-

×

The Stock Market Mastery Program with Ryan Hildreth

1 × $12.00

The Stock Market Mastery Program with Ryan Hildreth

1 × $12.00 -

×

The MMXM Trader’s 2nd Course: My Personal Approach

1 × $17.00

The MMXM Trader’s 2nd Course: My Personal Approach

1 × $17.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Advanced Course

1 × $39.00

Advanced Course

1 × $39.00 -

×

Unlocking the Mysteries of Trend Analysis - Rick Bensignor

1 × $6.00

Unlocking the Mysteries of Trend Analysis - Rick Bensignor

1 × $6.00 -

×

Complete Book Set

1 × $8.00

Complete Book Set

1 × $8.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

The Big 3 Squeeze Indicator TOS 2024 with Taylor Horton

1 × $69.00

The Big 3 Squeeze Indicator TOS 2024 with Taylor Horton

1 × $69.00 -

×

The Wolf of Investing: My Insider's Playbook for Making a Fortune on Wall Street with Jordan Belfort

1 × $6.00

The Wolf of Investing: My Insider's Playbook for Making a Fortune on Wall Street with Jordan Belfort

1 × $6.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

Graphs, Application to Speculation with George Cole

1 × $6.00

Graphs, Application to Speculation with George Cole

1 × $6.00 -

×

Candlestick - Training Videos (Videos 1.2 GB)

1 × $15.00

Candlestick - Training Videos (Videos 1.2 GB)

1 × $15.00 -

×

Interpreting Money Stream with Peter Worden

1 × $6.00

Interpreting Money Stream with Peter Worden

1 × $6.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Claytrader - Risk vs Reward Trading

1 × $23.00

Claytrader - Risk vs Reward Trading

1 × $23.00 -

×

The Bulls Eye System – Ready Aim Fire

1 × $31.00

The Bulls Eye System – Ready Aim Fire

1 × $31.00 -

×

Basic Astrotech

1 × $6.00

Basic Astrotech

1 × $6.00 -

×

GTA Professional Course with Gova Trading Academy

1 × $5.00

GTA Professional Course with Gova Trading Academy

1 × $5.00 -

×

The Oxford Handbook of Political Theory with John Dryzek, Bonnie Honig & Anne Phillips

1 × $6.00

The Oxford Handbook of Political Theory with John Dryzek, Bonnie Honig & Anne Phillips

1 × $6.00 -

×

Markets 101 Complete Course with Joseph Wang - Central Banking 101

1 × $13.00

Markets 101 Complete Course with Joseph Wang - Central Banking 101

1 × $13.00 -

×

Kash-FX Elite Course

1 × $10.00

Kash-FX Elite Course

1 × $10.00 -

×

Wealthpress Jump Trade Package (Course Only, None-elert)

1 × $85.00

Wealthpress Jump Trade Package (Course Only, None-elert)

1 × $85.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

Ultra Blue Forex 2024 with Russ Horn

1 × $17.00

Ultra Blue Forex 2024 with Russ Horn

1 × $17.00 -

×

OneUmbrellaFX

1 × $5.00

OneUmbrellaFX

1 × $5.00 -

×

Complete Day Trading : Stock Trading With Technical Analysis

1 × $15.00

Complete Day Trading : Stock Trading With Technical Analysis

1 × $15.00 -

×

London Super Conference 2019

1 × $62.00

London Super Conference 2019

1 × $62.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Lit Trading Course

1 × $15.00

Lit Trading Course

1 × $15.00 -

×

Blending Quantitative & Traditional Equity Analysis with CFA Institute

1 × $6.00

Blending Quantitative & Traditional Equity Analysis with CFA Institute

1 × $6.00 -

×

B The Trader Trading Course

1 × $15.00

B The Trader Trading Course

1 × $15.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Successful Algorithmic Trading with Mike Halls-Moore

1 × $8.00

Successful Algorithmic Trading with Mike Halls-Moore

1 × $8.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Options on Futures Trading Course

1 × $15.00

Options on Futures Trading Course

1 × $15.00 -

×

ZoneTrader Pro v2 (Sep 2013)

1 × $23.00

ZoneTrader Pro v2 (Sep 2013)

1 × $23.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

FX GOAT FOREX TRADING ACADEMY

1 × $8.00

FX GOAT FOREX TRADING ACADEMY

1 × $8.00 -

×

TheoTrade

1 × $31.00

TheoTrade

1 × $31.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

FXCharger

1 × $23.00

FXCharger

1 × $23.00 -

×

Portfolio Management-Earn 12 Hours CE Credits

1 × $85.00

Portfolio Management-Earn 12 Hours CE Credits

1 × $85.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Four Steps to Trading Economic Indicators

