-

×

Fisher Investments on Telecom with Dan Sinton, Andrew S.Teufel

1 × $6.00

Fisher Investments on Telecom with Dan Sinton, Andrew S.Teufel

1 × $6.00 -

×

Master Stock Course

1 × $6.00

Master Stock Course

1 × $6.00 -

×

Order Flow With The Power Of Point Of Control Course and The Imbalance

1 × $6.00

Order Flow With The Power Of Point Of Control Course and The Imbalance

1 × $6.00 -

×

Gannline. Total School Package

1 × $6.00

Gannline. Total School Package

1 × $6.00 -

×

The Complete Penny Stock Course: Learn How To Generate Profits Consistently By Trading Penny Stocks With Jamil Ben Alluch

1 × $6.00

The Complete Penny Stock Course: Learn How To Generate Profits Consistently By Trading Penny Stocks With Jamil Ben Alluch

1 × $6.00 -

×

How to Make Money in the Futures Market … and Lots of It with Charles Drummond

1 × $6.00

How to Make Money in the Futures Market … and Lots of It with Charles Drummond

1 × $6.00 -

×

Commodity Speculation for Beginners with Charles Huff, Barbara Marinacci

1 × $6.00

Commodity Speculation for Beginners with Charles Huff, Barbara Marinacci

1 × $6.00 -

×

Electronic Day Traders' Secrets: Learn From the Best of the Best DayTraders with Burton Friedfertig

1 × $6.00

Electronic Day Traders' Secrets: Learn From the Best of the Best DayTraders with Burton Friedfertig

1 × $6.00 -

×

Failure Rate Modelling for Reliabiliy & Risk with Maxim Finkelstein

1 × $6.00

Failure Rate Modelling for Reliabiliy & Risk with Maxim Finkelstein

1 × $6.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Forex Profit Formula System with Jason Fielder

1 × $6.00

Forex Profit Formula System with Jason Fielder

1 × $6.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Four Books with J.L.Lord

1 × $23.00

Four Books with J.L.Lord

1 × $23.00 -

×

DNA Wealth Blueprint 3 (Complete)

1 × $54.00

DNA Wealth Blueprint 3 (Complete)

1 × $54.00 -

×

Earnings Engine Class with Sami Abusaad - T3 Live

1 × $23.00

Earnings Engine Class with Sami Abusaad - T3 Live

1 × $23.00 -

×

Finding Astrocycles with an Ephemeris - Hans Hannula

1 × $6.00

Finding Astrocycles with an Ephemeris - Hans Hannula

1 × $6.00 -

×

Inner Circle Course with Darius Fx

1 × $24.00

Inner Circle Course with Darius Fx

1 × $24.00 -

×

Increasing Vertical Spread Probabilities with Technical Analysis with Doc Severson

1 × $6.00

Increasing Vertical Spread Probabilities with Technical Analysis with Doc Severson

1 × $6.00 -

×

Rockwell Trading - Money Management - 2 DVDs

1 × $6.00

Rockwell Trading - Money Management - 2 DVDs

1 × $6.00 -

×

Profiletraders - Market Profile Day Trading

1 × $15.00

Profiletraders - Market Profile Day Trading

1 × $15.00 -

×

Offensive & Defensive Strengths of Stocks, Groups & Sectors Gary Anderson

1 × $6.00

Offensive & Defensive Strengths of Stocks, Groups & Sectors Gary Anderson

1 × $6.00 -

×

Exchange Traded Funds & E-Mini Stock Index Futures with David Lerman

1 × $6.00

Exchange Traded Funds & E-Mini Stock Index Futures with David Lerman

1 × $6.00 -

×

Gold Trading Boot Camp: How to Master the Basics and Become a Successful Commodities Investor - Gregory Weldon & Dennis Gartman

1 × $6.00

Gold Trading Boot Camp: How to Master the Basics and Become a Successful Commodities Investor - Gregory Weldon & Dennis Gartman

