-

×

The Stock Market Mastery Program with Ryan Hildreth

1 × $12.00

The Stock Market Mastery Program with Ryan Hildreth

1 × $12.00 -

×

The MMXM Trader’s 2nd Course: My Personal Approach

1 × $17.00

The MMXM Trader’s 2nd Course: My Personal Approach

1 × $17.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Advanced Course

1 × $39.00

Advanced Course

1 × $39.00 -

×

Unlocking the Mysteries of Trend Analysis - Rick Bensignor

1 × $6.00

Unlocking the Mysteries of Trend Analysis - Rick Bensignor

1 × $6.00 -

×

Complete Book Set

1 × $8.00

Complete Book Set

1 × $8.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

The Big 3 Squeeze Indicator TOS 2024 with Taylor Horton

1 × $69.00

The Big 3 Squeeze Indicator TOS 2024 with Taylor Horton

1 × $69.00 -

×

The Wolf of Investing: My Insider's Playbook for Making a Fortune on Wall Street with Jordan Belfort

1 × $6.00

The Wolf of Investing: My Insider's Playbook for Making a Fortune on Wall Street with Jordan Belfort

1 × $6.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

Graphs, Application to Speculation with George Cole

1 × $6.00

Graphs, Application to Speculation with George Cole

1 × $6.00 -

×

Candlestick - Training Videos (Videos 1.2 GB)

1 × $15.00

Candlestick - Training Videos (Videos 1.2 GB)

1 × $15.00 -

×

Interpreting Money Stream with Peter Worden

1 × $6.00

Interpreting Money Stream with Peter Worden

1 × $6.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Claytrader - Risk vs Reward Trading

1 × $23.00

Claytrader - Risk vs Reward Trading

1 × $23.00 -

×

The Bulls Eye System – Ready Aim Fire

1 × $31.00

The Bulls Eye System – Ready Aim Fire

1 × $31.00 -

×

Basic Astrotech

1 × $6.00

Basic Astrotech

1 × $6.00 -

×

GTA Professional Course with Gova Trading Academy

1 × $5.00

GTA Professional Course with Gova Trading Academy

1 × $5.00 -

×

The Oxford Handbook of Political Theory with John Dryzek, Bonnie Honig & Anne Phillips

1 × $6.00

The Oxford Handbook of Political Theory with John Dryzek, Bonnie Honig & Anne Phillips

1 × $6.00 -

×

Markets 101 Complete Course with Joseph Wang - Central Banking 101

1 × $13.00

Markets 101 Complete Course with Joseph Wang - Central Banking 101

1 × $13.00 -

×

Kash-FX Elite Course

1 × $10.00

Kash-FX Elite Course

1 × $10.00 -

×

Wealthpress Jump Trade Package (Course Only, None-elert)

1 × $85.00

Wealthpress Jump Trade Package (Course Only, None-elert)

1 × $85.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

Ultra Blue Forex 2024 with Russ Horn

1 × $17.00

Ultra Blue Forex 2024 with Russ Horn

1 × $17.00 -

×

OneUmbrellaFX

1 × $5.00

OneUmbrellaFX

1 × $5.00 -

×

Complete Day Trading : Stock Trading With Technical Analysis

1 × $15.00

Complete Day Trading : Stock Trading With Technical Analysis

1 × $15.00 -

×

London Super Conference 2019

1 × $62.00

London Super Conference 2019

1 × $62.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Lit Trading Course

1 × $15.00

Lit Trading Course

1 × $15.00 -

×

Blending Quantitative & Traditional Equity Analysis with CFA Institute

1 × $6.00

Blending Quantitative & Traditional Equity Analysis with CFA Institute

1 × $6.00 -

×

B The Trader Trading Course

1 × $15.00

B The Trader Trading Course

1 × $15.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Successful Algorithmic Trading with Mike Halls-Moore

1 × $8.00

Successful Algorithmic Trading with Mike Halls-Moore

1 × $8.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Options on Futures Trading Course

1 × $15.00

Options on Futures Trading Course

1 × $15.00 -

×

ZoneTrader Pro v2 (Sep 2013)

1 × $23.00

ZoneTrader Pro v2 (Sep 2013)

1 × $23.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

FX GOAT FOREX TRADING ACADEMY

1 × $8.00

FX GOAT FOREX TRADING ACADEMY

1 × $8.00 -

×

TheoTrade

1 × $31.00

TheoTrade

1 × $31.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

FXCharger

1 × $23.00

FXCharger

1 × $23.00 -

×

Portfolio Management-Earn 12 Hours CE Credits

1 × $85.00

Portfolio Management-Earn 12 Hours CE Credits

1 × $85.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Four Steps to Trading Economic Indicators