1 × $6.00

Four Steps to Trading Economic Indicators

1 × $6.00 -

×

Trading the Fast Moves for Maximum Profit with William McLaren

1 × $4.00

Trading the Fast Moves for Maximum Profit with William McLaren

1 × $4.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

www Trading System Ezine with Alex Krzhechevsky

1 × $6.00

www Trading System Ezine with Alex Krzhechevsky

1 × $6.00 -

×

Trading the Eclipses

1 × $6.00

Trading the Eclipses

1 × $6.00 -

×

Trading Plan with Andrew Baxter

1 × $6.00

Trading Plan with Andrew Baxter

1 × $6.00 -

×

Bank Financial Model with Cash Flow Investing Pro

1 × $15.00

Bank Financial Model with Cash Flow Investing Pro

1 × $15.00 -

×

XLT– Option Trading Course

1 × $6.00

XLT– Option Trading Course

1 × $6.00 -

×

Instant Forex Profits Home Study Course

1 × $23.00

Instant Forex Profits Home Study Course

1 × $23.00 -

×

Triple Play Trading Ideas & Mentoring with MarketGauge

1 × $54.00

Triple Play Trading Ideas & Mentoring with MarketGauge

1 × $54.00 -

×

Ultimate Gann Course Coaching Safety in The Market COMPLETE 12 Modules with Aaron Lynch

1 × $6.00

Ultimate Gann Course Coaching Safety in The Market COMPLETE 12 Modules with Aaron Lynch

1 × $6.00 -

×

We Trade Waves

1 × $5.00

We Trade Waves

1 × $5.00 -

×

Trading the Pristine Method 2008 (Videos & Workbooks) with Pristine

1 × $4.00

Trading the Pristine Method 2008 (Videos & Workbooks) with Pristine

1 × $4.00 -

×

Trend Following Stocks - Complete Breakout System with Joe Marwood

1 × $6.00

Trend Following Stocks - Complete Breakout System with Joe Marwood

1 × $6.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

Trading With Market Timing and Intelligence with John Crain

1 × $23.00

Trading With Market Timing and Intelligence with John Crain

1 × $23.00 -

×

Trading Psychology, Day-trading & Swing Trading with Alexander Elder

1 × $31.00

Trading Psychology, Day-trading & Swing Trading with Alexander Elder

1 × $31.00 -

×

Building Wealth In Stock Market with David Novac

1 × $6.00

Building Wealth In Stock Market with David Novac

1 × $6.00 -

×

How To Design, Test, Evaluate and Implement Profitable Trading Systems(Manual Only)

1 × $4.00

How To Design, Test, Evaluate and Implement Profitable Trading Systems(Manual Only)

1 × $4.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Trading Indicators NT7

1 × $85.00

Trading Indicators NT7

1 × $85.00 -

×

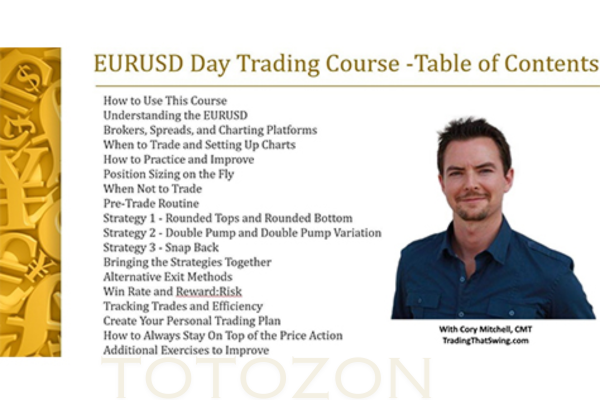

The EURUSD Day Trading Course with Cory Mitchell - Trade That Swing

1 × $15.00

The EURUSD Day Trading Course with Cory Mitchell - Trade That Swing

1 × $15.00 -

×

Point and Figure Mentorship Course

1 × $54.00

Point and Figure Mentorship Course

1 × $54.00 -

×

The Stock Index Futures Market with B.Thomas Byme Jr.

1 × $6.00

The Stock Index Futures Market with B.Thomas Byme Jr.

