-

×

Weekly Diagonal Spreads for Consistent Income By Doc Severson

1 × $6.00

Weekly Diagonal Spreads for Consistent Income By Doc Severson

1 × $6.00 -

×

Selected Articles by the Late by George Lindsay

1 × $6.00

Selected Articles by the Late by George Lindsay

1 × $6.00 -

×

Road Map to Riches with Steve Wirrick

1 × $6.00

Road Map to Riches with Steve Wirrick

1 × $6.00 -

×

Investment Science with David G.Luenberger

1 × $6.00

Investment Science with David G.Luenberger

1 × $6.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

SRs Trend Rider 2.0

1 × $6.00

SRs Trend Rider 2.0

1 × $6.00 -

×

Building a Better Trader with Glenn Ring

1 × $6.00

Building a Better Trader with Glenn Ring

1 × $6.00 -

×

Price Analysis Webinar with Carolyn Boroden

1 × $6.00

Price Analysis Webinar with Carolyn Boroden

1 × $6.00 -

×

OTC Oracle Course - PENNY WHALE with Simple Trade

1 × $31.00

OTC Oracle Course - PENNY WHALE with Simple Trade

1 × $31.00 -

×

Newsbeat Master Class Recording

1 × $39.00

Newsbeat Master Class Recording

1 × $39.00 -

×

Options Professional Online Webinar (2010-01 – 2010-02) with J.L.Lord

1 × $6.00

Options Professional Online Webinar (2010-01 – 2010-02) with J.L.Lord

1 × $6.00 -

×

Global Equity Investing By Alberto Vivanti & Perry Kaufman

1 × $6.00

Global Equity Investing By Alberto Vivanti & Perry Kaufman

1 × $6.00 -

×

Complete Best Practices - Weekly Options Income Trading System with Weekly Options Academy

1 × $23.00

Complete Best Practices - Weekly Options Income Trading System with Weekly Options Academy

1 × $23.00 -

×

Stock Traders Almanac 2010 with Jeffrey Hirsch & Yale Hirsch

1 × $6.00

Stock Traders Almanac 2010 with Jeffrey Hirsch & Yale Hirsch

1 × $6.00 -

×

Triple Your Trading Profits Couse with David Jenyns

1 × $6.00

Triple Your Trading Profits Couse with David Jenyns

1 × $6.00 -

×

Bar Ipro v9.1 for MT4 11XX

1 × $23.00

Bar Ipro v9.1 for MT4 11XX

1 × $23.00 -

×

How to Profit in Gold with Jonathan Spall

1 × $6.00

How to Profit in Gold with Jonathan Spall

1 × $6.00 -

×

Harmonic Patterns for ThinkorSwim Bat, Butterfly, Crab, and Gartley

1 × $6.00

Harmonic Patterns for ThinkorSwim Bat, Butterfly, Crab, and Gartley

1 × $6.00 -

×

Ichimoku Cloud Trading System Class with Jeff Bierman

1 × $6.00

Ichimoku Cloud Trading System Class with Jeff Bierman

1 × $6.00 -

×

Arcane 2.0 Course

1 × $6.00

Arcane 2.0 Course

1 × $6.00 -

×

The Market Maker’s Edge with Josh Lukeman

1 × $6.00

The Market Maker’s Edge with Josh Lukeman

1 × $6.00 -

×

Binary Defender

1 × $15.00

Binary Defender

1 × $15.00 -

×

Stock Option Trading 3 – Easy Advanced Profits and Success with Scott Paton

1 × $6.00

Stock Option Trading 3 – Easy Advanced Profits and Success with Scott Paton

1 × $6.00 -

×

Activedaytrader - Workshop: Practical Money Management

1 × $23.00

Activedaytrader - Workshop: Practical Money Management

1 × $23.00 -

×

Forex Millionaire Course with Willis University

1 × $6.00

Forex Millionaire Course with Willis University

1 × $6.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Modern Portfolio Theory and Investment Analysis (7th Edition) with Edwin Elton, Martin Gruber, Stephen Brown & William Goetzmann