1 × $6.00 -

×

Option Express Plugin

1 × $6.00

Option Express Plugin

1 × $6.00 -

×

Mark Sebastian – Gamma Trading Class

1 × $6.00

Mark Sebastian – Gamma Trading Class

1 × $6.00 -

×

How To Read The Trend (Recorded Session) with TradeSmart

1 × $31.00

How To Read The Trend (Recorded Session) with TradeSmart

1 × $31.00 -

×

Scalping Master Class with Day One Traders

1 × $5.00

Scalping Master Class with Day One Traders

1 × $5.00 -

×

Handbook of Computer Vision Algorithms in Image Algebra with Gerhard Ritter & Joseph Wilson

1 × $6.00

Handbook of Computer Vision Algorithms in Image Algebra with Gerhard Ritter & Joseph Wilson

1 × $6.00 -

×

Exploring MetaStock Advanced with Martin Pring

1 × $6.00

Exploring MetaStock Advanced with Martin Pring

1 × $6.00 -

×

Pattern Trader Pro with ForexStore

1 × $6.00

Pattern Trader Pro with ForexStore

1 × $6.00 -

×

Mindover Markets Enhanced: The Intensive Series 2 with Jim Dalton

1 × $20.00

Mindover Markets Enhanced: The Intensive Series 2 with Jim Dalton

1 × $20.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Pattern, Price & Time: Using Gann Theory in Trading Systems (1st Edition) with James Hyerczyk

1 × $6.00

Pattern, Price & Time: Using Gann Theory in Trading Systems (1st Edition) with James Hyerczyk

1 × $6.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Maximizing Profits with Weekly Options with Optionpit

1 × $15.00

Maximizing Profits with Weekly Options with Optionpit

1 × $15.00 -

×

Streetsmart Guide To Valuing a Stock (2nd Ed.) with Gary Gray

1 × $6.00

Streetsmart Guide To Valuing a Stock (2nd Ed.) with Gary Gray

1 × $6.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

Investment Intelligence from Insider Trading with H.N.Seyhun

1 × $6.00

Investment Intelligence from Insider Trading with H.N.Seyhun

1 × $6.00 -

×

Futures Trading (German)

1 × $6.00

Futures Trading (German)

1 × $6.00 -

×

Astro Cycles with Larry Pesavento

1 × $6.00

Astro Cycles with Larry Pesavento

1 × $6.00 -

×

Spartan Renko 2.0 Workshop 2017

1 × $23.00

Spartan Renko 2.0 Workshop 2017

1 × $23.00 -

×

Fractal Market Analysis with Edgar Peters

1 × $6.00

Fractal Market Analysis with Edgar Peters

1 × $6.00 -

×

Perfecting Execution and Trade Management Online Masterclass with The Trading Framework

1 × $6.00

Perfecting Execution and Trade Management Online Masterclass with The Trading Framework

1 × $6.00 -

×

Fractal Markets SFX with Tyson Bieniek

1 × $5.00

Fractal Markets SFX with Tyson Bieniek

1 × $5.00 -

×

Money & European Union with Stephen Frank Overturf

1 × $6.00

Money & European Union with Stephen Frank Overturf

1 × $6.00 -

×

Floor Trader Tools 8.2 with Roy Kelly

1 × $6.00

Floor Trader Tools 8.2 with Roy Kelly

1 × $6.00 -

×

Penny Stock Mastery

1 × $31.00

Penny Stock Mastery

1 × $31.00 -

×

E-Bonds: An Introduction to the Online Bond Market with Jake Wengroff

1 × $6.00

E-Bonds: An Introduction to the Online Bond Market with Jake Wengroff

1 × $6.00 -

×

Swing Trading for a Living (7 Video Cds & WorkBook 2.1 GB)

1 × $6.00

Swing Trading for a Living (7 Video Cds & WorkBook 2.1 GB)

