-

×

Build Your Own Trading System with John Hill

1 × $6.00

Build Your Own Trading System with John Hill

1 × $6.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Advanced Calculus with Applications in Statistics

1 × $6.00

Advanced Calculus with Applications in Statistics

1 × $6.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

PFAZoneSuite [Trading Indicator] 2017

1 × $109.00

PFAZoneSuite [Trading Indicator] 2017

1 × $109.00 -

×

Drewize Banks Course

1 × $5.00

Drewize Banks Course

1 × $5.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Surefire Trading Plans with Mark McRae

1 × $6.00

Surefire Trading Plans with Mark McRae

1 × $6.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

WickOrTreat Trading Course with WickOrTreat

1 × $6.00

WickOrTreat Trading Course with WickOrTreat

1 × $6.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

The Ultimate Forex Structure Course

1 × $31.00

The Ultimate Forex Structure Course

1 × $31.00 -

×

A Seminar On Ocean Theory Home Study Trading Course with Pat Raffalovich

1 × $6.00

A Seminar On Ocean Theory Home Study Trading Course with Pat Raffalovich

1 × $6.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

5-Step-Trading Stocks II - Avoid Common Trading Mistakes - Online Course (April 2014)

1 × $23.00

5-Step-Trading Stocks II - Avoid Common Trading Mistakes - Online Course (April 2014)

1 × $23.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Portfolio Optimization & Perfomance Analysis with Jean-Luc Prigent

1 × $6.00

Portfolio Optimization & Perfomance Analysis with Jean-Luc Prigent

1 × $6.00 -

×

DAY TRADING COURSE 2018

1 × $6.00

DAY TRADING COURSE 2018

1 × $6.00 -

×

Dan Dowd Trading

1 × $5.00

Dan Dowd Trading

1 × $5.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Our 3 Bread and Butter Trades In This Low IV Market Advanced Class with Day Trading Zones

1 × $39.00

Our 3 Bread and Butter Trades In This Low IV Market Advanced Class with Day Trading Zones

1 × $39.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Trade Setups And Strategies Program with The Daytrading Room

1 × $23.00

Trade Setups And Strategies Program with The Daytrading Room

1 × $23.00 -

×

Unreal Series - Forex Trading Master - Surreal Abilities with Talmadge Harper - Harper Healing

1 × $8.00

Unreal Series - Forex Trading Master - Surreal Abilities with Talmadge Harper - Harper Healing

1 × $8.00 -

×

Carolyn Boroden Package

1 × $15.00

Carolyn Boroden Package

1 × $15.00 -

×

ZipTraderU 2022 - Your Map To The Stock Market with ZipTrader

1 × $69.00

ZipTraderU 2022 - Your Map To The Stock Market with ZipTrader

1 × $69.00 -

×

Blank Check Trade

1 × $31.00

Blank Check Trade

1 × $31.00 -

×

Optionpit - Mastering Iron Condors and Butterflies

1 × $15.00

Optionpit - Mastering Iron Condors and Butterflies

1 × $15.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Building Your E-Mini Trading Strategy with Daniel Gramza

1 × $6.00

Building Your E-Mini Trading Strategy with Daniel Gramza

1 × $6.00 -

×

Using Robert’s Indicators with Rob Hoffman

1 × $6.00

Using Robert’s Indicators with Rob Hoffman

1 × $6.00 -

×

Volume Profile Formula with Aaron Korbs

1 × $5.00

Volume Profile Formula with Aaron Korbs

1 × $5.00 -

×

Zanzibar System for the EuroFx with Joe Ross

1 × $4.00

Zanzibar System for the EuroFx with Joe Ross

1 × $4.00 -

×

Yield Farming MasterClass Course (2022) with Boss Financial

1 × $5.00

Yield Farming MasterClass Course (2022) with Boss Financial

1 × $5.00 -

×

Advanced Breakthroughs in Day Trading DVD course with George Angell

1 × $6.00

Advanced Breakthroughs in Day Trading DVD course with George Angell

1 × $6.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Wyckoff Stock Market Institute

1 × $5.00

Wyckoff Stock Market Institute

1 × $5.00 -

×

The Golden Rule with Jim Gibbons

1 × $6.00

The Golden Rule with Jim Gibbons

1 × $6.00 -

×

Developing Profitable Systems from Discretionary to Mechanical with Fred Shutzman

