-

×

Astrology & Stock Market Forecasting with Louise McWhirter

1 × $4.00

Astrology & Stock Market Forecasting with Louise McWhirter

1 × $4.00 -

×

Options Income Generating Blueprint

1 × $31.00

Options Income Generating Blueprint

1 × $31.00 -

×

The Bomb & Bullet Trade Systems 2022 with Guerrilla Trading

1 × $10.00

The Bomb & Bullet Trade Systems 2022 with Guerrilla Trading

1 × $10.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

Advanced Seminar

1 × $31.00

Advanced Seminar

1 × $31.00 -

×

TurnSignal Complete 7-6A (Oct 2013)

1 × $6.00

TurnSignal Complete 7-6A (Oct 2013)

1 × $6.00 -

×

The PB Code Masterclass - Stock Options Trading Course with Ryan Coisson

1 × $5.00

The PB Code Masterclass - Stock Options Trading Course with Ryan Coisson

1 × $5.00 -

×

FX Accelerator 2

1 × $31.00

FX Accelerator 2

1 × $31.00 -

×

Voodoo Lines Indicator

1 × $62.00

Voodoo Lines Indicator

1 × $62.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

Ultimate Gann Trading

1 × $15.00

Ultimate Gann Trading

1 × $15.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Trend Forecasting with Technical Analysis with Louis Mendelsohn & John Murphy

1 × $6.00

Trend Forecasting with Technical Analysis with Louis Mendelsohn & John Murphy

1 × $6.00 -

×

Interactive Brokers Data Downloader 3.0 (software)

1 × $6.00

Interactive Brokers Data Downloader 3.0 (software)

1 × $6.00 -

×

Turnaround Trader Formula with Ifan Wei - T3 Live

1 × $23.00

Turnaround Trader Formula with Ifan Wei - T3 Live

1 × $23.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Swing Trade Pro 2.0 with PivotBoss

1 × $31.00

Swing Trade Pro 2.0 with PivotBoss

1 × $31.00 -

×

Breadth Internal Indicators - Winning Swing & Position Trading with Greg Capra

1 × $6.00

Breadth Internal Indicators - Winning Swing & Position Trading with Greg Capra

1 × $6.00 -

×

Trading to Win Course: One Day at Time (2004 ed.) with Bruce Gilmore

1 × $6.00

Trading to Win Course: One Day at Time (2004 ed.) with Bruce Gilmore

1 × $6.00 -

×

Porsche Dots For NinjaTrader

1 × $31.00

Porsche Dots For NinjaTrader

1 × $31.00 -

×

Binary Defender

1 × $15.00

Binary Defender

1 × $15.00 -

×

Wifxa - INSTITUTIONAL SCALPING

1 × $23.00

Wifxa - INSTITUTIONAL SCALPING

1 × $23.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

InterMarket Analysis (Ed.2004) with John J.Murphy

1 × $6.00

InterMarket Analysis (Ed.2004) with John J.Murphy

1 × $6.00 -

×

Workshop Metals Mastery

1 × $23.00

Workshop Metals Mastery

1 × $23.00 -

×

Z4X Long Term Trading System

1 × $6.00

Z4X Long Term Trading System

1 × $6.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Zeus Capital (ZCFX) Full Mentorship Course

1 × $13.00

Zeus Capital (ZCFX) Full Mentorship Course

1 × $13.00 -

×

Best & Simple Forex day trading strategy with Forex day trading

1 × $5.00

Best & Simple Forex day trading strategy with Forex day trading

1 × $5.00 -

×

Beginners Guide to Trading Intraday Futures Class with Doc Severson

1 × $6.00

Beginners Guide to Trading Intraday Futures Class with Doc Severson

1 × $6.00 -

×

Trading in the Shadow of the Smart Money with Gavin Holmes

1 × $6.00

Trading in the Shadow of the Smart Money with Gavin Holmes

1 × $6.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Twelve Ways to Survive the Next Twelve Months with Adam Lass