1 × $6.00 -

×

Mastering Momentum Gaps with Toni Hansen

1 × $6.00

Mastering Momentum Gaps with Toni Hansen

1 × $6.00 -

×

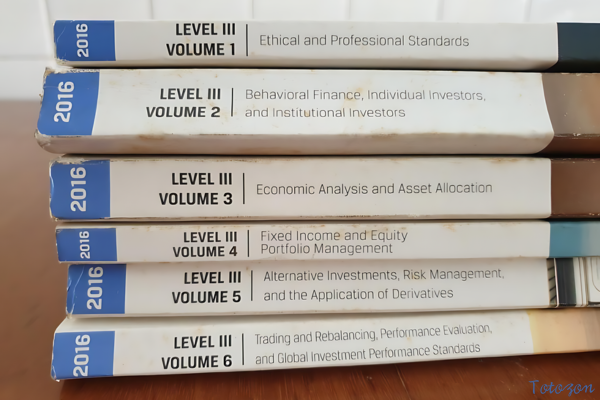

CFA Level 1,2,3 - Study Guides 2006

1 × $6.00

CFA Level 1,2,3 - Study Guides 2006

1 × $6.00 -

×

MATS Market Auction Trading System with Ryan Watts

1 × $6.00

MATS Market Auction Trading System with Ryan Watts

1 × $6.00 -

×

Mentfx Paid Mentoship (2021)

1 × $5.00

Mentfx Paid Mentoship (2021)

1 × $5.00 -

×

T.A.M.E. Home Study Course with Doug Sutton

1 × $6.00

T.A.M.E. Home Study Course with Doug Sutton

1 × $6.00 -

×

Complete Trading Bundle with AAA Quants

1 × $27.00

Complete Trading Bundle with AAA Quants

1 × $27.00 -

×

How to Make the Stock Market Make Money For You with Ted Warren

1 × $6.00

How to Make the Stock Market Make Money For You with Ted Warren

1 × $6.00 -

×

Hedged Strategy Series in Volatile Markets All 4 with Dan Sheridan

1 × $15.00

Hedged Strategy Series in Volatile Markets All 4 with Dan Sheridan

1 × $15.00 -

×

EFT for Prevention and Treatment of Serious Diseases with Kari Dawson

1 × $6.00

EFT for Prevention and Treatment of Serious Diseases with Kari Dawson

1 × $6.00 -

×

Outsmarting Wall Street (3rd Ed) with Daniel Alan Seiver

1 × $6.00

Outsmarting Wall Street (3rd Ed) with Daniel Alan Seiver

1 × $6.00 -

×

How I Trade Growth Stocks In Bull And Bear Markets

1 × $54.00

How I Trade Growth Stocks In Bull And Bear Markets

1 × $54.00 -

×

Foolproof Forex Trading with Louise Woof

1 × $6.00

Foolproof Forex Trading with Louise Woof

1 × $6.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Mastering Daily Option Trading with Option Pit

1 × $93.00

Mastering Daily Option Trading with Option Pit

1 × $93.00 -

×

Pre-Previews. 23 Articles and Forecasts

1 × $6.00

Pre-Previews. 23 Articles and Forecasts

1 × $6.00 -

×

Mechanics of Trading Module

1 × $6.00

Mechanics of Trading Module

1 × $6.00 -

×

Volume Profile Formula with Aaron Korbs

1 × $5.00

Volume Profile Formula with Aaron Korbs

1 × $5.00 -

×

Futures Spread Trading Intro Course with Thetradingframework

1 × $6.00

Futures Spread Trading Intro Course with Thetradingframework

1 × $6.00 -

×

The MMXM Trader – Personal Approach

1 × $5.00

The MMXM Trader – Personal Approach

1 × $5.00 -

×

Protecting your Retirement Account in a Correction with Dan Sheridan - Sheridan Options Mentoring

1 × $31.00

Protecting your Retirement Account in a Correction with Dan Sheridan - Sheridan Options Mentoring

1 × $31.00 -

×

Full Volume Forex Training Course with ThatFXTrader

1 × $5.00

Full Volume Forex Training Course with ThatFXTrader

1 × $5.00 -

×

Mastering Amibroker Formula Language

1 × $15.00

Mastering Amibroker Formula Language

1 × $15.00 -

×

TA_L2 & The Nasdaq

1 × $6.00

TA_L2 & The Nasdaq

1 × $6.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

4-Hour Income Strategy with Todd Mitchell & Craig Hill

1 × $62.00

4-Hour Income Strategy with Todd Mitchell & Craig Hill

1 × $62.00 -

×

Physicists on Wall Street and Other Essays on Science and Society with Jeremy Bernstein

1 × $6.00

Physicists on Wall Street and Other Essays on Science and Society with Jeremy Bernstein

1 × $6.00 -

×

John Bollinger on Bollinger Bands

1 × $6.00

John Bollinger on Bollinger Bands

1 × $6.00 -

×

Ron Wagner – Creating a Profitable Trading & Investing Plan. 6 Key Components with Pristine

1 × $4.00

Ron Wagner – Creating a Profitable Trading & Investing Plan. 6 Key Components with Pristine

1 × $4.00 -

×

The Ultimate Trading Resource with Clayton Bell, Alex Viscusi & Ben Chaffee

1 × $6.00

The Ultimate Trading Resource with Clayton Bell, Alex Viscusi & Ben Chaffee

1 × $6.00 -

×

Options, Futures & Other Derivatives (6th Ed.)