1 × $6.00 -

×

Price Ladder Training

1 × $15.00

Price Ladder Training

1 × $15.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

The Expected Return Calculator

1 × $23.00

The Expected Return Calculator

1 × $23.00 -

×

Sports Trading Journey with Jack Birkhead

1 × $23.00

Sports Trading Journey with Jack Birkhead

1 × $23.00 -

×

Order Flow Mastery (New 2024) with The Volume Traders

1 × $24.00

Order Flow Mastery (New 2024) with The Volume Traders

1 × $24.00 -

×

Private Seminars

1 × $23.00

Private Seminars

1 × $23.00 -

×

Beat The Market Maker

1 × $62.00

Beat The Market Maker

1 × $62.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Forex Never Lose Trade & Forex Unknown Secret with Karl Dittmann

1 × $6.00

Forex Never Lose Trade & Forex Unknown Secret with Karl Dittmann

1 × $6.00 -

×

The Winning Secret

1 × $23.00

The Winning Secret

1 × $23.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Volume Analysis – Smart Money

1 × $6.00

Volume Analysis – Smart Money

1 × $6.00 -

×

Big Morning Profits with Base Camp Trading

1 × $4.00

Big Morning Profits with Base Camp Trading

1 × $4.00 -

×

Vertex Investing Course (2023)

1 × $8.00

Vertex Investing Course (2023)

1 × $8.00 -

×

Complete 32+ Hour Video Training Course 2008

1 × $23.00

Complete 32+ Hour Video Training Course 2008

1 × $23.00 -

×

Learn to Trade Forex and Stocks – From Beginner to Advanced

1 × $6.00

Learn to Trade Forex and Stocks – From Beginner to Advanced

1 × $6.00 -

×

TradingWithBilz Course

1 × $10.00

TradingWithBilz Course

1 × $10.00 -

×

Uncertainty & Expectation Strategies for the Trading of Risk with Gerald Ashley

1 × $6.00

Uncertainty & Expectation Strategies for the Trading of Risk with Gerald Ashley

1 × $6.00 -

×

Market Geometry Mentoring Sessions with Timothy Morge

1 × $69.00

Market Geometry Mentoring Sessions with Timothy Morge

1 × $69.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

The Email Academy

1 × $31.00

The Email Academy

1 × $31.00 -

×

Course (Video, PDF, MT4 Indicators)

1 × $6.00

Course (Video, PDF, MT4 Indicators)

1 × $6.00 -

×

Elder-disk 1.01 for NinjaTrader7

1 × $6.00

Elder-disk 1.01 for NinjaTrader7

1 × $6.00 -

×

OptioPit Course 2013 (Gold & Silver Course)

1 × $23.00

OptioPit Course 2013 (Gold & Silver Course)

1 × $23.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

9-Pack of TOS Indicators

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

You may check content proof of “9-Pack of TOS Indicators” below:

Introduction

For traders using the ThinkOrSwim (TOS) platform, having the right set of indicators can make a significant difference in their trading success. The 9-Pack of TOS Indicators is a comprehensive collection designed to enhance your trading strategy by providing valuable insights into market conditions. This article will delve into each indicator, its benefits, and how to effectively use them in your trading.

Understanding the 9-Pack of TOS Indicators

What is the 9-Pack of TOS Indicators?

Definition

- Concept: The 9-Pack of TOS Indicators is a curated set of technical indicators available on the ThinkOrSwim platform, designed to provide diverse market insights.

- Purpose: These indicators help traders analyze price movements, trends, and potential trading opportunities.

Components of the 9-Pack

Overview

- Diverse Tools: The pack includes a mix of trend, momentum, volatility, and volume indicators.

- Customization: Each indicator can be customized to fit individual trading styles and strategies.

The Indicators Explained

1. Moving Average Convergence Divergence (MACD)

Function

- Trend and Momentum: MACD helps identify trend direction and momentum strength.

- Signals: Provides buy and sell signals based on crossovers and divergences.

Usage Tips

- Crossover Strategy: Use MACD line crossovers to identify potential entry and exit points.

- Divergence Analysis: Look for divergences between MACD and price to anticipate reversals.

2. Relative Strength Index (RSI)

Function

- Momentum Indicator: RSI measures the speed and change of price movements.

- Overbought/Oversold Conditions: Identifies potential overbought or oversold conditions in the market.

Usage Tips

- Thresholds: Use the 70/30 levels to identify overbought and oversold conditions.

- Divergence: Look for RSI divergences to predict potential reversals.

3. Bollinger Bands

Function

- Volatility Measurement: Bollinger Bands measure market volatility and identify overbought or oversold levels.

- Price Envelopes: Consist of a middle band (SMA) and two outer bands (standard deviations from the SMA).

Usage Tips

- Band Squeezes: Identify periods of low volatility that may precede significant price movements.

- Price Reversals: Look for price touching or breaking the outer bands to anticipate reversals.

