-

×

Things You Need To Know About Full Time Trading with Rajandran R

1 × $4.00

Things You Need To Know About Full Time Trading with Rajandran R

1 × $4.00 -

×

Ultimate Options Trading with Cash Flow Academy

1 × $34.00

Ultimate Options Trading with Cash Flow Academy

1 × $34.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

TTM Squeeze Clone for eSignal

1 × $6.00

TTM Squeeze Clone for eSignal

1 × $6.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

The Whale Order with The Forex Scalpers

1 × $5.00

The Whale Order with The Forex Scalpers

1 × $5.00 -

×

Winning Market Systems. 83 Ways to Beat the Market

1 × $6.00

Winning Market Systems. 83 Ways to Beat the Market

1 × $6.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

How To Design, Test, Evaluate and Implement Profitable Trading Systems(Manual Only)

1 × $4.00

How To Design, Test, Evaluate and Implement Profitable Trading Systems(Manual Only)

1 × $4.00 -

×

Ultimate Candlestick Bootcamp & B2 Reversal Indicator & Scanner with Steady Trader Secrets

1 × $23.00

Ultimate Candlestick Bootcamp & B2 Reversal Indicator & Scanner with Steady Trader Secrets

1 × $23.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

The FOREX Blueprint with The Swag Academy

1 × $5.00

The FOREX Blueprint with The Swag Academy

1 × $5.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Turning Point. Analysis in Price and Time

1 × $6.00

Turning Point. Analysis in Price and Time

1 × $6.00 -

×

Trading Psychology, Day-trading & Swing Trading with Alexander Elder

1 × $31.00

Trading Psychology, Day-trading & Swing Trading with Alexander Elder

1 × $31.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

System Trading Unleashed with Better System Trader

1 × $5.00

System Trading Unleashed with Better System Trader

1 × $5.00 -

×

The Rare Writings of W.D Gann

1 × $6.00

The Rare Writings of W.D Gann

1 × $6.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Winning Chart Patterns. 7 Patterns That Really Work with Ed Downs

1 × $6.00

Winning Chart Patterns. 7 Patterns That Really Work with Ed Downs

1 × $6.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Macro to Micro Volatility Trading with Mark Whistler

1 × $5.00

Macro to Micro Volatility Trading with Mark Whistler

1 × $5.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Tradeonix 2.0 + Maxinator Trade Assistant (Full Version)

1 × $54.00

Tradeonix 2.0 + Maxinator Trade Assistant (Full Version)

1 × $54.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Trading Pairs: Capturing Profits and Hedging Risk with Statistical Arbitrage Strategies - Mark Whistler

1 × $6.00

Trading Pairs: Capturing Profits and Hedging Risk with Statistical Arbitrage Strategies - Mark Whistler

1 × $6.00

Guide to Scanning for Potential Stock Trades class with Jeff Bierman

$95.00 Original price was: $95.00.$6.00Current price is: $6.00.

File Size: 913 MB

Delivery Time: 1–12 hours

Media Type: Online Course

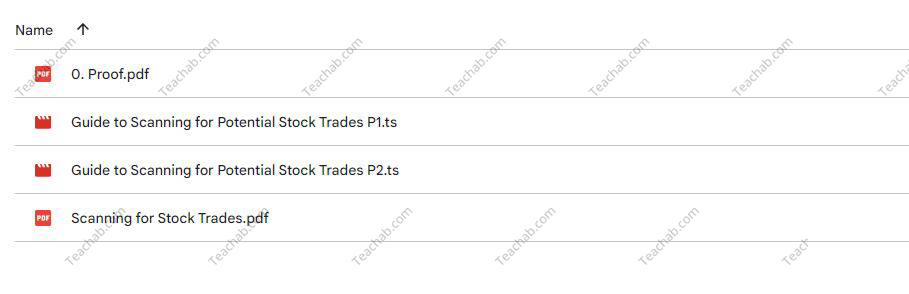

Content Proof: Watch Here!

