-

×

A Grand Supercycle Top Webinar with Steven Hochberg

1 × $6.00

A Grand Supercycle Top Webinar with Steven Hochberg

1 × $6.00 -

×

Winning with Value Charts with Dave Stendahl

1 × $6.00

Winning with Value Charts with Dave Stendahl

1 × $6.00 -

×

Trading with Price Ladder and Order Flow Strategies with Alex Haywood - Axia Futures

1 × $6.00

Trading with Price Ladder and Order Flow Strategies with Alex Haywood - Axia Futures

1 × $6.00 -

×

Ron Wagner - Creating a Profitable Trading & Investing Plan + Techniques to Perfect Your Intraday GAP

1 × $6.00

Ron Wagner - Creating a Profitable Trading & Investing Plan + Techniques to Perfect Your Intraday GAP

1 × $6.00 -

×

Understanding Equity & Trusts with Alastair Hudson

1 × $6.00

Understanding Equity & Trusts with Alastair Hudson

1 × $6.00 -

×

Simple Setups For Consistent Profits with Base Camp Trading

1 × $6.00

Simple Setups For Consistent Profits with Base Camp Trading

1 × $6.00 -

×

FXS Analytics Training and Q&A Access with FXS Analytics

1 × $6.00

FXS Analytics Training and Q&A Access with FXS Analytics

1 × $6.00 -

×

A Complete Beginner to Advanced Trading Mentorship Program with Habby Forex Trading Academy

1 × $5.00

A Complete Beginner to Advanced Trading Mentorship Program with Habby Forex Trading Academy

1 × $5.00 -

×

Dynamic Time and Price Analysis of Market Trends with Bruce Gilmore

1 × $6.00

Dynamic Time and Price Analysis of Market Trends with Bruce Gilmore

1 × $6.00 -

×

What Ranks Schema Course with Clint Butler

1 × $23.00

What Ranks Schema Course with Clint Butler

1 × $23.00 -

×

How I Made One Million Dollars with Larry Williams

1 × $6.00

How I Made One Million Dollars with Larry Williams

1 × $6.00 -

×

Reverse Engineering Deals on Wall Street with Microsoft Excel with Keith Allman

1 × $6.00

Reverse Engineering Deals on Wall Street with Microsoft Excel with Keith Allman

1 × $6.00 -

×

Road to consistent profits (Dec 2022) with Jarrod Goodwin - Trading Halls of Knowledge

1 × $31.00

Road to consistent profits (Dec 2022) with Jarrod Goodwin - Trading Halls of Knowledge

1 × $31.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Module 1 & 2 Swing Trading Forex and Financial Futures with Trader Dante

1 × $15.00

Module 1 & 2 Swing Trading Forex and Financial Futures with Trader Dante

1 × $15.00 -

×

Trading The E-Minis for a Living with Don Miller

1 × $6.00

Trading The E-Minis for a Living with Don Miller

1 × $6.00 -

×

PRICE ACTION MASTERY

1 × $39.00

PRICE ACTION MASTERY

1 × $39.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

MTA Master Trader Academy with Junior Charles

1 × $5.00

MTA Master Trader Academy with Junior Charles

1 × $5.00 -

×

Phantom Trading Course 2.0

1 × $7.00

Phantom Trading Course 2.0

1 × $7.00 -

×

Offensive & Defensive Strengths of Stocks, Groups & Sectors Gary Anderson

1 × $6.00

Offensive & Defensive Strengths of Stocks, Groups & Sectors Gary Anderson

1 × $6.00 -

×

Trade What You See How To Profit from Pattern Recognition with Larry Pesavento & Leslie Jouflas

1 × $6.00

Trade What You See How To Profit from Pattern Recognition with Larry Pesavento & Leslie Jouflas

1 × $6.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Alexander Elder Package ( Discount 28% )

1 × $31.00

Alexander Elder Package ( Discount 28% )

1 × $31.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

Pips&Profit Trading Course

1 × $13.00

Pips&Profit Trading Course

1 × $13.00 -

×

The Blockchain Bootcamp 2.0 with Gregory (Dapp University)