1 × $6.00

Developing Profitable Systems from Discretionary to Mechanical with Fred Shutzman

1 × $6.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Day Trade Online (2nd Ed.) with Christopher Farrell

1 × $6.00

Day Trade Online (2nd Ed.) with Christopher Farrell

1 × $6.00 -

×

Thetimefactor - TRADING WITH PRICE

1 × $15.00

Thetimefactor - TRADING WITH PRICE

1 × $15.00 -

×

ZoneTrader Pro v2 (Sep 2013)

1 × $23.00

ZoneTrader Pro v2 (Sep 2013)

1 × $23.00 -

×

Master Trader with InvestingSimple

1 × $15.00

Master Trader with InvestingSimple

1 × $15.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

Commodity Futures Traders Club (CTCN) Issues 01 – 77

1 × $6.00

Commodity Futures Traders Club (CTCN) Issues 01 – 77

1 × $6.00 -

×

Traders Seminars – 7 CD

1 × $31.00

Traders Seminars – 7 CD

1 × $31.00 -

×

Crypto for Starters: All You Need to Know to Start Investing and Trading Cryptocurrency on Binance with Malcolm Yard

1 × $5.00

Crypto for Starters: All You Need to Know to Start Investing and Trading Cryptocurrency on Binance with Malcolm Yard

1 × $5.00 -

×

WYCKOFF TRADING COURSE (WTC) PART I – ANALYSIS (Spring 2023) - Roman Bogomazov & Alessio Rutigliano

1 × $209.00

WYCKOFF TRADING COURSE (WTC) PART I – ANALYSIS (Spring 2023) - Roman Bogomazov & Alessio Rutigliano

1 × $209.00 -

×

The First Time Investors Workbook with Joe Jonh Duran & Larry Chambers

1 × $6.00

The First Time Investors Workbook with Joe Jonh Duran & Larry Chambers

1 × $6.00 -

×

Weekly Diagonal Spreads for Consistent Income By Doc Severson

1 × $6.00

Weekly Diagonal Spreads for Consistent Income By Doc Severson

1 × $6.00 -

×

Physicists on Wall Street and Other Essays on Science and Society with Jeremy Bernstein

1 × $6.00

Physicists on Wall Street and Other Essays on Science and Society with Jeremy Bernstein

1 × $6.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

The Noise Trader Approach to Finance (Article) with Andrei Schleifer, Laurence H.Summers

1 × $6.00

The Noise Trader Approach to Finance (Article) with Andrei Schleifer, Laurence H.Summers

1 × $6.00 -

×

Beginner Forex Mastery Course with Harrison Uwah - MHU FX Academy

1 × $78.00

Beginner Forex Mastery Course with Harrison Uwah - MHU FX Academy

1 × $78.00 -

×

Three Tricks, Two Traps, One Truth Real Help for Traders and Investors with D.R.Barton

1 × $6.00

Three Tricks, Two Traps, One Truth Real Help for Traders and Investors with D.R.Barton

1 × $6.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

The Professional Risk Manager Handbook with Carol Alexander

1 × $6.00

The Professional Risk Manager Handbook with Carol Alexander

1 × $6.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

The Next Big Short Class (Risk Twist Spreads) Class with Don Kaufman

1 × $6.00

The Next Big Short Class (Risk Twist Spreads) Class with Don Kaufman

1 × $6.00 -

×

Learn how to trade Volatility 75 Index Technical Analysis with Patrick Muke

1 × $6.00

Learn how to trade Volatility 75 Index Technical Analysis with Patrick Muke

1 × $6.00 -

×

Volatility Trading with Euan Sinclair

1 × $6.00

Volatility Trading with Euan Sinclair

1 × $6.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

NJAT Trading Course with Not Just A Trade

1 × $6.00

NJAT Trading Course with Not Just A Trade

1 × $6.00 -

×

Amazing Day Trading Ninjatrader Indicator Perfect For Stocks, Futures And Forex

1 × $15.00

Amazing Day Trading Ninjatrader Indicator Perfect For Stocks, Futures And Forex

1 × $15.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Cash In On Chaos with Hans Hannula