You may check content proof of “Guide to Scanning for Potential Stock Trades class with Jeff Bierman” below:

Guide to Scanning for Potential Stock Trades Class with Jeff Bierman

Introduction

Trading stocks successfully requires more than luck; it demands a thorough understanding of market signals and the ability to identify promising opportunities. Jeff Bierman’s “Guide to Scanning for Potential Stock Trades” class provides an extensive framework for doing just that.

Understanding Stock Scanning

What is Stock Scanning?

Stock scanning involves using software tools to filter stocks based on specific criteria to identify potential trading opportunities.

Benefits of Effective Stock Scanning

- Efficiency: Quickly sift through thousands of stocks.

- Precision: Pinpoint stocks that meet your trading strategy requirements.

Essential Tools for Stock Scanning

Choosing the Right Software

Overview of popular stock scanning tools like TradeStation, ThinkorSwim, and Finviz.

Setting Up Scanners

How to configure your stock scanner settings to match your trading goals.

Developing Scanning Criteria

Technical Indicators

Utilizing indicators such as moving averages, RSI, and MACD to set scanning parameters.

Volume and Volatility Filters

How to use volume and volatility as filters to find active stocks.

Scanning for Different Trading Styles

Day Trading Scans

Setting up scanners for high volatility and volume that are ideal for day trading.

Swing Trading Scans

Criteria for identifying stocks that show medium-term reversal patterns.

Incorporating Fundamental Analysis

Financial Health Indicators

Using scanners to filter stocks based on financial metrics like P/E ratio, earnings growth, and debt levels.

Market Sentiment Tools

How to gauge market sentiment using news filters and social media trending topics.

Advanced Scanning Techniques

Sector and Industry Scanning

Narrowing your focus to the best-performing sectors or industries.

Seasonal and Cyclical Opportunities

Identifying stocks that perform well during specific times of the year.

Real-Time Scanning in Action

Live Trading Examples

Jeff Bierman demonstrates live how to use stock scanners during trading sessions.

Case Studies

Analyzing past successful trades that were identified using sophisticated scanning techniques.

Common Pitfalls in Stock Scanning

Over-Filtering

The risks of setting too strict criteria, which might lead to missing out on potential opportunities.

Reliance on Outdated Data

The importance of ensuring your data feeds are current and accurate.

Maintaining and Updating Your Scanners

Regular Updates

How and why you should regularly update your scanning criteria and software.

Adapting to Market Changes

Adjusting your scanners to keep up with changing market conditions.

Practical Exercises and Homework

Hands-On Scanning Sessions

Practical sessions where students can practice setting up and using stock scanners.

Homework Assignments

Tasks designed to reinforce the lessons learned in class and to encourage independent study.

Conclusion

Jeff Bierman’s class on scanning for potential stock trades equips traders with the essential skills to effectively sift through the noise of the market and pinpoint valuable trading opportunities. With the right tools and strategies, traders can enhance their decision-making process and potentially increase their success rate.

Commonly Asked Questions:

- Business Model Innovation: Accept the truth of a legitimate business! Our strategy is organising a group buy in which participants share the costs. We use these cash to acquire popular courses from sale pages and make them available to people with limited financial resources. Despite the authors’ worries, our clients love the cost and accessibility we give.

- The Legal Environment: Yes or No The legality of our activity is ambiguous. While we don’t have specific permission from the course authors to resell the material, there is a technicality at work. The author did not specify any limits on resale when purchasing the course. This legal intricacy is both an opportunity for us and a boon for individuals looking for low-cost access.

- Quality Control: Uncovering the Truth

Getting to the heart of the issue – quality. Purchasing the course straight from the sale page guarantees that all documents and resources are the same as those obtained through traditional channels.

However, we distinguish ourselves by going beyond personal research and resale. It is crucial to note that we are not the official course providers, which means that the following premium services are not included in our package:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not permitted.

- No access to the author’s private membership forum.

- There is no direct email support available from the author or their team.

We operate independently, with the goal of bridging the pricing gap without the extra services provided by official course channels. Your comprehension of our distinct approach is much appreciated.

Be the first to review “Guide to Scanning for Potential Stock Trades class with Jeff Bierman” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.