman Bogomazov

1 × $209.00

WYCKOFF TRADING COURSE (WTC) PART I – ANALYSIS (Fall 2021) with Roman Bogomazov

1 × $209.00 -

×

Trading Trend Pullbacks - 3-Step Technical Analysis Method with Richard Deutsch

1 × $6.00

Trading Trend Pullbacks - 3-Step Technical Analysis Method with Richard Deutsch

1 × $6.00 -

×

Traders Guide to Emotional Management with Brian McAboy

1 × $4.00

Traders Guide to Emotional Management with Brian McAboy

1 × $4.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

Rise Precision Latest Course

1 × $10.00

Rise Precision Latest Course

1 × $10.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Growth Traders Toolbox Course with Julian Komar

1 × $5.00

Growth Traders Toolbox Course with Julian Komar

1 × $5.00 -

×

Trading Strategies for Capital Markets with Joseph Benning

1 × $6.00

Trading Strategies for Capital Markets with Joseph Benning

1 × $6.00 -

×

Private Seminars

1 × $23.00

Private Seminars

1 × $23.00 -

×

Zanzibar System for the EuroFx with Joe Ross

1 × $4.00

Zanzibar System for the EuroFx with Joe Ross

1 × $4.00 -

×

Trade Chart Patterns Like The Pros with Suri Duddella

1 × $6.00

Trade Chart Patterns Like The Pros with Suri Duddella

1 × $6.00 -

×

Market Masters. How Traders Think Trade And Invest with Jake Bernstein

1 × $6.00

Market Masters. How Traders Think Trade And Invest with Jake Bernstein

1 × $6.00 -

×

Month 01 to 08 2018

1 × $62.00

Month 01 to 08 2018

1 × $62.00 -

×

Price Action Trading with Bill Eykyn

1 × $6.00

Price Action Trading with Bill Eykyn

1 × $6.00 -

×

Forex Trading Like Banks - Step by Step by Live Examples with Taher Assaf

1 × $6.00

Forex Trading Like Banks - Step by Step by Live Examples with Taher Assaf

1 × $6.00 -

×

Options Master Class

1 × $54.00

Options Master Class

1 × $54.00 -

×

The STRAT Execution Basics with Jermaine McGruder

1 × $31.00

The STRAT Execution Basics with Jermaine McGruder

1 × $31.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

Winning Stock Selection Simplified (Vol I, II & III) with Peter Worden

1 × $6.00

Winning Stock Selection Simplified (Vol I, II & III) with Peter Worden

1 × $6.00 -

×

AIME System Forex Trading Course

1 × $6.00

AIME System Forex Trading Course

1 × $6.00 -

×

Naked Put Selling Acquiring Blue Chip Stocks and Creating Cash Flow with Lee Lowell

1 × $6.00

Naked Put Selling Acquiring Blue Chip Stocks and Creating Cash Flow with Lee Lowell

1 × $6.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

The Blueprint Course 2.0 with Mike Anderson

1 × $17.00

The Blueprint Course 2.0 with Mike Anderson

1 × $17.00 -

×

Jimdandym Ql4 Courses

1 × $15.00

Jimdandym Ql4 Courses

1 × $15.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

Trade What You See, Not What You Believe with Larry Pesavento

1 × $6.00

Trade What You See, Not What You Believe with Larry Pesavento

1 × $6.00 -

×

Advanced Course with Dimitri Wallace - Gold Minds Global

1 × $6.00

Advanced Course with Dimitri Wallace - Gold Minds Global

1 × $6.00 -

×

Real-Time Course with Rich Swannell

1 × $6.00

Real-Time Course with Rich Swannell

1 × $6.00 -

×

How To Invest Better

1 × $6.00

How To Invest Better

1 × $6.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

ALGO™ Online Retail - Version 2.9

1 × $155.00

ALGO™ Online Retail - Version 2.9

1 × $155.00 -

×

Trading Mindset, and Three Steps To Profitable Trading with Bruce Banks

1 × $6.00

Trading Mindset, and Three Steps To Profitable Trading with Bruce Banks

1 × $6.00 -

×

XLT– Option Trading Course

1 × $6.00

XLT– Option Trading Course

1 × $6.00 -

×

BD FX Course with FX Learning

1 × $6.00

BD FX Course with FX Learning

1 × $6.00 -

×

Traders World Past Issue Articles on CD with Magazine

1 × $6.00

Traders World Past Issue Articles on CD with Magazine

1 × $6.00 -

×

Trade The Price Action with Thomas Wood (Valuecharts)

1 × $15.00

Trade The Price Action with Thomas Wood (Valuecharts)