1 × $6.00

Four Steps to Trading Economic Indicators

1 × $6.00 -

×

Trading the Fast Moves for Maximum Profit with William McLaren

1 × $4.00

Trading the Fast Moves for Maximum Profit with William McLaren

1 × $4.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

www Trading System Ezine with Alex Krzhechevsky

1 × $6.00

www Trading System Ezine with Alex Krzhechevsky

1 × $6.00 -

×

Trading the Eclipses

1 × $6.00

Trading the Eclipses

1 × $6.00 -

×

Trading Plan with Andrew Baxter

1 × $6.00

Trading Plan with Andrew Baxter

1 × $6.00 -

×

Bank Financial Model with Cash Flow Investing Pro

1 × $15.00

Bank Financial Model with Cash Flow Investing Pro

1 × $15.00 -

×

XLT– Option Trading Course

1 × $6.00

XLT– Option Trading Course

1 × $6.00 -

×

Instant Forex Profits Home Study Course

1 × $23.00

Instant Forex Profits Home Study Course

1 × $23.00 -

×

Triple Play Trading Ideas & Mentoring with MarketGauge

1 × $54.00

Triple Play Trading Ideas & Mentoring with MarketGauge

1 × $54.00 -

×

Ultimate Gann Course Coaching Safety in The Market COMPLETE 12 Modules with Aaron Lynch

1 × $6.00

Ultimate Gann Course Coaching Safety in The Market COMPLETE 12 Modules with Aaron Lynch

1 × $6.00 -

×

We Trade Waves

1 × $5.00

We Trade Waves

1 × $5.00 -

×

Trading the Pristine Method 2008 (Videos & Workbooks) with Pristine

1 × $4.00

Trading the Pristine Method 2008 (Videos & Workbooks) with Pristine

1 × $4.00 -

×

Trend Following Stocks - Complete Breakout System with Joe Marwood

1 × $6.00

Trend Following Stocks - Complete Breakout System with Joe Marwood

1 × $6.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

Trading With Market Timing and Intelligence with John Crain

1 × $23.00

Trading With Market Timing and Intelligence with John Crain

1 × $23.00 -

×

Trading Psychology, Day-trading & Swing Trading with Alexander Elder

1 × $31.00

Trading Psychology, Day-trading & Swing Trading with Alexander Elder

1 × $31.00 -

×

Building Wealth In Stock Market with David Novac

1 × $6.00

Building Wealth In Stock Market with David Novac

1 × $6.00 -

×

How To Design, Test, Evaluate and Implement Profitable Trading Systems(Manual Only)

1 × $4.00

How To Design, Test, Evaluate and Implement Profitable Trading Systems(Manual Only)

1 × $4.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Trading Indicators NT7

1 × $85.00

Trading Indicators NT7

1 × $85.00 -

×

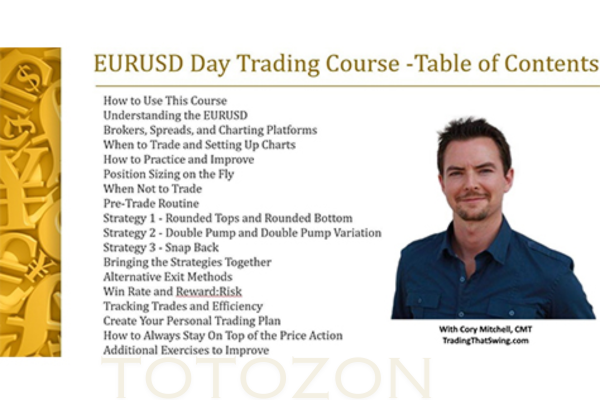

The EURUSD Day Trading Course with Cory Mitchell - Trade That Swing

1 × $15.00

The EURUSD Day Trading Course with Cory Mitchell - Trade That Swing

1 × $15.00 -

×

Point and Figure Mentorship Course

1 × $54.00

Point and Figure Mentorship Course

1 × $54.00 -

×

The Stock Index Futures Market with B.Thomas Byme Jr.

1 × $6.00

The Stock Index Futures Market with B.Thomas Byme Jr.