1 × $6.00

Options, Futures & Other Derivatives (6th Ed.)

1 × $6.00 -

×

Bulk REO 2.0

1 × $23.00

Bulk REO 2.0

1 × $23.00 -

×

RiskDoctor RD2 – Intermediate Course to Options Trading the RiskDoctor Way - Charles Cottle

1 × $6.00

RiskDoctor RD2 – Intermediate Course to Options Trading the RiskDoctor Way - Charles Cottle

1 × $6.00 -

×

Flipping Cash Rockstar with Lucas Adamski

1 × $6.00

Flipping Cash Rockstar with Lucas Adamski

1 × $6.00 -

×

Sovereign Man Confidential

1 × $6.00

Sovereign Man Confidential

1 × $6.00 -

×

Edge Trading Group with Edge Elite

1 × $6.00

Edge Trading Group with Edge Elite

1 × $6.00 -

×

Renko Profits Accelerator

1 × $15.00

Renko Profits Accelerator

1 × $15.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

Preview of Markets with George Bayer

1 × $6.00

Preview of Markets with George Bayer

1 × $6.00 -

×

Handbook for Enviroment Risk Decision Making with C.Richard Cothern

1 × $6.00

Handbook for Enviroment Risk Decision Making with C.Richard Cothern

1 × $6.00 -

×

Pentagonal Time Cycle Theory

1 × $6.00

Pentagonal Time Cycle Theory

1 × $6.00 -

×

Module I - Foundation with FX MindShift

1 × $6.00

Module I - Foundation with FX MindShift

1 × $6.00 -

×

New Generation Market Profile (May 2014)

1 × $15.00

New Generation Market Profile (May 2014)

1 × $15.00 -

×

Road to consistent profits (Dec 2022) with Jarrod Goodwin - Trading Halls of Knowledge

1 × $31.00

Road to consistent profits (Dec 2022) with Jarrod Goodwin - Trading Halls of Knowledge

1 × $31.00 -

×

Rich Jerk Program

1 × $15.00

Rich Jerk Program

1 × $15.00 -

×

Get Rich with Dividends

1 × $6.00

Get Rich with Dividends

1 × $6.00 -

×

Startup Trading Masterclass with Jack Gleason

1 × $93.00

Startup Trading Masterclass with Jack Gleason

1 × $93.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

FruitFly For Consistent Income with Matt Williamson

1 × $6.00

FruitFly For Consistent Income with Matt Williamson

1 × $6.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Full 2 Day Dark Pool And Market Strategy Training

1 × $6.00

Full 2 Day Dark Pool And Market Strategy Training

1 × $6.00 -

×

Generate Weekly Income by Trend-Trading Stocks Intraday Class with Corey Rosenbloom

1 × $6.00

Generate Weekly Income by Trend-Trading Stocks Intraday Class with Corey Rosenbloom

1 × $6.00 -

×

Hands On Training Bundle with Talkin Options

1 × $23.00

Hands On Training Bundle with Talkin Options

1 × $23.00 -

×

Profitable Patterns for Stock Trading with Larry Pesavento

1 × $6.00

Profitable Patterns for Stock Trading with Larry Pesavento

1 × $6.00 -

×

Stocks with Strauss

1 × $31.00

Stocks with Strauss

1 × $31.00 -

×

Hot Commodities: How Anyone Can Invest Profitably in the World's Best Market with Jim Rogers

1 × $6.00

Hot Commodities: How Anyone Can Invest Profitably in the World's Best Market with Jim Rogers

