-

×

The Stock Market Mastery Program with Ryan Hildreth

1 × $12.00

The Stock Market Mastery Program with Ryan Hildreth

1 × $12.00 -

×

The MMXM Trader’s 2nd Course: My Personal Approach

1 × $17.00

The MMXM Trader’s 2nd Course: My Personal Approach

1 × $17.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Advanced Course

1 × $39.00

Advanced Course

1 × $39.00 -

×

Unlocking the Mysteries of Trend Analysis - Rick Bensignor

1 × $6.00

Unlocking the Mysteries of Trend Analysis - Rick Bensignor

1 × $6.00 -

×

Complete Book Set

1 × $8.00

Complete Book Set

1 × $8.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

The Big 3 Squeeze Indicator TOS 2024 with Taylor Horton

1 × $69.00

The Big 3 Squeeze Indicator TOS 2024 with Taylor Horton

1 × $69.00 -

×

The Wolf of Investing: My Insider's Playbook for Making a Fortune on Wall Street with Jordan Belfort

1 × $6.00

The Wolf of Investing: My Insider's Playbook for Making a Fortune on Wall Street with Jordan Belfort

1 × $6.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

Graphs, Application to Speculation with George Cole

1 × $6.00

Graphs, Application to Speculation with George Cole

1 × $6.00 -

×

Candlestick - Training Videos (Videos 1.2 GB)

1 × $15.00

Candlestick - Training Videos (Videos 1.2 GB)

1 × $15.00 -

×

Interpreting Money Stream with Peter Worden

1 × $6.00

Interpreting Money Stream with Peter Worden

1 × $6.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Claytrader - Risk vs Reward Trading

1 × $23.00

Claytrader - Risk vs Reward Trading

1 × $23.00 -

×

The Bulls Eye System – Ready Aim Fire

1 × $31.00

The Bulls Eye System – Ready Aim Fire

1 × $31.00 -

×

Basic Astrotech

1 × $6.00

Basic Astrotech

1 × $6.00 -

×

GTA Professional Course with Gova Trading Academy

1 × $5.00

GTA Professional Course with Gova Trading Academy

1 × $5.00 -

×

The Oxford Handbook of Political Theory with John Dryzek, Bonnie Honig & Anne Phillips

1 × $6.00

The Oxford Handbook of Political Theory with John Dryzek, Bonnie Honig & Anne Phillips

1 × $6.00 -

×

Markets 101 Complete Course with Joseph Wang - Central Banking 101

1 × $13.00

Markets 101 Complete Course with Joseph Wang - Central Banking 101

1 × $13.00 -

×

Kash-FX Elite Course

1 × $10.00

Kash-FX Elite Course

1 × $10.00 -

×

Wealthpress Jump Trade Package (Course Only, None-elert)

1 × $85.00

Wealthpress Jump Trade Package (Course Only, None-elert)

1 × $85.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

Ultra Blue Forex 2024 with Russ Horn

1 × $17.00

Ultra Blue Forex 2024 with Russ Horn

1 × $17.00 -

×

OneUmbrellaFX

1 × $5.00

OneUmbrellaFX

1 × $5.00 -

×

Complete Day Trading : Stock Trading With Technical Analysis

1 × $15.00

Complete Day Trading : Stock Trading With Technical Analysis

1 × $15.00 -

×

London Super Conference 2019

1 × $62.00

London Super Conference 2019

1 × $62.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Lit Trading Course

1 × $15.00

Lit Trading Course

1 × $15.00 -

×

Blending Quantitative & Traditional Equity Analysis with CFA Institute

1 × $6.00

Blending Quantitative & Traditional Equity Analysis with CFA Institute

1 × $6.00 -

×

B The Trader Trading Course

1 × $15.00

B The Trader Trading Course

1 × $15.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Successful Algorithmic Trading with Mike Halls-Moore

1 × $8.00

Successful Algorithmic Trading with Mike Halls-Moore

1 × $8.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Options on Futures Trading Course

