-

×

Candlesticks MegaPackage Vol 1-4 (CCA) with Candle Charts

1 × $62.00

Candlesticks MegaPackage Vol 1-4 (CCA) with Candle Charts

1 × $62.00 -

×

Greatest Trading Tools

1 × $6.00

Greatest Trading Tools

1 × $6.00 -

×

Applying Fibonacci Analysis to Price Action

1 × $6.00

Applying Fibonacci Analysis to Price Action

1 × $6.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Beginner To Winner Boot Camp with Pips2Profit

1 × $41.00

Beginner To Winner Boot Camp with Pips2Profit

1 × $41.00 -

×

Edz Currency Trading Package with EDZ Trading Academy

1 × $5.00

Edz Currency Trading Package with EDZ Trading Academy

1 × $5.00 -

×

RiskDoctor Slingshot Hedge – Options Trading Strategies – Slingshot Hedge with Charles Cottle

1 × $6.00

RiskDoctor Slingshot Hedge – Options Trading Strategies – Slingshot Hedge with Charles Cottle

1 × $6.00 -

×

The Price Action Manual, 2nd Ed 2008 with Bryce Gilmore

1 × $4.00

The Price Action Manual, 2nd Ed 2008 with Bryce Gilmore

1 × $4.00 -

×

Best Trading Strategies Revealed - The Prosperity Trading Course (BTSR)

1 × $78.00

Best Trading Strategies Revealed - The Prosperity Trading Course (BTSR)

1 × $78.00 -

×

Precision Timing Your Options Trades Using Fibonacci with Trading Analysis

1 × $15.00

Precision Timing Your Options Trades Using Fibonacci with Trading Analysis

1 × $15.00 -

×

HINT (High Income No Taxes) with Jeff Watson

1 × $54.00

HINT (High Income No Taxes) with Jeff Watson

1 × $54.00 -

×

Trade Your Way to Wealth with Bill Kraft

1 × $6.00

Trade Your Way to Wealth with Bill Kraft

1 × $6.00 -

×

Astrology & Stock Market Forecasting with Louise McWhirter

1 × $4.00

Astrology & Stock Market Forecasting with Louise McWhirter

1 × $4.00 -

×

Exclusive Footprint and Market Profile with Adam Set

1 × $5.00

Exclusive Footprint and Market Profile with Adam Set

1 × $5.00 -

×

Trading Strategies with Ambush and Stealth Combined - Joe Ross

1 × $311.00

Trading Strategies with Ambush and Stealth Combined - Joe Ross

1 × $311.00 -

×

Regression Diagnostics: Identifying Influential Data and Sources of Collinearity with David Belsey, Edwin Kuh & Roy Welsch

1 × $6.00

Regression Diagnostics: Identifying Influential Data and Sources of Collinearity with David Belsey, Edwin Kuh & Roy Welsch

1 × $6.00 -

×

Breakout Trading Systems with Chris Tate

1 × $6.00

Breakout Trading Systems with Chris Tate

1 × $6.00 -

×

Bulk REO 2.0

1 × $23.00

Bulk REO 2.0

1 × $23.00 -

×

Trading System Building Blocks with John Hill

1 × $6.00

Trading System Building Blocks with John Hill

1 × $6.00 -

×

ChangeWave Investing 2.0 with Tobin Smith

1 × $6.00

ChangeWave Investing 2.0 with Tobin Smith

1 × $6.00 -

×

Complete Day Trading : Stock Trading With Technical Analysis

1 × $15.00

Complete Day Trading : Stock Trading With Technical Analysis

1 × $15.00 -

×

Elev8 Trading Complete Course

1 × $10.00

Elev8 Trading Complete Course

1 × $10.00 -

×

Evolve MasterClass with Irek Piekarski

1 × $13.00

Evolve MasterClass with Irek Piekarski

1 × $13.00 -

×

Gann’s Secret with Jeanne Long

1 × $4.00

Gann’s Secret with Jeanne Long

1 × $4.00 -

×

Using Options to Buy Stocks: Build Wealth with Little Risk and No Capital - Dennis Eisen

1 × $4.00

Using Options to Buy Stocks: Build Wealth with Little Risk and No Capital - Dennis Eisen

