-

×

E-mini Weekly Options Income with Peter Titus

1 × $15.00

E-mini Weekly Options Income with Peter Titus

1 × $15.00 -

×

Stock Market Crash of 1929 with Aron Abrams

1 × $6.00

Stock Market Crash of 1929 with Aron Abrams

1 × $6.00 -

×

Traders: Risks, Decisions, and Management in Financial Markets - Mark Fenton-O’Creevy, Nigel Nicholson, Emma Soane & Paul Willman

1 × $6.00

Traders: Risks, Decisions, and Management in Financial Markets - Mark Fenton-O’Creevy, Nigel Nicholson, Emma Soane & Paul Willman

1 × $6.00 -

×

Electronic Day Traders' Secrets: Learn From the Best of the Best DayTraders with Burton Friedfertig

1 × $6.00

Electronic Day Traders' Secrets: Learn From the Best of the Best DayTraders with Burton Friedfertig

1 × $6.00 -

×

After Hour Trading Made Easy with Joe Duarte & Roland Burke

1 × $6.00

After Hour Trading Made Easy with Joe Duarte & Roland Burke

1 × $6.00 -

×

Active Investment Management: Finding and Harnessing Investment Skill with Charles Jackson

1 × $6.00

Active Investment Management: Finding and Harnessing Investment Skill with Charles Jackson

1 × $6.00 -

×

Profitable Patterns for Stock Trading with Larry Pesavento

1 × $6.00

Profitable Patterns for Stock Trading with Larry Pesavento

1 × $6.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Traders Secret Success Package. Symmetry Wave Trading with Michael Gur Dillon

1 × $6.00

Traders Secret Success Package. Symmetry Wave Trading with Michael Gur Dillon

1 × $6.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

Successful Stock Speculation (1922) with John James

1 × $6.00

Successful Stock Speculation (1922) with John James

1 × $6.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Traders Classroom Collection Volume 1-4 with Jeffrey Kennedy

1 × $15.00

Traders Classroom Collection Volume 1-4 with Jeffrey Kennedy

1 × $15.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

Yarimi University Course

1 × $56.00

Yarimi University Course

1 × $56.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

How to Analyze Multifamily Investment Opportunities with Symon He & Brandon Young

1 × $6.00

How to Analyze Multifamily Investment Opportunities with Symon He & Brandon Young

1 × $6.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

Candlestick Charting Explained with Greg Morris

1 × $8.00

Candlestick Charting Explained with Greg Morris

1 × $8.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

CANDLESTICKS APPLIED with Steve Nison & Syl Desaulniers - Candle Charts

1 × $15.00

CANDLESTICKS APPLIED with Steve Nison & Syl Desaulniers - Candle Charts

1 × $15.00 -

×

Traders Secret Code Complete Course with Mark McRae

1 × $6.00

Traders Secret Code Complete Course with Mark McRae

1 × $6.00 -

×

Volume Profile 2023 (Elite Pack) with Trader Dale

1 × $5.00

Volume Profile 2023 (Elite Pack) with Trader Dale

1 × $5.00 -

×

CarterFX Membership with Duran Carter

1 × $23.00

CarterFX Membership with Duran Carter

1 × $23.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Best of Livestock with Timothy Sykes