1 × $6.00

Twelve Ways to Survive the Next Twelve Months with Adam Lass

1 × $6.00 -

×

Trading the Pristine Method 2020 with T3 Live

1 × $39.00

Trading the Pristine Method 2020 with T3 Live

1 × $39.00 -

×

iMF Tracker – Order Flow Program 2023

1 × $5.00

iMF Tracker – Order Flow Program 2023

1 × $5.00 -

×

Getting Started With Options with Peter Titus - Marwood Research

1 × $6.00

Getting Started With Options with Peter Titus - Marwood Research

1 × $6.00 -

×

Ultimate Guide Technical Trading

1 × $23.00

Ultimate Guide Technical Trading

1 × $23.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

The Secret To Making 7 Figures In A Year with Steven Dux

1 × $31.00

The Secret To Making 7 Figures In A Year with Steven Dux

1 × $31.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Trading Courses Bundle

1 × $31.00

Trading Courses Bundle

1 × $31.00 -

×

The Stock Investor's Pocket Calculator with Michael Thomsett

1 × $6.00

The Stock Investor's Pocket Calculator with Michael Thomsett

1 × $6.00 -

×

Level 3 - AlgoX Trading Tactics

1 × $31.00

Level 3 - AlgoX Trading Tactics

1 × $31.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

WyseTrade Trading Masterclass Course

1 × $5.00

WyseTrade Trading Masterclass Course

1 × $5.00 -

×

Institutional Scalping and Intraday Trading

1 × $5.00

Institutional Scalping and Intraday Trading

1 × $5.00 -

×

Channel Surfing Video Course

1 × $23.00

Channel Surfing Video Course

1 × $23.00 -

×

The In-N-Out Butterfly

1 × $6.00

The In-N-Out Butterfly

1 × $6.00 -

×

Trading The Connors Windows Strategy with Larry Connors

1 × $6.00

Trading The Connors Windows Strategy with Larry Connors

1 × $6.00 -

×

The Works (Full Educational Course) with Waves 618

1 × $39.00

The Works (Full Educational Course) with Waves 618

1 × $39.00 -

×

THE FULL PACKAGE! 8 COURSES with InTheMoneyStocks

1 × $443.00

THE FULL PACKAGE! 8 COURSES with InTheMoneyStocks

1 × $443.00 -

×

Tape Reading - Learn how to read the tape for day trading with Jose Casanova

1 × $15.00

Tape Reading - Learn how to read the tape for day trading with Jose Casanova

1 × $15.00 -

×

Trading BIG Moves With Options

1 × $31.00

Trading BIG Moves With Options

1 × $31.00 -

×

Quick Scalp Trader (Unlocked)

1 × $31.00

Quick Scalp Trader (Unlocked)

1 × $31.00 -

×

Deep Market Analysis Volume 1 with Fractal Flow Pro

1 × $6.00

Deep Market Analysis Volume 1 with Fractal Flow Pro

1 × $6.00 -

×

Eye Opening FX

1 × $5.00

Eye Opening FX

1 × $5.00 -

×

How To Day-Trade Micro Eminis with Dr. Stoxx

1 × $5.00

How To Day-Trade Micro Eminis with Dr. Stoxx

1 × $5.00 -

×

Ultimate Candlestick Bootcamp & B2 Reversal Indicator & Scanner with Steady Trader Secrets

1 × $23.00

Ultimate Candlestick Bootcamp & B2 Reversal Indicator & Scanner with Steady Trader Secrets

1 × $23.00 -

×

Complete Trading System with Segma Singh

1 × $6.00

Complete Trading System with Segma Singh

1 × $6.00 -

×

Options Trading Business with The Daytrading Room

1 × $23.00

Options Trading Business with The Daytrading Room

1 × $23.00 -

×

Tick Trader Bundle with Top Trade Tools

1 × $54.00

Tick Trader Bundle with Top Trade Tools

1 × $54.00 -

×

Trend Following Stocks - Complete Breakout System with Joe Marwood

1 × $6.00

Trend Following Stocks - Complete Breakout System with Joe Marwood

1 × $6.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

GMB Master Academy

1 × $31.00

GMB Master Academy

1 × $31.00 -

×

Volume Trader Course (SMART MONEY SYSTEM-in German)

1 × $139.00

Volume Trader Course (SMART MONEY SYSTEM-in German)

