-

×

CM Pivot Power Trade Method with Austin Passamonte

1 × $6.00

CM Pivot Power Trade Method with Austin Passamonte

1 × $6.00 -

×

ITPM Professional Trading Masterclass (PTM) V2.0 with Anton Kreil

1 × $6.00

ITPM Professional Trading Masterclass (PTM) V2.0 with Anton Kreil

1 × $6.00 -

×

Bootcamp and eBook with Jjwurldin

1 × $24.00

Bootcamp and eBook with Jjwurldin

1 × $24.00 -

×

Active Trader Program (Smarter Starter Pack + the Number One Trading Plan)

1 × $15.00

Active Trader Program (Smarter Starter Pack + the Number One Trading Plan)

1 × $15.00 -

×

Quarterly Theory with Trader Daye

1 × $20.00

Quarterly Theory with Trader Daye

1 × $20.00 -

×

London Super Conference 2018

1 × $54.00

London Super Conference 2018

1 × $54.00 -

×

The Handbook of Equity Style Management (3rd Ed) with Daniel Coggin & Frank Fabozzi

1 × $6.00

The Handbook of Equity Style Management (3rd Ed) with Daniel Coggin & Frank Fabozzi

1 × $6.00 -

×

Does a Holy Grail Really Exist with John Hayden

1 × $6.00

Does a Holy Grail Really Exist with John Hayden

1 × $6.00 -

×

Building High-Performance Trading Systems. What Works & What Doesn’t with Nelson Freeburg

1 × $6.00

Building High-Performance Trading Systems. What Works & What Doesn’t with Nelson Freeburg

1 × $6.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

Simple Cyclical Analysis with Stan Erlich

1 × $6.00

Simple Cyclical Analysis with Stan Erlich

1 × $6.00 -

×

Measuring & Controlling Interest Rate & Credit Risk (2nd Ed.) with Frank Fabozzi, Steven Mann & Moorad Choudhry

1 × $6.00

Measuring & Controlling Interest Rate & Credit Risk (2nd Ed.) with Frank Fabozzi, Steven Mann & Moorad Choudhry

1 × $6.00 -

×

How to Invest in ETFs By The Investors Podcast

1 × $6.00

How to Invest in ETFs By The Investors Podcast

1 × $6.00 -

×

Mastering the Geometry of Market Energy with Charles Drummond

1 × $6.00

Mastering the Geometry of Market Energy with Charles Drummond

1 × $6.00 -

×

No Bull Investing with Jack Bernstein

1 × $6.00

No Bull Investing with Jack Bernstein

1 × $6.00 -

×

All About Market Timing with Leslie N.Masonson

1 × $6.00

All About Market Timing with Leslie N.Masonson

1 × $6.00 -

×

Fundamentals of Futures & Options Markets (4th Ed.)

1 × $6.00

Fundamentals of Futures & Options Markets (4th Ed.)

1 × $6.00 -

×

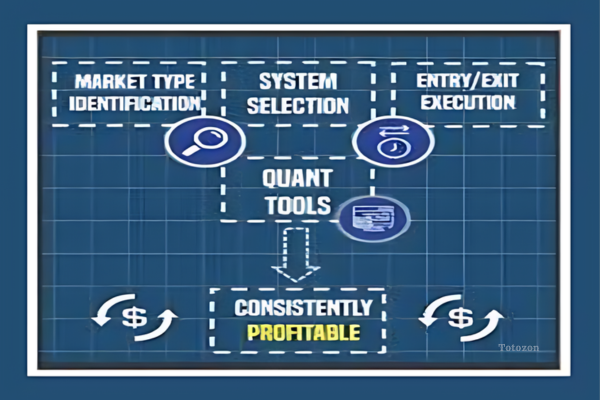

The Profitable Trading System Blueprint with Macro Ops

1 × $6.00

The Profitable Trading System Blueprint with Macro Ops

1 × $6.00 -

×

Astrology & Stock Market Forecasting with Louise McWhirter

1 × $4.00

Astrology & Stock Market Forecasting with Louise McWhirter

1 × $4.00 -

×

How To Flip All Those “Hard To Flip” Deals

1 × $6.00

How To Flip All Those “Hard To Flip” Deals

1 × $6.00 -

×

Commodities for Dummies with Amine Bouchentouf

1 × $6.00

Commodities for Dummies with Amine Bouchentouf

1 × $6.00 -

×

AmiBroker Ultimate Pack Pro v6.20.1 x64 (Feb 2017)