1 × $15.00

Options on Futures Trading Course

1 × $15.00 -

×

ZoneTrader Pro v2 (Sep 2013)

1 × $23.00

ZoneTrader Pro v2 (Sep 2013)

1 × $23.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

FX GOAT FOREX TRADING ACADEMY

1 × $8.00

FX GOAT FOREX TRADING ACADEMY

1 × $8.00 -

×

TheoTrade

1 × $31.00

TheoTrade

1 × $31.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

FXCharger

1 × $23.00

FXCharger

1 × $23.00 -

×

Portfolio Management-Earn 12 Hours CE Credits

1 × $85.00

Portfolio Management-Earn 12 Hours CE Credits

1 × $85.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Four Steps to Trading Economic Indicators

1 × $6.00

Four Steps to Trading Economic Indicators

1 × $6.00 -

×

Trading the Fast Moves for Maximum Profit with William McLaren

1 × $4.00

Trading the Fast Moves for Maximum Profit with William McLaren

1 × $4.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

www Trading System Ezine with Alex Krzhechevsky

1 × $6.00

www Trading System Ezine with Alex Krzhechevsky

1 × $6.00 -

×

Trading the Eclipses

1 × $6.00

Trading the Eclipses

1 × $6.00 -

×

Trading Plan with Andrew Baxter

1 × $6.00

Trading Plan with Andrew Baxter

1 × $6.00 -

×

Bank Financial Model with Cash Flow Investing Pro

1 × $15.00

Bank Financial Model with Cash Flow Investing Pro

1 × $15.00 -

×

XLT– Option Trading Course

1 × $6.00

XLT– Option Trading Course

1 × $6.00 -

×

Instant Forex Profits Home Study Course

1 × $23.00

Instant Forex Profits Home Study Course

1 × $23.00 -

×

Triple Play Trading Ideas & Mentoring with MarketGauge

1 × $54.00

Triple Play Trading Ideas & Mentoring with MarketGauge

1 × $54.00 -

×

Ultimate Gann Course Coaching Safety in The Market COMPLETE 12 Modules with Aaron Lynch

1 × $6.00

Ultimate Gann Course Coaching Safety in The Market COMPLETE 12 Modules with Aaron Lynch

1 × $6.00 -

×

We Trade Waves

1 × $5.00

We Trade Waves

1 × $5.00 -

×

Trading the Pristine Method 2008 (Videos & Workbooks) with Pristine

1 × $4.00

Trading the Pristine Method 2008 (Videos & Workbooks) with Pristine

1 × $4.00 -

×

Trend Following Stocks - Complete Breakout System with Joe Marwood

1 × $6.00

Trend Following Stocks - Complete Breakout System with Joe Marwood

1 × $6.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

Trading With Market Timing and Intelligence with John Crain

1 × $23.00

Trading With Market Timing and Intelligence with John Crain

1 × $23.00 -

×

Trading Psychology, Day-trading & Swing Trading with Alexander Elder

1 × $31.00

Trading Psychology, Day-trading & Swing Trading with Alexander Elder

1 × $31.00 -

×

Building Wealth In Stock Market with David Novac

1 × $6.00

Building Wealth In Stock Market with David Novac

1 × $6.00 -

×

How To Design, Test, Evaluate and Implement Profitable Trading Systems(Manual Only)

1 × $4.00

How To Design, Test, Evaluate and Implement Profitable Trading Systems(Manual Only)

1 × $4.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Trading Indicators NT7