1 × $139.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

Forex Knight Mentoring Program with Hector Deville

1 × $5.00

Forex Knight Mentoring Program with Hector Deville

1 × $5.00 -

×

Learn Forex Cash Bomb

1 × $6.00

Learn Forex Cash Bomb

1 × $6.00 -

×

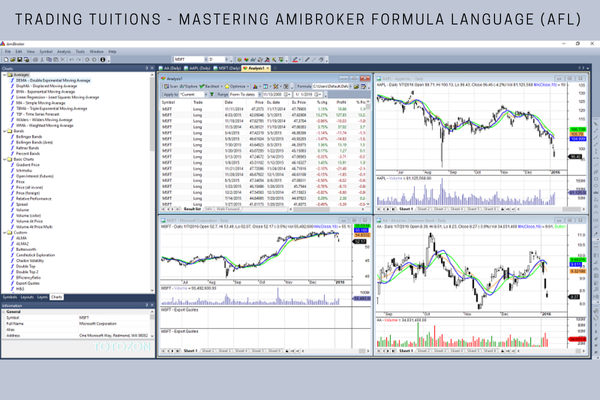

Trading Tuitions - Mastering Amibroker Formula Language (AFL)

1 × $15.00

Trading Tuitions - Mastering Amibroker Formula Language (AFL)

1 × $15.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

Strategy Spotlight Series

1 × $15.00

Strategy Spotlight Series

1 × $15.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

The Stock Market Course with George Fontanills & Tom Gentile

1 × $6.00

The Stock Market Course with George Fontanills & Tom Gentile

1 × $6.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

Transforming Debt into Wealth System with John Cummuta

1 × $6.00

Transforming Debt into Wealth System with John Cummuta

1 × $6.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

INSIDER HEDGE FUND FORMULA (IHFF)

1 × $6.00

INSIDER HEDGE FUND FORMULA (IHFF)

1 × $6.00 -

×

Winning on the Stock Market with Brian J.Millard

1 × $6.00

Winning on the Stock Market with Brian J.Millard

1 × $6.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Manage By The Greeks 2016 with Dan Sheridan

1 × $23.00

Manage By The Greeks 2016 with Dan Sheridan

1 × $23.00 -

×

Intermediate Guide To How Simpler Options Uses ThinkorSwim with Henry Gambell

1 × $15.00

Intermediate Guide To How Simpler Options Uses ThinkorSwim with Henry Gambell

1 × $15.00 -

×

Options Trading RD3 Webinar Series

1 × $31.00

Options Trading RD3 Webinar Series

1 × $31.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Advanced Nasdaq Trading Techniques with Alan Rich

1 × $6.00

Advanced Nasdaq Trading Techniques with Alan Rich

1 × $6.00 -

×

Rapid Revenue Formula with Kate Beeders

1 × $54.00

Rapid Revenue Formula with Kate Beeders

1 × $54.00 -

×

Market Trading Tactics: Beating the Odds Through Technical Analysis and Money Management with Daryl Guppy

1 × $6.00

Market Trading Tactics: Beating the Odds Through Technical Analysis and Money Management with Daryl Guppy

1 × $6.00 -

×

Intermediate Stock Course

1 × $54.00

Intermediate Stock Course

1 × $54.00 -

×

Winning in Options with Elliott Wave + 5 Options Strategies with Todd Gordon

1 × $23.00

Winning in Options with Elliott Wave + 5 Options Strategies with Todd Gordon

1 × $23.00 -

×

Credit Spread Plan to Generate 5% Weekly

1 × $31.00

Credit Spread Plan to Generate 5% Weekly

1 × $31.00 -

×

Integrated Pitchfork Analysis (Volume 1,2,3)

1 × $6.00

Integrated Pitchfork Analysis (Volume 1,2,3)

1 × $6.00 -

×

The Silver Edge Forex Training Program with T3 Live

1 × $5.00

The Silver Edge Forex Training Program with T3 Live

1 × $5.00 -

×

Wealth, War & Wisdom with Barton Biggs

1 × $6.00

Wealth, War & Wisdom with Barton Biggs

1 × $6.00 -

×

Trampoline Trading with Claytrader

1 × $6.00

Trampoline Trading with Claytrader

1 × $6.00 -

×

MTI - Scalping Course

1 × $15.00

MTI - Scalping Course

1 × $15.00 -

×

Ultimate Guide To Swing Trading ETF's

1 × $23.00

Ultimate Guide To Swing Trading ETF's

1 × $23.00 -

×

Trading Pivot Points with Andrew Peters

1 × $6.00

Trading Pivot Points with Andrew Peters

1 × $6.00 -

×

Evolution Markets (Full Main Course)

1 × $5.00

Evolution Markets (Full Main Course)