1 × $6.00

AmiBroker Ultimate Pack Pro v6.20.1 x64 (Feb 2017)

1 × $6.00 -

×

Be Smart, Act Fast, Get Rich with Charles Payne

1 × $6.00

Be Smart, Act Fast, Get Rich with Charles Payne

1 × $6.00 -

×

Lessons 1-30 & Tradestation Code with Charles Drummond

1 × $6.00

Lessons 1-30 & Tradestation Code with Charles Drummond

1 × $6.00 -

×

Lee Gettess’s Package

1 × $6.00

Lee Gettess’s Package

1 × $6.00 -

×

George Lindays. 3 Peaks and the Domed House Revised with Barclay T.Leib

1 × $6.00

George Lindays. 3 Peaks and the Domed House Revised with Barclay T.Leib

1 × $6.00 -

×

Reminiscences of a Stock Operator (75th Aniversary Ed.) with Edwin Lefevre

1 × $6.00

Reminiscences of a Stock Operator (75th Aniversary Ed.) with Edwin Lefevre

1 × $6.00 -

×

Market Timing & Technical Analysis with Alan Shaw

1 × $6.00

Market Timing & Technical Analysis with Alan Shaw

1 × $6.00 -

×

Fixed-Income Securities: Valuation, Risk Management and Portfolio Strategies - Lionel Martellini, Philippe Priaulet & Stéphane Priaulet

1 × $6.00

Fixed-Income Securities: Valuation, Risk Management and Portfolio Strategies - Lionel Martellini, Philippe Priaulet & Stéphane Priaulet

1 × $6.00 -

×

Trading For Busy People with Josias Kere

1 × $6.00

Trading For Busy People with Josias Kere

1 × $6.00 -

×

Market Science Volumes I & II Square of Twelve & Market Dynamics with Bradley Cowan

1 × $4.00

Market Science Volumes I & II Square of Twelve & Market Dynamics with Bradley Cowan

1 × $4.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

TRAING IRON CONDORS IN ANY ENVIRONMENT with Sheridan Options Mentoring

1 × $15.00

TRAING IRON CONDORS IN ANY ENVIRONMENT with Sheridan Options Mentoring

1 × $15.00 -

×

Trading Weekly Options for Income in 2016 with Dan Sheridan

1 × $23.00

Trading Weekly Options for Income in 2016 with Dan Sheridan

1 × $23.00 -

×

Quantitative Business Valuation with Jay Abrams

1 × $6.00

Quantitative Business Valuation with Jay Abrams

1 × $6.00 -

×

Volatility Position Risk Management with Cynthia Kase

1 × $6.00

Volatility Position Risk Management with Cynthia Kase

1 × $6.00 -

×

TraderSumo Academy Course

1 × $13.00

TraderSumo Academy Course

1 × $13.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Area 61 with BCFX

1 × $6.00

Area 61 with BCFX

1 × $6.00 -

×

The Market Geometry Basic Seminar DVD with Market Geometry

1 × $31.00

The Market Geometry Basic Seminar DVD with Market Geometry

1 × $31.00 -

×

Timing the Market with Unique Indicators with Sherman McCellan

1 × $6.00

Timing the Market with Unique Indicators with Sherman McCellan

1 × $6.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Trade Setups And Strategies Program with The Daytrading Room

1 × $23.00

Trade Setups And Strategies Program with The Daytrading Room

1 × $23.00 -

×

Secrets of the Darvas Trading System

1 × $6.00

Secrets of the Darvas Trading System

1 × $6.00 -

×

Day Trade Futures Online with Larry Williams

1 × $6.00

Day Trade Futures Online with Larry Williams

1 × $6.00 -

×

NXT Level FX with Investors Domain

1 × $5.00

NXT Level FX with Investors Domain

1 × $5.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Elite Keys to Trading Success Class

1 × $23.00

Elite Keys to Trading Success Class

1 × $23.00 -

×

Finding Astrocycles with an Ephemeris - Hans Hannula

1 × $6.00

Finding Astrocycles with an Ephemeris - Hans Hannula

1 × $6.00 -

×

Sixpart Study Guide to Market Profile

1 × $6.00

Sixpart Study Guide to Market Profile

1 × $6.00 -

×

Sun Tzu and the Art of War for Traders with Dean Lundell

1 × $6.00

Sun Tzu and the Art of War for Traders with Dean Lundell

1 × $6.00 -

×

Fundamentals of the Securities Industry with William A.Rini

1 × $6.00

Fundamentals of the Securities Industry with William A.Rini

1 × $6.00 -

×

TradeSafe Mechanical Trading System, Course, and Coaching

1 × $85.00

TradeSafe Mechanical Trading System, Course, and Coaching

1 × $85.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Stock Market Rules (3rd Ed.) with Michael Sheimo

