-

×

Trading Full Circle the Complete Underground Trader System for Timing with Jea Yu

1 × $6.00

Trading Full Circle the Complete Underground Trader System for Timing with Jea Yu

1 × $6.00 -

×

Create Your Trade Plan with Yuri Shramenko

1 × $6.00

Create Your Trade Plan with Yuri Shramenko

1 × $6.00 -

×

The Trader's Mindset Course with Chris Mathews

1 × $6.00

The Trader's Mindset Course with Chris Mathews

1 × $6.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

Candle Charting Essentials & Beyond Volume 1 & 2 with Steve Nison - Candle Charts

1 × $15.00

Candle Charting Essentials & Beyond Volume 1 & 2 with Steve Nison - Candle Charts

1 × $15.00 -

×

Day One Trader with John Sussex

1 × $6.00

Day One Trader with John Sussex

1 × $6.00 -

×

Advanced Trading Course with DovyFX

1 × $5.00

Advanced Trading Course with DovyFX

1 × $5.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Trade Execution & Trade Management with Kam Dhadwar

1 × $6.00

Trade Execution & Trade Management with Kam Dhadwar

1 × $6.00 -

×

The Bond Book (2nd Ed.) with Annette Thau

1 × $6.00

The Bond Book (2nd Ed.) with Annette Thau

1 × $6.00 -

×

Yield Farming MasterClass Course (2022) with Boss Financial

1 × $5.00

Yield Farming MasterClass Course (2022) with Boss Financial

1 × $5.00 -

×

The Practical Guide to Wall Street with Matthew Tagliani

1 × $6.00

The Practical Guide to Wall Street with Matthew Tagliani

1 × $6.00 -

×

FX GOAT NASDAQ COURSE 2.0

1 × $13.00

FX GOAT NASDAQ COURSE 2.0

1 × $13.00 -

×

7 Days Options Masters Course with John Carter

1 × $54.00

7 Days Options Masters Course with John Carter

1 × $54.00 -

×

An Ultimate Guide to Successful Investing with Trading Tuitions

1 × $23.00

An Ultimate Guide to Successful Investing with Trading Tuitions

1 × $23.00 -

×

Crash or Correction - Top 5 Patterns Every Trader Must Master with Todd Gordon

1 × $6.00

Crash or Correction - Top 5 Patterns Every Trader Must Master with Todd Gordon

1 × $6.00 -

×

Algo Wizard Essentials Course with Srategy Quant

1 × $13.00

Algo Wizard Essentials Course with Srategy Quant

1 × $13.00 -

×

Trade from Anywhere

1 × $6.00

Trade from Anywhere

1 × $6.00 -

×

Traders World Past Issue Articles on CD with Magazine

1 × $6.00

Traders World Past Issue Articles on CD with Magazine

1 × $6.00 -

×

Weekly Diagonal Spreads for Consistent Income By Doc Severson

1 × $6.00

Weekly Diagonal Spreads for Consistent Income By Doc Severson

1 × $6.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

Quantitative Trading: How to Build Your Own Algorithmic Trading Business (1st Edition) with Ernest Chan

1 × $6.00

Quantitative Trading: How to Build Your Own Algorithmic Trading Business (1st Edition) with Ernest Chan