1 × $5.00 -

×

Forex Options Trading

1 × $6.00

Forex Options Trading

1 × $6.00 -

×

The Stock Market Mastery Program with Ryan Hildreth

1 × $12.00

The Stock Market Mastery Program with Ryan Hildreth

1 × $12.00 -

×

Zedd Monopoly Platinum

1 × $5.00

Zedd Monopoly Platinum

1 × $5.00 -

×

Timing Solution Advanced Build February 2014

1 × $15.00

Timing Solution Advanced Build February 2014

1 × $15.00 -

×

Bulls on Wall Street Mentorship

1 × $31.00

Bulls on Wall Street Mentorship

1 × $31.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

The Advanced Technical Analysis Trading Course (New 2019)

1 × $6.00

The Advanced Technical Analysis Trading Course (New 2019)

1 × $6.00 -

×

Uncertainty & Expectation Strategies for the Trading of Risk with Gerald Ashley

1 × $6.00

Uncertainty & Expectation Strategies for the Trading of Risk with Gerald Ashley

1 × $6.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

How to Use Spreads to Construct a Trading Roadmap

1 × $6.00

How to Use Spreads to Construct a Trading Roadmap

1 × $6.00 -

×

Tick Trader Day Trading Course with David Marsh

1 × $6.00

Tick Trader Day Trading Course with David Marsh

1 × $6.00 -

×

Options University - FX Options Trading Course 2008

1 × $6.00

Options University - FX Options Trading Course 2008

1 × $6.00 -

×

Ultimate Options Trading with Cash Flow Academy

1 × $34.00

Ultimate Options Trading with Cash Flow Academy

1 × $34.00 -

×

Chart Pattern Recognition for Metastock with John Murphy

1 × $6.00

Chart Pattern Recognition for Metastock with John Murphy

1 × $6.00 -

×

TTM Bricks, Trend & BB Squeeze for TS

1 × $6.00

TTM Bricks, Trend & BB Squeeze for TS

1 × $6.00 -

×

Simple Profit Trading System 2020

1 × $54.00

Simple Profit Trading System 2020

1 × $54.00 -

×

Total Fibonacci Trading with TradeSmart University

1 × $31.00

Total Fibonacci Trading with TradeSmart University

1 × $31.00 -

×

Market Profile Course

1 × $54.00

Market Profile Course

1 × $54.00 -

×

Professional Development Program (BRONZE Bundle) with Deeyana Angelo

1 × $78.00

Professional Development Program (BRONZE Bundle) with Deeyana Angelo

1 × $78.00 -

×

ETF Sector Plus Strategy (Course Only) with MarketGauge

1 × $62.00

ETF Sector Plus Strategy (Course Only) with MarketGauge

1 × $62.00 -

×

TTM Indicators Package for eSignal

1 × $6.00

TTM Indicators Package for eSignal

1 × $6.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Optionetics Trading Strategies

1 × $5.00

Optionetics Trading Strategies

1 × $5.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00

Boiler Room Trading

$149.00 Original price was: $149.00.$15.00Current price is: $15.00.

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Boiler Room Trading: Protect Yourself from Scams

Boiler room trading conjures images of high-pressure sales tactics and shady practices. While this term might sound dubious, understanding its history and implications can provide valuable insights into the world of financial trading. In this article, we explore the concept of boiler room trading, its key characteristics, and how to avoid falling prey to such schemes.

What is Boiler Room Trading?

Definition and Origins

Boiler room trading refers to the aggressive selling of securities by unscrupulous brokers who use high-pressure tactics to convince unsuspecting investors to purchase often worthless or overvalued stocks. The term “boiler room” originates from the cramped, high-pressure environments where these brokers operated, similar to a ship’s boiler room.

Historical Context

Boiler room trading gained notoriety in the 1980s and 1990s, with movies like “Wall Street” and “Boiler Room” dramatizing these operations. These firms often targeted inexperienced investors with promises of high returns.

Key Characteristics of Boiler Room Trading

High-Pressure Sales Tactics

Boiler room brokers use aggressive and manipulative tactics to push investors into making quick decisions. They may call repeatedly and use scare tactics to create a sense of urgency.

Unregistered Securities

The stocks sold in boiler rooms are often unregistered and not listed on major exchanges. These securities are typically penny stocks, which are highly speculative and risky.

Misleading Information

Brokers in boiler rooms frequently provide false or misleading information about the stocks they are selling. They may exaggerate the potential returns and downplay the risks involved.