1 × $6.00

Stock Market Rules (3rd Ed.) with Michael Sheimo

1 × $6.00 -

×

Cracking The Forex Code with Kevin Adams

1 × $6.00

Cracking The Forex Code with Kevin Adams

1 × $6.00 -

×

Art & Science of Trend Trading Class with Jeff Bierman

1 × $6.00

Art & Science of Trend Trading Class with Jeff Bierman

1 × $6.00 -

×

Alexander Elder Full Courses Package

1 × $6.00

Alexander Elder Full Courses Package

1 × $6.00 -

×

The Dark Side Of Valuation with Aswath Damodaran

1 × $6.00

The Dark Side Of Valuation with Aswath Damodaran

1 × $6.00 -

×

Road to consistent profits (Dec 2022) with Jarrod Goodwin - Trading Halls of Knowledge

1 × $31.00

Road to consistent profits (Dec 2022) with Jarrod Goodwin - Trading Halls of Knowledge

1 × $31.00 -

×

Discounted Cash Flow Valuation: Spot Undervalued Stocks Fast with Jari Roomer

1 × $6.00

Discounted Cash Flow Valuation: Spot Undervalued Stocks Fast with Jari Roomer

1 × $6.00 -

×

Developing a Forex Trading Plan Webinar

1 × $6.00

Developing a Forex Trading Plan Webinar

1 × $6.00 -

×

DApp Mastermind (Crypto DApps) – Passive Income with DApps and SMART Contracts with Jason BTO

1 × $6.00

DApp Mastermind (Crypto DApps) – Passive Income with DApps and SMART Contracts with Jason BTO

1 × $6.00 -

×

The 80% Solution S&P Systems with Bruce Babcock

1 × $6.00

The 80% Solution S&P Systems with Bruce Babcock

1 × $6.00 -

×

Fractal Energy Trading with Doc Severson

1 × $6.00

Fractal Energy Trading with Doc Severson

1 × $6.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Set and Forget with Alex Gonzalez - Swing Trading Lab

1 × $5.00

Set and Forget with Alex Gonzalez - Swing Trading Lab

1 × $5.00 -

×

A Complete Guide to Technical Trading Tactics with John Person

1 × $6.00

A Complete Guide to Technical Trading Tactics with John Person

1 × $6.00 -

×

ABC Waves TOS Indicator & Live Class with Simpler Options

1 × $6.00

ABC Waves TOS Indicator & Live Class with Simpler Options

1 × $6.00 -

×

Trading with Price Ladder and Order Flow Strategies with Alex Haywood - Axia Futures

1 × $6.00

Trading with Price Ladder and Order Flow Strategies with Alex Haywood - Axia Futures

1 × $6.00 -

×

WD Gann’s Master Time Factor DVD With Miles Wilson Walker

1 × $6.00

WD Gann’s Master Time Factor DVD With Miles Wilson Walker

1 × $6.00 -

×

Super Conference 2020 - Premier Coaching Package with Vince Vora

1 × $109.00

Super Conference 2020 - Premier Coaching Package with Vince Vora

1 × $109.00 -

×

Fish Forex Robot 4G

1 × $6.00

Fish Forex Robot 4G

1 × $6.00 -

×

The Precision Profit Float Indicator (TS Code & Setups) with Steve Woods

1 × $6.00

The Precision Profit Float Indicator (TS Code & Setups) with Steve Woods

1 × $6.00 -

×

Advanced Bond Trading Course

1 × $62.00

Advanced Bond Trading Course

1 × $62.00 -

×

Intra-day Solar Trader with George Harrison

1 × $17.00

Intra-day Solar Trader with George Harrison

1 × $17.00 -

×

Investment Philosophies

1 × $6.00

Investment Philosophies

1 × $6.00 -

×

Cash In On Chaos with Hans Hannula

1 × $6.00

Cash In On Chaos with Hans Hannula

1 × $6.00 -

×

Scalping is Fun Course with Peter Devaere

1 × $109.00

Scalping is Fun Course with Peter Devaere

1 × $109.00 -

×

DAY TRADE (LONG & SHORT) STRATEGIES PACKAGE - The Chartist

1 × $272.00

DAY TRADE (LONG & SHORT) STRATEGIES PACKAGE - The Chartist

1 × $272.00 -

×

Create Your Trade Plan with Yuri Shramenko

1 × $6.00

Create Your Trade Plan with Yuri Shramenko

1 × $6.00 -

×

TECHNICAL ANALYSIS MODULE

1 × $6.00

TECHNICAL ANALYSIS MODULE

1 × $6.00 -

×

Investing in stocks: Avoid stock market loss

1 × $15.00

Investing in stocks: Avoid stock market loss

1 × $15.00 -

×

The Tyler Method For Successful Triangle Trading with Chris Tyler

1 × $6.00

The Tyler Method For Successful Triangle Trading with Chris Tyler

1 × $6.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00

ProfileTraders – Advanced Market Profile (May 2014)

