-

×

Options Masterclass with WallStreet Trapper

1 × $13.00

Options Masterclass with WallStreet Trapper

1 × $13.00 -

×

Trading Mastery For Financial Freedom with Marv Eisen

1 × $10.00

Trading Mastery For Financial Freedom with Marv Eisen

1 × $10.00 -

×

Orderflows Gems 2-Private Sessions with Mike Valtos

1 × $20.00

Orderflows Gems 2-Private Sessions with Mike Valtos

1 × $20.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Trend Commandments with Michael Covel

1 × $6.00

Trend Commandments with Michael Covel

1 × $6.00 -

×

Handbook of Integral Equations with Andrei D.Polyanin, Alexander V.Manzhirov

1 × $6.00

Handbook of Integral Equations with Andrei D.Polyanin, Alexander V.Manzhirov

1 × $6.00 -

×

Options On Futures Class By Mark Fenton - Sheridan Options Mentoring

1 × $6.00

Options On Futures Class By Mark Fenton - Sheridan Options Mentoring

1 × $6.00 -

×

Top Ultimate Breakout with Top Trade Tools

1 × $6.00

Top Ultimate Breakout with Top Trade Tools

1 × $6.00 -

×

Just What I Said: Bloomberg Economics Columnist Takes on Bonds, Banks, Budgets, and Bubbles with Caroline Baum

1 × $6.00

Just What I Said: Bloomberg Economics Columnist Takes on Bonds, Banks, Budgets, and Bubbles with Caroline Baum

1 × $6.00 -

×

FruitFly For Consistent Income with Matt Williamson

1 × $6.00

FruitFly For Consistent Income with Matt Williamson

1 × $6.00 -

×

4 Class Bundle

1 × $31.00

4 Class Bundle

1 × $31.00 -

×

PDFT (Price Driven Forex Trading) Course with Avi Frister

1 × $6.00

PDFT (Price Driven Forex Trading) Course with Avi Frister

1 × $6.00 -

×

A Convicted Stock Manipulators Guide to Investing with Marino Specogna

1 × $6.00

A Convicted Stock Manipulators Guide to Investing with Marino Specogna

1 × $6.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Trading the Elliott Waves with Robert Prechter

1 × $15.00

Trading the Elliott Waves with Robert Prechter

1 × $15.00 -

×

Spike 35 Traders Manual with J.D.Hamon

1 × $6.00

Spike 35 Traders Manual with J.D.Hamon

1 × $6.00 -

×

Investment Intelligence from Insider Trading with H.N.Seyhun

1 × $6.00

Investment Intelligence from Insider Trading with H.N.Seyhun

1 × $6.00 -

×

Game-Maker Forex Trading System

1 × $6.00

Game-Maker Forex Trading System

1 × $6.00 -

×

Momentum Explained

1 × $6.00

Momentum Explained

1 × $6.00 -

×

MambaFX - Bundle - Trading/Scalping

1 × $23.00

MambaFX - Bundle - Trading/Scalping

1 × $23.00 -

×

Introduction to Probability with Charles M.Grinstead, J.Laurie Snell

1 × $6.00

Introduction to Probability with Charles M.Grinstead, J.Laurie Snell

1 × $6.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Using Fundamental Analysis with Andrew Baxter

1 × $6.00

Using Fundamental Analysis with Andrew Baxter

1 × $6.00 -

×

W.D. Gann’s Best Trading Systems with Myles Wilson-Walker

1 × $27.00

W.D. Gann’s Best Trading Systems with Myles Wilson-Walker

1 × $27.00 -

×

War Room Technicals Volume 2 with Pat Mitchell – Trick Trades

1 × $6.00

War Room Technicals Volume 2 with Pat Mitchell – Trick Trades

1 × $6.00 -

×

Road Congestion Pricing in Europe: Implications for the United States with Harry Richardson & Chang-Hee Christine Bae

1 × $6.00

Road Congestion Pricing in Europe: Implications for the United States with Harry Richardson & Chang-Hee Christine Bae

1 × $6.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Bulk REO 2.0

1 × $23.00

Bulk REO 2.0

1 × $23.00 -

×

Forex Advanced with Prophetic Pips Academy

1 × $5.00

Forex Advanced with Prophetic Pips Academy

1 × $5.00 -

×

Full Volume Forex Training Course with ThatFXTrader

1 × $5.00

Full Volume Forex Training Course with ThatFXTrader

1 × $5.00 -

×

Wyckoff 2.0: Structures, Volume Profile and Order Flow (Trading and Investing Course: Advanced Technical Analysis) by Rubén Villahermosa

1 × $5.00

Wyckoff 2.0: Structures, Volume Profile and Order Flow (Trading and Investing Course: Advanced Technical Analysis) by Rubén Villahermosa