Cold Calling

Cold calling is a common method used by boiler room brokers. They obtain lists of potential investors and make unsolicited calls to pitch their stock offerings.

How Boiler Room Trading Works

Identifying Targets

Boiler rooms often target inexperienced investors who are less likely to recognize the red flags. They use marketing lists, social media, and other means to find potential victims.

Creating Hype

The brokers create hype around a stock by making exaggerated claims about its potential. They may use fabricated news, fake testimonials, and other deceptive tactics to build excitement.

The Hard Sell

Once an investor shows interest, the brokers employ high-pressure tactics to close the sale quickly. They might insist that the opportunity is time-sensitive and urge the investor to act immediately.

Dumping the Stock

After convincing enough investors to buy the stock, the brokers sell their shares at a profit, causing the stock price to plummet. This leaves the investors with worthless or severely devalued shares.

Risks and Consequences

Financial Loss

Investors who fall victim to boiler room schemes can suffer significant financial losses. The stocks sold are often worthless, resulting in a total loss of the invested capital.

Legal Issues

Participating in boiler room operations, even unknowingly, can lead to legal consequences. Regulatory bodies like the SEC actively pursue and prosecute those involved in such schemes.

Damage to Reputation

For brokers and firms, involvement in boiler room trading can lead to irreparable damage to their reputation. This can result in the loss of licenses, fines, and being barred from the industry.

How to Protect Yourself

Do Your Research

Before investing in any stock, conduct thorough research. Verify the legitimacy of the stock, the company, and the broker. Use reliable sources and consult financial advisors if needed.

Beware of High-Pressure Tactics

Be cautious of brokers who use high-pressure tactics. Legitimate brokers will not pressure you to make quick decisions. Take your time to evaluate the investment opportunity.

Check Registration and Licensing

Ensure that the broker and the securities are registered with appropriate regulatory bodies. The SEC and FINRA provide tools to verify the registration status of brokers and firms.

Be Skeptical of Unsolicited Calls

If you receive unsolicited calls promoting investment opportunities, be skeptical. Cold calling is a common tactic used by boiler rooms. Do not provide personal information or make investments based on such calls.

Legitimate Trading Alternatives

Registered Brokers and Firms

Work with registered brokers and established firms that adhere to regulatory standards. They provide transparency and accountability, reducing the risk of fraud.

Diversified Investment Portfolios

Diversify your investment portfolio to spread risk. Invest in a mix of stocks, bonds, and other assets to mitigate the impact of any single investment’s poor performance.

Use Reputable Platforms

Utilize reputable trading platforms that offer robust security measures and transparent practices. These platforms provide tools and resources to help you make informed decisions.

The Role of Regulators

SEC and FINRA

The Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA) play crucial roles in regulating and monitoring the securities industry. They enforce laws and regulations to protect investors.

Reporting Fraud

If you suspect boiler room activity, report it to the SEC or FINRA. These organizations have mechanisms in place to investigate and take action against fraudulent activities.

Conclusion

Boiler room trading represents one of the darker aspects of the financial industry. By understanding how these schemes operate and recognizing the red flags, investors can protect themselves from falling victim to such fraud. Staying informed, conducting thorough research, and working with reputable brokers are key steps in safeguarding your investments.

Commonly Asked Questions:

- Business Model Innovation: Accept the truth of a legitimate business! Our strategy is organising a group buy in which participants share the costs. We use these cash to acquire popular courses from sale pages and make them available to people with limited financial resources. Despite the authors’ worries, our clients love the cost and accessibility we give.

- The Legal Environment: Yes or No The legality of our activity is ambiguous. While we don’t have specific permission from the course authors to resell the material, there is a technicality at work. The author did not specify any limits on resale when purchasing the course. This legal intricacy is both an opportunity for us and a boon for individuals looking for low-cost access.

- Quality Control: Uncovering the Truth

Getting to the heart of the issue – quality. Purchasing the course straight from the sale page guarantees that all documents and resources are the same as those obtained through traditional channels.

However, we distinguish ourselves by going beyond personal research and resale. It is crucial to note that we are not the official course providers, which means that the following premium services are not included in our package:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not permitted.

- No access to the author’s private membership forum.

- There is no direct email support available from the author or their team.

We operate independently, with the goal of bridging the pricing gap without the extra services provided by official course channels. Your comprehension of our distinct approach is much appreciated.

Be the first to review “Boiler Room Trading” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.