1 × $6.00

Cash In On Chaos with Hans Hannula

1 × $6.00 -

×

BearProof Investing with Kenneth Little

1 × $6.00

BearProof Investing with Kenneth Little

1 × $6.00 -

×

The New Reality Of Wall Street with Donald Coxe

1 × $6.00

The New Reality Of Wall Street with Donald Coxe

1 × $6.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

War Room Psychology Package (Volume 1-4) with Pat Mitchell – Trick Trades

1 × $112.00

War Room Psychology Package (Volume 1-4) with Pat Mitchell – Trick Trades

1 × $112.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

What Ranks Schema Course with Clint Butler

1 × $23.00

What Ranks Schema Course with Clint Butler

1 × $23.00 -

×

Vertex Investing Course

1 × $6.00

Vertex Investing Course

1 × $6.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

The MMXM Traders Course - The MMXM Trader

1 × $5.00

The MMXM Traders Course - The MMXM Trader

1 × $5.00 -

×

Backtrade Marathon NEW with Real Life Trading

1 × $23.00

Backtrade Marathon NEW with Real Life Trading

1 × $23.00 -

×

FXS Analytics Training and Q&A Access with FXS Analytics

1 × $6.00

FXS Analytics Training and Q&A Access with FXS Analytics

1 × $6.00 -

×

War Room Psychology Vol.3 with Trick Trades

1 × $23.00

War Room Psychology Vol.3 with Trick Trades

1 × $23.00 -

×

Candlestick and Pivot Point Trading Triggers with John Person

1 × $6.00

Candlestick and Pivot Point Trading Triggers with John Person

1 × $6.00 -

×

Option, Futures and Other Derivates 9th Edition

1 × $6.00

Option, Futures and Other Derivates 9th Edition

1 × $6.00

Advanced Mentorship Course on Market Dynamics (Flip accounts with ease)

$99.00 Original price was: $99.00.$6.00Current price is: $6.00.

File Size: 399 MB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

SKU: Ttz- 57199o26dyD

Category: Forex Trading

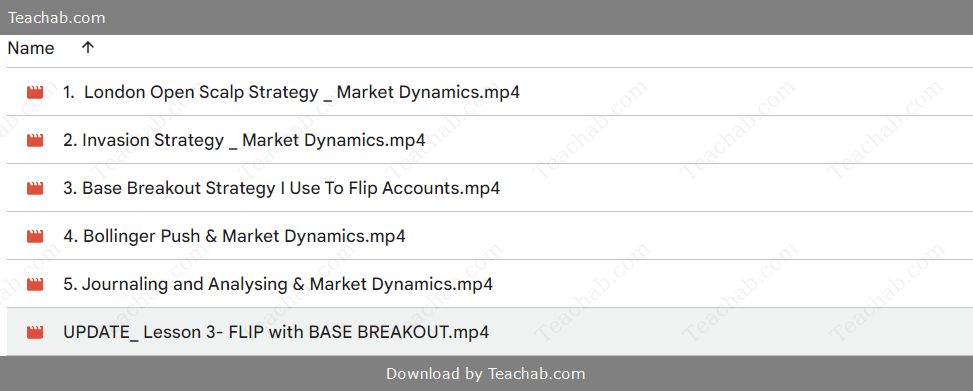

You may check content proof of “Advanced Mentorship Course on Market Dynamics (Flip accounts with ease)” below:

Advanced Mentorship on Market Dynamics – Flip Accounts

In the fast-paced world of trading, understanding market dynamics is key to consistent success. The Advanced Mentorship Course on Market Dynamics is designed for those who are serious about flipping accounts with ease. This course dives deep into the intricacies of the market, teaching strategies that can lead to exponential growth in trading accounts. Whether you’re a novice or a seasoned trader, this course offers insights that can transform your trading journey.

Why Market Dynamics Matter

Market dynamics refer to the forces that influence price movements in financial markets. Understanding these forces is crucial for making informed trading decisions. In this course, we delve into these dynamics, exploring how they can be leveraged to maximize trading profits.

The Basics of Market Dynamics

Before diving into advanced strategies, it’s essential to grasp the basics of market dynamics. These include supply and demand, market sentiment, and the impact of economic indicators. By understanding these core principles, traders can better predict market movements.

Supply and Demand

Supply and demand are the fundamental forces that drive price changes in any market. This section of the course explains how these forces interact and how traders can anticipate changes based on supply and demand analysis.

Market Sentiment

Market sentiment refers to the overall attitude of investors towards a particular security or market. This part of the course teaches how to gauge market sentiment and use it to your advantage.

Economic Indicators

Economic indicators such as GDP, unemployment rates, and inflation have a significant impact on market dynamics. The course covers how to interpret these indicators and incorporate them into your trading strategy.