1 × $6.00 -

×

Price Ladder Training

1 × $15.00

Price Ladder Training

1 × $15.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

The Expected Return Calculator

1 × $23.00

The Expected Return Calculator

1 × $23.00 -

×

Sports Trading Journey with Jack Birkhead

1 × $23.00

Sports Trading Journey with Jack Birkhead

1 × $23.00 -

×

Order Flow Mastery (New 2024) with The Volume Traders

1 × $24.00

Order Flow Mastery (New 2024) with The Volume Traders

1 × $24.00 -

×

Private Seminars

1 × $23.00

Private Seminars

1 × $23.00 -

×

Beat The Market Maker

1 × $62.00

Beat The Market Maker

1 × $62.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Forex Never Lose Trade & Forex Unknown Secret with Karl Dittmann

1 × $6.00

Forex Never Lose Trade & Forex Unknown Secret with Karl Dittmann

1 × $6.00 -

×

The Winning Secret

1 × $23.00

The Winning Secret

1 × $23.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Volume Analysis – Smart Money

1 × $6.00

Volume Analysis – Smart Money

1 × $6.00 -

×

Big Morning Profits with Base Camp Trading

1 × $4.00

Big Morning Profits with Base Camp Trading

1 × $4.00 -

×

Vertex Investing Course (2023)

1 × $8.00

Vertex Investing Course (2023)

1 × $8.00 -

×

Complete 32+ Hour Video Training Course 2008

1 × $23.00

Complete 32+ Hour Video Training Course 2008

1 × $23.00 -

×

Learn to Trade Forex and Stocks – From Beginner to Advanced

1 × $6.00

Learn to Trade Forex and Stocks – From Beginner to Advanced

1 × $6.00 -

×

TradingWithBilz Course

1 × $10.00

TradingWithBilz Course

1 × $10.00 -

×

Uncertainty & Expectation Strategies for the Trading of Risk with Gerald Ashley

1 × $6.00

Uncertainty & Expectation Strategies for the Trading of Risk with Gerald Ashley

1 × $6.00 -

×

Market Geometry Mentoring Sessions with Timothy Morge

1 × $69.00

Market Geometry Mentoring Sessions with Timothy Morge

1 × $69.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

The Email Academy

1 × $31.00

The Email Academy

1 × $31.00 -

×

Course (Video, PDF, MT4 Indicators)

1 × $6.00

Course (Video, PDF, MT4 Indicators)

1 × $6.00 -

×

Elder-disk 1.01 for NinjaTrader7

1 × $6.00

Elder-disk 1.01 for NinjaTrader7

1 × $6.00 -

×

OptioPit Course 2013 (Gold & Silver Course)

1 × $23.00

OptioPit Course 2013 (Gold & Silver Course)

1 × $23.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

Beginner Course + access to Introductory Course

1 × $6.00

Beginner Course + access to Introductory Course

1 × $6.00 -

×

Boiler Room Trading

1 × $15.00

Boiler Room Trading

1 × $15.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00

6-2-4 Winning Strategies & Systems with Jack Bernstein

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Master 6-2-4 Strategies with Jack Bernstein

Introduction

Success in trading requires a blend of strategy, discipline, and insight. Jack Bernstein, a renowned trading expert, has developed the 6-2-4 winning strategies and systems, which have helped numerous traders achieve consistent profitability. In this article, we will explore these strategies in detail, providing a comprehensive guide to implementing Bernstein’s methods in your trading endeavors.

Who is Jack Bernstein?

Jack Bernstein’s Background

Jack Bernstein is a highly respected trader, author, and analyst with decades of experience in the financial markets. His innovative strategies have made significant impacts on the trading community.

Bernstein’s Trading Philosophy

Bernstein emphasizes a systematic approach to trading, combining technical analysis, market psychology, and risk management to create robust trading systems.

Understanding the 6-2-4 Strategies

What are the 6-2-4 Strategies?

The 6-2-4 strategies refer to a set of trading systems developed by Jack Bernstein, focusing on various market conditions and trading styles to maximize profitability.

Why Use the 6-2-4 Strategies?

These strategies offer a structured approach to trading, providing clear rules and guidelines that help traders make informed decisions and manage risk effectively.

Key Components of the 6-2-4 Strategies

1. Market Analysis

Technical Analysis

Technical analysis involves studying price charts and using indicators to forecast future market movements. Key tools include moving averages, RSI, and MACD.

Fundamental Analysis

Fundamental analysis examines economic indicators, company performance, and market news to determine the intrinsic value of an asset.

2. Trading Systems

Trend Following Systems

These systems aim to capture profits by following the direction of the market trend. They work best in trending markets.

Counter-Trend Systems

Counter-trend systems seek to profit from market reversals. These are useful in volatile or range-bound markets.