1 × $5.00

Best of Livestock with Timothy Sykes

1 × $5.00 -

×

Candlestick Trading for Maximum Profitsn with B.M.Davis

1 × $6.00

Candlestick Trading for Maximum Profitsn with B.M.Davis

1 × $6.00 -

×

Advanced Forex Patterns with Vic Noble & Darko Ali

1 × $39.00

Advanced Forex Patterns with Vic Noble & Darko Ali

1 × $39.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

Forex Trading MasterClass with Torero Traders School

1 × $5.00

Forex Trading MasterClass with Torero Traders School

1 × $5.00 -

×

The Random Character of Interest Rates with Joseph Murphy

1 × $6.00

The Random Character of Interest Rates with Joseph Murphy

1 × $6.00 -

×

Candlesticks Explained with Martin Pring

1 × $6.00

Candlesticks Explained with Martin Pring

1 × $6.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

Fast Track Course with Tradelikerocket

1 × $233.00

Fast Track Course with Tradelikerocket

1 × $233.00 -

×

The Aftermath + Jack Savage Extras (How To Trade Gold) with FXSavages

1 × $6.00

The Aftermath + Jack Savage Extras (How To Trade Gold) with FXSavages

1 × $6.00 -

×

Basic Options Course Cash Flow. Diversification. Flexibility with Michael Drew

1 × $6.00

Basic Options Course Cash Flow. Diversification. Flexibility with Michael Drew

1 × $6.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Financial Fortress with TradeSmart University

1 × $6.00

Financial Fortress with TradeSmart University

1 × $6.00 -

×

ETFs for the Long Run: What They Are, How They Work, and Simple Strategies for Successful Long-Term Investing - Lawrence Carrel

1 × $6.00

ETFs for the Long Run: What They Are, How They Work, and Simple Strategies for Successful Long-Term Investing - Lawrence Carrel

1 × $6.00 -

×

Traders Winning Edge (Presentation) with Adrienne Laris Toghraie

1 × $6.00

Traders Winning Edge (Presentation) with Adrienne Laris Toghraie

1 × $6.00 -

×

Keynes & The Market with Justyn Walsh

1 × $6.00

Keynes & The Market with Justyn Walsh

1 × $6.00 -

×

Smart Money Concepts with MFX Trading

1 × $13.00

Smart Money Concepts with MFX Trading

1 × $13.00 -

×

All About Stock Market Strategies: The Easy Way To Get Started (All About Series) with David Brown

1 × $6.00

All About Stock Market Strategies: The Easy Way To Get Started (All About Series) with David Brown

1 × $6.00 -

×

Capital with Charles D.Ellis

1 × $6.00

Capital with Charles D.Ellis

1 × $6.00 -

×

Follow the Leader Trading System with Anthony Gibson

1 × $6.00

Follow the Leader Trading System with Anthony Gibson

1 × $6.00 -

×

ALGO™ Online Retail - Version 2.9

1 × $155.00

ALGO™ Online Retail - Version 2.9

1 × $155.00 -

×

Bird Watching in Lion Country. Retail Forex Explained with Dirk Du Toit

1 × $4.00

Bird Watching in Lion Country. Retail Forex Explained with Dirk Du Toit

1 × $4.00 -

×

How I use Technical Analysis & Orderflow with Adam Webb - Traderskew

1 × $54.00

How I use Technical Analysis & Orderflow with Adam Webb - Traderskew

1 × $54.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

A14 Weekly Options Strategy Workshop 2023 with Amy Meissner - Aeromir

1 × $23.00

A14 Weekly Options Strategy Workshop 2023 with Amy Meissner - Aeromir

1 × $23.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Day One Trader with John Sussex