1 × $5.00 -

×

Pine Script Mastery Course with Matthew Slabosz

1 × $5.00

Pine Script Mastery Course with Matthew Slabosz

1 × $5.00 -

×

Mastering the Complex Sale: How to Compete and Win When the Stakes are High! with Jeff Thull

1 × $6.00

Mastering the Complex Sale: How to Compete and Win When the Stakes are High! with Jeff Thull

1 × $6.00 -

×

9-Day Calendar Deep Dive 2023 with Jay Bailey - Sheridan Options Mentoring

1 × $31.00

9-Day Calendar Deep Dive 2023 with Jay Bailey - Sheridan Options Mentoring

1 × $31.00 -

×

Analysis Of Entry Signals Part Two (Fundamentals) with Joe Marwood

1 × $23.00

Analysis Of Entry Signals Part Two (Fundamentals) with Joe Marwood

1 × $23.00 -

×

Algorithmic Trading Systems: Advanced Gap Strategies for the Futures Markets with David Bean

1 × $5.00

Algorithmic Trading Systems: Advanced Gap Strategies for the Futures Markets with David Bean

1 × $5.00 -

×

A Forex System For Catching Pips All Day Long with Forex Pip Fishing

1 × $4.00

A Forex System For Catching Pips All Day Long with Forex Pip Fishing

1 × $4.00 -

×

NoBSFX Trading Workshop with Jaime Johnson

1 × $23.00

NoBSFX Trading Workshop with Jaime Johnson

1 × $23.00 -

×

Technical Analysis for Long-Term Investors with Clay Allen

1 × $6.00

Technical Analysis for Long-Term Investors with Clay Allen

1 × $6.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Trading Connors VIX Reversals Tradestation Files with Laurence A. Connors & Gregory J. Che

1 × $6.00

Trading Connors VIX Reversals Tradestation Files with Laurence A. Connors & Gregory J. Che

1 × $6.00 -

×

Alpesh Patel Indicator with Alpesh Patel

1 × $62.00

Alpesh Patel Indicator with Alpesh Patel

1 × $62.00 -

×

Tape Reading Small Caps with Jtrader

1 × $23.00

Tape Reading Small Caps with Jtrader

1 × $23.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

Cycle Hunter Support with Brian James Sklenka

1 × $6.00

Cycle Hunter Support with Brian James Sklenka

1 × $6.00 -

×

LT Pulse and LT Trend/Ultra

1 × $23.00

LT Pulse and LT Trend/Ultra

1 × $23.00 -

×

Zanzibar System for the EuroFx with Joe Ross

1 × $4.00

Zanzibar System for the EuroFx with Joe Ross

1 × $4.00 -

×

Mindover Markets Enhanced: The Intensive Series 2 with Jim Dalton

1 × $20.00

Mindover Markets Enhanced: The Intensive Series 2 with Jim Dalton

1 × $20.00 -

×

Futures Trading Secrets Home Study Course 2004 with Bill McCready

1 × $7.00

Futures Trading Secrets Home Study Course 2004 with Bill McCready

1 × $7.00 -

×

Pristine - Cardinal Rules of Trading

1 × $6.00

Pristine - Cardinal Rules of Trading

1 × $6.00 -

×

How to Make a Living Trading Foreign Exchange: A Guaranteed Income for Life with Courtney Smith

1 × $6.00

How to Make a Living Trading Foreign Exchange: A Guaranteed Income for Life with Courtney Smith

1 × $6.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Key to Speculation on the New York Stock Exchange

1 × $6.00

Key to Speculation on the New York Stock Exchange

1 × $6.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

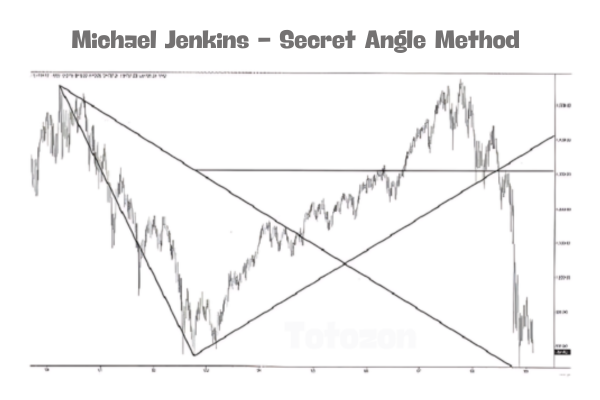

Secret Angle Method with Michael Jenkins

1 × $4.00

Secret Angle Method with Michael Jenkins

1 × $4.00 -

×

MACD Divergence Fully Automatic Indicator for ThinkOrSwim TOS

1 × $6.00

MACD Divergence Fully Automatic Indicator for ThinkOrSwim TOS

1 × $6.00 -

×

Hit The Mark Trading - Boot Camp 2016 Courses

1 × $23.00

Hit The Mark Trading - Boot Camp 2016 Courses

1 × $23.00 -

×

A Mathematician Plays The Stock Market with John Allen Paulos

1 × $6.00

A Mathematician Plays The Stock Market with John Allen Paulos

1 × $6.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

Increasing Vertical Spread Probabilities with Technical Analysis with Doc Severson