1 × $6.00 -

×

CANDLESTICKS APPLIED with Steve Nison & Syl Desaulniers - Candle Charts

1 × $15.00

CANDLESTICKS APPLIED with Steve Nison & Syl Desaulniers - Candle Charts

1 × $15.00 -

×

Commodity Futures Traders Club (CTCN) Issues 01 – 77

1 × $6.00

Commodity Futures Traders Club (CTCN) Issues 01 – 77

1 × $6.00 -

×

Advanced Options Concepts - Probability, Greeks, Simulation

1 × $6.00

Advanced Options Concepts - Probability, Greeks, Simulation

1 × $6.00 -

×

The Complete Foundation Stock Trading Course

1 × $62.00

The Complete Foundation Stock Trading Course

1 × $62.00 -

×

WYCKOFF TRADING COURSE (WTC) PART I – ANALYSIS (Fall 2021) with Roman Bogomazov

1 × $209.00

WYCKOFF TRADING COURSE (WTC) PART I – ANALYSIS (Fall 2021) with Roman Bogomazov

1 × $209.00 -

×

8 Strategies for Day Trading

1 × $31.00

8 Strategies for Day Trading

1 × $31.00 -

×

Masterclass 3.0 with RockzFX Academy

1 × $6.00

Masterclass 3.0 with RockzFX Academy

1 × $6.00 -

×

Active Trading Course Notes with Alan Hull

1 × $6.00

Active Trading Course Notes with Alan Hull

1 × $6.00 -

×

Advanced Pattern Trader Course with Trade Empowered

1 × $23.00

Advanced Pattern Trader Course with Trade Empowered

1 × $23.00 -

×

THE FULL PACKAGE! 8 COURSES with InTheMoneyStocks

1 × $443.00

THE FULL PACKAGE! 8 COURSES with InTheMoneyStocks

1 × $443.00 -

×

The Compleat Day Trader with Jake Bernstein

1 × $6.00

The Compleat Day Trader with Jake Bernstein

1 × $6.00 -

×

Wheels of Gann. Top Secret Forecast Guide with Pat Reda

1 × $6.00

Wheels of Gann. Top Secret Forecast Guide with Pat Reda

1 × $6.00 -

×

Algohub 2023 Full Completed with Algohub

1 × $5.00

Algohub 2023 Full Completed with Algohub

1 × $5.00 -

×

Getting Started in Forex Trading Strategies with Michael Duane Archer

1 × $6.00

Getting Started in Forex Trading Strategies with Michael Duane Archer

1 × $6.00 -

×

All About Market Timing with Leslie N.Masonson

1 × $6.00

All About Market Timing with Leslie N.Masonson

1 × $6.00 -

×

Capital Flows and Crises with Barry Eichengreen

1 × $6.00

Capital Flows and Crises with Barry Eichengreen

1 × $6.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Becoming a Disciplined Trader: Techniques for Achieving Peak Trading Performance with Ari Kiev

1 × $6.00

Becoming a Disciplined Trader: Techniques for Achieving Peak Trading Performance with Ari Kiev

1 × $6.00 -

×

Trading Blox Builder 4.3.2.1

1 × $31.00

Trading Blox Builder 4.3.2.1

1 × $31.00 -

×

Stock Market Winners with Maria Crawford Scott, John Bajkowski

1 × $6.00

Stock Market Winners with Maria Crawford Scott, John Bajkowski

1 × $6.00 -

×

Wyckoff simplified from Michael Z

1 × $6.00

Wyckoff simplified from Michael Z

1 × $6.00 -

×

Market Makers Method Forex Trading with Nick Nechanicky

1 × $5.00

Market Makers Method Forex Trading with Nick Nechanicky

1 × $5.00 -

×

Affinity Foundation Stocks Course with Affinitytrading

1 × $6.00

Affinity Foundation Stocks Course with Affinitytrading

1 × $6.00 -

×

Conquering Stock Market Hype with Allan Campbell

1 × $6.00

Conquering Stock Market Hype with Allan Campbell

1 × $6.00 -

×

Maximum Lots Trading Course with Joe Wright

1 × $34.00

Maximum Lots Trading Course with Joe Wright

1 × $34.00 -

×

Simpler Options - Insider’s Guide to Generating Income using Options Strategies Course (Oct 2014)

1 × $6.00

Simpler Options - Insider’s Guide to Generating Income using Options Strategies Course (Oct 2014)