1 × $15.00

The Blockchain Bootcamp 2.0 with Gregory (Dapp University)

1 × $15.00 -

×

Elliott Flat Waves CD with David Elliott

1 × $6.00

Elliott Flat Waves CD with David Elliott

1 × $6.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Trading From Your Gut with Curtis Faith

1 × $6.00

Trading From Your Gut with Curtis Faith

1 × $6.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Getting Started With Options with Peter Titus - Marwood Research

1 × $6.00

Getting Started With Options with Peter Titus - Marwood Research

1 × $6.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Part-Time Day Trading Courses

1 × $54.00

Part-Time Day Trading Courses

1 × $54.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

Winning With The Market with Douglas R.Sease

1 × $6.00

Winning With The Market with Douglas R.Sease

1 × $6.00 -

×

MLT Divergence Indicator with Major League Trading

1 × $23.00

MLT Divergence Indicator with Major League Trading

1 × $23.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

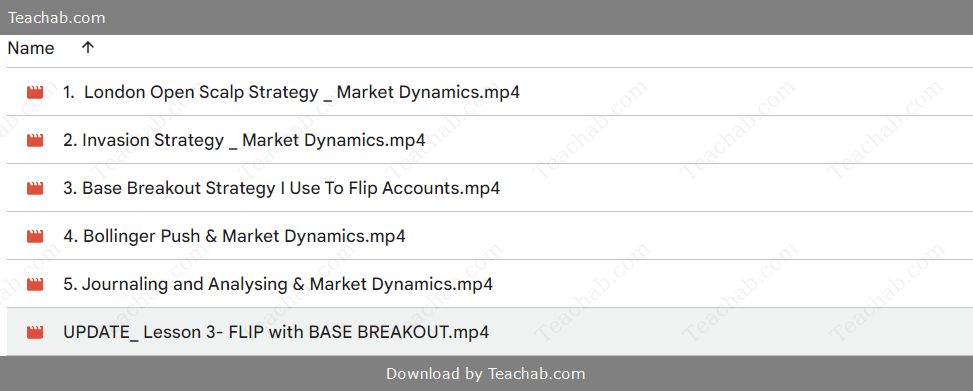

Advanced Mentorship Course on Market Dynamics (Flip accounts with ease)

$99.00 Original price was: $99.00.$6.00Current price is: $6.00.

File Size: 399 MB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

SKU: Ttz- 57199o26dyD

Category: Forex Trading

You may check content proof of “Advanced Mentorship Course on Market Dynamics (Flip accounts with ease)” below:

Advanced Mentorship on Market Dynamics – Flip Accounts

In the fast-paced world of trading, understanding market dynamics is key to consistent success. The Advanced Mentorship Course on Market Dynamics is designed for those who are serious about flipping accounts with ease. This course dives deep into the intricacies of the market, teaching strategies that can lead to exponential growth in trading accounts. Whether you’re a novice or a seasoned trader, this course offers insights that can transform your trading journey.

Why Market Dynamics Matter

Market dynamics refer to the forces that influence price movements in financial markets. Understanding these forces is crucial for making informed trading decisions. In this course, we delve into these dynamics, exploring how they can be leveraged to maximize trading profits.

The Basics of Market Dynamics

Before diving into advanced strategies, it’s essential to grasp the basics of market dynamics. These include supply and demand, market sentiment, and the impact of economic indicators. By understanding these core principles, traders can better predict market movements.

Supply and Demand

Supply and demand are the fundamental forces that drive price changes in any market. This section of the course explains how these forces interact and how traders can anticipate changes based on supply and demand analysis.

Market Sentiment

Market sentiment refers to the overall attitude of investors towards a particular security or market. This part of the course teaches how to gauge market sentiment and use it to your advantage.

Economic Indicators

Economic indicators such as GDP, unemployment rates, and inflation have a significant impact on market dynamics. The course covers how to interpret these indicators and incorporate them into your trading strategy.

Advanced Trading Strategies

Once the basics are covered, the course moves on to advanced strategies that can help traders flip accounts with ease. These strategies are designed to maximize returns while minimizing risks.