1 × $85.00

Trading Indicators NT7

1 × $85.00 -

×

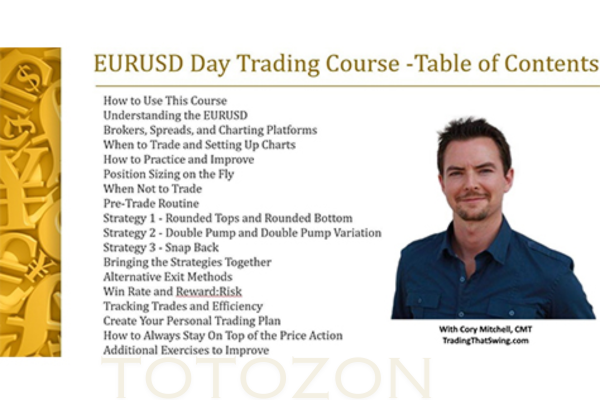

The EURUSD Day Trading Course with Cory Mitchell - Trade That Swing

1 × $15.00

The EURUSD Day Trading Course with Cory Mitchell - Trade That Swing

1 × $15.00 -

×

Point and Figure Mentorship Course

1 × $54.00

Point and Figure Mentorship Course

1 × $54.00 -

×

The Stock Index Futures Market with B.Thomas Byme Jr.

1 × $6.00

The Stock Index Futures Market with B.Thomas Byme Jr.

1 × $6.00 -

×

Price Ladder Training

1 × $15.00

Price Ladder Training

1 × $15.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

The Expected Return Calculator

1 × $23.00

The Expected Return Calculator

1 × $23.00 -

×

Sports Trading Journey with Jack Birkhead

1 × $23.00

Sports Trading Journey with Jack Birkhead

1 × $23.00 -

×

Order Flow Mastery (New 2024) with The Volume Traders

1 × $24.00

Order Flow Mastery (New 2024) with The Volume Traders

1 × $24.00 -

×

Private Seminars

1 × $23.00

Private Seminars

1 × $23.00 -

×

Beat The Market Maker

1 × $62.00

Beat The Market Maker

1 × $62.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

Connors on Advanced Trading Strategies with Larry Connors

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Connors on Advanced Trading Strategies with Larry Connors” below:

Connors on Advanced Trading Strategies with Larry Connors

Larry Connors is a well-respected figure in the trading world, known for his innovative and data-driven trading strategies. This article explores Connors on Advanced Trading Strategies with Larry Connors, providing you with valuable insights and actionable techniques to elevate your trading game. Whether you’re a seasoned trader or looking to expand your knowledge, Connors’ advanced strategies offer a robust framework for achieving consistent trading success.

Introduction to Larry Connors

Who is Larry Connors?

Larry Connors is a renowned trader, author, and educator with decades of experience in the financial markets. His work focuses on developing systematic, rule-based trading strategies backed by extensive research.

Why Follow Connors’ Strategies?

Connors’ strategies are designed to be both practical and effective, combining statistical analysis with real-world trading scenarios. His methods help traders make informed decisions and achieve higher probabilities of success.

Core Principles of Connors’ Trading Strategies

Systematic Approach

Connors advocates for a systematic approach to trading, emphasizing the importance of rules and discipline over emotional decision-making.

Statistical Analysis

Using historical data and statistical analysis, Connors’ strategies identify patterns and trends that can be exploited for profitable trading opportunities.

Risk Management

Effective risk management is a cornerstone of Connors’ strategies, ensuring traders protect their capital while maximizing returns.

Advanced Trading Strategies by Larry Connors

1. The RSI(2) Strategy

The RSI(2) strategy uses the Relative Strength Index with a two-period setting to identify short-term overbought and oversold conditions.

How to Implement RSI(2) Strategy

- Buy Signal: Enter a trade when the RSI(2) is below 10.

- Sell Signal: Exit the trade when the RSI(2) is above 90.

2. The PowerRatings Strategy

PowerRatings is a quantitative trading strategy that ranks stocks based on their historical performance over the next five days.

Using PowerRatings

- Select Stocks: Choose stocks with high PowerRatings (7-10).

- Timing: Enter trades in the direction of the rating, holding for a short-term period.

3. The VIX Reversal Strategy

The VIX, or Volatility Index, measures market volatility. Connors’ VIX Reversal strategy involves trading based on extreme VIX readings.