1 × $6.00 -

×

Build A Solid Foundation For Trading Options with Corey Halliday

1 × $6.00

Build A Solid Foundation For Trading Options with Corey Halliday

1 × $6.00 -

×

Stock Traders Almanac 2008 with Jeffrey Hirsch & Yale Hirsch

1 × $6.00

Stock Traders Almanac 2008 with Jeffrey Hirsch & Yale Hirsch

1 × $6.00 -

×

Flux Investor Package v2.2.1, (Jan 2016) with Back To The Future Trading

1 × $85.00

Flux Investor Package v2.2.1, (Jan 2016) with Back To The Future Trading

1 × $85.00 -

×

The Fundamentals of Options Trading Basis with Joseph Frey

1 × $6.00

The Fundamentals of Options Trading Basis with Joseph Frey

1 × $6.00 -

×

Affinity Foundation Option Course with Affinitytrading

1 × $6.00

Affinity Foundation Option Course with Affinitytrading

1 × $6.00 -

×

A-Z Course with InvestiTrade Academy

1 × $5.00

A-Z Course with InvestiTrade Academy

1 × $5.00 -

×

Volume Profile Video Course with Trader Dale

1 × $8.00

Volume Profile Video Course with Trader Dale

1 × $8.00 -

×

Credit Spread Trading Made Simple 3.0

1 × $6.00

Credit Spread Trading Made Simple 3.0

1 × $6.00 -

×

Dan Dowd Trading

1 × $5.00

Dan Dowd Trading

1 × $5.00 -

×

Get 95% Win Rate With The Triple Candy Method - Eden

1 × $5.00

Get 95% Win Rate With The Triple Candy Method - Eden

1 × $5.00 -

×

Beat The Binaries

1 × $15.00

Beat The Binaries

1 × $15.00 -

×

Active Beta Indexes with Khalid Ghayur

1 × $6.00

Active Beta Indexes with Khalid Ghayur

1 × $6.00 -

×

Power Cycle Trading The Ultimate Option Guide: When & How to Use Which Option Strategy For the Best Results - Powercycletrading

1 × $69.00

Power Cycle Trading The Ultimate Option Guide: When & How to Use Which Option Strategy For the Best Results - Powercycletrading

1 × $69.00 -

×

BSAPPS FX Course with Ben Barker

1 × $6.00

BSAPPS FX Course with Ben Barker

1 × $6.00 -

×

The Handbook of Equity Style Management (3rd Ed) with Daniel Coggin & Frank Fabozzi

1 × $6.00

The Handbook of Equity Style Management (3rd Ed) with Daniel Coggin & Frank Fabozzi

1 × $6.00 -

×

Seven Trading Systems for The S&P Futures with David Bean

1 × $6.00

Seven Trading Systems for The S&P Futures with David Bean

1 × $6.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

The Risk-Wise Investor: How to Better Understand and Manage Risk with Michael Carpenter

1 × $6.00

The Risk-Wise Investor: How to Better Understand and Manage Risk with Michael Carpenter

1 × $6.00 -

×

Cycle Hunter Support with Brian James Sklenka

1 × $6.00

Cycle Hunter Support with Brian James Sklenka

1 × $6.00 -

×

The Methodology Revealed with Nick Santiago & Gareth Soloway - InTheMoneyStocks

1 × $209.00

The Methodology Revealed with Nick Santiago & Gareth Soloway - InTheMoneyStocks

1 × $209.00 -

×

5 Day Volume Profile Analysis Indicator Course with Mark Stone

1 × $54.00

5 Day Volume Profile Analysis Indicator Course with Mark Stone

1 × $54.00 -

×

Predicting Market Trends with Alan S.Farley

1 × $6.00

Predicting Market Trends with Alan S.Farley

1 × $6.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

The One Trading Secret That Could Make You Rich Inside Days

1 × $6.00

The One Trading Secret That Could Make You Rich Inside Days

1 × $6.00 -

×

Advanced Technical Analysis PART2 with Corey Halliday

1 × $6.00

Advanced Technical Analysis PART2 with Corey Halliday

1 × $6.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

Zanzibar System for the EuroFx with Joe Ross

1 × $4.00

Zanzibar System for the EuroFx with Joe Ross

1 × $4.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

WEBINAR series 5 – EXECUTION: A DETAILED PROCESS with FuturesTrader71

1 × $4.00

WEBINAR series 5 – EXECUTION: A DETAILED PROCESS with FuturesTrader71

1 × $4.00 -

×

Learn Plan Profit 2.0 with Ricky Gutierrez

1 × $39.00

Learn Plan Profit 2.0 with Ricky Gutierrez

1 × $39.00 -

×

Butterfly's Guide to Weekly Returns with Don Kaufman

1 × $6.00

Butterfly's Guide to Weekly Returns with Don Kaufman

1 × $6.00 -

×

ACB Forex Trading Suite with ACB Forex Trading Solutions

1 × $6.00

ACB Forex Trading Suite with ACB Forex Trading Solutions

1 × $6.00 -

×

The Complete Guide to Option Selling, 2nd 2009 with James Cordier & Michael Gross