1 × $15.00 -

×

Cracking the Code Between Fib & Elliott Wave

1 × $23.00

Cracking the Code Between Fib & Elliott Wave

1 × $23.00 -

×

30 Days to Market Mastery: A Step-by-Step Guide to Profitable Trading with Jack Bernstein

1 × $6.00

30 Days to Market Mastery: A Step-by-Step Guide to Profitable Trading with Jack Bernstein

1 × $6.00 -

×

The Mango Trade 2017

1 × $6.00

The Mango Trade 2017

1 × $6.00 -

×

Technician’s Guide to Day and Swing Trading with Martin Pring

1 × $6.00

Technician’s Guide to Day and Swing Trading with Martin Pring

1 × $6.00 -

×

Iconic Trader Program with Urban Forex

1 × $5.00

Iconic Trader Program with Urban Forex

1 × $5.00 -

×

Trading Weekly Options for Income in 2016 with Dan Sheridan

1 × $23.00

Trading Weekly Options for Income in 2016 with Dan Sheridan

1 × $23.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Hands On Training Bundle with Talkin Options

1 × $23.00

Hands On Training Bundle with Talkin Options

1 × $23.00 -

×

Trend Trading Techniques with Rob Hoffman

1 × $6.00

Trend Trading Techniques with Rob Hoffman

1 × $6.00 -

×

Encyclopedia of Planetary Aspects for Short Term TradingPatrick Mikula – Encyclopedia of Planetary Aspects for Short Term Trading

1 × $4.00

Encyclopedia of Planetary Aspects for Short Term TradingPatrick Mikula – Encyclopedia of Planetary Aspects for Short Term Trading

1 × $4.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

Alternative Assets and Strategic Allocation with John Abbink

1 × $6.00

Alternative Assets and Strategic Allocation with John Abbink

1 × $6.00 -

×

Advanced Symmetrics Mental Harmonics Course

1 × $15.00

Advanced Symmetrics Mental Harmonics Course

1 × $15.00 -

×

Market Profile E-Course with Charles Gough - Pirate Traders

1 × $17.00

Market Profile E-Course with Charles Gough - Pirate Traders

1 × $17.00 -

×

CM APR (A Pivot Reverse) Trade Method with Austin Passamonte

1 × $6.00

CM APR (A Pivot Reverse) Trade Method with Austin Passamonte

1 × $6.00 -

×

Winning – Zodiacal Timing Revised 1980 with Joyce Wehrman

1 × $6.00

Winning – Zodiacal Timing Revised 1980 with Joyce Wehrman

1 × $6.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Learn Plan Profit 2.0 with Ricky Gutierrez

1 × $39.00

Learn Plan Profit 2.0 with Ricky Gutierrez

1 × $39.00 -

×

Channels & Cycles. A Tribute to J.M.Hurst with Brian J.Millard

1 × $6.00

Channels & Cycles. A Tribute to J.M.Hurst with Brian J.Millard

1 × $6.00 -

×

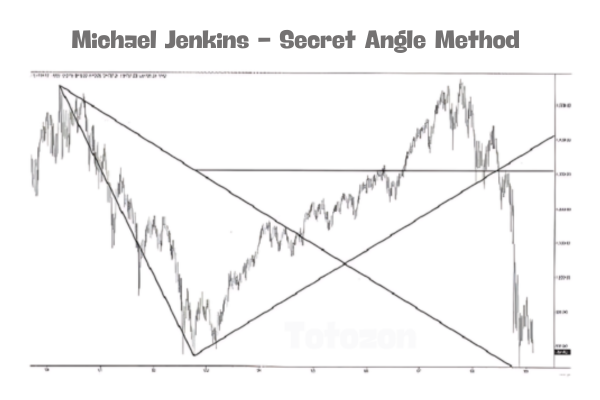

Secret Angle Method with Michael Jenkins

1 × $4.00

Secret Angle Method with Michael Jenkins

1 × $4.00

Bollinger Bands Trading Strategies That Work

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Bollinger Bands Trading Strategies That Work

Understanding Bollinger Bands

Bollinger Bands, created by John Bollinger, are one of the most versatile and effective tools in a trader’s arsenal. These bands consist of a middle band (usually a 20-day simple moving average), an upper band (2 standard deviations above the middle band), and a lower band (2 standard deviations below the middle band). They help traders identify overbought and oversold conditions in the market.

How Bollinger Bands Work

The Concept of Volatility

Volatility is a key aspect of Bollinger Bands. The bands expand and contract based on market volatility. When the market is volatile, the bands widen, and when the market is stable, they contract. This behavior makes Bollinger Bands an excellent indicator for anticipating price movements.

The Middle Band

The middle band, which is typically a 20-day simple moving average, serves as the baseline for the upper and lower bands. It represents the average price over a specific period and helps in identifying the overall trend.