1 × $6.00

Modern Portfolio Theory and Investment Analysis (7th Edition) with Edwin Elton, Martin Gruber, Stephen Brown & William Goetzmann

1 × $6.00 -

×

Selective Forex Trading with Don Snellgrove

1 × $6.00

Selective Forex Trading with Don Snellgrove

1 × $6.00 -

×

Trading Markets Swing Trading College 2019 with Larry Connor

1 × $5.00

Trading Markets Swing Trading College 2019 with Larry Connor

1 × $5.00 -

×

AstuceFX Mentorship 2023

1 × $27.00

AstuceFX Mentorship 2023

1 × $27.00 -

×

Krautgap By John Piper

1 × $6.00

Krautgap By John Piper

1 × $6.00 -

×

Pattern, Price & Time: Using Gann Theory in Trading Systems (1st Edition) with James Hyerczyk

1 × $6.00

Pattern, Price & Time: Using Gann Theory in Trading Systems (1st Edition) with James Hyerczyk

1 × $6.00 -

×

Futures Trading Secrets Home Study Course 2008 with Bill McCready

1 × $6.00

Futures Trading Secrets Home Study Course 2008 with Bill McCready

1 × $6.00 -

×

Trading to Win (Seminar WorkBook 2003) with Bruce Gilmore

1 × $6.00

Trading to Win (Seminar WorkBook 2003) with Bruce Gilmore

1 × $6.00 -

×

The A.M. Trader with MarketGauge

1 × $31.00

The A.M. Trader with MarketGauge

1 × $31.00 -

×

Long-Term Memory in the Stock Market Prices (Article) with Andrew W.Lo

1 × $6.00

Long-Term Memory in the Stock Market Prices (Article) with Andrew W.Lo

1 × $6.00 -

×

Advanced Options Concepts - Probability, Greeks, Simulation

1 × $6.00

Advanced Options Concepts - Probability, Greeks, Simulation

1 × $6.00 -

×

Longlived Information & Intraday Pattern (Article) with Back and Andersen

1 × $6.00

Longlived Information & Intraday Pattern (Article) with Back and Andersen

1 × $6.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Astro Cycles with Larry Pesavento

1 × $6.00

Astro Cycles with Larry Pesavento

1 × $6.00 -

×

VIP - One on One Coursework with Talkin Options

1 × $15.00

VIP - One on One Coursework with Talkin Options

1 × $15.00 -

×

Market Controller Course with Controller FX

1 × $5.00

Market Controller Course with Controller FX

1 × $5.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Tracking & Kalman Filtering Made Easy with Eli Brookner

1 × $6.00

Tracking & Kalman Filtering Made Easy with Eli Brookner

1 × $6.00 -

×

The Index Trading Course Workbook: Step-by-Step Exercises and Tests to Help You Master The Index Trading Course with George Fontanills & Tom Gentile

1 × $6.00

The Index Trading Course Workbook: Step-by-Step Exercises and Tests to Help You Master The Index Trading Course with George Fontanills & Tom Gentile

1 × $6.00 -

×

We Fund Traders - The Whale Order

1 × $5.00

We Fund Traders - The Whale Order

1 × $5.00 -

×

Full Volume Forex Training Course with ThatFXTrader

1 × $5.00

Full Volume Forex Training Course with ThatFXTrader

1 × $5.00 -

×

Trading the Moves - Consistent Gains in All Markets with Ed Downs

1 × $6.00

Trading the Moves - Consistent Gains in All Markets with Ed Downs

1 × $6.00 -

×

Reality Based Trading with Matt Petrallia - Trading Equilibrium

1 × $17.00

Reality Based Trading with Matt Petrallia - Trading Equilibrium

1 × $17.00 -

×

Building Winning Trading Systems with Tradestation (with CD) - George Pruitt

1 × $6.00

Building Winning Trading Systems with Tradestation (with CD) - George Pruitt

1 × $6.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Market Structure Masterclass with Braveheart Trading