1 × $6.00

Day One Trader with John Sussex

1 × $6.00 -

×

Capital Asset Investment with Anthony F.Herbst

1 × $6.00

Capital Asset Investment with Anthony F.Herbst

1 × $6.00 -

×

CAT 2007 Seminar with Stephen W.Bigalow

1 × $6.00

CAT 2007 Seminar with Stephen W.Bigalow

1 × $6.00 -

×

DFX Scalping Strategy Course with Disciplined FX

1 × $23.00

DFX Scalping Strategy Course with Disciplined FX

1 × $23.00 -

×

Fibonacci for the Active Trader with Derrik Hobbs

1 × $6.00

Fibonacci for the Active Trader with Derrik Hobbs

1 × $6.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

Fractal Flow Strategy Video Course with Fractal Flow Pro

1 × $6.00

Fractal Flow Strategy Video Course with Fractal Flow Pro

1 × $6.00 -

×

Trading Options Effectively with Paul Forchione

1 × $4.00

Trading Options Effectively with Paul Forchione

1 × $4.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

Fast Start Barter System with Bob Meyer

1 × $31.00

Fast Start Barter System with Bob Meyer

1 × $31.00

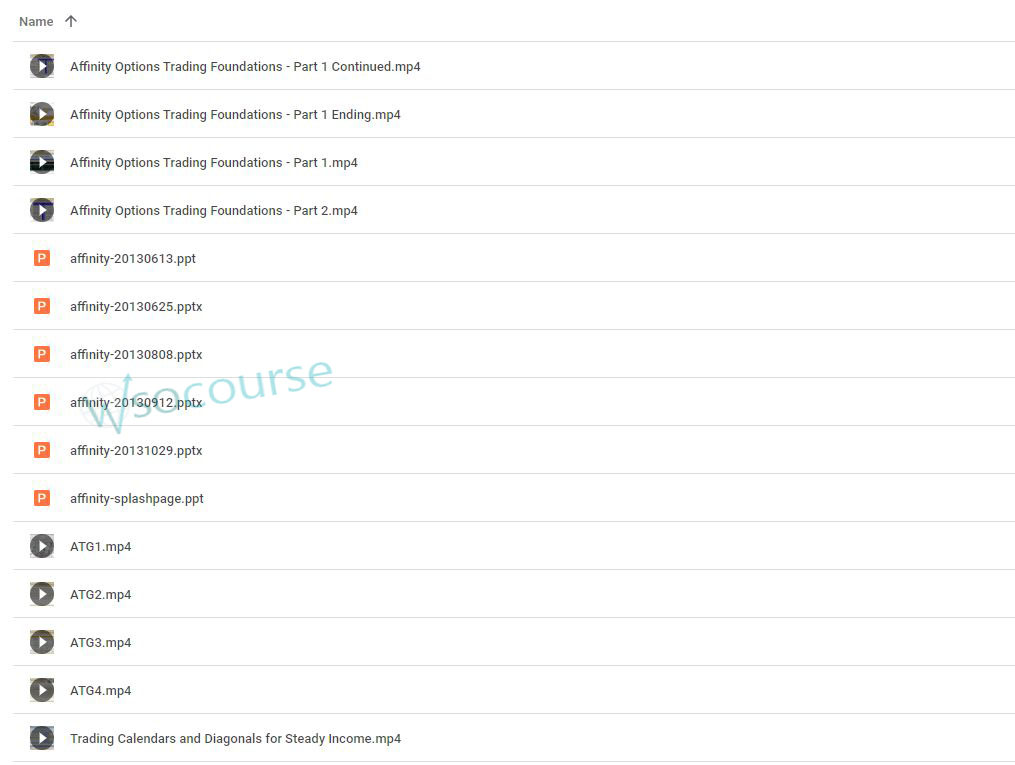

Affinity Foundation Stocks Course with Affinitytrading

$6.00

File Size: 1.48 GB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Affinity Foundation Stocks Course with Affinitytrading” below:

Affinity Foundation Stocks Course with Affinitytrading

Introduction

Investing in stocks can be a lucrative endeavor, but it requires a solid understanding of market dynamics and investment strategies. The Affinity Foundation Stocks Course offered by Affinitytrading provides a comprehensive guide to stock trading, designed for both beginners and seasoned investors. This article delves into the course structure, key topics covered, and the benefits of learning with Affinitytrading.

Who is Affinitytrading?

Background and Expertise

Affinitytrading is a renowned financial education provider known for its expert instructors and comprehensive courses. With years of experience in the stock market, Affinitytrading has helped numerous individuals achieve their financial goals.

Why Choose Affinitytrading?

Affinitytrading’s courses are designed to be practical and easy to understand, making complex concepts accessible. Their Foundation Stocks Course is particularly notable for its in-depth coverage and practical applications.

Course Structure

1. Introduction to Stock Trading

Overview of the Stock Market

Learn the basics of how the stock market operates, including the roles of exchanges and market participants.