Advanced Trading Strategies

Once the basics are covered, the course moves on to advanced strategies that can help traders flip accounts with ease. These strategies are designed to maximize returns while minimizing risks.

Momentum Trading

Momentum trading is a strategy that involves buying securities that are trending upward and selling those that are trending downward. This section of the course teaches how to identify momentum in the market and capitalize on it.

Identifying Momentum

Learn how to use technical indicators like moving averages and RSI to identify momentum in the market. Understanding these indicators is crucial for timing your trades effectively.

Executing Momentum Trades

Timing is everything in momentum trading. This part of the course explains how to enter and exit trades at the right time to maximize profits.

Scalping Techniques

Scalping is a trading strategy that involves making numerous trades throughout the day to capitalize on small price movements. This section covers the best scalping techniques for flipping accounts.

Setting Up for Scalping

Discover how to set up your trading platform for scalping, including the best tools and indicators to use. A proper setup is essential for success in scalping.

Managing Scalping Trades

Scalping requires quick decision-making and effective trade management. Learn the best practices for managing your trades and staying profitable.

Swing Trading

Swing trading is a strategy that involves holding positions for several days to capture short-term market moves. This strategy is ideal for those who want to balance trading with other commitments.

Choosing the Right Stocks for Swing Trading

Not all stocks are suitable for swing trading. This section teaches how to select the best stocks based on technical and fundamental analysis.

Timing Your Entries and Exits

Learn how to time your trades for maximum profit in swing trading. This part of the course covers the key indicators and signals to watch for.

Risk Management and Psychology

No trading strategy is complete without proper risk management and an understanding of trading psychology. This course emphasizes the importance of these aspects in ensuring long-term success.

Risk Management Techniques

Effective risk management is crucial for flipping accounts. This section covers various techniques, including position sizing, stop-loss orders, and risk-reward ratios.

Position Sizing

Learn how to determine the appropriate position size for each trade based on your risk tolerance and account size.

Using Stop-Loss Orders

Stop-loss orders are essential for protecting your capital. This part of the course teaches how to set and use stop-loss orders effectively.

Mastering Trading Psychology

Trading psychology can make or break a trader. This section covers the key psychological principles that every trader must master to succeed.

Controlling Emotions

Emotions like fear and greed can lead to poor trading decisions. Learn how to control your emotions and stick to your trading plan.

Developing Discipline

Discipline is the cornerstone of successful trading. This part of the course teaches how to develop and maintain discipline in your trading approach.

Case Studies and Real-World Examples

The course includes case studies and real-world examples that illustrate the concepts and strategies covered. These examples provide valuable insights into how market dynamics work in practice.

Case Study 1: Flipping a Small Account

In this case study, we analyze how a small trading account was flipped using the strategies taught in this course. Learn from the mistakes and successes of real traders.

Case Study 2: Overcoming Market Volatility

Market volatility can be challenging, but it also presents opportunities. This case study shows how traders can navigate volatile markets and come out ahead.

Conclusion

The Advanced Mentorship Course on Market Dynamics offers a comprehensive guide to mastering the market. By understanding the forces that drive market movements and applying advanced trading strategies, traders can flip accounts with ease. This course is not just about making quick profits; it’s about building a solid foundation for long-term success in trading.

Frequently Asked Questions:

- Business Model Innovation:

Embrace our legitimate business model! We organize group buys, allowing participants to share costs for popular courses, making them accessible to those with limited financial resources. Our approach ensures affordability and accessibility, despite author concerns. - The Legal Environment:

The legality of our activity is uncertain. While we lack specific permission from course authors, there’s a technicality: authors didn’t impose resale limits upon course purchase. This presents both an opportunity for us and a benefit for individuals seeking low-cost access. - Quality Control:

Unveiling the Truth

Quality is paramount. Purchasing courses directly from sales pages ensures consistency with traditionally obtained materials. However, we’re not official course providers and don’t offer premium services:

- No scheduled coaching calls or sessions with the author.

- No access to the author’s private Facebook group or web portal.

- No entry to the author’s private membership forum.

- Direct email support from the author or their team is unavailable. Operating independently, we aim to bridge the pricing gap without additional services provided by official channels. Your understanding of our unique approach is valued.

Be the first to review “Advanced Mentorship Course on Market Dynamics (Flip accounts with ease)” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.