1 × $4.00 -

×

Master Stock Course

1 × $6.00

Master Stock Course

1 × $6.00 -

×

Basecamptrading - Ichimoku Value Cloud Strategy

1 × $23.00

Basecamptrading - Ichimoku Value Cloud Strategy

1 × $23.00 -

×

Hamzei Analytics Indicators for eSignal (hamzeianalytics.com)

1 × $6.00

Hamzei Analytics Indicators for eSignal (hamzeianalytics.com)

1 × $6.00 -

×

Foundations Of Stocks And Options (2015) with TradeSmart University

1 × $5.00

Foundations Of Stocks And Options (2015) with TradeSmart University

1 × $5.00 -

×

Options for Long Term Trading & Hedging with Option Pit

1 × $39.00

Options for Long Term Trading & Hedging with Option Pit

1 × $39.00 -

×

James Dalton Mind Over Markets Expanded Intensive Series 2018

1 × $6.00

James Dalton Mind Over Markets Expanded Intensive Series 2018

1 × $6.00 -

×

The Top Tier Pro System Basic with Raghee Horner

1 × $41.00

The Top Tier Pro System Basic with Raghee Horner

1 × $41.00 -

×

Investing With Giants: Tried and True Stocks That Have Sustained the Test of Time with Linda T.Mead

1 × $6.00

Investing With Giants: Tried and True Stocks That Have Sustained the Test of Time with Linda T.Mead

1 × $6.00 -

×

CFA Level 1,2,3 - Study Guides 2006

1 × $6.00

CFA Level 1,2,3 - Study Guides 2006

1 × $6.00 -

×

Options Master Class

1 × $54.00

Options Master Class

1 × $54.00 -

×

Fast Track Forex Course

1 × $62.00

Fast Track Forex Course

1 × $62.00 -

×

Mastering the Gaps - Trading Gaps

1 × $15.00

Mastering the Gaps - Trading Gaps

1 × $15.00 -

×

Option Hydra - Mar 2020 Edition - Basics with Rajandran R

1 × $23.00

Option Hydra - Mar 2020 Edition - Basics with Rajandran R

1 × $23.00 -

×

Use the News with Maria Bartiromo

1 × $6.00

Use the News with Maria Bartiromo

1 × $6.00 -

×

Central Bank Trading Strategies with AXIA Futures

1 × $5.00

Central Bank Trading Strategies with AXIA Futures

1 × $5.00 -

×

License to Steal with John Carlton

1 × $6.00

License to Steal with John Carlton

1 × $6.00 -

×

Area 61 with BCFX

1 × $6.00

Area 61 with BCFX

1 × $6.00 -

×

Donchian’s 20 Guides to Trading Commodities with Barbara S.Dixon

1 × $4.00

Donchian’s 20 Guides to Trading Commodities with Barbara S.Dixon

1 × $4.00 -

×

The Power of the Hexagon

1 × $6.00

The Power of the Hexagon

1 × $6.00 -

×

The Vol.T Volume-Tick Indicator Package

1 × $23.00

The Vol.T Volume-Tick Indicator Package

1 × $23.00 -

×

Offshore Keys (2023)

1 × $5.00

Offshore Keys (2023)

1 × $5.00 -

×

The Hedge Fund Edge. Maximum Profit, Minimum Risk. Global Trading Trend Strategies - Mark Boucher

1 × $6.00

The Hedge Fund Edge. Maximum Profit, Minimum Risk. Global Trading Trend Strategies - Mark Boucher

1 × $6.00 -

×

Traders Forge with Ryan Litchfield

1 × $6.00

Traders Forge with Ryan Litchfield

1 × $6.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Trading MoneyTides & Chaos in the Stock Market with Hans Hannula

1 × $6.00

Trading MoneyTides & Chaos in the Stock Market with Hans Hannula

1 × $6.00 -

×

Tandem Trader - The Ultimate Day Trading Course with Nathan Michaud - Investors Underground

1 × $54.00

Tandem Trader - The Ultimate Day Trading Course with Nathan Michaud - Investors Underground