Trading the VIX Reversal

- Buy Signal: Enter a trade when the VIX is significantly high.

- Sell Signal: Exit the trade as the VIX reverts to its mean.

4. The 2-Period ROC Strategy

The Rate of Change (ROC) indicator measures the percentage change in price between the current price and the price a certain number of periods ago.

Applying the 2-Period ROC Strategy

- Buy Signal: Enter when the 2-period ROC is negative and the stock is in an uptrend.

- Sell Signal: Exit when the 2-period ROC turns positive.

5. The Multiple Days Up/Down Strategy

This strategy involves trading based on the number of consecutive up or down days in a stock’s price movement.

How to Use Multiple Days Up/Down Strategy

- Buy Signal: Buy after multiple consecutive down days (e.g., three days).

- Sell Signal: Sell after multiple consecutive up days (e.g., three days).

6. The Bollinger Bands Mean Reversion Strategy

Bollinger Bands measure market volatility. The mean reversion strategy involves trading when prices deviate significantly from the mean.

Implementing Bollinger Bands Strategy

- Buy Signal: Buy when the price touches the lower Bollinger Band.

- Sell Signal: Sell when the price touches the upper Bollinger Band.

7. The Momentum Pinball Strategy

This strategy is designed to capture short-term price movements using the momentum oscillator.

Trading Momentum Pinball

- Buy Signal: Enter when the momentum oscillator crosses above a specific threshold.

- Sell Signal: Exit when the momentum oscillator crosses below a specific threshold.

Combining Strategies for Enhanced Performance

Diversification

Using multiple strategies can diversify your trading approach, reducing risk and increasing the chances of success across different market conditions.

Backtesting

Always backtest new strategies on historical data to validate their effectiveness before implementing them in live trading.

Continuous Improvement

Markets evolve, and so should your strategies. Regularly review and refine your methods based on performance and market changes.

Advantages of Connors’ Advanced Trading Strategies

High Probability Setups

Connors’ strategies are based on statistical analysis, providing high-probability trading setups that can lead to consistent profits.

Clear Rules and Discipline

By following clear, rule-based strategies, traders can eliminate emotional decision-making and maintain discipline.

Adaptability

Connors’ strategies can be applied to various markets, including stocks, ETFs, and forex, offering flexibility to traders.

Challenges and Considerations

Market Volatility

Market conditions can change rapidly, affecting the performance of trading strategies. Stay informed and be ready to adapt.

Emotional Discipline

Maintaining discipline is crucial for trading success. Stick to your strategy and avoid impulsive decisions based on short-term market movements.

Continuous Learning

The financial markets are constantly evolving. Continuous education and refinement of strategies are essential for long-term success.

Conclusion

Connors on Advanced Trading Strategies with Larry Connors provides a comprehensive guide to mastering advanced trading techniques. By understanding and implementing Connors’ strategies, traders can improve their performance and achieve greater success in the markets.

Frequently Asked Questions:

- Business Model Innovation:

Embrace our legitimate business model! We organize group buys, allowing participants to share costs for popular courses, making them accessible to those with limited financial resources. Our approach ensures affordability and accessibility, despite author concerns. - The Legal Environment:

The legality of our activity is uncertain. While we lack specific permission from course authors, there’s a technicality: authors didn’t impose resale limits upon course purchase. This presents both an opportunity for us and a benefit for individuals seeking low-cost access. - Quality Control:

Unveiling the Truth

Quality is paramount. Purchasing courses directly from sales pages ensures consistency with traditionally obtained materials. However, we’re not official course providers and don’t offer premium services:

- No scheduled coaching calls or sessions with the author.

- No access to the author’s private Facebook group or web portal.

- No entry to the author’s private membership forum.

- Direct email support from the author or their team is unavailable. Operating independently, we aim to bridge the pricing gap without additional services provided by official channels. Your understanding of our unique approach is valued.

Be the first to review “Connors on Advanced Trading Strategies with Larry Connors” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.