4. Volume Profile

Function

- Volume Distribution: Volume Profile displays trading activity at different price levels.

- Support and Resistance: Helps identify key support and resistance levels based on volume concentration.

Usage Tips

- High Volume Nodes: Use high volume nodes to identify strong support and resistance levels.

- Volume Gaps: Look for gaps in volume to anticipate potential price movements.

5. Average True Range (ATR)

Function

- Volatility Indicator: ATR measures market volatility by calculating the average range of price movements over a period.

- Risk Management: Helps in setting stop-loss levels based on volatility.

Usage Tips

- Stop-Loss Levels: Use ATR to set appropriate stop-loss levels.

- Volatility Analysis: Compare ATR values to assess market volatility trends.

6. Fibonacci Retracement

Function

- Support and Resistance: Fibonacci retracement levels indicate potential support and resistance areas.

- Price Targets: Helps in setting price targets based on retracement levels.

Usage Tips

- Retracement Levels: Use common retracement levels (38.2%, 50%, 61.8%) to identify potential reversal points.

- Combination with Other Indicators: Combine with other indicators for stronger signals.

7. Stochastic Oscillator

Function

- Momentum Indicator: The Stochastic Oscillator compares a specific closing price to a range of prices over a certain period.

- Overbought/Oversold Conditions: Identifies overbought and oversold conditions.

Usage Tips

- %K and %D Crossovers: Use crossovers between the %K and %D lines to identify buy and sell signals.

- Divergence: Look for divergences between the Stochastic Oscillator and price to anticipate reversals.

8. On-Balance Volume (OBV)

Function

- Volume Indicator: OBV measures buying and selling pressure by accumulating volume based on price movement direction.

- Trend Confirmation: Confirms price trends based on volume flow.

Usage Tips

- Trend Analysis: Use OBV to confirm existing price trends.

- Divergence: Look for divergences between OBV and price to anticipate potential reversals.

9. Parabolic SAR

Function

- Trend Indicator: Parabolic SAR helps identify potential trend reversals and provides stop-loss levels.

- Trailing Stop: Acts as a trailing stop-loss indicator.

Usage Tips

- Trailing Stops: Use Parabolic SAR to set trailing stop-loss levels.

- Reversal Signals: Pay attention to the indicator’s position relative to price for reversal signals.

How to Implement the 9-Pack of TOS Indicators

Setting Up on ThinkOrSwim

Installation

- Platform Access: Ensure you have access to the ThinkOrSwim platform.

- Customization: Add the indicators to your chart and customize their settings to match your trading strategy.

Combining Indicators

Synergy

- Multiple Signals: Use multiple indicators to confirm trading signals.

- Diverse Perspectives: Gain a comprehensive view of market conditions by combining different types of indicators.

Developing a Trading Strategy

Step-by-Step Guide

- Identify Trends: Use trend indicators like MACD and Parabolic SAR to identify the market trend.

- Confirm Momentum: Confirm the trend with momentum indicators like RSI and Stochastic Oscillator.

- Set Entry and Exit Points: Use Bollinger Bands and Fibonacci Retracement to set entry and exit points.

- Manage Risk: Use ATR for setting stop-loss levels and Volume Profile for identifying key support and resistance levels.

Conclusion

The 9-Pack of TOS Indicators provides a comprehensive toolkit for traders looking to enhance their trading strategies. By understanding and effectively utilizing each indicator, traders can gain valuable insights into market conditions, identify trading opportunities, and manage risks more effectively. Whether you are a beginner or an experienced trader, integrating these indicators into your trading routine can significantly improve your trading outcomes.

Frequently Asked Questions:

- Business Model Innovation:

Embrace our legitimate business model! We organize group buys, allowing participants to share costs for popular courses, making them accessible to those with limited financial resources. Our approach ensures affordability and accessibility, despite author concerns. - The Legal Environment:

The legality of our activity is uncertain. While we lack specific permission from course authors, there’s a technicality: authors didn’t impose resale limits upon course purchase. This presents both an opportunity for us and a benefit for individuals seeking low-cost access. - Quality Control:

Unveiling the Truth

Quality is paramount. Purchasing courses directly from sales pages ensures consistency with traditionally obtained materials. However, we’re not official course providers and don’t offer premium services:

- No scheduled coaching calls or sessions with the author.

- No access to the author’s private Facebook group or web portal.

- No entry to the author’s private membership forum.

- Direct email support from the author or their team is unavailable.Operating independently, we aim to bridge the pricing gap without additional services provided by official channels. Your understanding of our unique approach is valued.

Be the first to review “9-Pack of TOS Indicators” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.