1 × $54.00 -

×

Point And Figure Part III By Bruce Fraser & Roman Bogomazov - Wyckoff Analytics

1 × $23.00

Point And Figure Part III By Bruce Fraser & Roman Bogomazov - Wyckoff Analytics

1 × $23.00 -

×

Trading Futures for Dummies with Joe Duarte

1 × $6.00

Trading Futures for Dummies with Joe Duarte

1 × $6.00 -

×

Options University - Ron Ianieri – The Option Pricing Model

1 × $6.00

Options University - Ron Ianieri – The Option Pricing Model

1 × $6.00 -

×

Dan Sheridan Butterfly Course (Sep 2012)

1 × $6.00

Dan Sheridan Butterfly Course (Sep 2012)

1 × $6.00 -

×

USDX Trading Course with Jared Martinez - MTI

1 × $6.00

USDX Trading Course with Jared Martinez - MTI

1 × $6.00 -

×

Trading Triggers - The Secrets to Profitable Trading with John Person

1 × $6.00

Trading Triggers - The Secrets to Profitable Trading with John Person

1 × $6.00 -

×

War Room Technicals Vol. 3 with Trick Trades

1 × $6.00

War Room Technicals Vol. 3 with Trick Trades

1 × $6.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

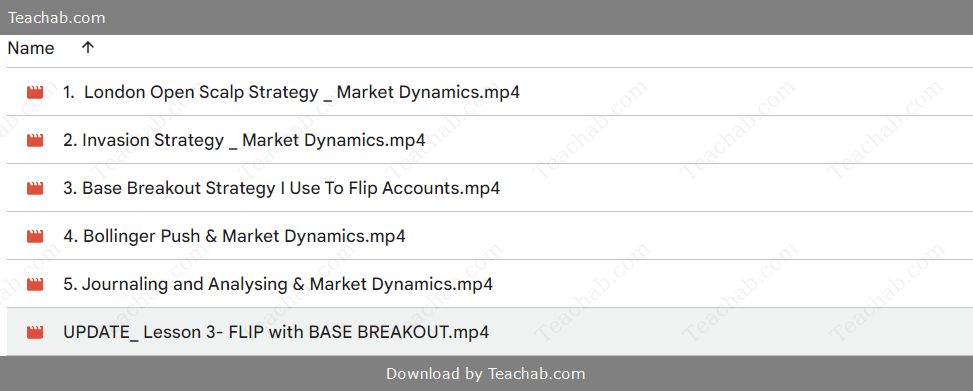

Advanced Mentorship Course on Market Dynamics (Flip accounts with ease)

$99.00 Original price was: $99.00.$6.00Current price is: $6.00.

File Size: 399 MB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

SKU: Ttz- 57199o26dyD

Category: Forex Trading

You may check content proof of “Advanced Mentorship Course on Market Dynamics (Flip accounts with ease)” below:

Advanced Mentorship on Market Dynamics – Flip Accounts

In the fast-paced world of trading, understanding market dynamics is key to consistent success. The Advanced Mentorship Course on Market Dynamics is designed for those who are serious about flipping accounts with ease. This course dives deep into the intricacies of the market, teaching strategies that can lead to exponential growth in trading accounts. Whether you’re a novice or a seasoned trader, this course offers insights that can transform your trading journey.

Why Market Dynamics Matter

Market dynamics refer to the forces that influence price movements in financial markets. Understanding these forces is crucial for making informed trading decisions. In this course, we delve into these dynamics, exploring how they can be leveraged to maximize trading profits.

The Basics of Market Dynamics

Before diving into advanced strategies, it’s essential to grasp the basics of market dynamics. These include supply and demand, market sentiment, and the impact of economic indicators. By understanding these core principles, traders can better predict market movements.

Supply and Demand

Supply and demand are the fundamental forces that drive price changes in any market. This section of the course explains how these forces interact and how traders can anticipate changes based on supply and demand analysis.

Market Sentiment

Market sentiment refers to the overall attitude of investors towards a particular security or market. This part of the course teaches how to gauge market sentiment and use it to your advantage.

Economic Indicators

Economic indicators such as GDP, unemployment rates, and inflation have a significant impact on market dynamics. The course covers how to interpret these indicators and incorporate them into your trading strategy.

Advanced Trading Strategies

Once the basics are covered, the course moves on to advanced strategies that can help traders flip accounts with ease. These strategies are designed to maximize returns while minimizing risks.