1 × $6.00 -

×

POS+ Hindi 30 Days Subscription with Surjeetkakkar

1 × $62.00

POS+ Hindi 30 Days Subscription with Surjeetkakkar

1 × $62.00 -

×

Philadelphia Seminar Replay & PDF Study Guide with ASFX Day Trading

1 × $31.00

Philadelphia Seminar Replay & PDF Study Guide with ASFX Day Trading

1 × $31.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

SWING TRADING WITH CONFIDENCE

1 × $31.00

SWING TRADING WITH CONFIDENCE

1 × $31.00 -

×

Market Magic: Riding the Greatest Bull Market of the Century with Louise Yamada

1 × $6.00

Market Magic: Riding the Greatest Bull Market of the Century with Louise Yamada

1 × $6.00 -

×

ETF and Leveraged ETF Trading Summit

1 × $23.00

ETF and Leveraged ETF Trading Summit

1 × $23.00 -

×

Strategy Factory Workshop with Kevin Davey - KJ Trading Systems

1 × $5.00

Strategy Factory Workshop with Kevin Davey - KJ Trading Systems

1 × $5.00 -

×

Scalping the Nasdaq Emini Futures Method (Includes Indicators) with Ryan Watts

1 × $4.00

Scalping the Nasdaq Emini Futures Method (Includes Indicators) with Ryan Watts

1 × $4.00 -

×

From Wall Street to the Great Wall with Jonathan Worrall

1 × $6.00

From Wall Street to the Great Wall with Jonathan Worrall

1 × $6.00 -

×

Options University - FX Technical Analysis

1 × $6.00

Options University - FX Technical Analysis

1 × $6.00 -

×

Investing In Stocks The Complete Course! (11 Hour) with Steve Ballinger

1 × $6.00

Investing In Stocks The Complete Course! (11 Hour) with Steve Ballinger

1 × $6.00 -

×

Fibsdontlie - Fibs Don’t Lie Advanced Course

1 × $15.00

Fibsdontlie - Fibs Don’t Lie Advanced Course

1 × $15.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Options Academy Elevate with Simon Ree - Tao of Trading

1 × $109.00

Options Academy Elevate with Simon Ree - Tao of Trading

1 × $109.00 -

×

Millionaire Traders with Kathy Lien & Boris Schlossberg

1 × $6.00

Millionaire Traders with Kathy Lien & Boris Schlossberg

1 × $6.00 -

×

George Wollsten: Expert Stock and Grain Trader with George Bayer

1 × $6.00

George Wollsten: Expert Stock and Grain Trader with George Bayer

1 × $6.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

DAY TRADE (LONG & SHORT) STRATEGIES PACKAGE - The Chartist

1 × $272.00

DAY TRADE (LONG & SHORT) STRATEGIES PACKAGE - The Chartist

1 × $272.00 -

×

Day Trading For A Living

1 × $31.00

Day Trading For A Living

1 × $31.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

Options Foundations Class

1 × $23.00

Options Foundations Class

1 × $23.00

Backspreads, Diagonals and Butterflies – Advanced Options Strategies

$199.00 Original price was: $199.00.$6.00Current price is: $6.00.

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Advanced Options Strategies: Backspreads, Diagonals, Butterflies

Introduction

Are you ready to elevate your options trading game? Delving into advanced strategies like backspreads, diagonals, and butterflies can significantly enhance your trading repertoire. These strategies offer sophisticated ways to manage risk and capitalize on market movements. Let’s explore these advanced options strategies and how you can use them to your advantage.

What Are Backspreads?

Backspreads are options strategies that involve buying more options than you sell, creating a net position that benefits from large price movements in the underlying asset.

1. Call Backspread

A call backspread is a bullish strategy. You sell one call option and buy two (or more) call options at a higher strike price. This strategy profits from significant upward moves in the underlying asset.

2. Put Backspread

A put backspread is a bearish strategy. You sell one put option and buy two (or more) put options at a lower strike price. This strategy profits from significant downward moves in the underlying asset.

Why Use Backspreads?

1. Unlimited Profit Potential

Backspreads offer unlimited profit potential while limiting risk to the net debit or credit received.

2. Hedging Volatility

These strategies are effective in volatile markets, allowing traders to benefit from large price swings.

Setting Up a Backspread

1. Select the Underlying Asset

Choose an asset with potential for significant price movement.

2. Choose Strike Prices

Select strike prices that align with your market outlook.