$6.00

File Size: Cooming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

SKU: Ttz-31260M7OP2f8E

Category: Forex Trading

You may check content proof of “ProfileTraders – Advanced Market Profile (May 2014)” below:

ProfileTraders – Advanced Market Profile (May 2014)

Introduction to Advanced Market Profile

In May 2014, ProfileTraders introduced an advanced course on market profile techniques that promised to revolutionize the way traders analyze markets. This in-depth guide explores the key concepts and strategies from that pivotal course, highlighting how they can be applied to today’s trading environment.

What is Market Profile?

Market profile is a statistical analysis tool that traders use to understand the dynamics of market prices in a specified timeframe. It provides a graphical representation of price and time information, which helps traders identify trading opportunities based on market value development.

The Origin of Market Profile

Developed in the early 1980s by Peter Steidlmayer, a trader at the Chicago Board of Trade (CBOT), market profile has become a fundamental tool in the trading strategies of many successful traders.

Understanding Market Profile

The core of market profile lies in its ability to display price movements in a way that highlights areas of significant trading activity.

The Price and Volume Distribution

Market profile charts display price on the vertical axis and time on the horizontal axis, forming what are known as “Time Price Opportunities” or TPOs.

Significance of TPOs

TPOs indicate where the market has spent a significant amount of time, suggesting areas of strong support or resistance.

Utilizing Market Profile in Trading

Strategy 1: Identifying Value Areas

Value areas are where 70% of the day’s trading took place, reflecting high levels of market acceptance.

How to Trade Value Areas

- Entering Trades: Look for entry points near the edges of the value area.

- Exiting Trades: Consider taking profits near the opposite edge or beyond, if the market shows signs of breaking out.

Strategy 2: Understanding Market Development

Market profile can help predict future price movements by analyzing the shape and structure of the profile.

Types of Market Profiles

- Balanced Profiles: Symmetrical shapes that suggest a market in equilibrium.

- Imbalanced Profiles: Asymmetrical shapes indicating potential market shifts.

Advanced Techniques in Market Profile

Leveraging advanced market profile techniques can provide deeper insights into market behavior and trader psychology.

The Point of Control (POC)

The POC is the price level with the most trading activity, representing the fairest price to both buyers and sellers during a specific timeframe.

Importance of POC

Understanding the POC can help traders determine the strength or weakness of a market move.

Using Volume at Price (VAP)

Volume at Price shows the amount of trading activity at each price level, adding depth to the market profile analysis.

Benefits of VAP

- Market Sentiment: Indicates bullish or bearish tendencies.

- Decision Making: Aids in making more informed trading decisions.

Case Study: May 2014 Market Analysis

A detailed case study from May 2014 demonstrates the practical application of these advanced market profile techniques.

Key Findings

- Market Trends: Identification of critical turning points and trend continuations.

- Trader Behavior: Insights into trader decisions during significant market events.

Conclusion

The advanced market profile course offered by ProfileTraders in May 2014 remains a vital resource for traders aiming to enhance their analytical skills. By integrating these methodologies, traders can gain a nuanced understanding of market dynamics and improve their strategic decision-making.

Frequently Asked Questions

- What is a market profile? Market profile is a statistical tool that represents the price and volume of a stock over a specified period, helping traders identify dominant market areas.

- How can market profile improve trading strategies? By revealing the distribution of price movements and trading volume, market profile helps traders pinpoint value areas and potential price directions.

- What is the Point of Control in market profile? The Point of Control is the price level at which the most trading activity occurred, considered the most accepted market price.

- How does Volume at Price aid in market analysis? Volume at Price provides insights into the volume traded at different price levels, offering clues about market sentiment and potential price moves.

- Can the techniques from 2014 still be applied today? Absolutely, the fundamental principles of market profile are timeless and continue to be relevant in today’s trading environment.

Be the first to review “ProfileTraders – Advanced Market Profile (May 2014)” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.