Momentum Trading

Momentum trading is a strategy that involves buying securities that are trending upward and selling those that are trending downward. This section of the course teaches how to identify momentum in the market and capitalize on it.

Identifying Momentum

Learn how to use technical indicators like moving averages and RSI to identify momentum in the market. Understanding these indicators is crucial for timing your trades effectively.

Executing Momentum Trades

Timing is everything in momentum trading. This part of the course explains how to enter and exit trades at the right time to maximize profits.

Scalping Techniques

Scalping is a trading strategy that involves making numerous trades throughout the day to capitalize on small price movements. This section covers the best scalping techniques for flipping accounts.

Setting Up for Scalping

Discover how to set up your trading platform for scalping, including the best tools and indicators to use. A proper setup is essential for success in scalping.

Managing Scalping Trades

Scalping requires quick decision-making and effective trade management. Learn the best practices for managing your trades and staying profitable.

Swing Trading

Swing trading is a strategy that involves holding positions for several days to capture short-term market moves. This strategy is ideal for those who want to balance trading with other commitments.

Choosing the Right Stocks for Swing Trading

Not all stocks are suitable for swing trading. This section teaches how to select the best stocks based on technical and fundamental analysis.

Timing Your Entries and Exits

Learn how to time your trades for maximum profit in swing trading. This part of the course covers the key indicators and signals to watch for.

Risk Management and Psychology

No trading strategy is complete without proper risk management and an understanding of trading psychology. This course emphasizes the importance of these aspects in ensuring long-term success.

Risk Management Techniques

Effective risk management is crucial for flipping accounts. This section covers various techniques, including position sizing, stop-loss orders, and risk-reward ratios.

Position Sizing

Learn how to determine the appropriate position size for each trade based on your risk tolerance and account size.

Using Stop-Loss Orders

Stop-loss orders are essential for protecting your capital. This part of the course teaches how to set and use stop-loss orders effectively.

Mastering Trading Psychology

Trading psychology can make or break a trader. This section covers the key psychological principles that every trader must master to succeed.

Controlling Emotions

Emotions like fear and greed can lead to poor trading decisions. Learn how to control your emotions and stick to your trading plan.

Developing Discipline

Discipline is the cornerstone of successful trading. This part of the course teaches how to develop and maintain discipline in your trading approach.

Case Studies and Real-World Examples

The course includes case studies and real-world examples that illustrate the concepts and strategies covered. These examples provide valuable insights into how market dynamics work in practice.

Case Study 1: Flipping a Small Account

In this case study, we analyze how a small trading account was flipped using the strategies taught in this course. Learn from the mistakes and successes of real traders.

Case Study 2: Overcoming Market Volatility

Market volatility can be challenging, but it also presents opportunities. This case study shows how traders can navigate volatile markets and come out ahead.

Conclusion

The Advanced Mentorship Course on Market Dynamics offers a comprehensive guide to mastering the market. By understanding the forces that drive market movements and applying advanced trading strategies, traders can flip accounts with ease. This course is not just about making quick profits; it’s about building a solid foundation for long-term success in trading.

Frequently Asked Questions:

- Business Model Innovation:

Embrace our legitimate business model! We organize group buys, allowing participants to share costs for popular courses, making them accessible to those with limited financial resources. Our approach ensures affordability and accessibility, despite author concerns. - The Legal Environment:

The legality of our activity is uncertain. While we lack specific permission from course authors, there’s a technicality: authors didn’t impose resale limits upon course purchase. This presents both an opportunity for us and a benefit for individuals seeking low-cost access. - Quality Control:

Unveiling the Truth

Quality is paramount. Purchasing courses directly from sales pages ensures consistency with traditionally obtained materials. However, we’re not official course providers and don’t offer premium services:

- No scheduled coaching calls or sessions with the author.

- No access to the author’s private Facebook group or web portal.

- No entry to the author’s private membership forum.

- Direct email support from the author or their team is unavailable. Operating independently, we aim to bridge the pricing gap without additional services provided by official channels. Your understanding of our unique approach is valued.

Be the first to review “Advanced Mentorship Course on Market Dynamics (Flip accounts with ease)” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.