3. Risk Management

Setting Stop-Loss Orders

Stop-loss orders help limit potential losses by automatically closing a trade at a predetermined price.

Position Sizing

Proper position sizing ensures that each trade represents a manageable portion of your overall portfolio, reducing the risk of significant losses.

Implementing Bernstein’s 6-2-4 Strategies

Developing Your Trading Plan

Define Your Goals

Set clear, achievable trading goals, including profit targets and risk tolerance levels.

Create a Trading System

Develop a trading system based on Bernstein’s principles, incorporating entry and exit rules, risk management strategies, and performance metrics.

Analyzing the Market

Conduct Thorough Research

Perform comprehensive market analysis using both technical and fundamental approaches to identify potential trading opportunities.

Monitor Market Conditions

Stay informed about market trends, economic news, and other factors that could impact your trades.

Executing Trades

Entering Trades

Follow your system’s entry rules, using limit orders to control trade execution and ensure optimal entry points.

Managing Open Positions

Regularly review and adjust your positions based on market conditions and your trading system’s guidelines.

Exiting Trades

Exit trades according to your predefined exit rules, whether through profit targets, trailing stops, or other criteria.

Case Studies: Success Stories Using Bernstein’s Methods

Case Study 1: Trend Following Success

Setup and Execution

Identify a strong upward trend in a major stock index and enter a long position using a trend-following system.

Outcome and Analysis

Analyze the trade outcome, highlighting how the trend-following strategy captured significant gains.

Case Study 2: Counter-Trend Success

Setup and Execution

Spot a reversal pattern in a currency pair and enter a short position using a counter-trend system.

Outcome and Analysis

Review the trade results, focusing on the accuracy of the reversal prediction and the profitability of the counter-trend approach.

Tools and Resources for Implementing 6-2-4 Strategies

Trading Platforms

Choose platforms that offer advanced charting tools, real-time data, and robust order execution capabilities.

Educational Resources

Utilize books, online courses, webinars, and trading communities to deepen your understanding of Bernstein’s strategies.

Analytical Tools

Incorporate tools like TradingView, MetaTrader, and Bloomberg Terminal for comprehensive market analysis and strategy testing.

Benefits of Using Bernstein’s 6-2-4 Strategies

1. Structured Approach

The 6-2-4 strategies provide a clear, structured approach to trading, reducing the complexity of decision-making.

2. Enhanced Risk Management

Effective risk management techniques help protect your capital and ensure long-term trading success.

3. Increased Confidence

A systematic approach boosts trader confidence, allowing for more decisive and disciplined trading.

4. Versatility

These strategies are versatile and can be applied across various markets, including stocks, commodities, and forex.

Challenges in Implementing 6-2-4 Strategies

1. Market Volatility

High market volatility can pose significant challenges, requiring robust risk management strategies.

2. Emotional Discipline

Maintaining emotional discipline is crucial to stick to your trading plan and avoid impulsive decisions.

3. Continuous Learning

The markets are constantly evolving, necessitating ongoing education and adaptation of strategies.

Conclusion

Jack Bernstein’s 6-2-4 winning strategies offer a comprehensive and systematic approach to trading. By focusing on market analysis, trading systems, and risk management, traders can enhance their performance and achieve their financial goals. Embrace Bernstein’s methods to navigate the complexities of the financial markets with confidence and precision.

Commonly Asked Questions:

- Business Model Innovation: Accept the truth of a legitimate business! Our strategy is organising a group buy in which participants share the costs. We use these cash to acquire popular courses from sale pages and make them available to people with limited financial resources. Despite the authors’ worries, our clients love the cost and accessibility we give.

- The Legal Environment: Yes or No The legality of our activity is ambiguous. While we don’t have specific permission from the course authors to resell the material, there is a technicality at work. The author did not specify any limits on resale when purchasing the course. This legal intricacy is both an opportunity for us and a boon for individuals looking for low-cost access.

- Quality Control: Uncovering the Truth

Getting to the heart of the issue – quality. Purchasing the course straight from the sale page guarantees that all documents and resources are the same as those obtained through traditional channels.

However, we distinguish ourselves by going beyond personal research and resale. It is crucial to note that we are not the official course providers, which means that the following premium services are not included in our package:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not permitted.

- No access to the author’s private membership forum.

- There is no direct email support available from the author or their team.

We operate independently, with the goal of bridging the pricing gap without the extra services provided by official course channels. Your comprehension of our distinct approach is much appreciated.

Be the first to review “6-2-4 Winning Strategies & Systems with Jack Bernstein” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.