Momentum Trading

Momentum trading is a strategy that involves buying securities that are trending upward and selling those that are trending downward. This section of the course teaches how to identify momentum in the market and capitalize on it.

Identifying Momentum

Learn how to use technical indicators like moving averages and RSI to identify momentum in the market. Understanding these indicators is crucial for timing your trades effectively.

Executing Momentum Trades

Timing is everything in momentum trading. This part of the course explains how to enter and exit trades at the right time to maximize profits.

Scalping Techniques

Scalping is a trading strategy that involves making numerous trades throughout the day to capitalize on small price movements. This section covers the best scalping techniques for flipping accounts.

Setting Up for Scalping

Discover how to set up your trading platform for scalping, including the best tools and indicators to use. A proper setup is essential for success in scalping.

Managing Scalping Trades

Scalping requires quick decision-making and effective trade management. Learn the best practices for managing your trades and staying profitable.

Swing Trading

Swing trading is a strategy that involves holding positions for several days to capture short-term market moves. This strategy is ideal for those who want to balance trading with other commitments.

Choosing the Right Stocks for Swing Trading

Not all stocks are suitable for swing trading. This section teaches how to select the best stocks based on technical and fundamental analysis.

Timing Your Entries and Exits

Learn how to time your trades for maximum profit in swing trading. This part of the course covers the key indicators and signals to watch for.

Risk Management and Psychology

No trading strategy is complete without proper risk management and an understanding of trading psychology. This course emphasizes the importance of these aspects in ensuring long-term success.

Risk Management Techniques

Effective risk management is crucial for flipping accounts. This section covers various techniques, including position sizing, stop-loss orders, and risk-reward ratios.

Position Sizing

Learn how to determine the appropriate position size for each trade based on your risk tolerance and account size.

Using Stop-Loss Orders

Stop-loss orders are essential for protecting your capital. This part of the course teaches how to set and use stop-loss orders effectively.

Mastering Trading Psychology

Trading psychology can make or break a trader. This section covers the key psychological principles that every trader must master to succeed.

Controlling Emotions

Emotions like fear and greed can lead to poor trading decisions. Learn how to control your emotions and stick to your trading plan.

Developing Discipline

Discipline is the cornerstone of successful trading. This part of the course teaches how to develop and maintain discipline in your trading approach.

Case Studies and Real-World Examples

The course includes case studies and real-world examples that illustrate the concepts and strategies covered. These examples provide valuable insights into how market dynamics work in practice.

Case Study 1: Flipping a Small Account

In this case study, we analyze how a small trading account was flipped using the strategies taught in this course. Learn from the mistakes and successes of real traders.

Case Study 2: Overcoming Market Volatility

Market volatility can be challenging, but it also presents opportunities. This case study shows how traders can navigate volatile markets and come out ahead.

Conclusion

The Advanced Mentorship Course on Market Dynamics offers a comprehensive guide to mastering the market. By understanding the forces that drive market movements and applying advanced trading strategies, traders can flip accounts with ease. This course is not just about making quick profits; it’s about building a solid foundation for long-term success in trading.

Frequently Asked Questions:

- Business Model Innovation:

Embrace our legitimate business model! We organize group buys, allowing participants to share costs for popular courses, making them accessible to those with limited financial resources. Our approach ensures affordability and accessibility, despite author concerns. - The Legal Environment:

The legality of our activity is uncertain. While we lack specific permission from course authors, there’s a technicality: authors didn’t impose resale limits upon course purchase. This presents both an opportunity for us and a benefit for individuals seeking low-cost access. - Quality Control:

Unveiling the Truth

Quality is paramount. Purchasing courses directly from sales pages ensures consistency with traditionally obtained materials. However, we’re not official course providers and don’t offer premium services:

- No scheduled coaching calls or sessions with the author.

- No access to the author’s private Facebook group or web portal.

- No entry to the author’s private membership forum.

- Direct email support from the author or their team is unavailable. Operating independently, we aim to bridge the pricing gap without additional services provided by official channels. Your understanding of our unique approach is valued.

Be the first to review “Advanced Mentorship Course on Market Dynamics (Flip accounts with ease)” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.