1 × $6.00

The Complete Guide to Option Selling, 2nd 2009 with James Cordier & Michael Gross

1 × $6.00 -

×

The Logical Trader: Applying a Method to the Madness with Mark Fisher

1 × $6.00

The Logical Trader: Applying a Method to the Madness with Mark Fisher

1 × $6.00 -

×

Complete Guide to Online Stock Market Investing (2nd Edition) with Alexander Davidson

1 × $6.00

Complete Guide to Online Stock Market Investing (2nd Edition) with Alexander Davidson

1 × $6.00 -

×

The Profitable Trading System Blueprint with Macro Ops

1 × $6.00

The Profitable Trading System Blueprint with Macro Ops

1 × $6.00 -

×

Financial Markets Online – VIP Membership with James Bentley

1 × $6.00

Financial Markets Online – VIP Membership with James Bentley

1 × $6.00 -

×

Profitable Patterns for Stock Trading with Larry Pesavento

1 × $6.00

Profitable Patterns for Stock Trading with Larry Pesavento

1 × $6.00 -

×

Algorithmic Rules of Trend Lines

1 × $23.00

Algorithmic Rules of Trend Lines

1 × $23.00 -

×

Elliott Flat Waves CD with David Elliott

1 × $6.00

Elliott Flat Waves CD with David Elliott

1 × $6.00 -

×

The Management of Equity Investments with Dimitris Chorafas

1 × $6.00

The Management of Equity Investments with Dimitris Chorafas

1 × $6.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

How to Predict and Prepare for a Stock Market Crash with Damon Verial

1 × $6.00

How to Predict and Prepare for a Stock Market Crash with Damon Verial

1 × $6.00 -

×

Commitment Workshop for Traders by Adrienne Laris Toghraie

1 × $6.00

Commitment Workshop for Traders by Adrienne Laris Toghraie

1 × $6.00 -

×

Algo Trading Strategies 2017 with Autotrading Academy

1 × $6.00

Algo Trading Strategies 2017 with Autotrading Academy

1 × $6.00 -

×

Dynamic Trading Indicators with Mark W.Helweg, David C.Stendahl

1 × $6.00

Dynamic Trading Indicators with Mark W.Helweg, David C.Stendahl

1 × $6.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

Baby Blue Trading Technique for the E-Minis with Dave Wright

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Baby Blue Trading Technique for the E-Minis with Dave Wright” below:

Baby Blue Trading Technique for the E-Minis with Dave Wright

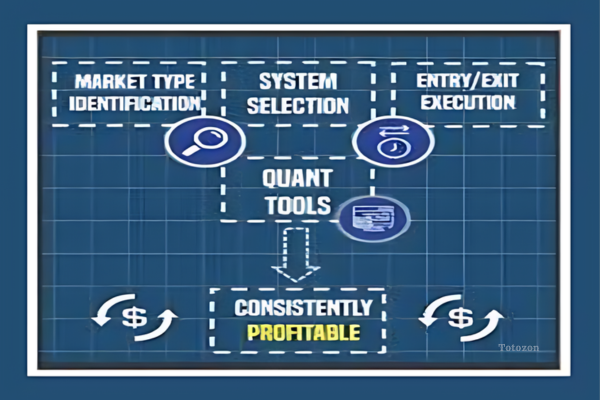

In the fast-paced world of E-Mini futures trading, the Baby Blue Trading Technique developed by Dave Wright offers a unique approach to maximizing profits. This method combines technical analysis, strategic planning, and disciplined execution to help traders navigate the volatile E-Mini markets. Let’s dive into the essentials of this technique and understand how it can enhance your trading strategy.

Introduction to the Baby Blue Trading Technique

The Baby Blue Trading Technique is specifically designed for trading E-Mini futures. It aims to provide clear, actionable signals based on market trends and patterns.

Why Choose the Baby Blue Technique?

- Simplicity: Easy to understand and implement.

- Effectiveness: Proven track record of success.

- Flexibility: Can be adapted to different market conditions.

Who is Dave Wright?

Dave Wright is a seasoned trader and educator known for his innovative trading strategies and practical insights into the E-Mini futures market.