Types of Stocks

Understand the different types of stocks, such as common and preferred shares, and their characteristics.

2. Fundamental Analysis

Financial Statements

Learn to read and interpret financial statements, including balance sheets, income statements, and cash flow statements.

Valuation Techniques

Explore various methods of valuing stocks, such as price-to-earnings ratio, dividend discount model, and discounted cash flow analysis.

3. Technical Analysis

Chart Patterns

Identify and understand key chart patterns like head and shoulders, double tops and bottoms, and triangles.

Technical Indicators

Learn to use indicators such as moving averages, RSI, MACD, and Bollinger Bands to make informed trading decisions.

4. Risk Management

Diversification

Understand the importance of diversification and how to create a balanced portfolio.

Stop-Loss Orders

Learn how to use stop-loss orders to protect your investments from significant losses.

5. Trading Strategies

Day Trading

Discover strategies for making quick trades within the same day, focusing on high volatility stocks.

Swing Trading

Learn techniques for holding positions for several days to capture market swings.

Long-Term Investing

Explore strategies for long-term investing, including value investing and growth investing.

Key Topics Covered

1. Market Analysis

Understand how to analyze market trends and make predictions based on historical data and current events.

2. Trading Psychology

Learn about the psychological aspects of trading, including managing emotions and maintaining discipline.

3. Portfolio Management

Develop skills to manage and optimize your investment portfolio for maximum returns.

4. Trade Execution

Master the art of trade execution, ensuring you enter and exit trades at the optimal times.

5. Performance Evaluation

Evaluate your trading performance and learn how to make adjustments to improve your results.

Benefits of the Affinity Foundation Stocks Course

1. Comprehensive Learning

The course covers all aspects of stock trading, from basic concepts to advanced techniques, providing a well-rounded education.

2. Expert Instruction

Learn from experienced instructors who provide valuable insights and practical advice.

3. Practical Experience

Participate in live trading sessions and case studies to gain hands-on experience.

4. Community Support

Join a community of like-minded traders, share experiences, and learn from each other.

5. Flexible Learning

The course is designed to be flexible, allowing you to learn at your own pace and revisit materials as needed.

Success Stories

1. Professional Growth

Many participants have reported significant improvements in their trading skills and professional growth after completing the course.

2. Financial Success

Numerous participants have achieved financial success by applying the strategies and techniques learned in the course.

3. Personal Development

The course also focuses on personal development, helping traders build confidence and develop a disciplined approach to trading.

How to Get the Most Out of the Course

1. Set Clear Goals

Identify your learning objectives and what you hope to achieve by the end of the course.

2. Stay Consistent

Dedicate regular time to study and practice, ensuring consistent progress.

3. Engage Actively

Participate actively in live sessions, ask questions, and engage with other participants.

4. Apply What You Learn

Apply the concepts and strategies in real market conditions to reinforce your learning.

5. Review and Reflect

Regularly review course materials and reflect on your progress to identify areas for improvement.

Conclusion

The Affinity Foundation Stocks Course with Affinitytrading offers a comprehensive and practical approach to mastering stock trading. Whether you are a beginner or an experienced trader, this course provides valuable insights and strategies to help you succeed in the stock market. By learning from experts and participating in hands-on activities, you can enhance your trading skills and achieve your financial goals.

Frequently Asked Questions

1. What makes the Affinity Foundation Stocks Course unique?

The course is unique due to its comprehensive coverage of stock trading topics, practical applications, and expert instruction.

2. Who should take this course?

The course is suitable for traders of all levels, from beginners to advanced traders looking to enhance their skills.

3. How can I access the course materials?

Course materials are accessible online, allowing you to learn at your own pace and revisit content as needed.

4. Are there live trading sessions included?

Yes, the course includes live trading sessions where you can apply what you’ve learned in real market conditions.

5. How can I benefit from the community support?

Joining the course community allows you to connect with other traders, share experiences, and learn from each other’s successes and challenges.

Be the first to review “Affinity Foundation Stocks Course with Affinitytrading” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.