-

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Alternative Assets and Strategic Allocation with John Abbink

1 × $6.00

Alternative Assets and Strategic Allocation with John Abbink

1 × $6.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00

Algo Trading Strategies 2017 with Autotrading Academy

$6.00

File Size: Cooming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Algo Trading Strategies 2017 with Autotrading Academy” below:

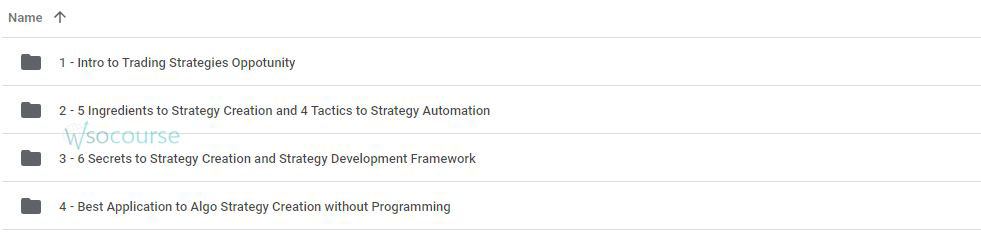

Exploring Algo Trading Strategies 2017 with Autotrading Academy

Introduction to Algo Trading in 2017

Algorithmic trading, or algo trading, has significantly transformed financial markets, offering new efficiencies and trading strategies. In 2017, Autotrading Academy introduced cutting-edge algo trading strategies that continue to influence the markets.

What is Algo Trading?

Definition of Algo Trading

Algo trading involves using computer algorithms to execute trades at high speeds and volumes, based on predetermined criteria.

Advantages of Algo Trading

This method offers precision, speed, and efficiency, reducing the impact of human emotions on trading decisions.

Core Principles of Algo Trading

Automated Trading Systems

Overview of how automated systems are designed to monitor and execute trades across multiple markets simultaneously.

Algorithm Development

Discussion on the process of creating effective trading algorithms that can adapt to market conditions.

Algo Trading Strategies from Autotrading Academy

Trend Following Systems

Exploration of algorithms designed to identify and capitalize on market trends.

Arbitrage Opportunities

How algorithms detect price discrepancies across different markets and execute simultaneous trades to gain profit.

2017 Innovations in Algo Trading

Machine Learning Integration

Introduction of machine learning techniques to enhance predictive accuracy and decision-making processes in algorithms.

High-Frequency Trading (HFT) Techniques

Advancements in HFT strategies that allow transactions to be executed within microseconds.

Risk Management in Algo Trading

Volatility Adjustment

Strategies to adjust algorithms in real-time based on market volatility levels.

Backtesting and Optimization

The importance of rigorous backtesting to ensure strategies perform well in various market scenarios.

Regulatory Compliance and Ethical Considerations

Navigating Regulatory Frameworks

Challenges of keeping algorithmic trading systems compliant with global financial regulations.

Ethical Trading Algorithms

Ensuring that trading algorithms operate fairly and transparently to maintain market integrity.

Tools and Technologies Used in Algo Trading

Software and Platforms

Review of the top software and platforms used in 2017 for developing and deploying trading algorithms.

Data Analytics and Management

How big data analytics and management tools play a crucial role in algorithmic trading.

Educational Resources from Autotrading Academy

Courses and Workshops

Details on comprehensive courses and workshops offered by Autotrading Academy to train aspiring algo traders.

Webinars and Online Tutorials

Availability of online learning resources to help traders understand and implement advanced algo trading strategies.

Success Stories and Case Studies

Real-World Applications

Examples of successful algo trading strategies implemented in 2017 that yielded high returns.

Lessons Learned

Analyzing the challenges faced and how they were overcome, providing valuable insights for future strategies.

The Future of Algo Trading

Predictions for Technological Advancements

Speculations on future technologies that will shape the next generation of algo trading.

Adapting to Changing Markets

Strategies for algo traders to remain adaptable and competitive in evolving financial markets.

Conclusion

The Autotrading Academy’s algo trading strategies of 2017 have set a benchmark in the finance industry, offering insights and tools that continue to influence trading techniques today. As markets evolve, these strategies remind us of the importance of adaptability and continuous learning in the realm of algorithmic trading.

Frequently Asked Questions:

- What is required to start algo trading?

- A fundamental understanding of financial markets, programming knowledge, and access to algorithmic trading software.

- How can one ensure the security of trading algorithms?

- By implementing robust cybersecurity measures, conducting regular audits, and adhering to best practices in data encryption and secure coding.

- What were some major challenges in algo trading in 2017?

- Issues included handling unexpected market volatility, ensuring regulatory compliance, and managing technological complexities.

- Can algo trading be employed by individual investors?

- Yes, individual investors can use algo trading, but it requires significant investment in technology and a deep understanding of both trading and software development.

- Where can I learn more about algo trading?

- Autotrading Academy, along with various financial education platforms, offers extensive resources for learning about algorithmic trading.

Be the first to review “Algo Trading Strategies 2017 with Autotrading Academy” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.