3. Execute the Trade

Sell one option and buy two (or more) options at a different strike price.

What Are Diagonal Spreads?

Diagonal spreads are options strategies that involve buying and selling options with different strike prices and expiration dates.

1. Call Diagonal Spread

A call diagonal spread is a bullish strategy where you buy a long-term call option and sell a shorter-term call option at a higher strike price.

2. Put Diagonal Spread

A put diagonal spread is a bearish strategy where you buy a long-term put option and sell a shorter-term put option at a lower strike price.

Why Use Diagonal Spreads?

1. Flexibility

Diagonal spreads provide flexibility in adjusting to changing market conditions.

2. Income Generation

These strategies can generate income through the sale of shorter-term options.

Setting Up a Diagonal Spread

1. Select the Underlying Asset

Choose an asset with a clear directional bias.

2. Choose Strike Prices and Expiration Dates

Select strike prices and expiration dates that align with your market outlook.

3. Execute the Trade

Buy a long-term option and sell a shorter-term option at a different strike price.

What Are Butterfly Spreads?

Butterfly spreads are neutral options strategies that involve buying and selling options at three different strike prices.

1. Long Call Butterfly Spread

A long call butterfly spread is set up by buying one call option at a lower strike price, selling two call options at a middle strike price, and buying one call option at a higher strike price.

2. Long Put Butterfly Spread

A long put butterfly spread is set up by buying one put option at a higher strike price, selling two put options at a middle strike price, and buying one put option at a lower strike price.

Why Use Butterfly Spreads?

1. Limited Risk and Reward

Butterfly spreads offer limited risk and reward, making them suitable for traders with a neutral market outlook.

2. Profit from Low Volatility

These strategies can be profitable in low-volatility markets where the underlying asset remains within a specific range.

Setting Up a Butterfly Spread

1. Select the Underlying Asset

Choose an asset that you believe will remain within a specific price range.

2. Choose Strike Prices

Select three strike prices: one lower, one middle, and one higher.

3. Execute the Trade

Buy one option at the lower strike price, sell two options at the middle strike price, and buy one option at the higher strike price.

Risk Management in Advanced Options Strategies

1. Position Sizing

Only risk a small percentage of your capital on each trade to manage overall risk.

2. Setting Stop-Loss Orders

Use stop-loss orders to limit potential losses.

3. Monitoring Market Conditions

Stay informed about market trends and news that could impact your trades.

Advantages of Using Advanced Options Strategies

- Sophisticated Risk Management: Advanced strategies offer more nuanced risk management techniques.

- Potential for Higher Returns: These strategies can yield higher returns compared to basic options strategies.

- Flexibility: Adapt to various market conditions with a diverse set of strategies.

Conclusion

Backspreads, diagonals, and butterflies are advanced options strategies that can significantly enhance your trading toolkit. By understanding and implementing these strategies, you can better manage risk, capitalize on market movements, and potentially increase your returns. Whether you’re bullish, bearish, or neutral on the market, these strategies provide flexibility and opportunities for profit.

Commonly Asked Questions:

- Business Model Innovation: Accept the truth of a legitimate business! Our strategy is organising a group buy in which participants share the costs. We use these cash to acquire popular courses from sale pages and make them available to people with limited financial resources. Despite the authors’ worries, our clients love the cost and accessibility we give.

- The Legal Environment: Yes or No The legality of our activity is ambiguous. While we don’t have specific permission from the course authors to resell the material, there is a technicality at work. The author did not specify any limits on resale when purchasing the course. This legal intricacy is both an opportunity for us and a boon for individuals looking for low-cost access.

- Quality Control: Uncovering the Truth

Getting to the heart of the issue – quality. Purchasing the course straight from the sale page guarantees that all documents and resources are the same as those obtained through traditional channels.

However, we distinguish ourselves by going beyond personal research and resale. It is crucial to note that we are not the official course providers, which means that the following premium services are not included in our package:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not permitted.

- No access to the author’s private membership forum.

- There is no direct email support available from the author or their team.

We operate independently, with the goal of bridging the pricing gap without the extra services provided by official course channels. Your comprehension of our distinct approach is much appreciated.

Be the first to review “Backspreads, Diagonals and Butterflies – Advanced Options Strategies” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.