Author’s Credentials

- Experience: Over 20 years in trading and market analysis.

- Education: Background in finance and economics.

- Publications: Numerous articles and books on trading strategies.

Understanding E-Mini Futures

What are E-Mini Futures?

E-Mini futures are electronically traded futures contracts that represent a fraction of the value of standard futures contracts.

Advantages of Trading E-Minis

- Liquidity: High trading volumes.

- Leverage: Significant leverage with lower margin requirements.

- Accessibility: Available for trading almost 24 hours a day.

Core Concepts of the Baby Blue Trading Technique

1. Technical Analysis

Importance of Technical Analysis

Technical analysis is crucial for identifying market trends and making informed trading decisions.

Key Indicators Used

- Moving Averages: Identifying trend directions.

- Relative Strength Index (RSI): Measuring market momentum.

- Bollinger Bands: Determining volatility and price range.

2. Chart Patterns

Recognizing Chart Patterns

Chart patterns help predict future price movements based on historical data.

Common Patterns in Baby Blue Technique

- Head and Shoulders: Trend reversal signal.

- Double Tops and Bottoms: Indicating market direction changes.

- Triangles: Continuation or reversal patterns.

3. Risk Management

Setting Stop-Loss Orders

Protect against significant losses by setting predefined exit points.

Position Sizing

Determine the appropriate size of each trade to manage risk effectively.

Implementing the Baby Blue Trading Technique

Step-by-Step Guide

- Set Up Charts: Use trading software to set up charts with relevant technical indicators.

- Identify Trends: Look for trends using moving averages and RSI.

- Recognize Patterns: Identify chart patterns that signal potential trades.

- Enter Trades: Execute trades based on signals from your analysis.

- Manage Risks: Use stop-loss orders and position sizing to protect your investments.

Example Trade Setup

- Identify Trend: Spot an upward trend using moving averages.

- Find Pattern: Recognize a continuation pattern, such as a triangle.

- Enter Trade: Place a buy order at the breakout point.

- Set Stop-Loss: Place a stop-loss below the pattern’s low point.

- Monitor Trade: Adjust stop-loss and take profit levels as the trade progresses.

Advantages of the Baby Blue Trading Technique

Simplicity

The technique is straightforward, making it accessible for both novice and experienced traders.

Proven Effectiveness

Many traders have reported success using this method, attributing their profitability to its clear signals and disciplined approach.

Adaptability

The technique can be adapted to various market conditions, ensuring its relevance over time.

Challenges in Trading E-Minis

Market Volatility

E-Mini markets can be highly volatile, requiring traders to stay alert and manage risks carefully.

Emotional Discipline

Maintaining emotional discipline is crucial to avoid impulsive decisions that can lead to losses.

Practical Tips for Success

1. Continuous Learning

Stay updated with market trends and continuously improve your trading skills.

2. Regular Practice

Use demo accounts to practice and refine your trading strategy without financial risk.

3. Keep a Trading Journal

Document your trades to analyze performance and identify areas for improvement.

Conclusion

The Baby Blue Trading Technique by Dave Wright offers a structured approach to trading E-Mini futures, combining technical analysis, chart patterns, and risk management. By following this method, traders can enhance their decision-making process and potentially increase their profitability. Whether you’re a novice or an experienced trader, the Baby Blue Technique provides valuable insights to help you navigate the complex world of E-Mini futures.

FAQs

1. What is the Baby Blue Trading Technique?

The Baby Blue Trading Technique is a trading method developed by Dave Wright, focusing on E-Mini futures using technical analysis and chart patterns.

2. Who can benefit from this technique?

Both novice and experienced traders can benefit from the simplicity and effectiveness of the Baby Blue Trading Technique.

3. How do I manage risk in E-Mini trading?

Manage risk by setting stop-loss orders, using proper position sizing, and maintaining emotional discipline.

4. What are E-Mini futures?

E-Mini futures are smaller-sized futures contracts that are electronically traded, offering high liquidity and leverage.

5. Can I practice this technique before using real money?

Yes, use demo accounts to practice and refine the Baby Blue Trading Technique without financial risk.

Be the first to review “Baby Blue Trading Technique for the E-Minis with Dave Wright” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.