1 × $6.00

Increasing Vertical Spread Probabilities with Technical Analysis with Doc Severson

1 × $6.00 -

×

Trade The Price Action with Thomas Wood (Valuecharts)

1 × $15.00

Trade The Price Action with Thomas Wood (Valuecharts)

1 × $15.00 -

×

Investing Online with Benton E.Gup

1 × $6.00

Investing Online with Benton E.Gup

1 × $6.00 -

×

Order Flow With The Power Of Point Of Control Course and The Imbalance

1 × $6.00

Order Flow With The Power Of Point Of Control Course and The Imbalance

1 × $6.00 -

×

Introduction To Advanced Options Trading 201

1 × $23.00

Introduction To Advanced Options Trading 201

1 × $23.00 -

×

Phantom of the Pit BY Art Simpson

1 × $6.00

Phantom of the Pit BY Art Simpson

1 × $6.00 -

×

Lessons from the Greatest Stock Traders of all Time with John Boik

1 × $6.00

Lessons from the Greatest Stock Traders of all Time with John Boik

1 × $6.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Gann Wheel 1.2.15 (globalviewtech.com)

1 × $6.00

Gann Wheel 1.2.15 (globalviewtech.com)

1 × $6.00 -

×

Ichimoku Cloud Trading System Class with Jeff Bierman

1 × $6.00

Ichimoku Cloud Trading System Class with Jeff Bierman

1 × $6.00 -

×

Marder Videos Reports 2019 with Kevin Marder

1 × $34.00

Marder Videos Reports 2019 with Kevin Marder

1 × $34.00 -

×

Fx Engine Trading Course with Adeh Mirzakhani

1 × $6.00

Fx Engine Trading Course with Adeh Mirzakhani

1 × $6.00 -

×

How to Trade a Vertical Market

1 × $93.00

How to Trade a Vertical Market

1 × $93.00 -

×

Managing By The Greeks (6 Classes) Sept 2010 [9 Videos(mp4) 11 docs(pdf)] by Dan Sheridan

1 × $6.00

Managing By The Greeks (6 Classes) Sept 2010 [9 Videos(mp4) 11 docs(pdf)] by Dan Sheridan

1 × $6.00 -

×

YTC Price Action Trader

1 × $6.00

YTC Price Action Trader

1 × $6.00 -

×

Trading Psychology with Barry Burns

1 × $4.00

Trading Psychology with Barry Burns

1 × $4.00 -

×

Make Money While You Sleep with Forex Night Train

1 × $6.00

Make Money While You Sleep with Forex Night Train

1 × $6.00 -

×

Systems Trading for Spread Betting: An end-to-end guide for developing spread betting systems with Gary Ford

1 × $6.00

Systems Trading for Spread Betting: An end-to-end guide for developing spread betting systems with Gary Ford

1 × $6.00 -

×

Mastering Candlestick Charts I with Greg Capra

1 × $6.00

Mastering Candlestick Charts I with Greg Capra

1 × $6.00 -

×

Managing Debt for Dummies with John Ventura

1 × $6.00

Managing Debt for Dummies with John Ventura

1 × $6.00 -

×

Investing Classroom 2022 with Danny Devan

1 × $15.00

Investing Classroom 2022 with Danny Devan

1 × $15.00 -

×

Tail Hedging - Learn to Insure Stocks Against Large Declines with James Marsh

1 × $15.00

Tail Hedging - Learn to Insure Stocks Against Large Declines with James Marsh

1 × $15.00 -

×

Galactic Trader Seminar

1 × $15.00

Galactic Trader Seminar

1 × $15.00 -

×

Forex Courses Collection

1 × $55.00

Forex Courses Collection

1 × $55.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Best & Simple Forex day trading strategy with Forex day trading

$5.00

File Size: 3.27 GB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Best & Simple Forex day trading strategy with Forex day trading” below:

Best & Simple Forex Day Trading Strategy with Forex Day Trading

Navigating the world of Forex trading can be challenging, but with the right strategy, it becomes significantly more manageable. In this article, we will explore a Best & Simple Forex Day Trading Strategy with Forex Day Trading that can help you enhance your trading performance. This strategy is designed for both beginners and experienced traders, offering a straightforward approach to making informed trading decisions.

Introduction to Forex Day Trading

Forex day trading involves buying and selling currency pairs within the same trading day. The goal is to capitalize on short-term price movements, avoiding overnight risks. This strategy requires a keen understanding of the market, quick decision-making, and effective risk management.

Why Choose Day Trading in Forex?