The Upper and Lower Bands

The upper and lower bands are set at 2 standard deviations away from the middle band. These bands act as dynamic support and resistance levels, which help traders make informed decisions.

Bollinger Bands Trading Strategies

Strategy 1: Bollinger Bounce

What is the Bollinger Bounce?

The Bollinger Bounce strategy relies on the concept that prices tend to revert to the mean. When the price touches the upper or lower band, it often bounces back towards the middle band.

How to Trade the Bollinger Bounce

- Identify the Touch: Wait for the price to touch the upper or lower band.

- Confirm the Bounce: Look for a reversal candlestick pattern to confirm the bounce.

- Enter the Trade: Enter the trade once the bounce is confirmed, aiming for the middle band as the target.

Strategy 2: Bollinger Squeeze

What is the Bollinger Squeeze?

The Bollinger Squeeze occurs when the bands contract, indicating low volatility. This situation often precedes a significant price movement, making it a great setup for breakout trades.

How to Trade the Bollinger Squeeze

- Identify the Squeeze: Look for the bands to contract tightly.

- Confirm the Breakout: Use additional indicators like the Relative Strength Index (RSI) to confirm the breakout direction.

- Enter the Trade: Enter the trade in the direction of the breakout, placing stop-loss orders just outside the bands.

Strategy 3: Riding the Bands

What is Riding the Bands?

Riding the Bands involves trading with the trend, where the price stays close to the upper or lower band for an extended period.

How to Trade by Riding the Bands

- Identify the Trend: Use the middle band to determine the trend direction.

- Confirm the Trend: Ensure the price consistently touches the upper or lower band without significant pullbacks.

- Enter the Trade: Enter the trade in the direction of the trend, using the opposite band as a trailing stop.

Strategy 4: Bollinger Band Breakouts

What are Bollinger Band Breakouts?

Breakouts occur when the price moves outside the bands, indicating a strong directional movement.

How to Trade Bollinger Band Breakouts

- Identify the Breakout: Look for the price to close outside the bands.

- Confirm the Strength: Use volume indicators to confirm the strength of the breakout.

- Enter the Trade: Enter the trade in the direction of the breakout, setting stop-loss orders within the bands.

Combining Bollinger Bands with Other Indicators

Relative Strength Index (RSI)

Combining Bollinger Bands with the RSI can enhance the reliability of trading signals. The RSI helps confirm overbought or oversold conditions, providing additional context for Bollinger Band signals.

Moving Averages

Using moving averages alongside Bollinger Bands can help in identifying the overall trend. For example, a 50-day moving average can be used to confirm long-term trends.

Volume Indicators

Volume indicators, such as the On-Balance Volume (OBV), can confirm the strength of breakouts and bounces, making them valuable tools in conjunction with Bollinger Bands.

Risk Management in Bollinger Bands Trading

Setting Stop-Loss Orders

Stop-loss orders are crucial in Bollinger Bands trading to manage risk effectively. Place stop-loss orders just outside the bands to minimize losses in case of false signals.

Position Sizing

Proper position sizing ensures that you do not risk too much on a single trade. Use a fixed percentage of your trading capital for each trade to manage risk effectively.

Regular Review and Adjustment

Regularly review your trading strategy and adjust the parameters of the Bollinger Bands to suit changing market conditions. This ongoing adjustment helps in maintaining the effectiveness of the strategy.

Conclusion

Bollinger Bands Trading Strategies are powerful tools for both novice and experienced traders. By understanding the principles behind Bollinger Bands and implementing these strategies, you can enhance your trading performance and achieve consistent results. Remember to combine Bollinger Bands with other indicators, practice risk management, and stay disciplined in your trading approach.

FAQs

What are Bollinger Bands?

Bollinger Bands are a technical analysis tool that consists of a middle band (usually a 20-day simple moving average) and two outer bands set at 2 standard deviations away from the middle band. They help identify overbought and oversold conditions.

How do Bollinger Bands help in trading?

Bollinger Bands help in identifying volatility and potential price reversals. They provide dynamic support and resistance levels, making them useful for various trading strategies.

What is the Bollinger Bounce strategy?

The Bollinger Bounce strategy involves trading based on the idea that prices tend to revert to the mean. When the price touches the upper or lower band, it often bounces back towards the middle band.

Can Bollinger Bands be used with other indicators?

Yes, Bollinger Bands can be combined with indicators like the Relative Strength Index (RSI), moving averages, and volume indicators to enhance the reliability of trading signals.

What is the Bollinger Squeeze?

The Bollinger Squeeze occurs when the bands contract, indicating low volatility. This situation often precedes a significant price movement, making it a great setup for breakout trades.

Be the first to review “Bollinger Bands Trading Strategies That Work” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.