1 × $5.00

Market Structure Masterclass with Braveheart Trading

1 × $5.00 -

×

Trading the Post with Ron Friedman

1 × $5.00

Trading the Post with Ron Friedman

1 × $5.00 -

×

Launchpad Trading

1 × $23.00

Launchpad Trading

1 × $23.00 -

×

International Mergers & Acquisitions Activity Since 1990 with Greg Gregoriou & Luc Renneboog

1 × $6.00

International Mergers & Acquisitions Activity Since 1990 with Greg Gregoriou & Luc Renneboog

1 × $6.00 -

×

Daytraders Bulletin – Recurrent Structures for Profit with Charles Holt

1 × $6.00

Daytraders Bulletin – Recurrent Structures for Profit with Charles Holt

1 × $6.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Patterns of Speculation with Bertrand M.Roehner

1 × $6.00

Patterns of Speculation with Bertrand M.Roehner

1 × $6.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Trading Without Gambling with Marcel Link

1 × $6.00

Trading Without Gambling with Marcel Link

1 × $6.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

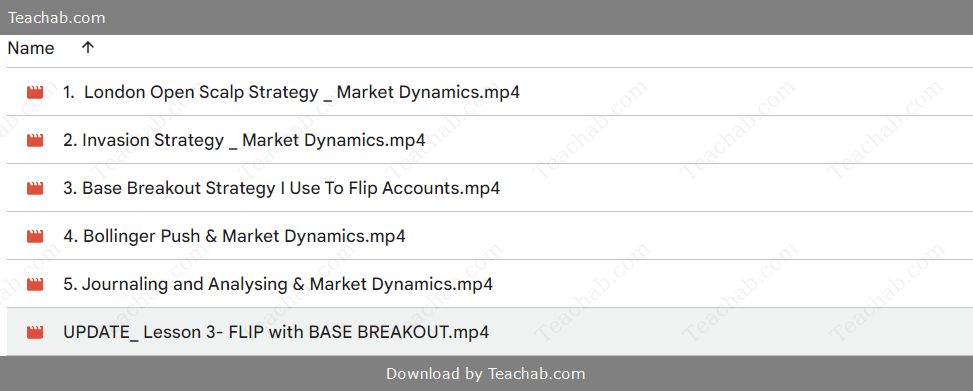

Advanced Mentorship Course on Market Dynamics (Flip accounts with ease)

$99.00 Original price was: $99.00.$6.00Current price is: $6.00.

File Size: 399 MB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

SKU: Ttz- 57199o26dyD

Category: Forex Trading

You may check content proof of “Advanced Mentorship Course on Market Dynamics (Flip accounts with ease)” below:

Advanced Mentorship on Market Dynamics – Flip Accounts

In the fast-paced world of trading, understanding market dynamics is key to consistent success. The Advanced Mentorship Course on Market Dynamics is designed for those who are serious about flipping accounts with ease. This course dives deep into the intricacies of the market, teaching strategies that can lead to exponential growth in trading accounts. Whether you’re a novice or a seasoned trader, this course offers insights that can transform your trading journey.

Why Market Dynamics Matter

Market dynamics refer to the forces that influence price movements in financial markets. Understanding these forces is crucial for making informed trading decisions. In this course, we delve into these dynamics, exploring how they can be leveraged to maximize trading profits.

The Basics of Market Dynamics

Before diving into advanced strategies, it’s essential to grasp the basics of market dynamics. These include supply and demand, market sentiment, and the impact of economic indicators. By understanding these core principles, traders can better predict market movements.

Supply and Demand

Supply and demand are the fundamental forces that drive price changes in any market. This section of the course explains how these forces interact and how traders can anticipate changes based on supply and demand analysis.

Market Sentiment

Market sentiment refers to the overall attitude of investors towards a particular security or market. This part of the course teaches how to gauge market sentiment and use it to your advantage.

Economic Indicators

Economic indicators such as GDP, unemployment rates, and inflation have a significant impact on market dynamics. The course covers how to interpret these indicators and incorporate them into your trading strategy.

Advanced Trading Strategies

Once the basics are covered, the course moves on to advanced strategies that can help traders flip accounts with ease. These strategies are designed to maximize returns while minimizing risks.