Day trading in Forex offers several advantages:

- High Liquidity: The Forex market is highly liquid, allowing for quick entry and exit of trades.

- Flexibility: Traders can choose their trading hours, as the Forex market operates 24 hours a day.

- Potential for Quick Profits: Day trading can yield profits quickly due to short-term price movements.

Key Components of a Simple Forex Day Trading Strategy

- Understanding Market Trends

- Identifying the direction of the market

- Using trend lines to determine entry and exit points

- Utilizing Technical Indicators

- Moving Averages (MA): Helps identify the direction of the trend.

- Relative Strength Index (RSI): Indicates overbought or oversold conditions.

- Bollinger Bands: Measures market volatility and potential price reversals.

- Setting Up Your Trading Platform

- Choosing a reliable Forex trading platform

- Customizing charts and indicators for easy analysis

- Risk Management Techniques

- Setting stop-loss and take-profit levels

- Determining position size based on risk tolerance

Step-by-Step Guide to a Simple Forex Day Trading Strategy

Step 1: Identify the Market Trend

Start by analyzing the overall trend of the currency pair you are interested in. Use moving averages to smooth out price data and identify the direction of the trend. A common approach is to use the 50-day and 200-day moving averages:

- If the 50-day MA is above the 200-day MA, the trend is upward.

- If the 50-day MA is below the 200-day MA, the trend is downward.

Step 2: Use RSI to Confirm Entry Points

The Relative Strength Index (RSI) helps you determine whether a currency pair is overbought or oversold:

- An RSI above 70 suggests the currency pair is overbought and may reverse downwards.

- An RSI below 30 suggests the currency pair is oversold and may reverse upwards.

Step 3: Implement Bollinger Bands

Bollinger Bands consist of a middle band (a moving average) and two outer bands that indicate market volatility. Use Bollinger Bands to:

- Identify potential breakouts when the price moves outside the bands.

- Confirm trend reversals when the price moves back inside the bands.

Step 4: Set Stop-Loss and Take-Profit Levels

Risk management is crucial in day trading. Set your stop-loss order slightly below the support level in an uptrend, or slightly above the resistance level in a downtrend. Determine your take-profit level based on a reasonable risk-reward ratio, typically 1:2 or 1:3.

Step 5: Monitor and Adjust

Continuously monitor your trades and be prepared to adjust your strategy based on market conditions. Keep an eye on major economic announcements and news that could impact currency prices.

Practical Tips for Successful Forex Day Trading

- Stay Informed: Keep up with market news and economic indicators.

- Practice Discipline: Stick to your trading plan and avoid emotional decisions.

- Use a Demo Account: Practice your strategy with virtual money before trading with real funds.

- Keep a Trading Journal: Record your trades and analyze your performance to identify areas for improvement.

Common Mistakes to Avoid in Forex Day Trading

- Overtrading: Avoid taking too many trades within a short period.

- Ignoring Risk Management: Always use stop-loss orders to protect your capital.

- Chasing Losses: Do not attempt to recover losses by taking impulsive trades.

Benefits of a Simple Forex Day Trading Strategy

- Ease of Implementation: Simple strategies are easier to understand and execute.

- Focus on Key Indicators: Using a few reliable indicators can improve your decision-making.

- Effective Risk Management: A straightforward approach makes it easier to manage risks.

Conclusion

Adopting a Best & Simple Forex Day Trading Strategy with Forex Day Trading can significantly enhance your trading performance. By understanding market trends, utilizing technical indicators, and implementing effective risk management techniques, you can navigate the Forex market with confidence. Remember, consistent practice and continuous learning are key to becoming a successful day trader.

Commonly Asked Questions:

- Business Model Innovation: Accept the truth of a legitimate business! Our strategy is organising a group buy in which participants share the costs. We use these cash to acquire popular courses from sale pages and make them available to people with limited financial resources. Despite the authors’ worries, our clients love the cost and accessibility we give.

- The Legal Environment: Yes or No The legality of our activity is ambiguous. While we don’t have specific permission from the course authors to resell the material, there is a technicality at work. The author did not specify any limits on resale when purchasing the course. This legal intricacy is both an opportunity for us and a boon for individuals looking for low-cost access.

- Quality Control: Uncovering the Truth

Getting to the heart of the issue – quality. Purchasing the course straight from the sale page guarantees that all documents and resources are the same as those obtained through traditional channels.

However, we distinguish ourselves by going beyond personal research and resale. It is crucial to note that we are not the official course providers, which means that the following premium services are not included in our package:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not permitted.

- No access to the author’s private membership forum.

- There is no direct email support available from the author or their team.

We operate independently, with the goal of bridging the pricing gap without the extra services provided by official course channels. Your comprehension of our distinct approach is much appreciated.

Be the first to review “Best & Simple Forex day trading strategy with Forex day trading” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.