Momentum Trading

Momentum trading is a strategy that involves buying securities that are trending upward and selling those that are trending downward. This section of the course teaches how to identify momentum in the market and capitalize on it.

Identifying Momentum

Learn how to use technical indicators like moving averages and RSI to identify momentum in the market. Understanding these indicators is crucial for timing your trades effectively.

Executing Momentum Trades

Timing is everything in momentum trading. This part of the course explains how to enter and exit trades at the right time to maximize profits.

Scalping Techniques

Scalping is a trading strategy that involves making numerous trades throughout the day to capitalize on small price movements. This section covers the best scalping techniques for flipping accounts.

Setting Up for Scalping

Discover how to set up your trading platform for scalping, including the best tools and indicators to use. A proper setup is essential for success in scalping.

Managing Scalping Trades

Scalping requires quick decision-making and effective trade management. Learn the best practices for managing your trades and staying profitable.

Swing Trading

Swing trading is a strategy that involves holding positions for several days to capture short-term market moves. This strategy is ideal for those who want to balance trading with other commitments.

Choosing the Right Stocks for Swing Trading

Not all stocks are suitable for swing trading. This section teaches how to select the best stocks based on technical and fundamental analysis.

Timing Your Entries and Exits

Learn how to time your trades for maximum profit in swing trading. This part of the course covers the key indicators and signals to watch for.

Risk Management and Psychology

No trading strategy is complete without proper risk management and an understanding of trading psychology. This course emphasizes the importance of these aspects in ensuring long-term success.

Risk Management Techniques

Effective risk management is crucial for flipping accounts. This section covers various techniques, including position sizing, stop-loss orders, and risk-reward ratios.

Position Sizing

Learn how to determine the appropriate position size for each trade based on your risk tolerance and account size.

Using Stop-Loss Orders

Stop-loss orders are essential for protecting your capital. This part of the course teaches how to set and use stop-loss orders effectively.

Mastering Trading Psychology

Trading psychology can make or break a trader. This section covers the key psychological principles that every trader must master to succeed.

Controlling Emotions

Emotions like fear and greed can lead to poor trading decisions. Learn how to control your emotions and stick to your trading plan.

Developing Discipline

Discipline is the cornerstone of successful trading. This part of the course teaches how to develop and maintain discipline in your trading approach.

Case Studies and Real-World Examples

The course includes case studies and real-world examples that illustrate the concepts and strategies covered. These examples provide valuable insights into how market dynamics work in practice.

Case Study 1: Flipping a Small Account

In this case study, we analyze how a small trading account was flipped using the strategies taught in this course. Learn from the mistakes and successes of real traders.

Case Study 2: Overcoming Market Volatility

Market volatility can be challenging, but it also presents opportunities. This case study shows how traders can navigate volatile markets and come out ahead.

Conclusion

The Advanced Mentorship Course on Market Dynamics offers a comprehensive guide to mastering the market. By understanding the forces that drive market movements and applying advanced trading strategies, traders can flip accounts with ease. This course is not just about making quick profits; it’s about building a solid foundation for long-term success in trading.

Frequently Asked Questions:

- Business Model Innovation:

Embrace our legitimate business model! We organize group buys, allowing participants to share costs for popular courses, making them accessible to those with limited financial resources. Our approach ensures affordability and accessibility, despite author concerns. - The Legal Environment:

The legality of our activity is uncertain. While we lack specific permission from course authors, there’s a technicality: authors didn’t impose resale limits upon course purchase. This presents both an opportunity for us and a benefit for individuals seeking low-cost access. - Quality Control:

Unveiling the Truth

Quality is paramount. Purchasing courses directly from sales pages ensures consistency with traditionally obtained materials. However, we’re not official course providers and don’t offer premium services:

- No scheduled coaching calls or sessions with the author.

- No access to the author’s private Facebook group or web portal.

- No entry to the author’s private membership forum.

- Direct email support from the author or their team is unavailable. Operating independently, we aim to bridge the pricing gap without additional services provided by official channels. Your understanding of our unique approach is valued.

Be the first to review “Advanced Mentorship Course on Market Dynamics (Flip accounts with ease)” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Reviews

There are no reviews yet.